In [1] we investigate the effect of flow of funds on an assets management problem when the manager is remunerated through a High Water Mark (HWM) and a management fee. More precisely, we assume that the assets under management (AUM) are characterized by in/outflow of funds as a function of the relative performance of the fund with respect to an exogenous benchmark (the sensitivity being η). The remuneration scheme is defined as a convex combination of a management and of a HWM fee. Both fees are defined as constant fractions: of the AUM (management fee) and of the HWM, i.e., the highest peak reached by AUM or by the performance of fund. Therefore, the remuneration in a small period (t,t+dt) is given by

(1-x)aW(t)dt+xkdH(t) (1)

where W is the AUM, H is the HWM, and x, a and k are constants. If the AUM or the performance of the fund (depending on the specification of the HWM fee) does not reach a new peak in the period dt (dH(t)=0), then no HWM fee is due. This ensures that the manager is not remunerated in case of a poor performance.

We concentrate our attention on the role of the management and of the HWM fee on the optimal portfolio choice of the manager and in particular on its propension to take risk in excess with respect to the benchmark and to the optimal portfolio choice without flow of funds (a solution that has been identified in [2]). We show two main results.

First, we show that, independently of the specification of the HWM fee, increasing the importance of the HWM fee with respect to the management one (increasing x in (1)), the asset manager adopts a more aggressive optimal investment strategy. This result can be rationalized observing that the management fee is linear on the AUM, instead the HWM incentive fee is an option like component. As a consequence, when the latter component becomes more important with respect to the first one the asset manager tends to take more risk.

The practice in the hedge fund industry is to consider remuneration schemes with both a management fee and a HWM incentive fee. Our analysis shows that the design of the fee structure may induce more or less risk taking. It is well known that an investor is likely to consider the investment in a hedge fund as risky, so he/she may not in principle be against the fact that the asset manager takes risk in excess and/or a high leverage exposure. However, we may consider as “expected” risk exposure the risk taking level obtained without flow of funds, i.e., in the case the AUM is not characterized by in/outflows, and “unwanted” the extra risk taking exposure that comes from the flow of funds.

The analysis depends on the design of the remuneration scheme. We consider two types of HWM: one defined on the AUM, i.e., H(t)=max{W(s), s in [0,t]}, and the other defined on the AUM depurated by the in/outflow of funds, as it is in the habit of the hedge fund industry. In the latter case, the HWM is thus defined on the pure performance of the fund.

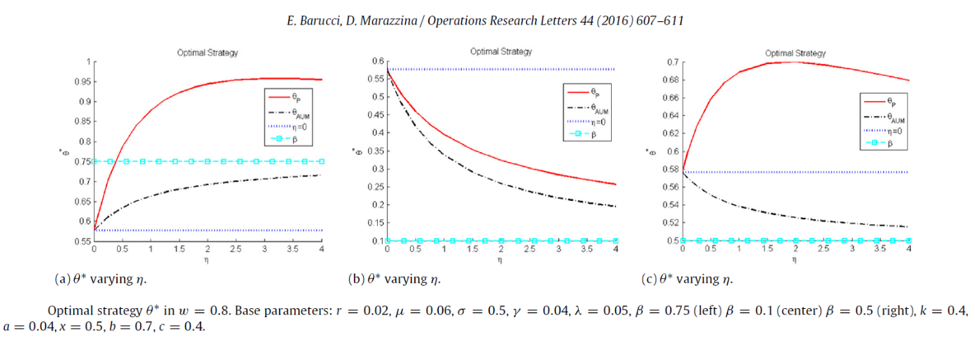

In the above picture, we show the optimal strategy, defined as the fraction of funds invested in the risky asset, varying η, i.e., the sensitivity with respect to the flow of funds. We recall that flow of funds is designed as a function of the relative performance of the fund with respect to an exogenous benchmark, which is a convex combination of parameter β of the risk-free and the risky asset; the benchmark coincides with the risk-free (risky) asset if β=0 (β=1). In the picture, three different values of β are considered.

As shown in the picture, a contract with a remuneration as in (1) with the HWM defined on the performance of the fund (θP in the picture) leads to excess risk taking with respect to the benchmark and to the optimal strategy assuming that the fund is not affected by flow of funds (η=0 in the picture). The effect is not observed in case of a HWM defined on the AUM (θAUM in the picture): in this case the optimal strategy is always intermediate between the benchmark and the optimal strategy obtained without flow of funds (η=0 in the picture).

So the flow of funds with a standard HWM induces excess risk taking with respect to the strategy of a manager without flow of funds. This is a negative result from the investor point of view because we may consider that the investor looking for an aggressive strategy by the hedge fund would like the manager to stick to the level of risk exposure obtained without flow of funds and may dislike the extra component that comes from the flow of funds.

Bibliography

[1] E.Barucci, D.Marazzina, Asset management, High Water Mark and flow of funds, Operations Research Letters 44 (2016) 607–611. http://authors.elsevier.com/a/1TRDdc7SoX-Cl

[2] S.Panageas, M.Westerfield, High-water marks: high risk appetites? Convex compensation, long horizons, and portfolio choice, Journal of Finance 64-1 (2009) 1–36.