COVID-19 is the acronym for “coronavirus disease 2019”, an infectious respiratory disease, whose rapid outbreak made the World Health Organization (WHO) declaring it to be a global pandemic last 11th March 2020. The diagnosis is confirmed by a test and no vaccine has been yet identified.

According to the WHO, 80% of people who become infected will recover without the need of any special treatment, while older adults, as well as people with underlying compromised medial conditions (like heart disease, lung disease or diabetes) seem to be at higher risk for developing serious complications. Common symptoms are fever, cough and breathing difficulties, but in more severe cases, the infection can also lead to pneumonia or severe acute respiratory syndrome, even causing the death of the individual. The virus spreads through the air by coughing and sneezing and through close personal contact, like shaking hands. It is also possible that a person gets COVID-19 by touching a surface that has the virus on it and then touching its own mouth, nose or eyes.

Because of the rapid spread of the novel Coronavirus, all governments have taken drastic measures to contain it, such as school closures, prohibitions against public gatherings, closures of restaurants and bars, widespread quarantine and shelter-in-place orders. Many states are already lockdown and, probably, many others will be soon. The long-term business impacts of these measures are a matter of conjecture, but what is sure is that the outbreak has already caused widespread concern and economic hardship for consumers, businesses and communities. COVID-19 is challenging our social security systems, putting under pressure the healthcare, illness and unemployment benefits.

Although most companies already have business continuity plans, they usually seem not to be prepared for an outbreak like this: the stock market has plunged, and businesses have begun to feel the immediate strain of the drastic measures, being unable to fulfil their obligations and therefore facing some losses.

Most of the firms were not ready to tackle a pandemic scenario and in less than two weeks had to switch from a mainly on-site servicing to a total smart-working environment, setting up lots of VPN infrastructures and activating remote desktops.

For what concerns the insurance industry, the limits of some policies have emerged, showing a little flexibility in offering ad-hoc coverages or customized extensions. Moreover, insurances need to change: agents have to use digital collaboration instruments, like video chat, to shorten the physical distance with their clients, maintaining the engagement and the documentation needs to be fully digitalized, using on-line authentication systems. Obviously, all the services must be available on line so that the policyholders can review their policies, make changes or check the status of their claims. The insurance industry needs to form strategic alliances as well as to integrate insurtech with traditional models and to invest in technology and human capital.

A positive outcome of the COVID-19 outbreak may be the birth of new needs, driven by a change in the consumers’ mind-set: people will seek for more coverages, being more sensitive to unforeseeable tragic events. The perception of the risk has already changed. It is easy to draw a parallelism with two other moments in time of public fear, like the terrorist attacks of 2001 and the subprime crisis of 2008: both have boosted the spread of digitalization in our habits. The beginning of 2000 saw the rising of on-line platforms such as Google, Amazon, Ebay and Paypal, while fintech and sharing economy services like Uber and Airbnb started their gradual appearance after 2008. India and Italy, countries that are currently under lockdown, already provide two examples.

- INDIA

Over the last month, as the number of coronavirus positive cases started growing, the demand for life and health insurance policies has skyrocketed, with a 40% increase in online insurance sales.

Insurers, together with the distributors, are deploying an increased volume of health professionals to consult with patients over the phone, making unnecessary the need of physical contact.

Thanks to its comprehensive health insurance policies, linked to coronavirus specific insurance products, the company Digit Insurance, whose headquarters are located in Bangalore, experienced a 50% increase in average policies sold per day comparing March over January.

- ITALY

The “bel paese” has been seen as under insured for a long time and this was blamed to its culture, not properly inclined to prevent and manage the risks, but things are changing: the insurtech platform Yolo states that on line queries related to health insurance policies have grown incredibly in the last weeks. Moreover, two large Italian companies (FS Italiane Group and Enel) have recently decide to buy additional insurance coverages for their employees in the event of hospitalization with the COVID-19 virus. On the 25th March 2020 FS has bought an insurance coverage managed by UniSalute of one year duration, that provides a daily allowance and a care services package. One day after, Enel has drawn up an insurance policy developed by Aon SpA, specifically designed for the needs of the Enel Group, which provides a cash allowance.

All these examples concern Life and Health businesses, but COVID-19 is expected to have a large impact on the Non-life business as well: let us think of car insurances and business continuity policies.

- In the first case, insurances will experience a better combined ratio, as the claims are bound to drop significantly due to the drastic measures adopted by the governments: with dramatically fewer cars on the road and businesses closed, the level of motor liability claims will plummet.

For this reason but also with the aim of helping middle class people struggling with economic difficulties, many car insurance companies have offered extended grace periods and other payment options to people who are not able to afford the premiums. This initiative has widely spread over both northern Italy in the early red areas (as ANIA – the Italian National Insurance Association – has recalled last 28th February) and in California, where the Insurance Commissioner has requested that insurance companies allow a 60-day premium grace period due to COVID-19. Furthermore, a petition has been filed to demand a refund or credit premiums to drivers because fewer accidents will mean bigger profits for auto insurers.

- Business interruption insurance provisions cover lost income and associated increased costs that a business incurs during a period of interruption to its operations, that is caused by direct physical loss or damage caused by the interruption of the business of the policyholder. A growing number of complaints from restaurants, pubs and other venues have already been refused as the insurance companies assert that the closure of their property, due to the outbreak of the COVID-19, is outside the policy limits. Following the SARS outbreak in 2003, most insurers added broad exclusions for damage caused by biological agents or communicable diseases and many policies have waiting periods before the coverage starts. Just in few cases, the cover is triggered and the compensation provided, but, most of the times, it is not straightforward to understand the exclusions: for instance, policies covering communicable diseases may not accept the COVID-19 as it did not originate inside the buildings. Moreover, if all the insurance companies were to cover all the business interruptions policies, many of them would become insolvent; it is also questionable whether it is fair to call insurers to pay out these claims when the governments already provide assistance.

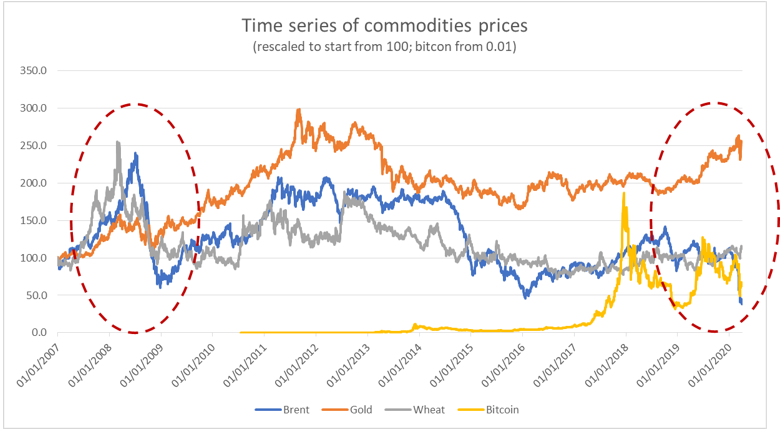

COVID-19 is also having a significant impact on the markets and, in turn, on the SII position of all the insurance players.

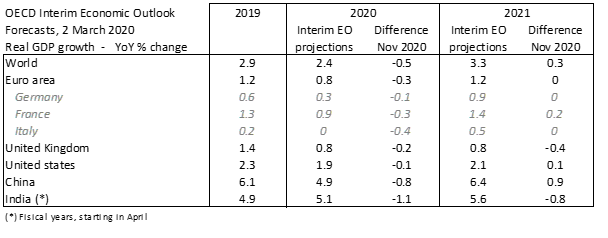

As reported by the OECD in their Interim Economic Assessment dated 2nd March 2020, COVID-19 has already brought major economic disruption: “Output contractions in China are being felt around the world, reflecting the key and rising role China has in global supply chains, travel and commodity markets. Subsequent outbreaks in other economies are having similar effects, albeit on a smaller scale. Growth prospects remain highly uncertain”. The global growth is likely decreasing by around half percentage point this year compared to the expectation of the Economic Outlook made in November 2019, as shown in the following.

For what concerns Italy, the already lagging economic growth showed in the table below as reported by ISTAT in their statistics dated March 2020, is expected to worsen due to the crisis the country is undergoing.

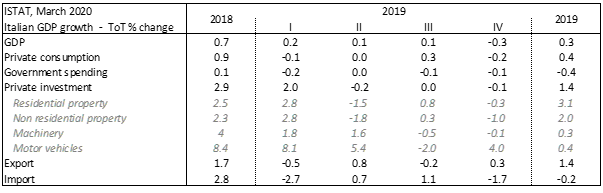

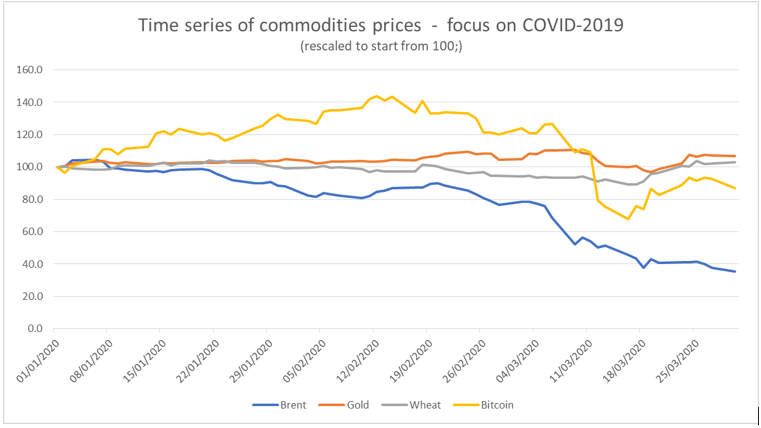

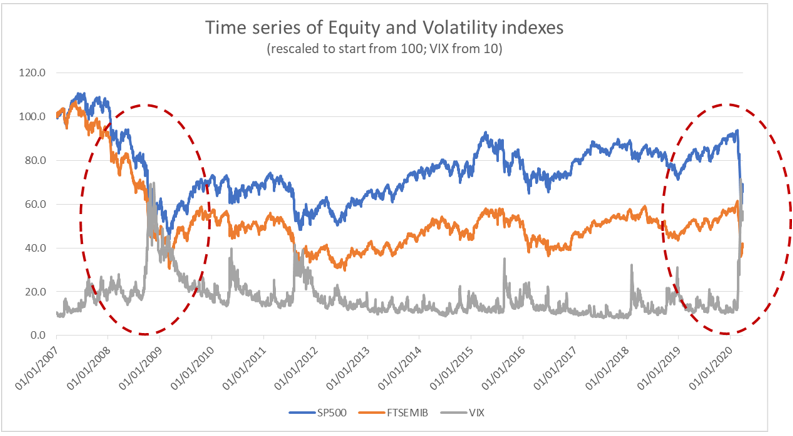

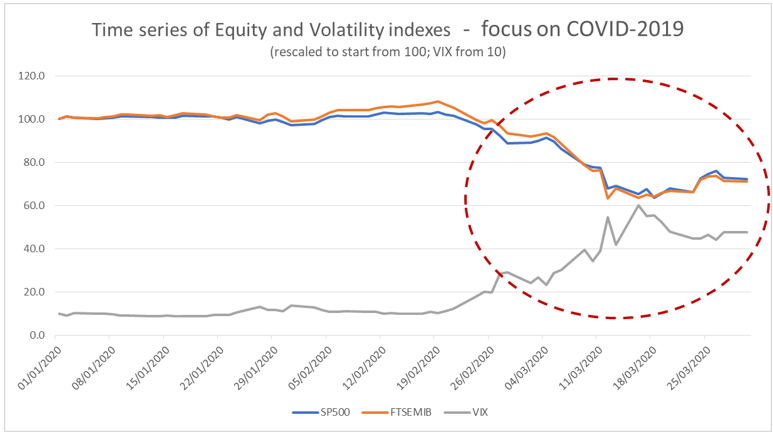

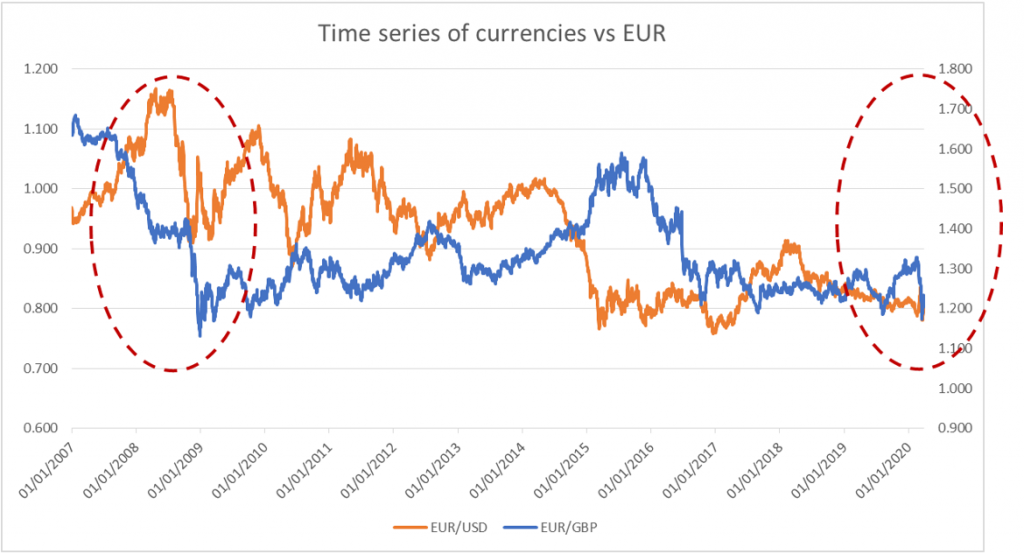

The following paired charts aim at both drawing a parallelism with the 2008 financial crisis and at highlighting the reaction of the markets to the COVID-19 outbreak.

All quantities are rescaled to a starting value of 100 to ease the comparison, except Bitcoin (0.01) and VIX (10).

The fall of Brent Oil (-60% from the beginning of the year) after the economic slowdown is dramatic, while Gold and Wheat seem to resist. Bitcoins are somehow recovering after a huge drop, showing a consistently higher volatility than Gold, the safe-haven asset by definition.

The equity market performance is also performing very negatively (-30% since 01.01.2020), recalling what we saw in 2008/2009, joined with a high level of fear registered by the VIX index.

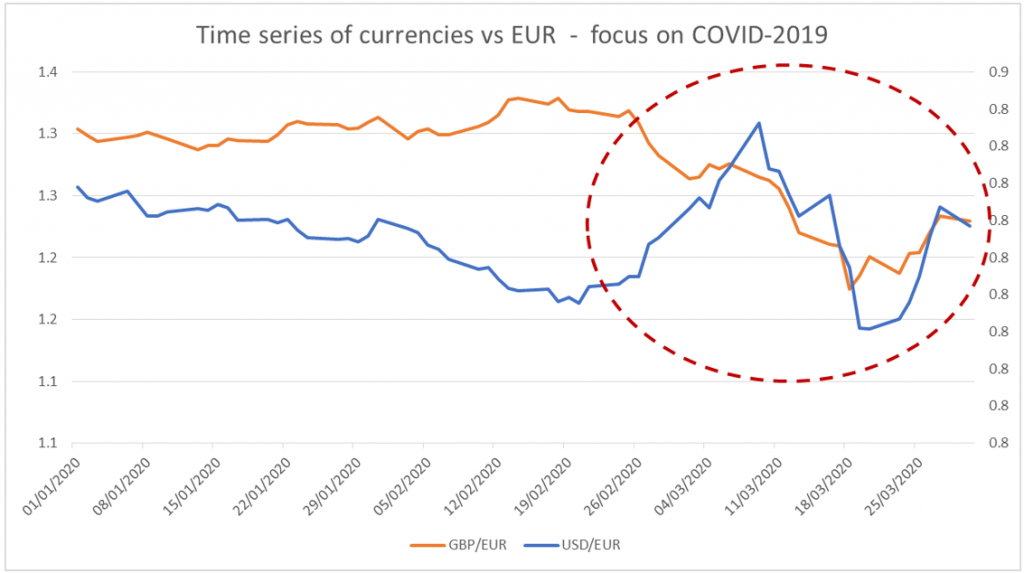

About the foreign exchanges, it is very interesting to notice that since the beginning of the year, GBP has lost much more value (-5.7%) than USD (-1.3%) compared to the EUR currency (at 30.03.2020, 1 GBP = 1.23 EUR, while 1 USD= 0.81 EUR). The USD rise experienced during the first ten days of March can be attributed to the fact the pandemic was already well spread through Europe, but it was not yet that recognised as an issue in the States.

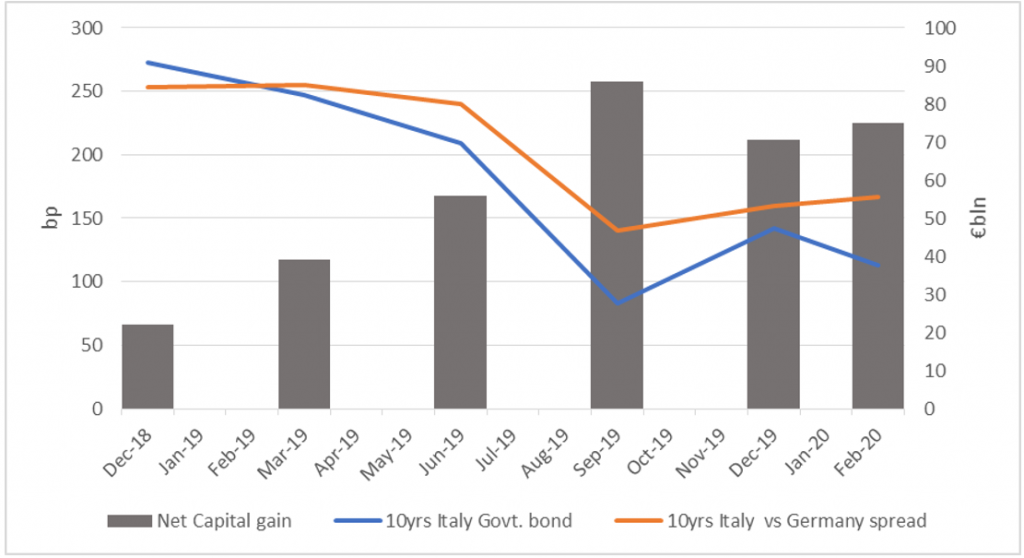

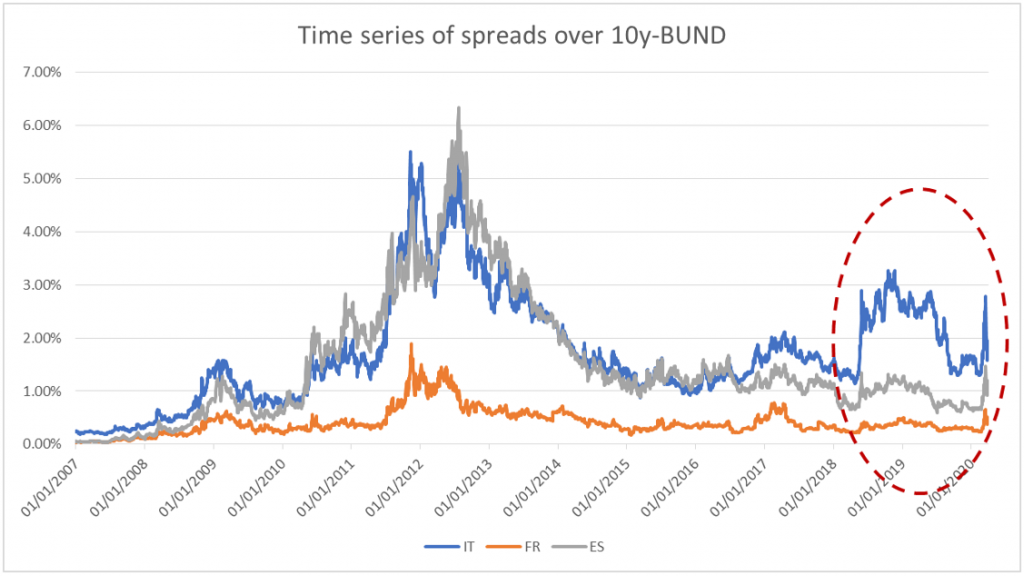

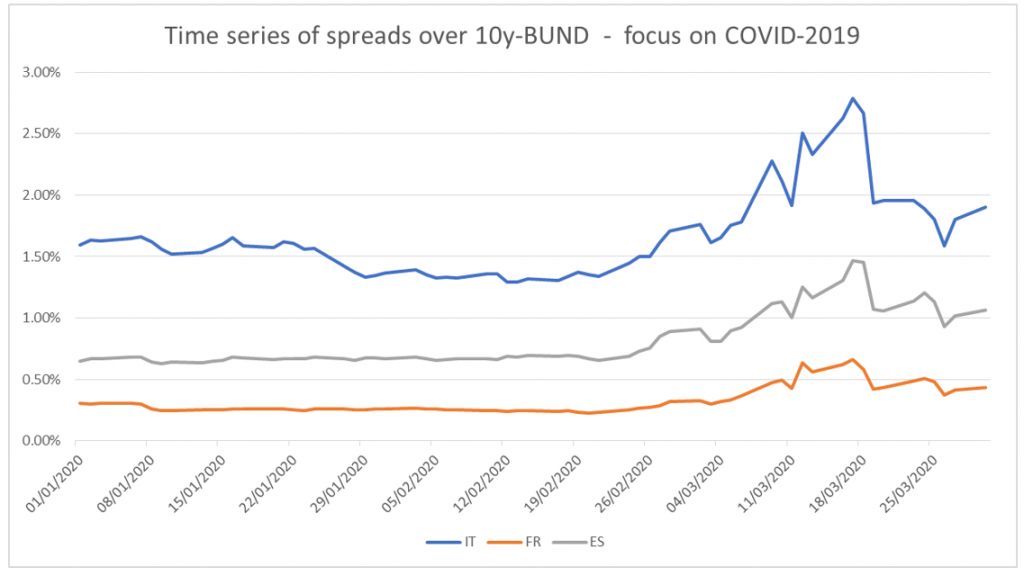

Lastly, it is very important to look at the evolution of the spreads over the 10-years BUND.

Although it has not reached the 500bps recorded in 2012-2013, Italy has almost breached the 300bps level (2.7%) last 17th of March. The spreads of Italy, Spain and France seem to move with a certain correlation, but still being based on quite different levels.

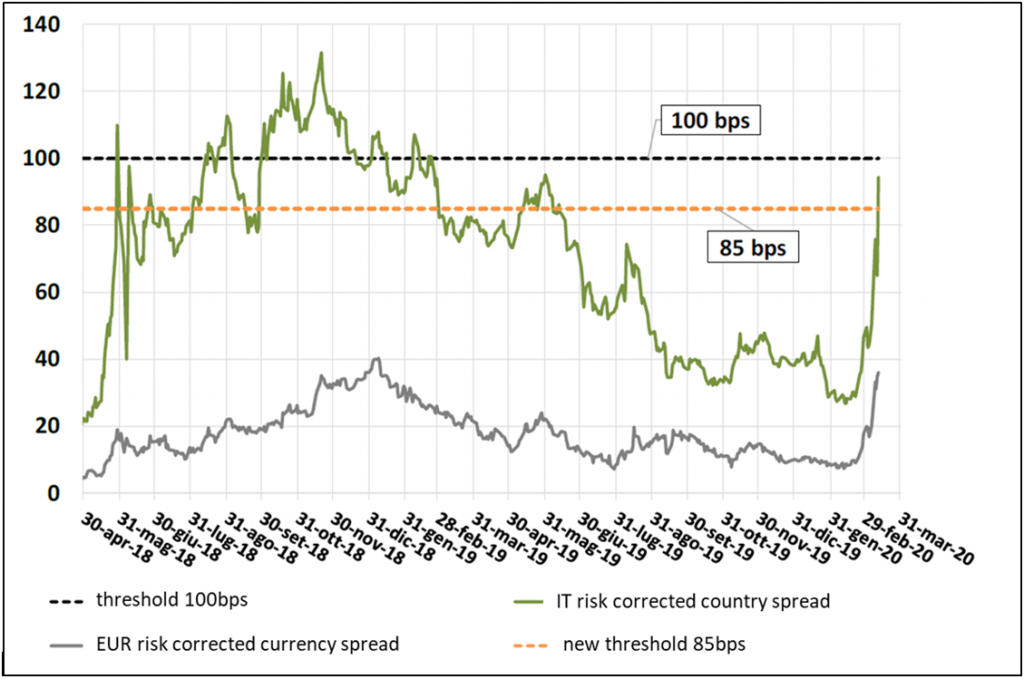

Spreads in general (of both Government and Corporate bonds) are a crucial element in the determination of the SII position of the insurance companies, as they do not only affect the Assets values, but also the Liabilities ones though the mechanism of the Volatility Adjustment (VA). When the spreads rise, and the value of the Assets falls down, the VA, applied on top of the Risk Free yield curve, increases as well, reducing the value of the Liabilities. In addition to the Currency VA, related to a certain currency (e.g. EUR) and derived over a reference portfolio of Assets, a Country VA is applied in situations where a country (e.g. IT) suffers a remarkable credit downgrade of its government bonds. The downgrade should be such that the risk corrected country spread is greater than twice the risk-corrected currency spread and the risk correct country spread is greater than 85 (previously 100) bps. As the Country VA works like a binary variable (on/off) rather than a continuous function, in an unstable economic environment like the one we are experiencing, the SII position of especially Italian Insurance companies can vary significantly from one day to the other. Furthermore, it always important to stress that the VA calculation is based on a pre-defined reference investment portfolio, representing an average European insurer and may not be appropriate for firms that show different durations or assets allocations.

The following chart, reported by ANIA in their newsletter trend dated March 2020, depicts the evolution of the EUR risk corrected currency spreads and the IT risk corrected country spread, highlighting the VA country thresholds (please note that the value of March is the one registered on the 12th).

This last chart shows the Net Capital gain of the Assets hold by the Italian Insurance companies. At the end of December 2018, its value was around 22blns, less than a third of the value of 71blns registered in December 2019, coherently to the spread that has fallen from 250 to 160bps and the 10y-BTP rate that has fallen as well (from 2.73% to 1.42%). At the end of February 2020, the net Capital gain was around 75bln (higher than in December 2019), together with a higher spread of 167bps but a lower 10y-BTP rate (1.13% vs 1.42%). This picture may change significantly at the end of March 2020, just in correspondence of the 20Q1 SII evaluation.