The financial services industry is experiencing significant disruption as companies navigate increasing customer expectations, shifting regulations, and rising competition.

According to the latest Deloitte’s “State of Generative AI in the Enterprise Q3” report, 70% of Financial Services leaders surveyed agree that their organizations are increasing investments in AI and GenAI, having already seen substantial value from these initiatives.

In this article, we’ll explore the key trends shaping the future of financial services, with a focus on how AI is revolutionizing the sector.

1. AI-Driven Investment Strategies: A New Frontier

One of the most exciting developments in investment banking is the application of AI to create innovative investment strategies. Traditionally, banks have relied on structured data, such as historical financial metrics, to make informed decisions. However, today’s financial markets are more complex, and unstructured data—ranging from news reports to alternative data sources—is becoming critical for decision-making.

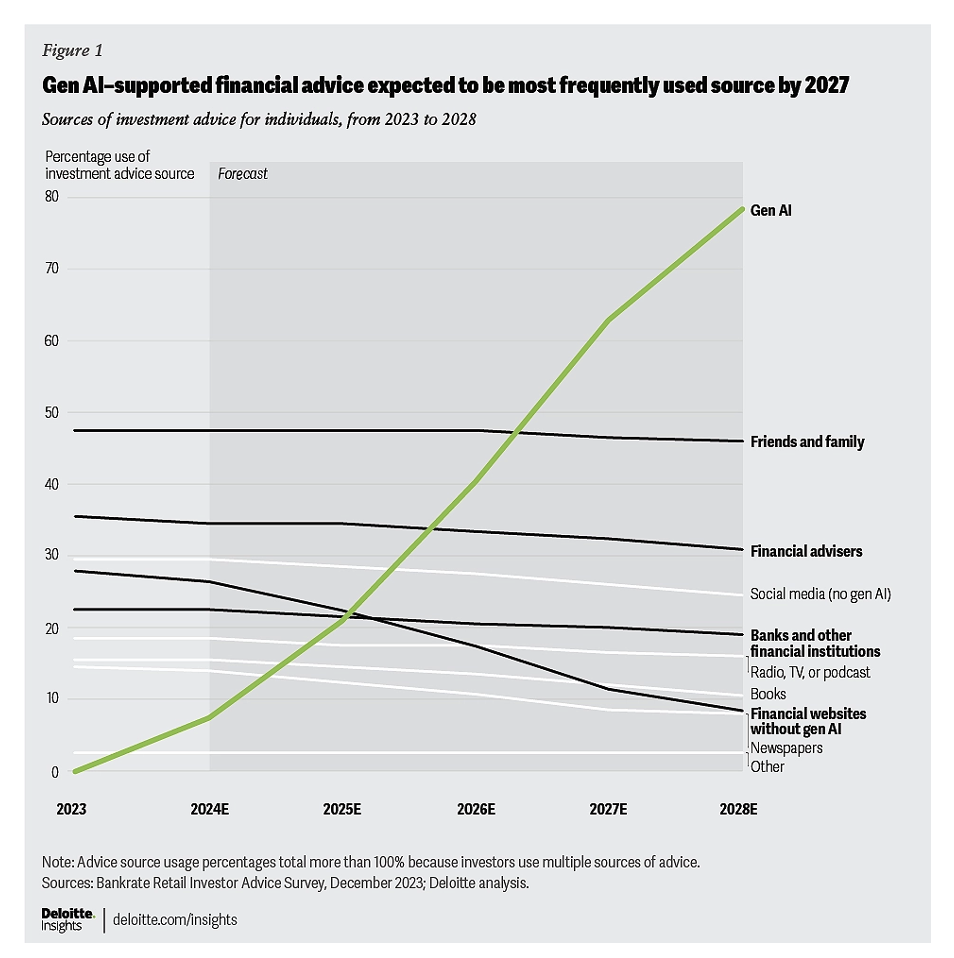

GenAI tools, particularly those focused on natural language processing (NLP), are proving invaluable in analyzing vast amounts of unstructured data. By identifying patterns and trends that humans might miss, AI can provide fresh insights, enhance risk assessments, and support portfolio optimization. As the GenAI marketplace grows, GenAI capabilities are expected to be included in the process of offering advice and guidance on investment opportunities.

The Deloitte Center for Financial Services forecasts that GenAI-enabled applications will likely dominate the retail investment advice landscape, with usage expected to grow from its current early stage to 78% by 2028.[3] By 2027, these applications could become the primary source of investment advice for retail investors. [3] This marks a major shift in the way investment advice is delivered, as traditional methods like relying on banks and financial advisers are projected to decline and may no longer be sufficient without the integration of GenAI tools.

Figure 1. Evolution of financial advice sources over the next five years with the introduction of GenAI capabilities[3]

2. GenAI-Enabled Fraud: How Banks Can Protect Customers and Strengthen Trust

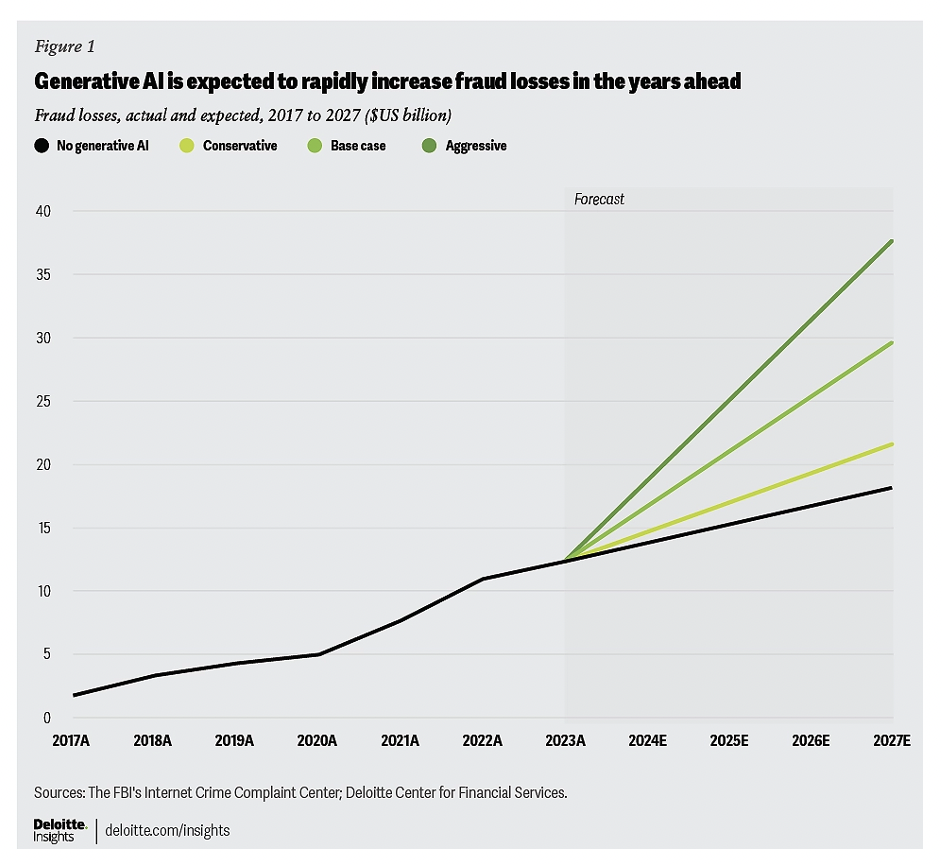

Deloitte’s Center for Financial Services predicts that generative AI could drive a 32% annual increase in fraud losses in the United States. [3] The vast potential of generative AI amplifies both the scale and complexity of fraud.

Figure 2. Expected increase in fraud losses due to the rise of GenAI[3]

The key to staying ahead of generative AI-enabled fraud is continued investment in AI technologies. Banks are now using advanced AI and machine learning tools to detect and respond to sophisticated fraud threats in real time, moving beyond outdated rule-based systems.

Customers expect security and efficiency, and failures can damage the relationship. To strengthen trust, banks should highlight their prevention efforts through proactive communication about potential threats. By integrating AI-powered tools like virtual agents, banks can deliver dynamic, personalized support that adapts to each client’s changing financial needs.

3. GenAI and Quantum Computing: Driving the Next Wave of Technology Adoption in Investment Banking

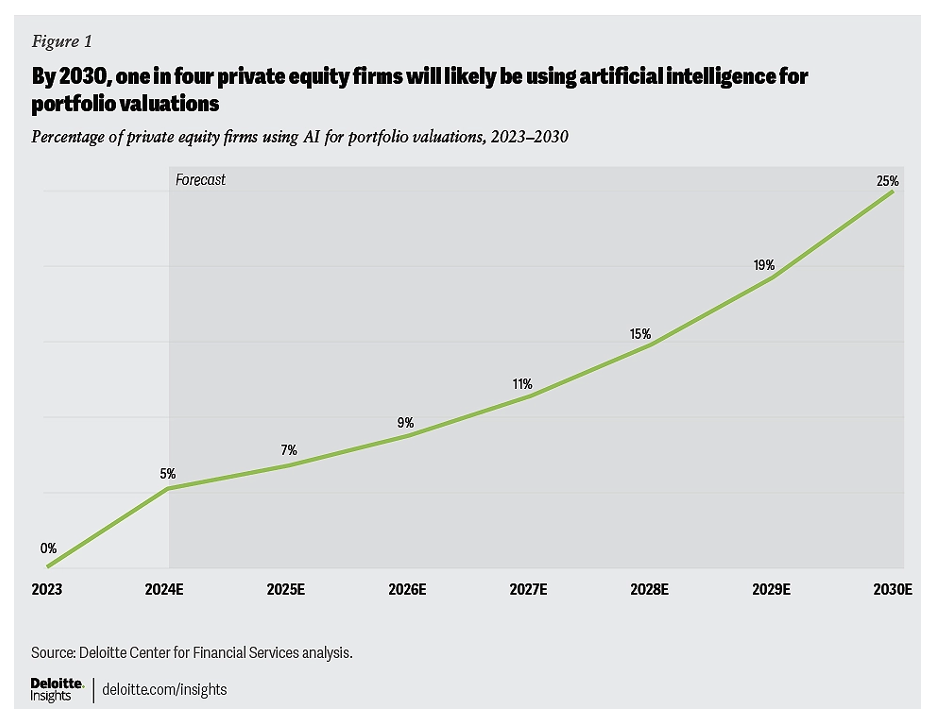

Over the next five to seven years, Deloitte predicts that up to 25% of private equity (PE) firms will adopt AI to enhance portfolio valuations, increasing both the frequency and accuracy of these assessments.[3]

Figure 3. The rise of new technologies in financial services: A case of private equity using AI for portfolio valuations[3]

The financial services sector is at the forefront of adopting new technologies to boost efficiency and performance. Innovations like generative AI (GenAI) and quantum computing are reshaping how investment banks operate.

GenAI is automating tasks such as document processing, data analysis, and report generation, allowing human talent to focus on more complex, high-value activities. AI-powered virtual assistants enhance productivity and enable faster responses to market fluctuations.

While still emerging, quantum computing offers immense potential for financial institutions. By leveraging quantum algorithms, banks can solve complex problems at extraordinary speeds, essential for tasks like risk modeling and financial forecasting. Quantum-enhanced AI also promises to strengthen cybersecurity, safeguarding sensitive financial data in an increasingly digital landscape.

Together, these technologies are paving the way for a more productive, secure, and future-ready financial services industry.

4. Adapting to Climate Change: How AI and Advanced Technologies Are Transforming Insurance Strategies and Premiums

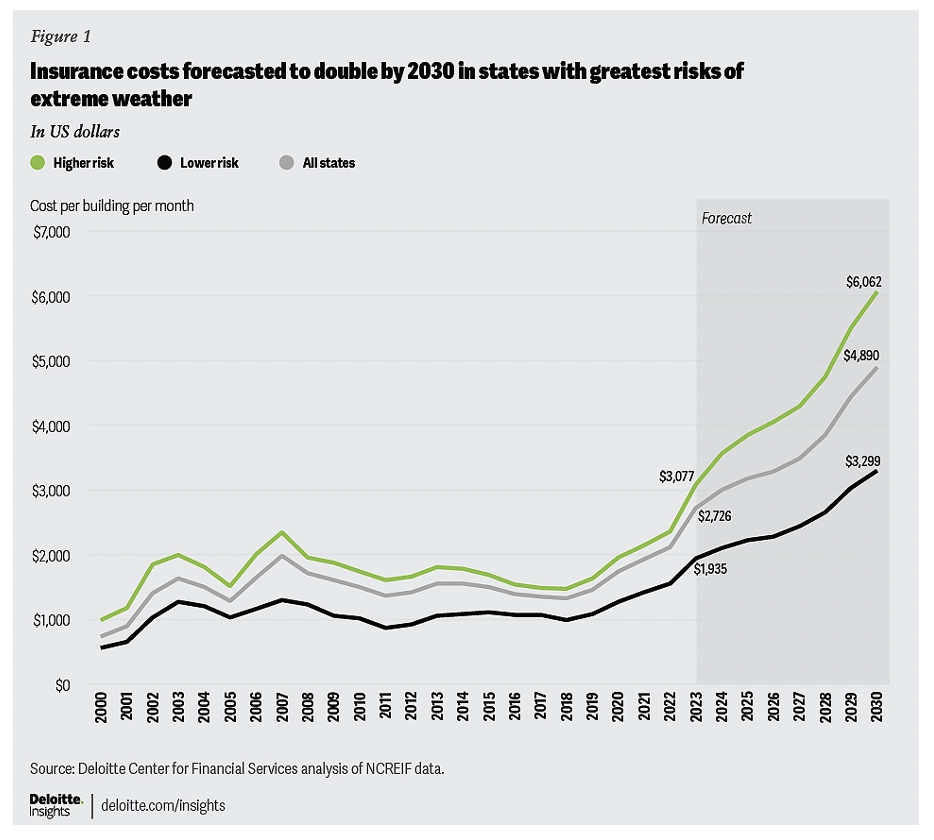

The increasing frequency and severity of natural disasters, driven by climate change, are causing more damage to assets each year. Property and casualty insurers can adopt new strategies, such as loss prevention and mitigation, to remain viable in regions vulnerable to climate risks.

AI and advanced technologies provide them with essential tools to adapt to the growing challenges of climate change. With enhanced satellite imaging and AI-driven solutions, insurers can map high-risk areas more accurately. As climate shifts become more frequent, dynamic risk mapping with AI helps insurers stay ahead of emerging threats. AI can assess climate risks and property vulnerabilities, identifying hazard-prone zones and guiding safer construction or rebuilding efforts.

As climate risks grow, insurers are responding by raising premiums, particularly for buildings in vulnerable areas. According to Deloitte Center for Financial Services, the average monthly insurance cost for a commercial property in the U.S. could rise from $2,726 in 2023 to $4,890 by 2030, driven by an 8.7% compound annual growth rate. [3]

Figure 4. Scenarios of insurance cost increases driven by climate risk[3]

In this rapidly changing environment, AI plays a pivotal role in helping insurers anticipate risks, adjust pricing, and support risk mitigation efforts.

AI Solutions Addressing Emerging Trends in Financial Services

Conversational AI

In the financial services industry, improving customer experience and operational efficiency is crucial, and conversational AI solutions are transforming how companies interact with customers. These AI-powered systems—such as chatbots and virtual assistants—are revolutionizing the customer service journey by automating routine interactions, reducing wait times, and ensuring faster responses to inquiries.

Conversational AI can go beyond simple scripted responses and engage customers in natural, dynamic conversations. GenAI-powered chatbots can understand and process more complex queries, providing personalized answers based on customer data and past interactions.

The digitalization of customer care processes also brings substantial cost savings to financial institutions. Conversational AI systems can operate 24/7, providing continuous customer support. This accessibility not only enhances satisfaction but also allows institutions to serve a global customer base, regardless of time zones.

Enhanced Fraud Detection

AI is becoming an indispensable tool for enhancing fraud detection and security in the Financial Services industry. One of the keyways AI is being used is through the identification of unusual patterns or outliers within a bank’s databases. By analyzing large volumes of transactional and behavioral data, AI systems can spot anomalies that deviate from normal patterns of activity. This could include unusual spending behaviors, such as large withdrawals or purchases outside of a customer’s typical geographic location, as well as rapid changes in account activity, like multiple logins in short periods or from different devices.

AI-driven fraud detection systems continuously evolve, and this dynamic learning capability enables banks to improve their fraud prevention measures over time, providing more reliable alerts. As a result, AI not only strengthens the bank’s security framework but also ensures a smoother and more secure experience for customers.

AI-driven underwriting

As climate change accelerates, the financial services industry (FSI) faces mounting pressure to adapt to new, complex risks, particularly in underwriting processes. Traditionally a manual, resource-heavy task, underwriting is essential for assessing risks related to insurance policies, loans, and investments. However, with more frequent and severe climate-related events, such as floods, wildfires, and hurricanes, traditional methods are no longer sufficient.

AI and automation offer a solution by enhancing underwriting efficiency and accuracy. By integrating real-time climate data, satellite imaging, and predictive models, AI can better assess the risks associated with natural disasters and changing climate conditions allowing insurers and lenders to adjust premiums or loan terms accordingly.

Conclusion

The Financial Services Industry (FSI) is data-intensive, simultaneously representing an opportunity for business success and a challenge to operations and efficiency. Artificial intelligence is rapidly reshaping the financial services industry, driving innovation across multiple sectors. As technology continues to evolve, the full potential of AI in the financial sector is just beginning to be realized, promising a transformative impact on the way we manage money, invest, and plan.

Authors:

Daniele Bobba – Senior Partner, Deloitte Consulting

Chiara Celsi – Partner, Deloitte Consulting

Marzia del Prete – Manager, Deloitte Consulting

Sara Ceschin – Senior Consultant, Deloitte Consulting

Sources:

[1] Deloitte Center for Financial Services

[2] 2023 FSI Prediction – Deloitte Center for Financial Services

[3] 2024 FSI Prediction – Deloitte Center for Financial Services

[4] The Financial Services AI Dossier – By Deloitte AI Institute