Under the regulation in force, in the Solvency II balance sheet the liabilities are valued at market level. The Best Estimate of liabilities is calculated by discounting future cash-flows using the risk free rate. On top of the risk free curve, EIOPA allows to add a Volatility Adjustment (VA). The VA aims to dampen irrational market movements that are associated with non-motivated credit spreads (corporate and government bonds). The purpose of the VA is to moderate the effect of low prices as a result of poor liquidity conditions or exceptional (non- credit related) widening of bond spreads.

The regulation refers to exaggerations of bond spreads. Thanks to the VA mechanism, the Own Funds of an insurance company should not be affected by temporary/non fundamental changes of bond prices yielding a lower Best Estimate of liabilities and a higher capital ratio.

There is some evidence that the actual VA is not effective and is not able to capture irrational spread movements, see Barucci et al. (2019).

The regulation in force assumes that the VA is made up of two components: the currency VA (VAcu) and the country VA (VAco). In case of Italy, the first component refers to the euro, the second one to the country. The first component is defined as:

VAcu = 65%SRCcu;

where SRCcu is the risk-corrected currency spread which is given by

SRCcu = Scu – RCcu;

with Scu being the currency spread and RCcu the risk correction computed according to the reference portfolio associated with the currency, i.e.,

Scu = wgov_cu max( Sgov_cu ; 0) + wcorp_cu max( Scorp_cu ; 0);

RCcu = wgov_cu max( RCgov_cu ; 0) + wcorp_cu max( RCcorp_cu ; 0).

The variables at currency level are as follows:

- wgov_cu denotes the weight of the value of government bonds included in the reference portfolio for that currency;

- wcorp_cu denotes the weight of the value of bonds other than government bonds, loans and securitisations included in the reference portfolio for that currency;

- Sgov_cu denotes the average spread of government bonds, loans and securitisations included in the reference portfolio for that currency;

- Scorp_cu denotes the average spread of bonds other than government bonds, loans and securitisations included in the reference portfolio for that currency;

- RCgov_cu denotes the risk correction of government bonds included in the reference portfolio for that currency;

- RCcorp_cu denotes the risk correction of bonds other than government bonds, loans and securitisations included in the reference portfolio for that currency.

The VAco is computed as:

VAco = 65% max(SRCco – 2SRCcu; 0),

where the risk-corrected country spread SRCco is defined as in the currency case for a country specific reference portfolio, i.e.

SRCco = Sco – RCco;

with Sco being the country spread and RCco the risk correction computed according to the reference portfolio associated with the country

Sco = wgov_co max(Sgov_co ; 0) + wcorp_co max(Scorp_co ; 0);

RCco = wgov_co max(RCgovco ; 0) + wcorp_co max(RCcorp_co ; 0).

Therefore

- VAcu (VAco) is the currency (country) VA,

- SRCcu (SRCco) is the currency (country) risk-corrected spread,

- Scu (Sco) is the currency (country) spread,

- RCcu (RCco) is the currency (country) risk correction.

The VA is computed as

VA= 65% (SRCcu+1SRCco>1%max(SRCco – 2SRCcu; 0)),

In the Consultation paper on the Opinion on the 2020 review of Solvency II by European Insurance and Occupational Pensions Authority (2019), the following Options have been proposed to modify the VA:

- Undertaking-specific VA – calculating the VA based on the undertaking- specific asset weights (and not for weights at market level). For each asset class, the spreads used in the calculation of the VA would still be the same for all undertakings and taken from market indices.

- Middle bucket approach – in addition to the current VA an undertaking-specific VA is introduced, but subject to strict application criteria that relate to the asset liability management of the undertaking.

- Asset driven approach – instead of applying the VA to the risk-free interest rates of technical provisions it would be used to revalue the bonds held by the undertaking by adjusting the bond spreads by the VA. The difference in the value of the bonds without and with the VA adjustment is recognised as an own funds item.

- An adjustment that takes into account the amount of fixed-income assets and the asset-liability duration mismatch by means of application ratios.

- An adjustment that takes into account the illiquidity features of liabilities by means of an application ratio.

- The risk-correction to the spread is decoupled from the fundamental spread, and instead calculated as a fixed percentage of the spread.

- Amend the trigger and the calculation of country-specific increase of the VA.

- Establish a clearer split of the VA between its function as a crisis and a permanent tool.

In the document Barucci e Marazzina (2020) we provide an answer to three questions provided in the Consultation Paper:

Q2.3: What is your view on the identified deficiencies of the current VA?

Q2.4: What is your view on this deficiency of the country-specific component of the VA? How should it be addressed? (You may want to take into account in particular the options 1, 7 and 8 set out in the following section.)

In a nutshell the main results of our analysis are the following:

- There is some evidence of cliff edge/erratic behavior of the VA in the actual setting.

- There is some evidence of overshooting in the impact of the VA mechanism in the actual setting (come insurance companies benefit more than others because of asset allocation strategies/credit quality of their assets).

- The VA seems to capture turbulence in financial markets and risk aversion surges, there is almost no evidence that the VA reflects illiquidity in financial markets.

- Small effects associated with removing the zero-lower bound on the spread.

- Considering the risk correction as a fixed percentage of the spread (Option 6), a smoothing effect is observed with respect to the actual mechanism with a higher VA in normal times and a smaller one in crisis periods.

- Accounting for the amount of fixed-income assets (Option 4) has a little impact on the effect of the VA with an advantage for insurance companies.

- A smoothing on the activation of the country-specific component (Option 7) would have produced a positive effect on discounting liabilities for insurance companies leading to a reduction of the erratic dynamics of the VA.

Option 8 concerns a clearer split of the VA between its function as a crisis and a permanent tool. More precisely, the VA is splitted as a permanent tool (VApermanent) and a macro-economic VA (VAmacro). The Consultation paper presents two methods to perform this split: in Method 1 the VA is defined as the sum of the macro and the permanent component; in Method 2, the VA is defined as the maximum between the two. The main difference is that Method 1 is based on the risk-corrected spread, while Method 2 builds on the spread. Moreover, to design the VApermanent, EIOPA has assessed the following two combinations of options:

- Approach 1: the permanent VA is determined by combining options 4, 5 and 6;

- Approach 2: the permanent VA is determined by combining options 1, 4 and 5.

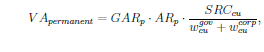

We have analyzed Method 2 and Approach 1, i.e.:

where

- GARp = 65% is the general application ratio,

- ARp is chosen according to [1, Figure Illiquidity Application Ratios, page 126]. Notice that we do not consider the duration mismatch component of Option 4 due to the lack of data, therefore our ARp only relies on Option 5,

- SRCcu = Scu – RCcu; where Scu is the currency spread and RCcu is the risk correction computed as follows (Option 6):

Scu = wgov_cu max(Sgov_cu ; 0) + wcorp_cu max(Scorp_cu ; 0);

RCcu = wgov_cu max(0.3 Sgov_cu ; 0) + wcorp_cu max(0.5 Scorp_cu ; 0).

Moreover, we have

VAmacro = max (Sco – Sco36 – corridor; 0),

where corridor=0.2% and Sco36 is the average spread over the past 36 months.

We would like to stress that this VAmacro should replace the VAco, while the VApermanent is more related to the previous VAcu.

Under this framework we address the following question

Q2.7: What are your views on Approach 1 and Approach 2? Your comments are also invited on the options that are implemented in Approach 1 and Approach 2 as well as on the other options specified in this section.

Our analysis mainly focus on the use of the average spread in the definition of the VAmacro: in Option 8 (Approach 1), considering the moving average to define the risk corrected spread seems to penalize low rating countries. The actual mechanism seems to do a better job yielding higher VA values for low rating countries and, therefore, addressing potential issues related to illiquidity/ financial distress.

Details on our analysis are provided in Barucci and Marazzina (2020).

Bibliography

Barucci E., Marazzina, D. Rroji, E. (2019) An investigation of the volatility adjustment. MIMEO

Barucci and Marazzina (2020) Comments on the Consultation paper by EIOPA on the revision of Solvency II: https://www.finriskalert.it/wp-content/uploads/Comments-on-the-Consultation-paper-on-the-Opinion_2020_review.pdf

European Insurance and Occupational Pensions Authority (2019) Consultation paper on the Opinion on the 2020 review of Solvency II.