The Packaged Retail and Insurance-based Investment Products (PRIIPs) Regulation went live with MiFID II in January 2018, introducing requirements for firms to disclose specific information on certain investment products or services. The regulation’s main objective is to help investors assess the money value of these investments and make more informed decisions.

Some important issues have arisen since the implementation of KID and a process of regulatory review has been activated by the ESAs (European Regulatory Authorities).

This article aims to assess whether the PRIIPs regulation has created transparency and comparability across investment products, and the implications in the relationship with retail clients, on the basis of the observation of the market application of the new regulatory framework.

New Forms of Disclosure for PRIIPs

PRIIPs include a wide range of products such as investment funds, investment trusts, insurance-based investment products, structured investments (i.e bonds with derivatives components), and structured deposits.

Under the regulation, manufacturers/issuers are obliged to produce a Key Information Document (KID) for each product in scope.

The KID must be provided in the investors’ local language and be published on the company website prior to the product being offered to retail investors. Any distributor or financial intermediary, who sells or provides advice to a retail investor about PRIIPs, or receives a buy order on a PRIIP from a retail investor, must provide him/her with a KID.

KIDs are standardized three page documents built to answer the following four questions:

- What is the product?

- What are the risk?

- What are the costs?

- What do I get in return?

The document provides specific information such as the aggregated charges associated with the product as well as a breakdown of costs, riskiness, and the simulation outcome of different performance scenarios. All the information is summarized in the document and the net effect of the costs included is presented as an annual percentage reduction in yield.

For UCITS funds that meet the definition of PRIIP, a transitional period was planned until 31 December 2019, and has recently been voted for an extension by another two years [1].

Proposed changes for PRIIPs

Since its implementation, Manufacturers and Distributors have experienced several issues related to the following topics:

- Performance scenarios methodology;

- Calculation of “Transaction costs”;

- Different representation of cost and charges between PRIIPs and MiFID II.

In October 2018, the ESAs sent the European Commission a letter to propose how to tackle the key issues which have arisen since the implementation of KID. In November, the ESAs issued a consultation paper on targeted amendments to the Delegated Regulation covering the rules for KID. The consultation paper addresses, in particular, amendments to the information regarding investment products’ performance scenarios.

While the abovementioned consultation was still open, representatives of the funds industry have increased their lobby strongly supporting a delay in the application of PRIIPs to UCITS funds to the 2022 horizon, finally voted by the ECON committee last December. It is worth mentioning that nothing has changed in the current regulation therefore, as of January 1st 2022, a retail investor investing in a UCITS product will be given two different documents: the KIID for UCITS and the KID for PRIIPs. However, the Commission has been given one more year to finalize their Level 1 review (by 31 December 2019) with the expectation to address the question of the overlapping.

Performance Scenarios

PRIIPs requires the financial industry to inform retail clients on the possible evolution of their investment under different future scenarios, to assess the possible product losses or gains in different market conditions. The intention is to increase both client’s awareness on the products’ risks and the comparability with other similar financial instruments.

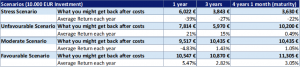

The regulation requires four performance scenarios in which the financial industry has to report the incomes or losses in absolute terms (assuming an investment of tenthousands euros) over different time periods, until the product’s maturity or the recommended holding period expires. Absolute gains and losses have to be illustrated adjusted for the costs the client would incur.

A favorable scenario, a moderate scenario, an unfavorable scenario, and a stressed scenario aim to depict clearly, through a forward looking approach, the evolution of investment losses and gains depending on the possible future market movements. While for some instruments the performance scenarios work well, this would not be the same for others. Some products are reporting incoherent performance scenarios (example below extracted from the KID of a certificate on “Eurostoxx 50” index.)

The forward-looking approach of the performance scenarios failed due to the dependence on the assumption that historic returns will continue in future. The simulation of the future performance scenarios is driven by the historic returns the product has had over its recommended holding period. Looking at the equity markets over the last years characterized by a strong positive performance, the KID’s performance scenario methodology could bring positive results also under the unfavorable scenario. The investor could misinterpret such performance scenarios, considering these products less risky than others and able to grant a profit also during negative market conditions.

Consideration of “Transaction costs”

In the PRIIP KIDs, recurring costs, including the transaction costs, must be disclosed in percentage terms. The PRIIPs delegat act sets out how firms should calculate actual transaction costs: they must be determined using an “arrival price”, which requires firms to calculate the difference between the bid/ask midpoint price where a trade is first submitted, and the final execution price of the same trade. This means that the costs disclosed are often heavily influenced by market movements and, in some cases, have resulted in some firms disclosing negative figures for their transaction costs. These negative figures may lead investors to draw inaccurate conclusions about the desirability of certain funds and the true brokerage charges which they will ultimately bear.

Different representation of cost and charges between PRIIPs and MiFID II

With the introduction of PRIIPs, MiFID II has also introduced a requirement for firms to disclose an aggregate cost figure across all financial instruments in pre-sales activities. The MiFID perspective is different and covers all kinds of investors (not only retail as for PRIIPs) and the entire service value chain (e.g. cost of distribution, cost of service) where incentives paid or received by the distributor have to be reported. For the first time investors receive the overall cost of investing.

Differently from PRIIPs, no format template or guidelines have been foreseen by the regulation. Thanks to PRIIPs and MIFID II investors should now have a much wider set of costs and charges figures across a much wider set of investments. Nevertheless, full comparability and transparency is still very far.

Conclusion and impacts for firms

It is evident that PRIIPs has still not reached its purpose, with significant issues emerging that are limiting the new Regulatory framework from expressing its potential.

While Regulators have already activated the process to review the requirements, firms are free to take additional steps to help investors navigate the new set of information provided to them and reduce the possibility of inaccurate interpretation. Such steps could include:

- reporting all information in one place consistently with the investment process (e.g. presenting all information together with the investment proposal)

- explaining how various cost and charges figures and risk indicators are calculated and why differences can exist;

- explaining why they are required to produce these information and warning the customer about its limitations.

Alessandro Mastrantuono | Director Deloitte Consulting

Emanuele Meo | Senior Manager Deloitte Consulting

Donato Masi | Manager Deloitte Consulting

Notes

[1] At the beginning of December 2018, the Committee on Economic and Monetary Affairs of the European Parliament (ECON committee voted to postpone the PRIIPs application to UCITS to 2022 (initially scheduled for 2020).