The Solvency II Directive (Article 77f) requires a review of the Long Term Guarantee (LTG) and equity risk measures by 1 January 2021:

- EIOPA is publishing every year an annual report on the impact of these measures

- EIOPA plans to submit to the European Commission (EC) an opinion on the assessment of the measures in 2020

- the EC will then submit a report and, if needed, some legislative proposals to the European Parliament and the European Council

The same Article 77f requires that, on an annual basis, the National Supervisory Authorities (NSAs) provide EIOPA with the following information:

- availability of LTG in insurance products

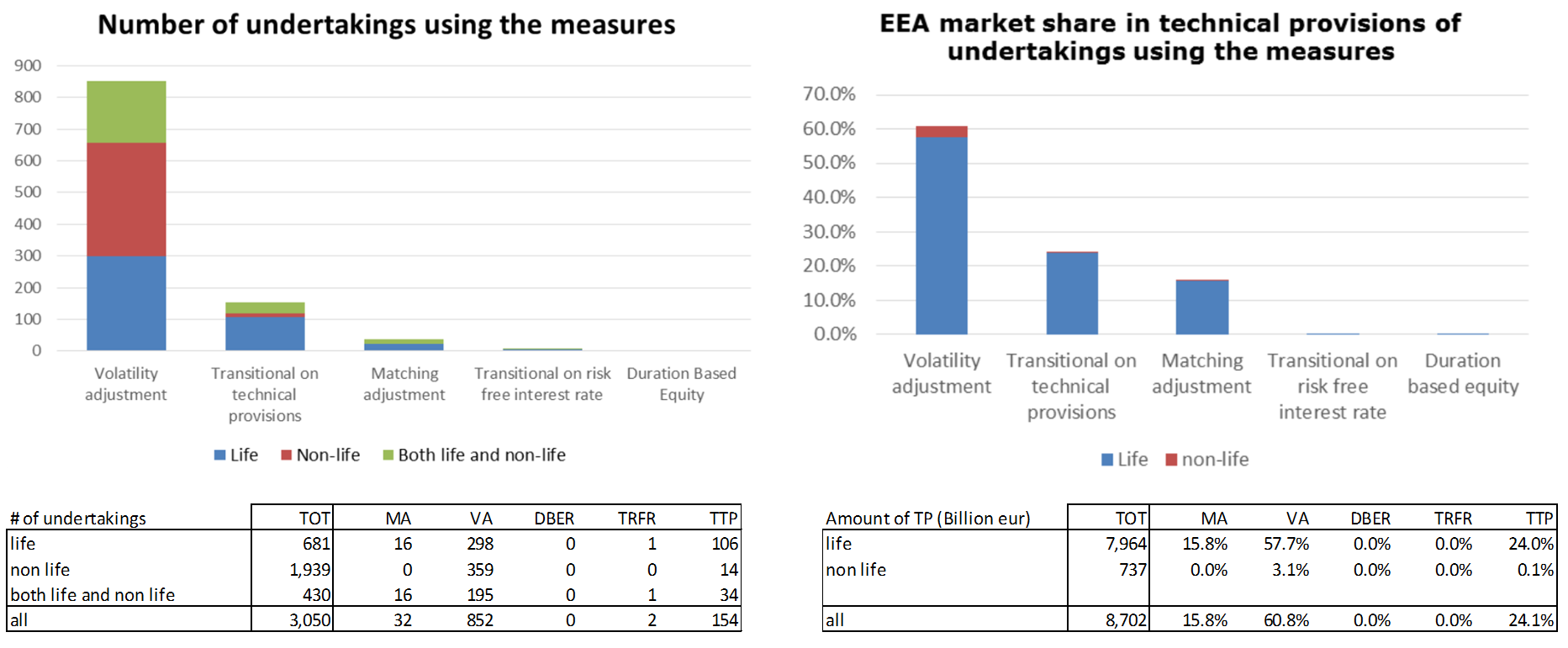

- number of undertakings applying the measures

- the impacts of the measures on the undertakings’ financial position and capital charge

- the effects of any extension of the recovery period and, in case the transitional measures were applied, the compliance with the phasing-in plans and the prospects for a reduced dependency on the measures

The LTG measures were introduced in the SII Directive through the Omnibus II Directive to ensure an appropriate treatment of insurance products that include LTG; likewise, the equity risk measure should ensure the appropriate setting of capital requirements related to changes in the level of equity prices. The measures are recalled in the following table; though it is admissible to apply several at the same time, certain combinations are excluded (MA ad VA, TRFR and MA, TRFR and TTP)

|

Name |

Description |

Article |

| [UFR]

Extrapolation of the RF YC |

the RF Rate YC is extrapolated smoothly towards an ultimate forward rate for maturities where the markets of the relevant financial instruments are no longer deep, liquid and transparent |

77a |

| [MA]

Matching Adjustment |

when the expected assets cash flows replicate each of the expected insurance obligations cash flows, the undertakings are not exposed to the risk of movements of the spreads and can (prior to the approval from the NSA) adjust the relevant RF Rate YC in line with the spread movements of their assets. The MA is deduced by a fundamental spread that allows for expected loss and downgrade of the assets |

77b/c |

| [VA]

Volatility Adjustment |

the undertakings can (prior to the approval from the NSA) adjust the relevant RF Rate YC to mitigate the exaggerations of bond spreads. This is meant to prevent pro-cyclical investment behaviours. The VA is based on 65% of the risk corrected spreads between the interest rates that could be earned from a reference portfolio of assets and the base RF Rates. |

77d |

| [ED]

Equity Dampener |

In order to mitigate undue potential pro-cyclical effects of the financial system in case of adverse movements of the financial markets, the market risk module of the SF includes a symmetric adjustment mechanism with respect to the change in the level of equity prices, that is positive/negative when markets rise/drop |

106 |

| [ERP] Extension of the Recovery Period | If undertakings are not compliant to SII capital requirements, they have 6 months to re-establish the appropriate level of EOF to cover the SCR. If appropriate, the NSAs can extend the period by 3 further months and, in case of exceptional adverse situations, by 7 additional years. During this ERP the undertakings must submit every 3 months a progress report setting out the measures taken – so far, EIOPA has not received any request to declare an exceptional adverse situation |

138(4) |

| [DBR] Duration-Based Equity Risk sub

module |

if the undertakings provide occupational retirements provisions or benefits with an average duration of the liabilities that exceeds 12y and are able to hold equity investments for more than 12y, they can calculate the capital charge of the Equity Risk sub module applying a fall in equity market prices of 22% in place of the value established for the SF (39% or 49%) |

304 |

| [TRFR] Transitional on the RF

Rate |

for a period of 16 after the start of SII, the undertakings can (prior to the approval from the NSA) adjust the RF Rate by the difference between the SII and SI YC, multiplied by a ratio that was 100% at the beginning of SII and is decreasing linearly to 0 over the next years |

308c |

| [TTP] Transitional on the TP | for a period of 16 after the start of SII, the undertakings can (prior to the approval from the NSA) adjust their TP by the difference between the TP calculated under SII and SI, multiplied by a ratio that was 100% at the beginning of SII and is decreasing linearly to 0 over the next years |

308d |

The deadline to submit the 2017 results (reference date 01/01/17) to the NSAs is June the 15th and the NSAs have to report to EIOPA within the following month. The impacts of the measures on the financial positions will be reported for the first time. In 2016, the first year of application of the SII directive, the reporting was limited and, to publish its annual report (reference date 01/01/16), EIOPA has considered also data taken from the 2016 Insurance Stress Test.

LTG products are widespread in most of the national market and comprise:

- traditional life insurance (with profit, savings, whole life, endowments, annuities)

- UL with guaranteed investments yields or capital protection

- variable annuities

- some types of health insurance (annuities stemming from protection contracts that offer the maintenance of the wage in case of severe illness)

- non life annuities

These products offer lifelong guarantees or with fixed durations non shorter than 6/8 years. The availability of LTG products is mainly stable or slightly decreasing across the EEA due to the low interest rates environment.

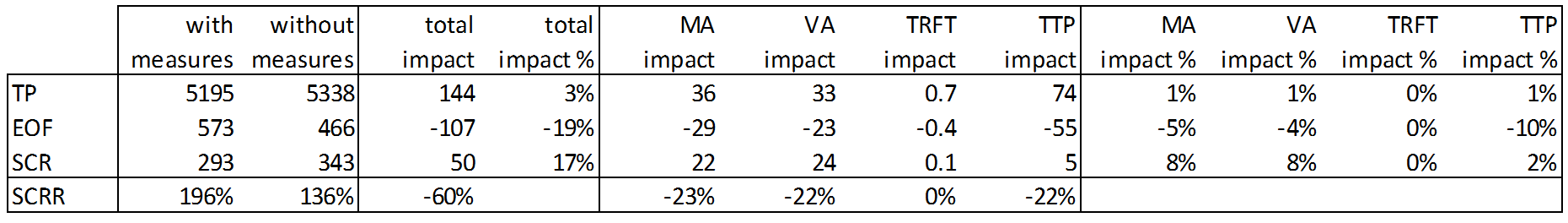

The removal of the measures is expected to increase the level of TP, SCR and MCR and to decrease the level of Net Deferred tax liabilities, EOF and LAC. The following table shows the impacts of the four main measures on TP, EOF and SCR.

At EEA level, the removal of the measures results in an average decrease of the SCR Ratio of 60%, but the NSAs has indicated that there is not yet any specific case where undue capital relief was observed due to the application of the LTG and equity measures.

MA

- applied by undertakings with lower proportion of government debt and higher proportion of equity and assets held for index products than the whole market; the proportion of not rated assets is lower than that of the whole market, with a higher bond duration

- fulfilling the conditions needed to apply the MA is quite challenging, especially for small companies

VA

- applied by undertakings with higher proportion of government debt and a lower proportion of assets held for linked products than the whole market; the credit quality distribution is similar to that of the whole market, with a lower bond duration

- it is widely applied in most of the EEA countries

TRFR

- applied by undertakings with higher proportion of participations and lower proportion of debt and assets held for linked products than the whole market

- the market share in TP is negligible both at EEA level and national level except in Greece, where 10% of the national market uses this measure

TTP

- applied by undertakings with lower proportion of government debt and higher proportion of assets held for linked products than the whole market, with a higher bond duration

- in Norway the 87.2% of the national market makes use of this measure, while in the UK, Finland and Portugal the undertakings represent more than 50%