Following the publishment of the draft Delegated Act [5] and concerned to the main items falling under Pillar I, this article explores the confirmation and changes to the “best guess” rules outlined in [4] and highlights the remaining areas of uncertainty. Technical discussions are complemented with numerical examples at 25Q2, together with impact assessments based on simplified insurance portfolios that cover several Macaulay liabilities durations (short 5y; medium 10y; long 15y) and duration gaps (-/+1.5y). The opinions expressed by the Author represent her view and do not necessarily represent the position or opinion of her employer.

The changes to the SII Directive [2] were published on the 08.01.25 in the Official Journal of the European Union by the European Parliament and European Council, with new measures expected to enter in force by the end of January 2027. On the 17.07.25 the European Commission published a proposal for the revision of the SII Delegated Act [5], opening a consultation phase that will last till the 05.09.25. The extension of the 4-weeks standard consultation period considers the summer holidays and aims at landing the final acts before year end, to help the market meeting the enter in force due date. Technical Standards are expected to come.

It is worth recalling that the revision of the SII directive twists together with the adoption of the Insurance Capital Standards (ICS) from the IAIS (International Association of Insurance Supervisors) [3]: the IAIS will begin developing a detailed ICS assessment methodology in 2025, monitoring the implementation process in 2026, with the aim of starting a detailed assessment of the ICS implementation in 2027.

Before Deeping dive into the details of the changes, it is worth recalling the aim the European Commission.

The insurance sector is a key institutional investor to contribute to the European Union priorities (defence, research, innovation and the green and digital transitions), with around 10 trillion of assets under management. In view of the long-term nature of its business, the insurance section is well-placed to provide stable funding to the real economy, including long-term capital financing to small-medium enterprises and small mid-caps, or investments in equity and certain alternative assets (such as venture capital, private equity and infrastructure). Insurers can also contribute to securitisation by facilitating the transfer of risks outside the banking sector. As of today, the share of the insurance sector in such investments is very limited. The amendments proposed in the draft delegated acts (such as those related to the risk margin calculation and the long-term equity investments) are aimed at increasing the capital in excess of the solvency capital requirement (SCR), strengthening the undertakings’ capacity to support the real economy of the European Union. The lower risk charges for the securitizations investments aim at facilitating the risk transfer outside the banking sector. Supervisory authorities are encouraged to monitor how the freed-up capital is being used, including its effect on insurers’ capital positions over time.

The main changes falling under Pillar I are:

- interpolation and extrapolation of the base risk-free yield curve

- determination of the volatility adjustment

- calculation of the risk margin

- interest rate risk sub-module: stresses definition and correlation parameters

- equity risk sub-module: symmetric adjustments and qualifying criteria for long term equity investment

- catastrophe risk (non-life catastrophe sub-module) and potential treatment of sustainability risk

- capital requirements of securitisation positions

- simplified calculations

- dividends, risk-mitigation techniques and counterparty default risk

Points a) to f) were already covered in [4], while g) to i) are now being addressed. The numerical examples provided are based on 25Q2 market data and derived on simplified insurance portfolios whose cash flows are linearly decreasing over time and subject to the discount effect only: the liabilities are fully composed by minimum guarantees (i.e. no change assumed in the future discretionary benefits following movements in rates) and the backing assets, bonds-like, have the same market value as the liabilities in t=0, with the remaining assets defining the base own funds not subject to interest rates movements. The base own funds are assumed to be about 10% of the total assets.

Base risk-free yield curve

No changes compared to what the Author described in [4], a minor doubt remains on the VA application to the first element of the LLFR.

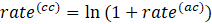

The formulas to extrapolate the risk free yield curve are outlined in the draft delegated acts, confirming the definition of the extrapolated forward rates being a weighted average between the last liquid forward rate (LLFR) and the ultimate forward rate (UFR), with speed of convergence to the UFR equal to a=11% for all the currency except for the Swedish Krona (a=40%).

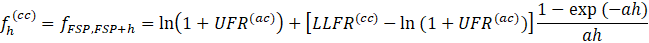

For each year h exceeding the first smoothing point (FSP) the (continuous compounded) annual forward rate is defined as

and the extrapolated (annual compounded) spot rates are equal to

Note that

where (cc) and (ac) respectively indicate the continuous and annual compounding.

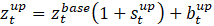

The FSP corresponds to a maturity for which the volume of outstanding bonds of that or longer maturities is sufficiently high. To confirm the First Smoothing Point (FSP) for EUR to be 20y at end January 2027, the currency related threshold is rounded up to 8%, including a safety margin, given the increase in long-maturity bonds observed in recent years.

The LLFR is defined as a weighted average of multi-years annualized continuously compounded forward rates. The first one covers a period prior to the FSP and the other periods starting at the FSP and lasting up to maturities where the swaps are available from DTL (deep, liquid and transparent) markets. The weights to apply to these multi-years annualized forward rates are derived by the average notional amount of traded contracts of interest rate swaps of the respective relevant maturities. Please refer to [4] for the best guess adopted in the calculations.

As commented in [4] the Author believes that this new definition of the base risk-free yield curve introduces discontinuities in the forward rates, by “patching” two pieces of information: one coming from the market data up to the FSP, and the other coming from the extrapolation.

It must be noted that the volatility adjustment is applied only to the first annualized continuously compounded forward rate of those summed up to define the LLFR and is therefore just partially accounted for in the extrapolation (by a share equal to the first weight). It is not yet clear whether the VA shall be translated into an equivalent continuous compound rate to be correctly summed up to a value expressed in continuous compounding.

A 5-year phasing-in mechanism may be applied, subject to approval, by linearly decreasing the speed of convergence a at the beginning of each calendar year from 20% during the year starting at 1st January 2027, to 11% on 1st January 2032 (Swedish Krona from 70% to 40%).

Volatility adjustment (VA)

Additional clarifications are provided compared to what the Author described in [4], but some areas of uncertainty remain.

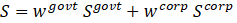

The definition of the spread (S) to be adopted in the VA calculation is given, such as the parameters and formulas to use for the risk correction (RC) calculation. Additional specifications are provided for the calculation of the credit spread sensitivity ratio (CSSR).

Namely:

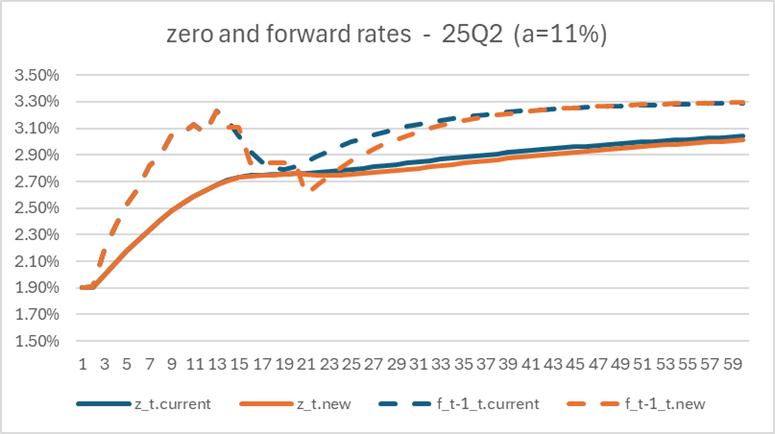

where

- wgovt and wcorp denote the ratios of the value of respectively government bonds (govt) and bonds other than government, loans and securitisations (corp) compared to the value of all bonds, loans and securitizations included in the reference portfolio of assets for the currency or country under examination (i.e. the two sum up to 100%). Government bonds are meant to describe exposures to both central governments and central banks. These definitions clarify that that the reference portfolio adopted for the calculation of the macro component shall be the country reference portfolios provided by EIOPA, and not that of the undertakings.

- sgovt and scorp denote the average currency spread of respectively government bonds and bonds other than government, loans and securitisations included in the reference portfolio of assets for the currency or country under examination

It is worth noting that the spread levels can go negative, while being floored to 0 in the current calculation. This may produce a lower VA, albeit being irrelevant in the current market situation and considering the duration of the assets in the reference portfolios.

The risk corrections (RC for both the govt and corp parts) are defined according to this formula and parameters

where

| cap | pcI | pcII | pcIII | |

| govt | 65% | 30% | 20% | 15% |

| corp | 125% | 50% | 40% | 35% |

The parametrization chosen is the “Option 3” reported in [4]. LTAS is based on data relating to the last 30 years (or replaced by constructed data when not available) and x+ = max(0,x).

Note that

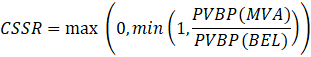

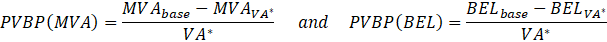

The formula for the credit spread sensitivity ratio is confirmed to be

where the two PVBP indicate the Price Value of a Basis Point of respectively the values of the investments in bonds, loans and securitizations (MVA) and of the Best Estimate Liabilities (BEL) of an undertaking. These two PVBP are calculated by comparing the stressed value of the quantity (under respectively a parallel shift in credit spreads and interest rates) to its base value and standardizing the difference by the stress level. The stress level are set to the VA*, that is the level of the permanent volatility adjustment under the assumption of a CSSR=100%.

For the calculation of the latter, the undertakings should consider the effect of future discretionary benefits (FDB, i.e. the profit sharing). For the calculation of the former, the undertakings should exclude fixed income investments which give rise to no or residual credit spreads. The Autor’s interpretation on this is that undertakings should exclude investments which are not credit sensitive from a market perspective (such as checking accounts) or assets linked to liabilities capable of absorbing the shocks (such as Unit Linked assets) but should include assets credit sensitive that are hedged with derivatives and whose net exposure to credit stress may not be relevant. Indeed, the Author’s interpretation is that credit derivatives are excluded from the CSSR numerator calculation (assets PVBP), coherently to the CIC codes proposed by EIOPA in their 2020 opinion [1]. The Author believes that BEL values should be net of reinsurance and include Unit Linked contracts: the former allows for a correct calculation, the latter for a coherency of treatment of Unit Linked business where the VA is applied. Specific to the German market, it is not clear whether Surplus Funds should be included or excluded from the FDB (and therefore the BEL) value.

As pointed out in [4] the Author believes such CSSR formulation may either slow the calculation process or introduce dependences on previous quarters data (undertakings need time to have their assets and liabilities portfolios ready at the evaluation date). Finally, while understanding the reasons driving the choice of a stress level comparable to the permanent VA (that correctly captures the convexity of the liabilities), the Author wonders if that could be substituted by a fixed parameters (like 25bps) that can be updated by EIOPA once a year. Indeed, having a stress value that varies in time may cause an undue effect: an undertaking whose portfolios (and so the credit and interest rate sensitivities) do not change over time should calculate the same PVPB(BEL) but may experience different outcomes driven by changes in VA*, just because of different stressing levels and interconnections with sampling errors of stochastic evaluations.

Risk Margin

A little change compared to what the Author described in [4] concerning the decay parameter.

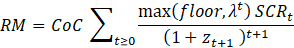

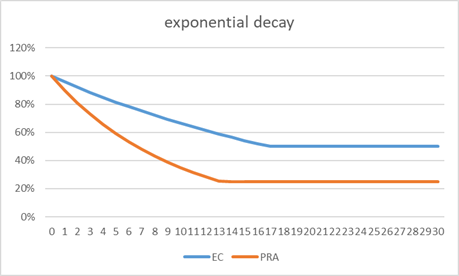

The Risk Margin formula is amended to introduce an exponential term-dependent factor (λ=96%, compared to the 97.5% proposed by EIOPA in their 2020 opinion [1] and used as best guess by the Author in [4]), with decrease floored to 50%. This correction fixes the bias of the current definition, reducing the technical provisions and releasing capital, that is expected to be channelled towards productive investments in the real economy. The cos-of capital rate (CoC=4.75%) introduced by the Directive (EU) 2025/2 is confirmed. In the formula, z denotes the annual compounded zero risk free rate

The Author already pointed out in [4] the competitive disadvantage for European life insurers compared to UK peers (whose supervisor is the PRA – Prudential Regulation Authority), that are subject to a CoC=4%, λ=90% and floor=25%.

Compared to the current regulation, these amendments produce an important release in capital, almost halving the value of the RM for a 7y duration portfolio (with the decrease in RM being about -40% = (96%^7)*(4.75%/6.00%) – 1).

Interest Rates stresses and correlation

The main items described by the Author in [4] remains the same, with some changes in the stress parametrization, some clarifications provided around the convergency and few areas of uncertainty still pending. Indeed, the delegated acts amend the rules to allow for:

- a lower correlation between the spread risk and interest rate risk in interest down scenario (decreased from 50% to 25%), that was examined by EIOPA in their 2020 review [1], but not quoted in the amendments to the SII Directive [2]

- the need of extrapolate the stressed interest rates beyond the FSP, following the same methodology adopted for the base case and a stressed UFR (-/+15bps) and a stressed LLFR (where the rates at the maturities considered are stressed). The Author believes that stressing the LLFR is far too complicated compared to the benefits it may bring. Furthermore, for the EUR currency, the calculation would imply the need of stressing parameters for tenors (t=20, 25, 30, 40 and 50) after the FSP: are those published (designed for zero rates) suitable for “multi-year” forward rates hold constant between the illiquidity windows?

The extrapolation of the stressed yield curves causes an additional burden from a practical perspective and is also debatable from a theoretical perspective: one could claim that just a massive structural change in the economy would lead to a change in UFR, others may agree that it can move by -/+15bps, others may think it should move more. Back in 2018 (EIOPA’s second set of advice to the European Commission on specific items in the Solvency II Delegated Regulation), EIOPA hinted that the UFR in stressed scenarios could be higher than 15bps

- the need to allow for interest rates to become negative, or to decrease further when they are already negative, including a maturity-dependent floor (that reflects the lower plausibility of extreme long-term rates, being equal to -1.25% up to 7 years, -0.893% after 20 years and linearly interpolated in-between)

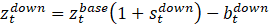

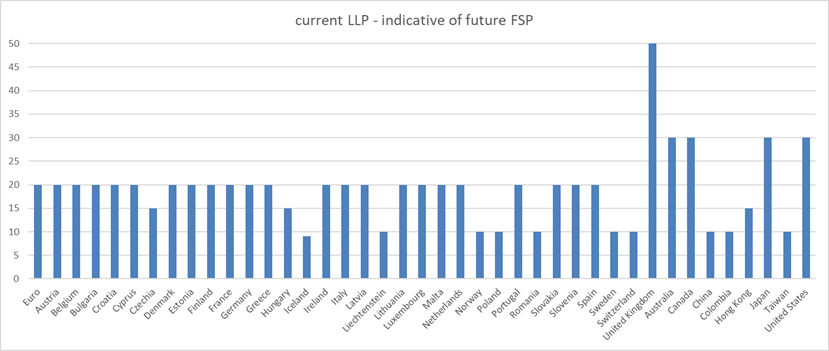

- the stress methodology that moves from relative shocks to a combination of relative and absolute shocks (derived from a relative displaced model)

where zt denote the risk free zero rates without VA and st and bt are defined for integer maturities t=1:50, then linearly interpolated to respectively 20% (st) and 0% (bt) between t=50 and t=90/60. For maturities shorter than a year, st and bt should be equal to those of maturity 1.

The Author believes that the rules to calculate the stressed parameters for maturities longer than 50 years are redundant, since stressed rates have to be extrapolated and the current maximum last liquid point (LLP) is 50y for the GBP currency

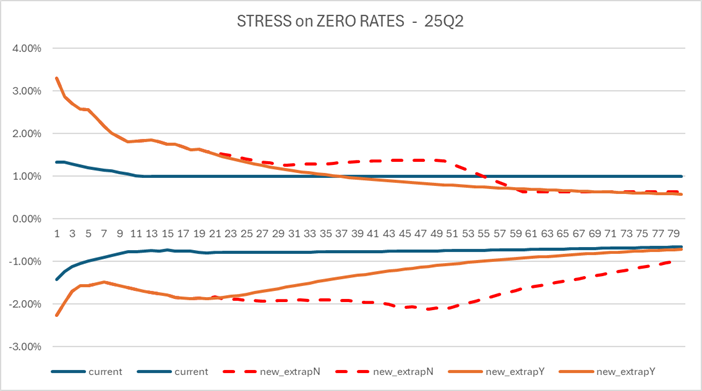

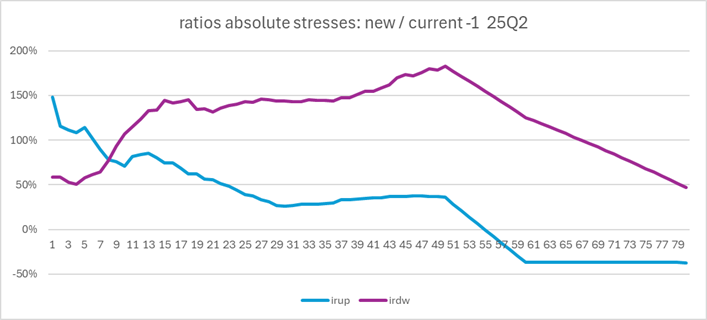

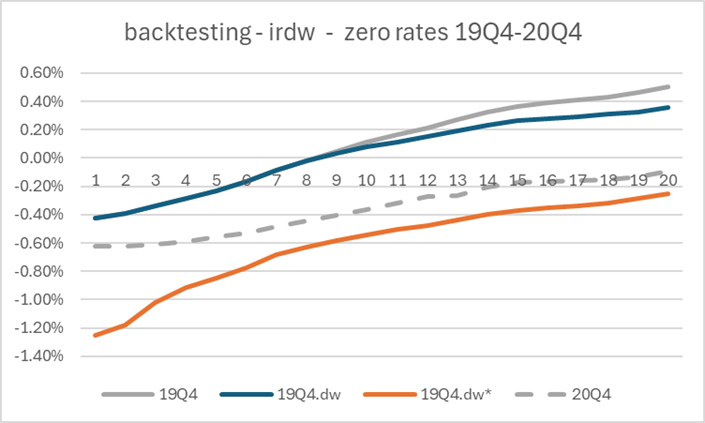

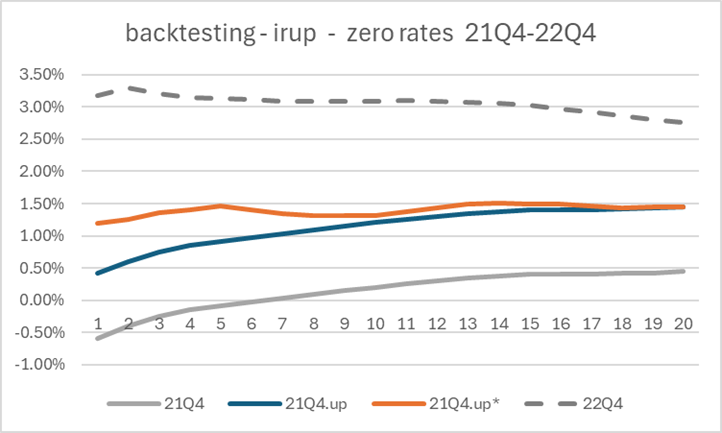

As shown in the following pictures, it is worth nothing that:

- compared to the current, the alternative down shock is much harsher than the up one; the alternative up shock can even be less conservative than the current due to the in-force application of a floor (the up stress shall be at minimum 1%)

- the new formulation succeeds the back testing exercise of replicating the 1y fall in rates occurred between 31.12.19 and 31.12.20 but fails at capturing the 1y spike occurred between 31.12.21 and 31.12.22

As a minor note, the proposed stressing parameters slightly deviate from those reported by EIOPA in their 2020 opinion [1] for maturities greater than 20y, that do not impact the results because of the extrapolation (or has a minor impact because of the stressed LLFR).

Finally, while the amendments to the Directive [2] quoted a not-so-clear approach to the phasing-in mechanism (“amendments to the interest rate risk sub-module may be phased in over a transitional period of up to five years. Such phasing-in shall be mandatory and apply to all insurance or reinsurance undertakings”), nothing is said in the draft delegated acts [5]. The Author believes that the phasing-in mechanism should not be mandatory: in case an undertaking was well matched, with negligible (or positive) impacts coming from the amendments in the regulation, the phasing in would become a disadvantage, adding an undue burden from a process perspective.

An impact assessment is performed on six simplified insurance portfolios to compare their loss in own funds (OF) under stress conditions: three liabilities durations are considered (short 5y, medium 10y and long 15y) as well as two duration gaps (-/+1.5y). As expected, portfolios with negative/positive duration gap (i.e. Liabilities longer/shorter than Assets) are exposed to the interest rate down/up risk. The table only shows the results of the portfolios where the scenario is biting, expressing their loss in OF (corresponding to the capital requirement of that scenario) in relative terms of the base OF value, like a capital charge metric.

| short | medium | long | ||

| current | Irup | -22% | -22% | -19% |

| Irdown | -11% | -10% | -7% | |

| revised | Irup | -33% | -21% | -11% |

| Irdown | -27% | -27% | -14% |

In the IR down scenario, the revised capital charges are always higher than the current. In the IR up scenario, the revised capital charges are higher/comparable/lower than the current for portfolios with short/medium/long duration. In the latter the 1% minimum stress prevails that of the new formulation.

Equity risk sub-module: symmetric adjustments and qualifying criteria for long term equity investment

The symmetric adjustment boundaries are widened (not lower than -13% or higher than 13%, with limits increased from the current -/+10%), to generate greater variations in the standard equity capital charge, thereby enhancing its capacity to dampen the impact of sharp market fluctuations.

The other amendments aim at facilitating the insurers’ long-term investments in equity (subject to a reduced capital charge of 22% on the absolute value of the equity investments). They clarify the approach to demonstrate the undertakings’ ability to avoid force selling of such instruments, as well as the need of performing the assessment at the level of the funds (instead of their underlying assets) when holding investment funds. Finally, in article 173, the draft delegate acts introduce a new prudential treatment for equity investments that benefit from a significand subsidy or guarantee from public authorities (legislative programs), that can be qualified as long-term equity investments. These are subject to a limit: the standard equity risk submodule corresponding to such equity investments should not exceed 10% of the undertaking own funds. Concerning the force-selling assessment, article 171a clarifies that undertakings are allowed to select the most appropriate approach from several methods but cannot opportunistically switch between approaches over time (safeguards and supervisory monitoring requirements). Article 171d indicates that the assessment can be conducted at the level of the fund and that type 1 funds should be considered to present a lower risk profile for the purpose of identifying long-term equity investments, including when they are invested in qualifying infrastructure equities or qualifying infrastructure corporate equities.

Catastrophe risk and potential treatment of sustainability risk

The definition of perils (windstorm, earthquake, flood, hail, subsidence) in the scope of the natural cat sub-module are provided, together with some amendments on the parameters, risk weights and correlation coefficients for the calculation of the capital requirements; the man-made catastrophe risk module is simplified.

Undertakings shall put in place internal procedures to avoid overreliance on data from past events related to climate change trends and should include where appropriate the usage of climate scenarios. Moreover, article 297a of the draft delegated acts clarify that the solvency and financial condition report (SFCR) shall state whether the undertaking has any material exposure to climate change-related risks, following the materiality assessment, and, where relevant, whether it has taken any actions to manage such exposure.

Finally, the European Commission, together with EIOPA, will assess how sustainability risks related to fossil fuel assets and activities associated with high emissions are managed by insurance and reinsurance undertakings. The Commission will also consider, as part of the forthcoming European Climate Adaptation Plan, a mandate on whether prudential rules can be more conducive to issuances of or investments in catastrophe bonds and other green bonds.

Securitization positions

As institutional investors, insurance and reinsurance undertakings should be fully integrated into the Union’s securitisation market. STS (simple, transparent and standardized) instruments are securitizations that meet these criteria:

- Simple: clear structure, free of complex derivatives or excessive layers

- Transparent: extensive availability of data on the underlying pool and performance

- Standardized: uniform rules for loan selection, monitoring, and investor protection

The draft delegate acts further align the risk factors for senior tranches of STS with those applicable to corporate or covered bonds, improving the consistency across asset classes with comparable risk profiles. Lower risk factors are introduced for senior tranches of non-STS securitizations to capture their high quality. Both changes significantly lower the risk charges compared to the current values. As an illustrative example, on a AAA STS senior with 2y of duration, the capital charge moves from 2.0% to 1.4%. The longer the duration, the higher the benefit (e.g. for 6y duration the capital charge moves from 5.60% to 4.00%). Similarly, for the AAA non-senior STS, the capital charge moves from 5.60% to 4.00% (2y duration) and from 15.60% to 10.90% (6y duration 6). The worse the rating, the higher the capital release. Securitizations becomes cheaper than comparable investment grade bonds.

Simplified calculations

Simplifications concern a carve-out from the mandatory application of the ‘look-through’ (LT) in investment funds (namely, the calculation of capital requirements based on each of the underlying assets of such funds) and exceptions to the use of external ratings.

Article 89a introduces the definition of a simplified formula to calculate the SCR of immaterial risk modules or sub-modules (other than the market risk and its sub-modules). This simplification can be adopted for three years from the reference date of calculation and is based on the undertaking’s specific volume measure for the risk.

Dividends, risk-mitigation techniques and counterparty default risk

Rules governing the calculation of foreseeable dividends are introduced (New Article 70a) to improve the level playing field: during the financial year, these should be deducted from the available own funds (OF) following an accrual approach, rather being immediately fully deducted. Dividends are foreseeable just if the person or body running the undertaking has formally taken a decision regarding the amount of dividend to be paid out (dividends normally corresponds to profits of the previous financial years).

Risk transfers between insurance and reinsurance sectors are facilitated in paragraph (18) (New Article 212a) by some forms of non-proportional reinsurance arrangements. These are called “adverse developments covers” and are explicitly recognized in the standard formula, where their risk mitigating effect is better reflected in the capital requirements.

Concerning the counterparty default risk module:

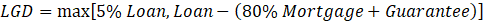

- article 192 corrects the loss-given default formula for reinsurance contracts subject to collateral agreement, where =60% counterparty assets subject to collateral

rewarding the risk mitigating effect (change in sign) and modifying F from F to F’’’, that appears to still be 100%.

- a floor to the loss-given defaults is introduced for the mortgage loans, to avoid unduly assumptions of these being risk-free (the standard formula capital requirement is currently null when the loan-to-value does not exceed 60%)

where Guarantee denotes the amount the guarantor would pay to the undertaking in case of default of the mortgage loan at the time when the value of the property held as a mortgage was equal to the 80% of the risk-adjusted value of the mortgage (Mortgage)

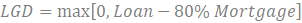

This new formulation replaces the current formula with 0 floor and 0 guarantee

- similarly, the loss given default for defaulted loans or forborne loans is defined as

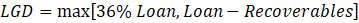

- the rules governing the capital requirements on direct exposures to central clearing counterparties (CCPs) are amended to lower their counterparty default risk and make it comparable to that of indirect exposures

- repurchase and securities landing/borrowing transactions are classified as type 1 exposures and the risk-reducing effect of central clearing (contractual netting) is recognized to improve the consistency with the treatment of derivatives and avoid an overly conservative capital requirement

where Exposure denotes the value of securities or cash lent to the counterparty under the transaction and Collateral denoted the risk-adjusted value od securities or cash received from the counterparty.

Lastly, the amounts expressed in euro in the current Delegated Regulation (2015/35) should be revised and inflated with a cumulative inflation that is approaching 35% since the entry in force of the regulation in 2014.

References

[1] “Opinion on the 2020 review of Solvency II” – EIOPA – 17.12.20

[2] “Directive (EU) 2025/2 of the European Parliament and of the Council amending Directive 2009/138/EC as regards … and amending Directives 2002/87/EC and 2013/34/EU” – European Parliament and European Council – 27.11.24

[3] https://www.iais.org/2024/12/iais-adopts-insurance-capital-standard-and-other-enhancements-to-its-global-standards-to-promote-a-resilient-insurance-sector/ – IAIS – 05.12.24

[4] “SII review – Pillar I technicalities and latest discussions” – Silvia Dell’Acqua – 15.03.25

[5] “COMMISSION DELEGATED REGULATION (EU) …/…, amending Delegated Regulation (EU) 2015/35” – European Commission – 17.07.25