Benoit Coeuré, member of the executive board of the ECB, addressed the annual US Monetary Policy Forum which took place in New York on February, 23rd. Coeuré focused on assets purchase programme, which reached unprecedently high levels in recent years.

Particularly, he addresses the question on whether it is the cumulated stock or the quarter-by-quarter flow of such purchases affecting the price of the underlying obligations. This question is particularly important for the ECB, as the assets purchase programmes comprise three components: first, net asset purchases; second, the stock of acquired assets and forthcoming reinvestments; and third, an ECB forward guidance on interest rates.

The detailed evidences supplied reveal the non-linear nature of the stock effect, which implies that the amount of purchases needed to compress the term premium is likely to fall over time, as the cumulated amount of stock increases. There exists a threshold (“crossover point”) then additional purchases become less necessary.

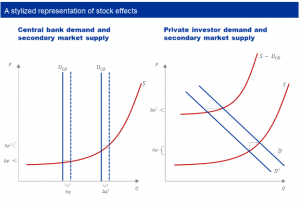

Figure 1 : A stylized representation of stock effects

(Source: ECB)

The underlying theoretical reasoning is relatively simple: asset purchase programmes consists of an inelastic demand of obligations from the central bank (D_CB in Figure 1). This demand constrains de facto the supply of bonds available to price-sensitive private investors. The demand curve for private investors, is price-elastic. Hence, if central banks have succeeded in shifting the supply curve sufficiently inwards, that is, the price variation induced by investors’ demand (D in Figure 1) will get smaller, then prices may become less sensitive even when purchases start being reduced. The full speech is available in the ECB website.

The persistence and signalling power of central bank asset purchase programmes (link)