Abstract

The Basel III standards comprise a package of reforms agreed by the Basel Committee on Banking Supervision (“BCBS”) in December 2017 and set out in the BCBS standard “Basel III: Finalizing post-crisis reforms” (BCBS 424).

With the aim to implement these standards, the European Commission has amended the Capital Requirements Regulation (Regulation (EU) 575/2013, “CRR”) by Regulation (EU) 2024/1623 (“CRR III”) and the Capital Requirements Directive (Directive (EU) 2013/36, “CRD IV”) by Directive (EU) 2024/1619 (“CRD VI”). Both have been published in the Official Journal of the European Union on 19 June 2024 and shall enter into force on the twentieth day following that of its publication.

Most amended provisions of the CRR will become effective on 1 January 2025. EU member states will now need to transpose the requirements of CRD VI into national law, to be applied by January 11th, 2026.

This document highlights, with specific reference to the new Market Risk Framework (i.e., Fundamental Review of the Trading Book – FRTB) the main differences set up with the EU Regulatory requirements. Indeed, CRR II inserted an Alternative Standardised Approach (A-SA), Art. 325c to 325ay CRR, and an Alternative Internal Model Approach (“A-IMA”), Art. 325az to 325bp CRR. CRR III by comparison, imposes these approaches as binding own funds requirements. Art. 325 CRR will be amended to provide that institutions should calculate their own funds for market risk in accordance with the A-SA, the A-IMA, or the Simplified Standardised Approach (Art. 326 to 361 CRR). Furthermore, the CRR III will also:

- Amend the provisions referred to the trading book and the assignment of instruments to trading and banking books (Art. 104 to 104c CRR).

- Technical and methodological amendments to provisions on the A-SA and A-IMA.

- Give the European Commission the power to adopt delegated acts to amend the approaches to calculating Own Funds Requirements for market risk and to amend the date of entry of application of these approaches (Art. 461a CRR).

1. Introduction

The proposed amendment to Regulation (EU) No 575/2013, known as the Capital Requirements Regulation (CRR), is part of a legislative package that also includes changes to Directive 2013/36/EU, referred to as the Capital Requirements Directive (CRD).

Following the Great Financial Crisis of 2008-2009, the Union implemented significant reforms to the prudential framework for banks to improve their resilience and prevent a similar crisis from happening again. These reforms were primarily based on international standards established since 2010 by the Basel Committee on Banking Supervision (BCBS), known as the Basel III standards.

These standards have become increasingly crucial due to the banking sector’s growing global and interconnected nature. The initial set of post-crisis reforms under the Basel III framework were implemented in two phases:

- In June 2013 with the adoption of CRR and CRD IV.

- In May 2019 with the adoption of Regulation (EU) 2019/876 (CRR II) and Directive (EU) 2019/878, also known as CRD V.

These reforms aimed to increase both the quality and quantity of regulatory capital that banks must hold to cover potential losses.

Consequently, the new rules enhanced the criteria for eligible regulatory capital, raised minimum capital requirements, and introduced new requirements for Credit Valuation Adjustment (CVA) risk and exposures to central counterparties. Additionally, several new prudential measures were introduced: a minimum leverage ratio requirement, a short-term liquidity ratio (liquidity coverage ratio), a longer-term stable funding ratio (net stable funding ratio), limits on large exposures, macro-prudential capital buffers, and a market risk framework.

Regarding market risk, in 2016, the BCBS published revised standards known as the Fundamental Review of the Trading Book (FRTB) to address deficiencies in the market risk capital requirements framework for trading book positions. While monitoring the impact of the FRTB standards, the BCBS identified several issues and released updated FRTB standards in January 2019.

In November 2016, the Commission initially proposed binding Own Funds Requirements (OFR) based on the FRTB standards as part of the CRR II to address deficiencies in the market risk framework. However, due to the BCBS’s subsequent revisions to these standards, which were not aligned with the CRR II negotiation timeline, the European Parliament and the Council agreed to implement the FRTB standards in the CRR II solely for reporting purposes.

The introduction of binding Own Funds Requirements based on the FRTB standards was postponed, pending the adoption of a separate legislative proposal yet to be published. To introduce binding Own Funds Requirements for Market Risk in line with the revised FRTB standards, several amendments are made to the CRR (with the publication of CRR III regulation), better detailed in the following section.

The goal of this document is to highlight the main differences arising by the publication of the CRR III Regulation in the Official Journal of the European Union (e.g., Regulation (EU) 2024/1623 of 31 May 2024[1]) with respect to the Proposal for a Regulation of the European Parliament and of the Council (2021/0342) issued in October 2021[2].

Finally, the main differences between the CRR II Regulation[3] (2019/876) and the CRR III Regulation have been already reported in the dedicated document (cfr. par. “Market Risk”) published by the European Parliament.

2. Main differences on CRR Regulation regarding Market Risk

To complete the reform agenda introduced after the global financial crisis of 2008-2009 and to address deficiencies in the current market risk framework, binding Own Funds Requirements for market risk based on the final FRTB standards should be implemented in Union law. Specifically, Regulation (EU) 2024/1623 (CRR III) amending Regulation (EU) No 575/2013 (CRR) introduced the Fundamental Review of the Trading Book (FRTB), developed by the Basel Committee on Banking Supervision (BCBS), into the prudential framework of the EU. Despite not yet being binding in terms of Own Funds Requirements, the FRTB was implemented by means of a reporting requirement, constituting the first step towards the full implementation of the FRTB in the EU.

In addition, in line with the Basel III standards, the implementation of the boundary requirements should include the lists of instruments to be assigned to the trading book or the non-trading book, as well as the derogation allowing institutions to assign, subject to the approval of the competent authority, certain instruments usually held in the trading book, including listed equities, to the non-trading book, where positions in those instruments are not held with trading intent or do not hedge positions held with trading intent.

This article focuses on the key changes introduced in the final version of CRR III, published on the Official Journal of the European Union in May 2024, compared to the October 2021 draft and with specific reference to the market risk framework. These changes pave the way for the full implementation of FRTB in the EU. Specifically:

- 102 deal with the FRTB approach to calculate a bank’s capital requirements.

- 104 revises the criteria for classifying financial instruments as either “trading book” or “non-trading book” (banking book).

- 106 clarifies existing provisions on internal risk transfers within a bank.

- 325 set up new rules for calculating a bank’s capital requirements for market risk based on the FRTB approaches.

- 461 deal with own fund requirements

Further details are provided in the following section.

Article 102 – Requirements for the Trading Book

- It is added that an institution shall have in place an independent risk control function which shall evaluate, on an ongoing basis, whether its instruments are being properly assigned to the trading book or the non-trading book.

- It is specified that is provided a derogation, regarding point (i) about options, or other derivatives, embedded in the own liabilities of the institution in the non-trading book that relate to credit risk or equity risk). Indeed, where, due to its nature, it is not possible to split the instrument, an institution shall assign the whole instrument to the trading book. In such a case, it shall duly document the reason for applying that treatment.

- It has been specified that hedge fund (and derivatives on such instrument) shall be allocated to the banking book; a derogation subject to the approval of its competent authority is permitted once such exposure has a trading intent.

- It has been stated that EBA shall submit draft Regulatory Technical Standards to the Commission by 10 July 2027 to further specify the process that institutions are to use to calculate and monitor net short credit or net short equity positions in the non-trading book.

Article 104a – Inclusion in the Trading Book

It has been specified that by 10 July 2027 (instead of June 2024) EBA will issue guidelines on the exceptional circumstances for which a position shall be reclassified between banking and trading book (or vice versa).

Article 106 – Internal Hedges

- Regarding the internal hedge, has been removed the requirement for which a trading desk shall be established in accordance with Article 104b (“Requirement for trading desk”)

- It has been created a new paragraph (4a) which relaxes the conditions related to the internal hedge. Indeed, the credit or equity derivative transaction entered into by an institution may be composed of multiple transactions with multiple eligible third-party protection providers, provided that the resulting aggregated transaction meets the conditions set out in the related paragraphs.

Article 325 – Approaches for calculating the Own Funds Requirements for market risk

It has been prescribed that the institution shall document the usage of the derogation according to which FX risks (both of banking and trading book position) is not included in the own fund requirements calculation where those position are deducted from it. To this purpose, it shall be also documented its impact and materiality, and make the information available, upon request, to its competent authority.

Article 325c – Scope and structure of the alternative standardized approach

- It has been specified that when calculating the Own Funds Requirements for market risk for own debt instruments under the sensitivities-based method, the institution shall exclude from that calculation the risks from the institution’s own credit spread.

- It has been added that EBA shall develop draft Regulatory Technical Standards to specify the assessment methodology under which competent authorities conduct the verification of the implementations of the alternative standardized approach.

Article 325j – Treatment of Collective Investment Undertakings

- It has been clarified that when an institution calculates the own funds requirement for market risk of the CIU by considering the position in the CIU as a single equity position allocated to the bucket “Other sector”, the institution shall consider the position in the CIU as a single unrated equity position allocated to the bucket “Unrated” in Article 325y(1).

- It has been inserted that an institution may use a combination of the approaches referred to in paragraph 1, points a. (Look Through Approach) and b. (single equity position), for its positions in CIUs. However, an institution shall use only one of those approaches for all positions in the same CIU.

- It has been specified that an institution may use the approaches referred to in paragraph 1 (Look Through Approach) only where the CIU meets all of the conditions set out in Article 132(3) – i.e., UCITS and AIF. Where the CIU does not meet all the conditions set out in Article 132(3), the institution shall assign its positions in that CIU to the non-trading book.

- It has been clarified that EBA shall submit draft Regulatory Technical Standards to the Commission by 10 January 2027 in order to specify the technical elements of the methodology to determine hypothetical portfolio.

Article 325s – Vega risk sensitivities

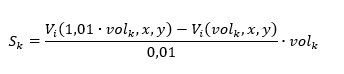

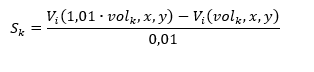

The formula for the vega risk sensitivity of an option to a given risk factor k has been modified. In particular, it has been removed the factor volk which multiply the ratio. The old formula inserted in CRR 3 – October 2021

has been modified as follows:

Where:

Sk = the vega risk sensitivity of an option.

k = a specific vega risk factor, consisting of an implied volatility.

volk = the value of that risk factor, which should be expressed as a percentage; and

x,y = risk factors other than volk in the pricing function Vi.

Article 325t – Requirements on sensitivity computations

Par. 6 point (b) is replaced, and it specifies that the institution which calculates the vega sensitivities on the basis of a linear transformation of alternative definitions of sensitivities in the calculation of the Own Funds Requirements of a trading book position according to Alternative Standardised Approach (A-SA), shall demonstrate that the alternative definitions are more appropriate for capturing the sensitivities for the position than are the formulae set out in the Vega Risk Sensitivities. In addition, it shall demonstrate that the linear transformation reflects a vega risk sensitivity, and that the resulting sensitivities do not materially differ from the ones applying those formulae.

Article 325u – Own Funds Requirements for residual risks

The new Par. 4a, 6 and 7 have been inserted. In particular:

Par. 4a specifies that by way of derogation from Par. 1, until 31 December 2032, an institution shall not apply the Own Funds Requirements for residual risks to instruments that aim solely to hedge the market risk of positions in the trading book that generate an own funds requirement for residual risks and are subject to the same type of residual risks as the positions they hedge. The competent authority shall grant permission to apply the treatment referred to in the first subparagraph if the institution can demonstrate on an ongoing basis to the satisfaction of the competent authority that the instruments comply with the criteria to be treated as hedging positions.

Par. 6 specifies that EBA shall develop draft Regulatory Technical Standards to specify the criteria that the institutions are to use to identify the positions qualifying for the derogation referred to in paragraph 4a. The EBA shall submit those draft Regulatory Technical Standards to the Commission by 30 June 2024.

Par. 7 specifies that by 31 December 2029, EBA shall submit a report to the Commission on the impact of the application of the treatment referred to in paragraph 4a. On the basis of the findings of that report, the Commission shall, where appropriate, submit to the European Parliament and to the Council a legislative proposal to prolong the treatment referred to in that paragraph.

Article 325x – Net jump-to-default amounts

A new Par. 5 has been inserted. In particular, it specifies that if there is a derivative position having a debt or equity cash instrument as an underlying, and hedged with that debt or equity cash instrument, allow an institution to close out both legs of that position at the time of the expiry of the first-to-mature of the two legs with no exposure to default risk of the underlying, the net jump-to-default amount of the combined position shall be set equal to zero.

Article 325ad – Calculation of the Own Funds Requirements for the default risk for the ACTP

Par. 1 and Par. 3 have been modified. In particular:

Par. 1 has been replaced by specifying that the Net JTD amount should be multiplied by:

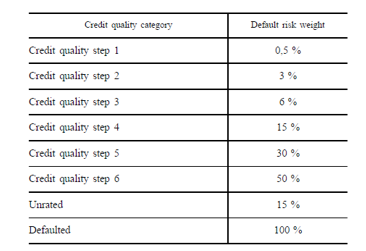

a. for non-tranched products, the default risk weights corresponding to their credit quality as specified in Article 325y(1) and (2), i.e.:

Similarly, exposures which would receive a 0 % risk-weight under the Standardised Approach for credit risk shall receive a 0 % default risk weight for the own funds requirements for the default risk.

b. for tranched products, the default risk weights referred to in Article 325aa(1). Indeed, net JTD amounts of securitization exposures shall be multiplied by 8 % of the risk weight that applies to the relevant securitization exposure in the non-trading book irrespective of the type of counterparty.

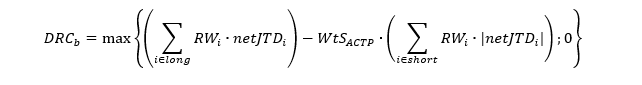

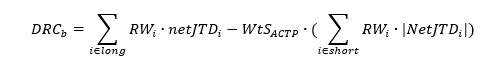

In Par. 3 the DRCb old formula inserted in CRR II

has been replaced by:

Where:

- DRCb = the Own Funds Requirement for the default risk for bucket b.

- i = an instrument belonging to bucket b; and

- WtSACTP = the ratio recognising a benefit for hedging relationships within a bucket, which shall be calculated in accordance with the WtS formula set out in Article 325y(4), but using long positions and short positions across the entire ACTP and not just the positions in the particular bucket.

Article 325ak – Risk weights for credit spread risk for securitizations included in the ACTP

Par. 1, table 6, has been modified as follows:

- i (1), the second row is replaced by ‘Credit quality step 1 to 10’

- ii (2), the third row is replaced by ‘Credit quality step 11 to 17’

Article 325am – Risk weights for credit spread risk for securitizations not included in the ACTP

Par. 1 and Par. 3 have been modified. In particular:

Par. 1 specifies that the column ‘Credit quality’ in par. 1, table 7, is modified as follows:

- Par. 1 i, the first row is replaced by ‘Senior and credit quality step 1 to 10’

- Par. 1 ii, the second row is replaced by ‘Non-senior and credit quality step 1 to 10’

- Par. 1 iii, the third row is replaced by ‘Credit quality step 11 to 17 and unrated’

Par. 3 specifies that an exposure shall be assigned the credit quality category corresponding to the credit quality category that it would be assigned under the External Rating Based Approach.

Article 325ax – Vega and curvature risk weights

A new Par. 6 has been inserted. In particular, it specifies that for general interest rate, credit spread and commodity curvature risk factors, the curvature risk weight shall be the parallel shift of all vertices for each curve on the basis of the highest prescribed delta risk weight for the relevant risk bucket.

Article 325as – Risk weights for commodity risk

Regarding Bucket 3 (Energy – Electricity) a new bucket has been defined: it regards the “Energy — non-EU ETS carbon trading” to which is attribute a Risk Weight equal to 60%.

Article 325az – Alternative Internal Model Approach and permission to use Alternative Internal Models

- It has been specified that EBA shall issue an opinion to better clarify the extraordinary circumstances under which a back testing breach shall not be compute. Moreover, EBA shall submit draft Regulatory Technical Standards to the Commission by 30 June 2024.

Article 325ba – Own Funds Requirements when using alternative internal models

It has been clarified that, where calculating the Own Funds Requirements for market risk using an internal model, an institution shall not include its own credit spreads in the calculation of Expected Shortfall and SSRM for positions in the institution’s own debt instruments.

Article 325bc – Partial Expected Shortfall Calculation

It has been specified that EBA shall develop draft Regulatory Technical Standards to specify the criteria for the use of data inputs in the risk-measurement model referred, including criteria on data accuracy and criteria on the calibration of the data inputs, where market data are insufficient. EBA shall submit those draft Regulatory Technical Standards to the Commission by 10 January 2026.

Article 325bd – Liquidity Horizon

- It has been clarified that for the mapping of risk factor of each asset class and liquidity horizon, currencies of Member States participating in ERM II shall be included in the most liquid currencies and domestic currency sub-category within the broad category of interest rate risk.

- It has been specified that EBA shall develop draft Regulatory Technical Standards to specify the criteria to assess the modellability of risk factors, including where market data provided by third-party vendors are used, and the frequency of that assessment. EBA shall submit those draft Regulatory Technical Standards to the Commission by 10 July 2025.

Article 325bf – Regulatory back-testing requirements and multiplication factors

- It has been specified that EBA shall submit draft Regulatory Technical Standards to the Commission by 10 July 2026 to specify the conditions and the criteria according to which an institution may be permitted not to count an overshooting where the one-day change in the value of its portfolio that exceeds the related value-at-risk number calculated by that institution’s internal model is attributable to a Non-Modellable risk factor.

- It has been specified that EBA shall submit Draft Regulatory Technical Standards to the Commission by 10 July 2025 regarding the criteria specifying whether the theoretical changes in the value of a trading desk’s portfolio are either close or sufficiently close to the hypothetical changes in the value of a trading desk’s portfolio, considering international regulatory development.

Article 325bh – Requirements on risk measurement

It has been added that the internal risk-measurement model shall incorporate risk factors corresponding to gold and to the individual foreign currencies in which the institution’s positions are denominated; for CIUs, the actual foreign exchange positions of the CIU shall be considered; institutions may rely on third-party reporting of the foreign exchange position of the CIU, provided that the correctness of that report is adequately ensured.

Article 325bo – Recognition of hedges in an internal default risk model

Regarding the recognition of hedges in an internal default risk model, has been provided technical detail regarding the model. Indeed, institutions shall capture material basis risks in hedging strategies that arise from differences in the type of product, seniority in the capital structure, internal or external ratings, vintage, and other differences. In addition, institutions shall ensure that maturity mismatches between a hedging instrument and the hedged instrument that could occur during the one-year time horizon, where those mismatches are not captured in their internal default risk model, do not lead to a material underestimation of risk. Finally, institutions shall recognize a hedging instrument only to the extent that it can be maintained even as the obligor approaches a credit event or other event.

Article 325bp – Particular requirements for an internal default risk model

It has been specified that in the internal default risk measurement model, PD shall be floored at 0,01% for exposures to which a 0 % risk weight is applied in accordance with Articles 114 to 118 (exposure to central governments or central banks, regional governments or local authorities, public sector entities, multilateral development banks, international organization) and at 0,01 % for covered bonds to which a 10 % risk weight is applied in accordance with Article 129 (covered bonds); otherwise, the default probabilities shall be floored at 0,03 %.

Article 461a – Own funds requirement for market risks

It has been specified that where the Commission adopts the delegated act, the Commission shall, where appropriate, submit a legislative proposal to the European Parliament and to the Council to adjust the implementation in the Union of international standards on Own Funds Requirements for market risk to preserve in a more permanent manner a level playing field with third countries, in terms of Own Funds Requirements and the impact of those requirements. By 10 July 2026, EBA shall submit a report to the European Parliament, to the Council and to the Commission on the implementation of international standards on Own Funds Requirements for market risk in third countries. Based on that report, the Commission shall, where appropriate, submit to the European Parliament and to the Council a legislative proposal, to ensure a global level playing field.

3. Conclusion

On 31 May 2024, the Council of the EU announced the adoption of the Directive amending the Capital Requirements Directive concerning supervisory powers, sanctions, third-country branches, and environmental, social, and governance risks (CRD VI), along with the Regulation amending the Capital Requirements Regulation related to requirements for credit risk, credit valuation adjustment risk, operational risk, market risk, and the output floor (CRR III).

The publication of CRR III in the Official Journal of the European Union marked the final step in the roadmap for integrating the key elements of the new regulatory framework into EU law. Member states will have 18 months to transpose the directive into national legislation. The regulation will apply from 1 January 2025.

This development poses significant challenges for institutions regarding their methodological, IT, and governance infrastructures. The main innovations related to the June 2024 official publication are mainly on technical details regarding the risk measure computation: in particular, they refer to the perimeter of risk factors that shall be included in the simulation (e.g., own credit risk), the methodological model underlying the Default Risk Charge (DRC) simulation (with the introduction of a 0.01% PD floor for certain types of exposure) as well as some technicalities regarding the computation of sensitivity that shall be used for the market risk Alternative Standardized Approach (A-SA).

Finally, with reference to the governance requirements, it shall be highlight that, in line with the current requirements, the European Commission shall, where appropriate, submit a legislative proposal to the European Parliament and to the Council to adjust the implementation in the Union of international standards on Own Funds Requirements for market risk to preserve in a more permanent manner a level playing field with third countries, in terms of Own Funds Requirements and the impact of those requirements. To this purpose, on 18 June 2024, the European Commission published a speech by Mairead McGuinness[4] in which she discusses the Capital Markets Union and Banking Union.

Among other points, Commissioner McGuinness underlying that the finalization of the Basel III reforms is a major achievement for the Commission the only area where the Commission is empowered to delay the entry into application of the new standards is market risk, if the level playing field cannot be ensured.

The Commission feels that it has become clear that the United States (US) will delay its implementation of Basel III and in practice it is now highly unlikely that the US will not implement the reforms before 1 January 2026, at the earliest. Therefore, the Commission will use its empowerment to postpone the date of application of the rules on market risk in the EU by one year, until 1 January 2026. The Commission will work closely with the new European Parliament and the Council in this process. It will adopt this delay by way of a delegated act which will be subject to scrutiny by the European Parliament and the Council. This will take a minimum of 3 months. The delay of one year of the market risk rules in the EU should not be considered an encouragement to depart from the Basel standards. The EU is adhering to 1 January 2025 for entry into application of the bulk of the Basel standards. But on market risk, it feels the need to ensure a global level playing field and alignment on the entry into application of the rules.

Authors:

Paolo Gianturco, Senior Partner | FSI & FS Tech Leader, Deloitte Italy, pgianturco@deloitte.it

Francesco Zeigner, Senior Partner | Banking & Capital Markets Sector Leader, Financial Risk Leader, Deloitte Italy, fzeigner@deloitte.it

Silvia Manera, Senior Partner, Deloitte Italy, smanera@deloitte.it

Michael Zottarel, Senior Manager, Deloitte Italy, mzottarel@deloitte.it

Andrea Rodonò, Manager, Deloitte Italy arodono@deloitte.it

[1] Reference LINK. Date of effect: 09/07/2024

[4] European Commissioner for Financial Services, Financial Stability and Capital Markets Union, REFERENCE LINK