As required by Article #9 of EIOPA’s founding regulation, the Authority shall collect and report on consumer trends with the aim of identifying risks for the customers arising from trends in the market that may require policy proposals or supervisory actions.

EIOPA publishes a Consumer Trends Report once a year and has disclosed the seventh version in December 2018. The report provides a description of the main market developments, complemented with an analysis of quantitative data and additional information derived from 2016 and 2017 Solvency II data.

The main outcomes are

- Increase of total Gross Written Premiums (GWP) for selected Lines of Business (LoBs) in the European Economic Area (EEA): +11% in 2017, with significant differences among member states (e.g. +70% in UK, -28% in ES).

- The life insurance sector continues to be significantly larger than non-life sector. Life premiums continue to represent 50% or more of total GWP in many member states (e.g. IT or UK).

- Growth in life insurance was led by a common increase in Index Linked (IL) and Unit Linked (UL) products (+42% in 2017). Despite of that, a number of NCAs have noticed that IL and UL policies reaching maturity have not always delivered the expected returns, leading to a negative media coverage that turned out into a drop in sales in some member states. Insurance with participation continued to decrease (-9% in 2017 EEA level) because of the law rate environment which affects both the demand (consumers seek for high returns) and the offer (insurers shift away from products with guarantees).

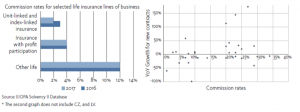

- Commission rates (percentage of the premium used to pay commissions) for the life sector are quite stable, showing the highest rates for the class “other life insurance”. There are anyway commission rates above 20%.

- The sale of mortgage life insurance (and also Payment Protection Insurances (PPI) in the non-lie sector) jointly with consumer loans continues to be a practice in many Member States. Despite several measures put in place at the European and national levels to address some of the challenges brought along by sale of mortgage life insurance, there still are some concerns, revealed by the increasing number of complaints. High commissions and remuneration structures could potentially encourage the sale of these products even if consumers may not need or request them. This could lead to intermediaries potentially adopting pressure sales tactics, leveraging on the fact that consumers are focused on the primary product, being reluctant to look for a better insurance product elsewhere. Finally, as both the number of ancillary intermediaries and the segmentation in the distribution chain increases, it is difficult for supervisory authorities to assess whether these intermediaries have enough professional competence to properly advice consumers and explain the features, risks, and benefits of the products.

- The non-life sector remained stable (+0.3% GWP in 2017), after continuous growth over the part years. The most prominent product is still the motor vehicle insurance, although the medical expense one is the most important single LoB in terms of GWP.

- The purchase of motor insurance products has been strongly affected by the usage of innovation and technology: consumers use price comparison websites (PCW). In UK in 2017 60% of policies were purchased or arranged though PCW; a similar picture was seen in IT.

- The claims ratios for motor liability insurance decreased thanks to a lower number of car accidents, higher premiums and stricter policies. These ratios are still high and steadily above 60%.

- The growth in accident and health insurance products was driven by the need of consumers to complement the public insurance system. It was also fostered by the technology, which had made both policies premiums cheaper and the claims submissions easier.

- The usage of Big Data in the health insurance has a strong potential to increase and become a standard practice. Allowing for a better risk assessment, it can have a positive impact on consumers but it can also turn into a challenge for consumers and supervisors. On one hand the usage of Big Data can help in lowering prices, in tailoring products on the clients’ needs and in identifying new risks and covering them, but on the other side it can undermine the risk-pooling solidarity principle, potentially making the policies unaffordable for some customers segments (e.g. consumers with pre-existing conditions)

- IT has experience an increase in health insurance products linked to smartphones and other wearable devices. The data collected by such devices are often used by insurers to give a discount at renewal, but also to monitor the policyholders’ health and offer specific programs to improve it

- In the UK many market players offer a variety of products using this technology and some insurers sell traditional insurances taking into account physical activity when calculating the premiums.

- In FR and DE insurers have begun to offer add-on products using Big Data, such as coaching on how to prevent sickness and diseases and improve the life style.

- The total number of complains has just slightly increased compared to 2016, with non-life insurance products that continue to generate the highest number of complains and travel insurance related complains that have experiences the highest growth (+85%), while the life insurance products related complains continue to drop.

- No major changes have been reported in the European pension sector, for both occupational and personal pensions. In 2017 the total number of occupational active members across the EEA gradually increase mostly due to the continued economic recovery and improvements in many labour markets, while the evolution in terms of numbers of personal pension scheme is diverse across member states.

- Pension funds need to consider long term risks, which may be associated to their investments, including climate changes.

- There are many different ways in which member states and pension funds are currently implementing these ESG requirements

- NCAs are still concerned with potential conduct risks in relation to life insurance products. They carried out several activities to identify, prevent, and manage such risks. For example:

- In FI, the NCA conducted inspections and found that complex investment products were sold as underlying assets of insurance-based investment products, being targeted to elderly people without providing them with necessary information.

- In IT the NCA continued the work on dormant life policies by asking insurers to adopt a plan to address the shortcomings identified and by assisting them in performing cross-checks with the Tax Authority, to verify the death of policyholders and identify beneficiaries.