IFRS 9: main innovations introduced

In 2005 the IASB & FASB jointly started a new accounting project in order to reduce the complexities related to the IAS 39 financial asset classification. This study aims at simplifying the financial instruments’ classification, hedge accounting rules and better monitoring financial market evolutions as well as financial engineering developments.

IFRS 9 is composed by three main pillars:

- “Classification and measurement”, which replaces existing categories of financial assets and liabilities with new ones;

- “Impairment”, that proposes a new forward looking model, based on expected credit losses instead of already incurred ones;

- “Hedge accounting”, focused on hedging test simplification and on the extension of eligible hedging instruments’ perimeter.

A new loan market view

IAS 39 provided a single classification category for loans with credit exposures (“loans and receivables”) with an amortized cost measurement while the new financial instruments standard allows two possible measurements for financial assets (amortized cost and fair value – “FV” -, based on the entity’s business model and characteristics of the instrument), removing the IAS 39 loan portfolio constraint.

The IFRS 13 defines fair value as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date”.

Therefore, the introduction of IFRS 9 allows banks to assign a FV measurement to credit exposures implying a market driven method where the value is related to market conditions (buy/sell trades) and not to an amortizing schedule.

These changes regarding the measurement and the classification of credit portfolios are part of a deeper supervisory review on the treatment of loans within the regulatory framework:

- Bank of Italy 2006/263 Circular excluded credit exposures from the regulatory trading book,

- EU 2013/575 Regulation (“Capital Requirements Regulation”, CRR) firstly opened to this new classification by not strictly bind credit exposures from the perimeter of the trading book,

- In 2017 the introduction of the ECB “Guidance on Leveraged Transactions” explicitly stated the opportunity to include loans in trading portfolios.

Therefore, accounting and regulatory evolutions confirm a new market trend for loans, considered more as “hybrid market-credit instruments” than fixed assets to be maintained on balance sheet till maturity.

Implications for banks

Credit supply represents a fundamental part of the traditional banking activity, generating money to lend from public savings collection. Credit exposures have always been treated as fixed assets in banks’ balance sheets. The borrower’s financial stability and solvency were hence one of a bank’s major concern, which introduced monitoring systems in order to prevent missed repayments.

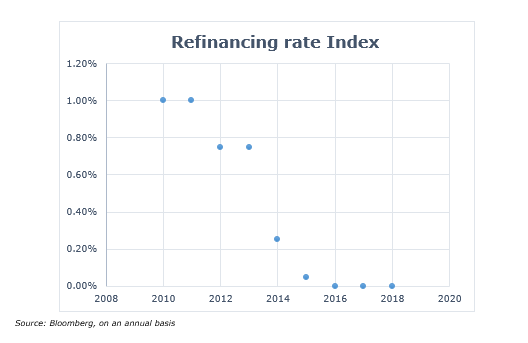

In the last few years, monetary policies focused on liquidity injections carried out by central banks have resulted in a strong reduction of the lending interest rates. This has been leading commercial banks to struggle to reach their profitability targets.

The current economic situation, as well as the described regulatory developments, has boosted financial institutions to look for new business opportunities to increase incomes and reduce costs even in loan management. Innovation has led to:

- buy and sell loans in order to get capital gains introducing an high frequency loan trading activity (sustained by quick risk and issue valuations to catch market momentum),

- dispose part of the loan portfolio reducing the regulatory capital consumption,

- participate to ABS, CDO, CLO’s secondary market through the securitization process.

Besides this new credit portfolio management, there is also the possibility to get higher returns from advisory, arrangement and structuring activities by receiving upfront and ongoing fees.

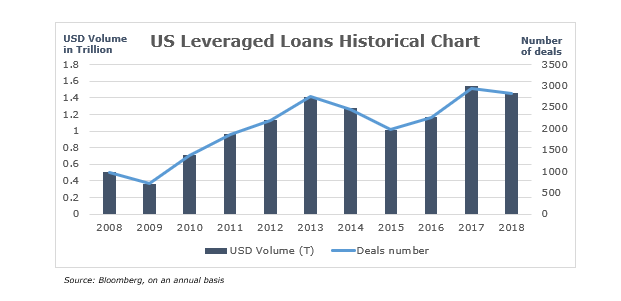

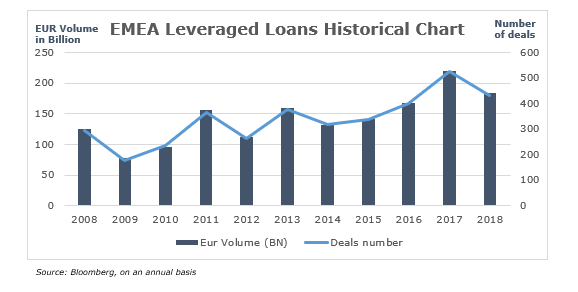

A clear indicator of this continuous change is represented by the huge rise of the Over The Counter leveraged loan market, where loans, disbursed to high leveraged firms, are traded like bonds.

Following this new market driven view for credit instruments and the related market opportunities, banks face an important challenge: adapt their processes, functions and systems in order to produce analyses and valuations granting the correct “time to market”.

The internal processes must be radically reviewed in order to be agile since the client’s due diligence and information technology systems need to become dynamic enough to provide on demand data required for qualitative and quantitative assessments. Easily accessible databases and quick information flows are necessary also to allow Risk Management functions to assess risks over the time.

Risk management, in fact, assumes a fundamental importance due to the establishment of these new practices; risk-sensitive analyses on instruments must be adequately set up considering new extended risk frameworks, no longer exclusively represented by default risk but also by market dynamics. Loans are not considered fixed assets in balance sheets anymore but they are exchanged in the primary and secondary market as more “liquid” instruments.

Namely, some strict market risk metrics such as Value at Risk can be put in place also for loans in accordance to their new hybrid nature and intent.

This roll-out of metrics is not simple: new and dedicated methodologies have to be defined according to some specific credit characteristics of the instrument; in fact loans are typically tailor-made, not standardized and less liquid than other traded assets making it necessary to customize Value at Risk calculation in relation to the credit exposure.

Main methodological aspects to be considered are:

- approach (in consideration of time-step and length of historical series),

- confidence level,

- time horizon (relating to instruments liquidity/market maturity to sustain daily calculation),

- yield to be used (gross or net of funding and/or cost of capital)

- spread curve to discount future cash flows (potential use of: single name curves, comparable single name curves, credit spread re-engineered from quoted obligations, use of CDS index or rating/sector comparable curves).

Implications for regulators

While on one side the described dynamic context creates new banking business opportunities, on the other side regulators have to put increasing attention on banks’ loan management incoming practices.

In recent years, supervisory authorities have been concerned about the growth of high risk markets such as leveraged loan one. The financial system and real economy were until recently considered mature enough for a normalization of monetary policies but, nowadays, due to several geo-political issues, uncertainty is rising once again.

Because of continuous bank businesses evolutions, regulators have to carefully supervise any new activity put in place and its impact on the overall financial system. Financial sustainability has to be continuously monitored to avoid the dramatic consequences occurred in 2008. Even if after the financial crisis regulation constraints have increased, banking activity constantly evolves, forcing the supervisors to promote effective risk mitigation techniques at the right time.

Joint working groups of analysis between banks and regulators may set a positive framework in order to converge a sustainable business, share their different points of view and assess together adequately risks and opportunities.

Conclusion

European banks have only started approaching this business. A more dynamic balance sheet, an increasing focus on brokerage margin, a relevant reduction of regulatory capital requirements are just some of the benefits of these new practices. Business has the chance to turn the regulatory evolutions and market trends into new significant opportunities to increase the profitability and better manage its portfolio. Furthermore, this new loan management allows firms to access more easily to the credit supply and consequently to invest in their ideas and development.

Within this new loan market, earning opportunities are as relevant as their inherent risks, especially if related to high leveraged loans. Spreads of leveraged credit exposures allow institution to get high profits but also expose them to systemic risks considering intrinsic interrelation of these instruments among banks.

For this reason, a constant communication between Front Office functions and Risk Management should be the base to accurately and prudentially participate to these new business model activities.

Even though Risk Management structures are essential in defining and monitoring risk appetite frameworks and limits to this kind of exposure, it is as well really important that market participants will be able to self-regulate their actions avoiding to take excessively speculative positions. Given the market driven nature of these credit instruments, default risk may become a dangerous source of systemic risk to be burdened by a broader range of entities.

Regulators need to anticipate or, at least, strictly go hand in hand with the banking business developments in the eternal conflict between risk and return laying the foundations for a new and more comprehensive risk valuation which can cover at 360° almost all principal risks.

A strong and resilient historical memory should be the common base to inspire both banking and regulatory activities for the future.

Autori:

Paolo Gianturco – Business Operations & FinTech Leader

Silvia Manera – Business Operations Director

Tommaso Sacchi – Business Operations Senior Consulting

Nizar Mohamed Saeed Ahmed – Business Operations Analyst

Si ringrazia per il contributo Massimiliano Semprini – Leader of the Italian IFRS Centre of Excellence

Bibliography

Cimini Riccardo, “Il sistema di bilancio degli enti finanziari e creditizi”, Cedam Scienze Economiche e Aziendali, Wolters Kluwer Italia, 2016.

International Accounting Standard Board, “IFRS 9 – Financial Instruments”, 2014.

International Accounting Standard Board, “IAS 39 – Recognition and Measurement”, 2003.

International Accounting Standard Board, “IFRS 13 – Fair Value Measurement”, 2013.

Gazzetta Ufficiale dell’Unione Europea, “Regolamento (UE) n. 575/2013 del Parlamento Europeo e del Consiglio del 26 giugno 2013 relativo ai requisiti prudenziali per gli enti creditizi e le imprese di investimento”.

Banca d’Italia, Eurosistema, “Nuove disposizioni di vigilanza prudenziale per le banche”, Circolare n. 263 del 27 dicembre 2006.

European Central Bank, Banking Supervision, “Guidance on Leveraged Transactions”, 2017.

M. Longo, Il Sole 24 Ore, “Quali sono i subprime 2.0? Occhi puntati sui leveraged loans made in Usa”, 17 Febbraio 2019.