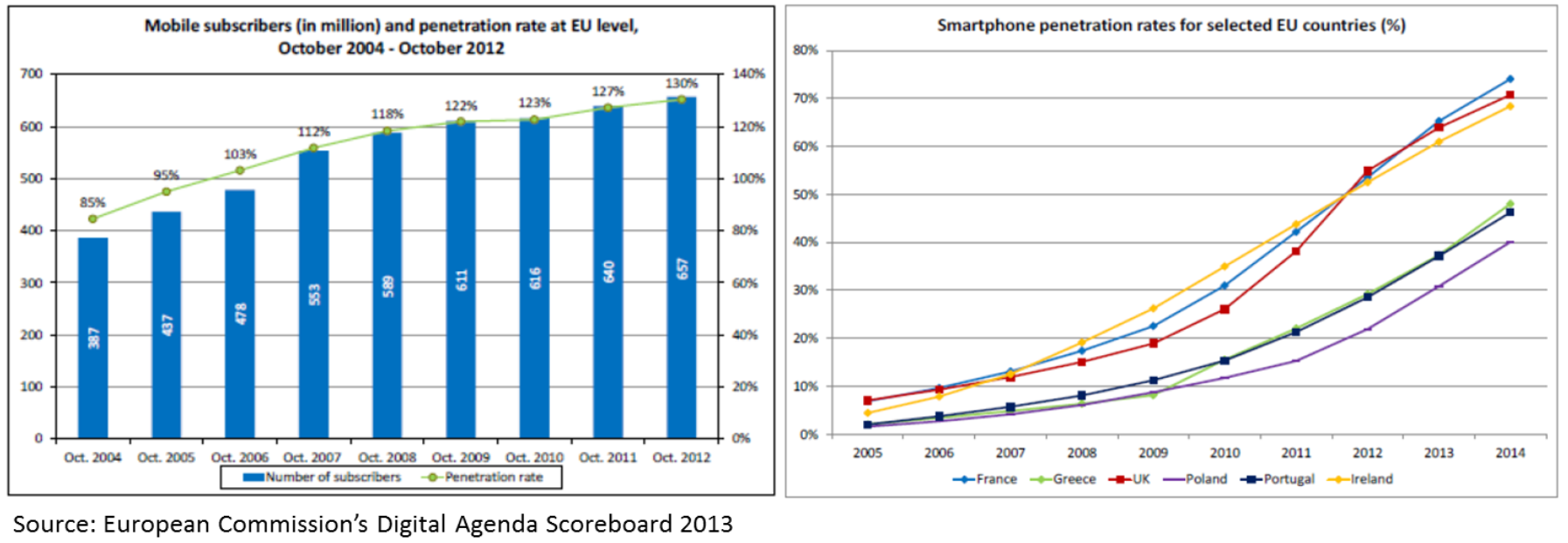

The mobile phone market has developed a lot in the last ten years across Europe: the penetration of mobile phones has increased significantly (since 2006 the subscriptions of SIM cards is higher than the number of inhabitants!) and the devices have experienced an increase in their price and values. As a result, the customers has begun to seeking for a coverage for their mobile devices and in response to that need the Mobile Phone Insurance (MPI) market has started to grow; MPI are insurance products that cover some kind of damages of mobile phones, like loss, theft or physical damages. Obviously, the MPI market goes hand in hand with the smart phone market, that is more pronounced in some EU countries.

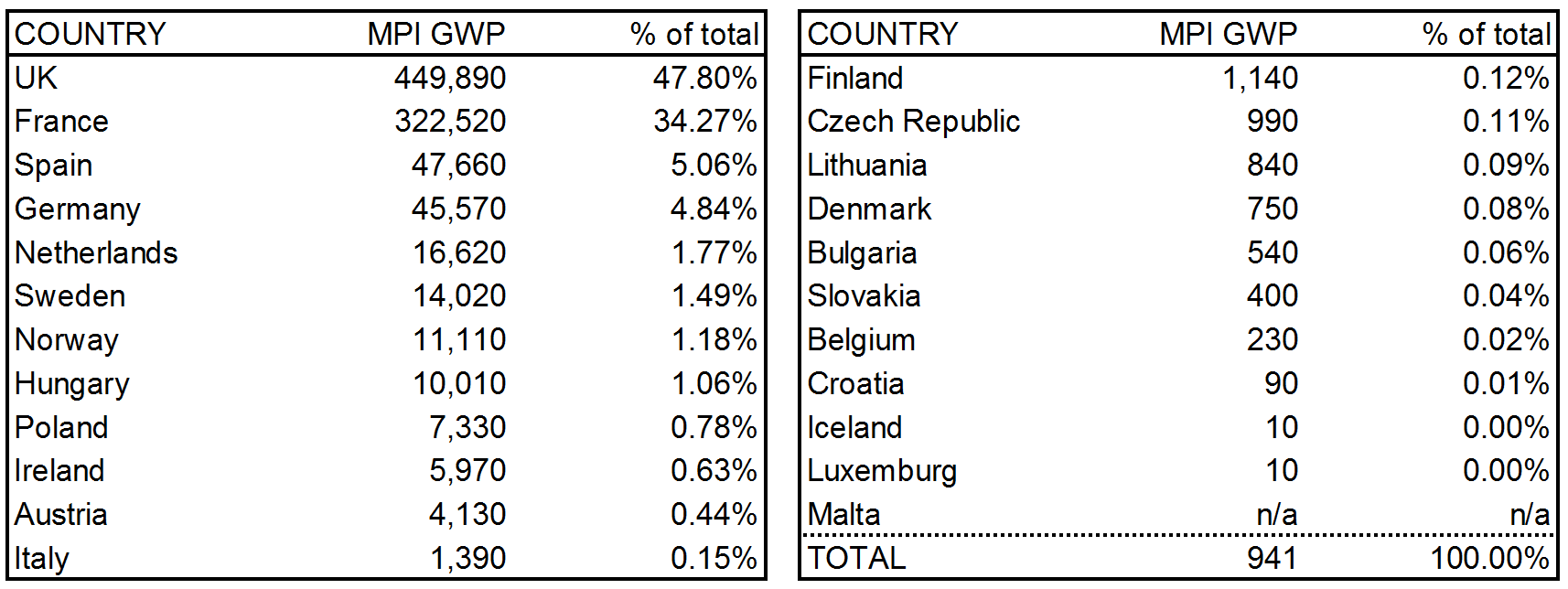

As it is reasonable to expect the MPI market to grow, EIOPA decided to conduct an EU-wide survey of this sector among its Member authorities to map the gap between what undertakings offer and what customers believe to have purchased. The summary report published on the 12th of November 2015 is based on data provided by 50 insurance undertaking and active MPI sector in 2013 of 23 countries. Covering over 80% of all sales in EU, UK and France are the largest MPI markets.

At that year, 2013, the sale of MPI insurance products through mobile operators or electronic stores was regulated at national level or in general EU legislations, but was not covered by the Directive 2002/92/EC on Insurance Mediation (IMD). As it is necessary to intervene with regulations and supervisions to prevent the customers detriment, the forthcoming IDD, expected in January 2016, will include some relevant provisions affecting the distribution of MPI products and the Member States are required to ensure their application within 2 years after the publication of the Directive. Among the most relevant provisions:

- prior the conclusion of the contract a needs and demands analysis has to be undertaken and customers have to be provided with a Product Information Document that explain in a transparent and user-friendly way not misleading information about the characteristics of the MPI product

- in case of cross-selling practice, the customer must be offered the possibility to buy both items separately; in case of package banks accounts separate information on costs and fees of each product/service must be communicated

- the remuneration policies of selling entities shall not conflict with the interest of customers and a complaints-handling procedure must be in place.

The survey suggests that MPI products are relatively standardized and very often (60%) the undertakings offer just one type of product. Among the other major evidences:

- duration: the most frequent (>55%) is 1y, in line with the usual boundaries of the mobile phone contracts. The short duration is driven by rapidity of the good to lose value (intensive daily use + constant innovation). Anyway, 34% of the cases show longer durations, up to 5 years, useless for the customer. Customers shall also be careful with the indication of the premium (a monthly one can be misleading) and if an automatic renewal is present

- type: half of the MPI policies are occurrence-based. This serves to prevent the temptation of using the insurance coverage to improve the quality of the mobile phone (usually the indemnity is a new mobile phone, maybe from the newest generation). However, 38% of the policies are claims based, so the coverage lasts until the premiums are paid

- coverage: policies commonly cover eventualities that are not already covered by the guarantee of the mobile device and are therefore known as “extended warranties”; the most common are “damage to the mobile phone”, “theft” and “loss”, but there are others like “abuse of the mobile phone after loss” and “loss of data in mobile phone”

- exclusions: differently from what customers are often incline to believe, there are a number of exclusions in the coverage: more than 50% of the products have theft-related exclusions and 32% of products have loss-related exclusions. These exclusions are sometimes misleading or not understood, e.g.

- UK: the majority of products do not cover instances where the customer accidentally leaves the mobile phone unattended in a public space

- Spain: customers are asked to provide as a proof of theft a report from the police within too short deadlines (this is not compliant with the Local legislation)

- France: the loss in case of negligence is not covered, but the word “negligence” is not defined

- sales channels: the largest one is composed of mobile phone operators and retailers, but also banking institutions play an important role. Particularly for the UK, it’s worth mentioning the package bank accounts that charge a monthly or annual fee in exchange of a series of benefits like MPI or travel insurances. The cross selling is another interesting phenomena as it can improve the quality of the products and increase the differentiation on one hand, but on the other it can lead to a lack of effective competition in the market as customers are more focused on the primary product rather than the in the add-on coverage (customers may also not be aware of buying an insurance)

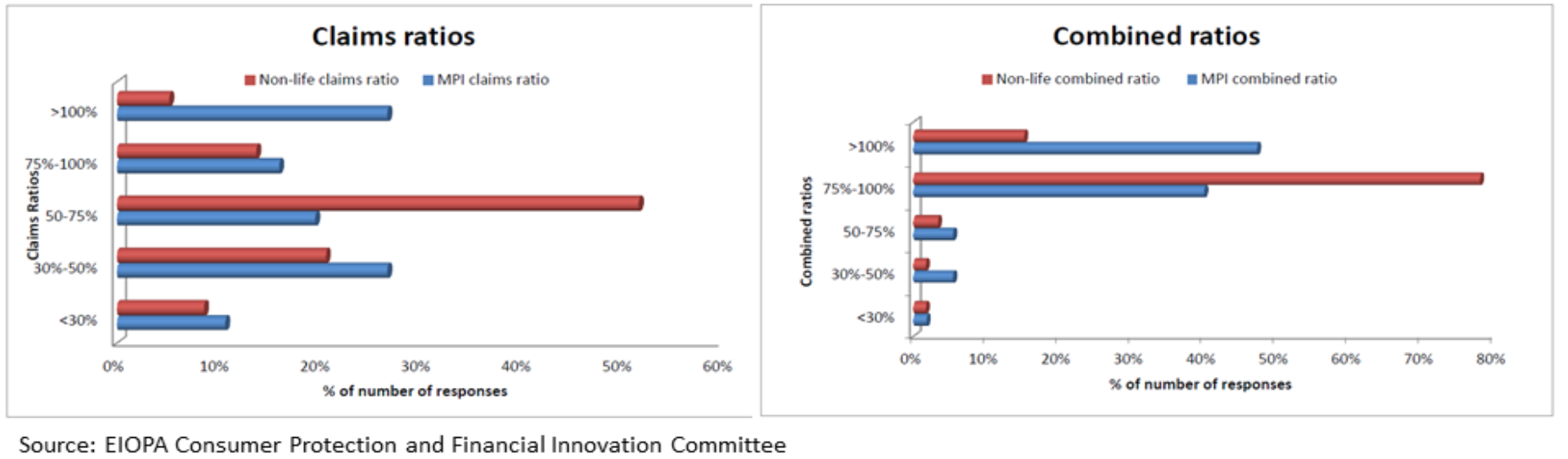

- profitability: compared to non life insurances of similar values, the claim ratios (claims payable / premium income) and combined ratios (sum of incurred losses and expenses / earned premium) of MPI products highlight that these types of insurances are often not profitable (in the 27% of cases the premia are not sufficient to cover the claims) with higher expenses. Intuitively, this is expected for a business at its early stage as the products have to bear starting costs that will be amortized in the future and on a larger scale, anyway it’s worth noticing that the average commission paid by the undertaking to the sales channels is extremely high (40% of the premium) and premia are usually small and this can turn out in aggressive selling practices. From the customer perspective, it’s important to analyze situations with very small claim ratio as this is symptomatic of misleading exclusions

- complaints: the majority (62%) are related to the administration of claims, followed by mis-selling (9%) and excessive exclusions (3%); unfortunately the complaints have not played an important role in the design of MPI products.