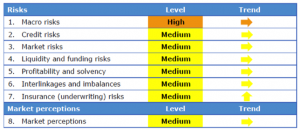

EIOPA has recently published the risk dashboard (RDB) update at January 2018. The RDB is published on a quarterly basis, showing the level of risk for 8 (=7+1) risk categories. This is the outcome at January 2018:

Some comments

- Macro risks [high, stable]

This is an overarching category affecting the whole economy, which considers economic growth, monetary policies, consumer price indices and fiscal balances.

The data show an economic environment that remains fragile because of the enduring low-yields. The GDP forecast continues to increase (it should approach 2.3% over the next year) and the unemployment rate to decrease (6.7%), but the fiscal deficit confirms the persistence of structural imbalances (-2.2% of the GDP)

- Credit risks [medium, stable]

This category measures the vulnerability to the credit risk by looking at the relevant credit asset classes exposures combined with the associated metrics (e.g. government securities and credit spread on sovereigns). The credit risk is still not to be properly reflected in the market prices, it remains stable while the observed spreads continue to decline: corporate bond spreads continue to be negatively related to non-financial corporates’ debt service, pointing to a potential risk mispricing.

- Market risks [medium, stable]

This vulnerability of the insurance sector to adverse developments is evaluated based on the investment exposures, while the current level of riskiness is evaluated based on the volatility of the yields together with the difference between the investment returns and the guaranteed interest rates. Market risks remain stable, despite a reduction of the volatility of prices (but the book value of European stocks, that moves in the direction of risk increase)

- Liquidity and funding risk [medium, stable]

The vulnerability to liquidity shocked is monitored measuring the lapse rate, the holding in cash and the issuance of catastrophe bonds (low volumes or high spreads correspond to a reduction in the demand which could forma a risk). The overall assessment shows that liquidity is not a major issue for the insurance industry, moreover the CAT bond issuance significantly decrease when compared to the record high registered during the previous quarter: the low volume of issued bonds makes the indicator less relevant.

- Profitability and solvency [medium, stable]

The solvency level is measured via SCR and quality of OF, while the profitability via return on investments / combined ratio for the life / non-life sectors. The SCR ratios generally improve thanks to an increase in the OF: (199%, +6%) for the groups, (190%, +10%) for the life solo undertakings, (224%, +5%) for non-life solo. The net combined ratio deteriorates in the tail (90 percentile) of its distribution, though the median value is still below 100%.

- Interlinkages and imbalances [medium, stable]

Interlinkages are assessed between primary insurers and reinsurers, insurance and banking sector and among the derivative holdings. The exposure towards domestic sovereign debt is considered as well. Data show a slight increase in investment exposures to the different financial services (banks and other insurers). The median value of the reinsurance part of premium remains stable, as the insurers’ derivative holdings.

- Insurance (underwriting) risk [medium, increasing]

Indicators for insurance risks are gross written premia, claims and losses due to natural catastrophes. The risk increases to a medium level, driven by the significant increase in the loss ratio (average value from 60% to 65%, 3rd quartile from 71% to 81%) resulting from the impact of the catastrophic events observed in Q3 (mainly on reinsurers’ technical results). The impacts of hurricanes Harvey, Irma and Maria was already foreseen in the previous RDB. Other indicators, such as the growth rate of gross written premiums for life and non-life, still point to a stable risk exposure.

- Market perception [medium, stable]

The market perception remains constant. The quantities assessed are relative stock market performances (insurance stock performed slightly better than the Stoxx 600: +1.5% life, +0.5% non-life), price to earnings ratio (increased from the previous released: average from 11 to 13, 3rd quartile from 15 to 18), CDS spreads (average value decreased from 60 to 50) and external rating outlooks (marginally improved).