The last few years have seen significant growth in “sustainable” financial products and instruments. These products and instruments have been able to capture a growing share of saving flows globally, and particularly in Europe. The focus on the environment and social responsibility has prompted many Asset and Wealth Managers globally to accelerate the integration of ESG factors (Environmental, Social, Governance) in investment processes and operating models. The Covid-19 pandemic draw attention on “sustainability” and is an additional boost factor. Corporate decisions on human capital, social and environmental aspects will play an even greater role in the assessment of investments.

The new regulatory wave connected to the European Commission’s Sustainable Finance Action Plan is part of this context and represents the next big regulatory challenge for the financial and banking system, and in particular for the investment services industry.

One of the objectives set by the Commission in the Sustainable Finance Action Plan is, indeed, to convey private investments towards a sustainable real economy, in order to achieve the goals set out in the Paris Climate Agreement, through a series of specific regulatory interventions, that integrate each other, such as:

- Classification system of sustainable activities (so called “Taxonomy”) with the aim of facilitating sustainable investments by providing criteria to identify the level of sustainability of some economic activities. Adopting uniform criteria in identifying sustainable activities should lead to greater efficiency in the “ESG data value chain” and will encourage more effective investor engagement;

- New definitions, such as “Sustainable investments” and “Products promoting environmental or social characteristics“ which have different disclosure requirements;

- Detection of customers’ ESG preferences during the distribution phase, in order to offer them products corresponding to these preferences, with an impact on the mix of products offered, on the definition of the Target Market, on profiling, on suitability and reporting;

- Inclusion of sustainability risk within governance, investment processes, risk management policy and remuneration and incentive policies. This is likely to require a review of the operating model adopted;

- New and extensive disclosure requirements on how ESG factors impact product performance and how the investment choices adopted contribute to environmental and social aspects. These new disclosure requirements pose significant challenges in terms of timing and methodologies, but especially in terms of data availability and reliability.

The compliance with the new rules currently being drawn up is expected to be challenging, with important impacts on both the business and operational model. The areas on which intermediaries will have to intervene more proactively to exploit the opportunities are, for the Asset Managers, the management of new data and, for distributors, the revision of the service model.

Data management will become an enabling factor in integrating ESG practices for Asset Managers, as well as for distributors. One of the crucial aspects is the treatment of a large non-financial dataset and the need for new tools to support both decision-making processes, risk management and monitoring processes.

Global leading Asset Managers identify the inconsistency of data between different economic sectors/assets as the main obstacle to the integration of the ESG into investment processes. ESG disclosure is essentially provided by larger companies with greater resources, with the consequence that asymmetrical disclosure can lead to conveying ESG investment flows to larger companies, even if smaller companies have a similar or better impact on society and the environment.

Advanced data analysis will become an essential component. Asset managers can leverage artificial intelligence, such as machine learning and alternative data analytics, to develop ESG metrics that are functional to investment analysis, decision making and informing investors. By aligning advanced analytics tools with sustainability metrics, Asset Managers may be able to go beyond simple screening methods and actively leverage the benefits of investing in sustainable assets.

ESG rating companies, for example, already use alternative data in their rating processes. MSCI Inc. estimates that only 35% of the data used to define a company’s ESG rating comes from a voluntary disclosures. As a result, strong growth is expected in the use of alternative data and emerging technologies to introduce quality ESG data into investment processes and identify the risks and opportunities of such investments.

For players offering Investment Advisory services, it will be essential to integrate ESG aspects into personal financial planning by introducing tools and capabilities in order to understand investor preferences, select ESG products and measure the contribution of investments to risk management, sustainability goals and how much these are capable of creating a premium in terms of overall performance.

The integration of ESG into Financial Advisory is an opportunity for distributors to seize, especially considering the following three aspects: (i) the efficiency of ESG products in terms of return, (ii) the economic environment of the coming years, which will be increasingly oriented to environmental and social issues and iii) the growing attitude of investors for sustainable investments.

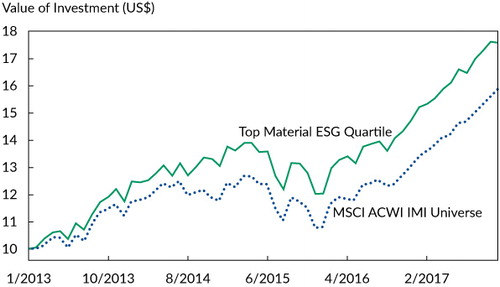

The growth of ESG, in fact, also depends on the expected return. Analysis shows that ESG metrics can actually help the search for “Alpha” (specific risk). A recent analysis tested ESG metrics and showed that a strategy that based its investment decisions solely on these metrics outperformed the performance of a global set of equities, strengthening the thesis of an active ESG investment strategy. As a result, ESG can provide real opportunities to meet customer demand and improve returns.

In the most recent period, ESG funds have shown a greater capacity to respond to volatility. Based on a comparison of returns in Q1 2020 of 206 ESG funds and ETFs and those not ESG of their respective categories, sustainable funds performed better on a relative basis.

In addition, public policies will play a role in promoting sustainable sectors and initiatives in the coming years through significant investments (e.g. the European Green Deal presented by the European Commission envisages investments in the order of EUR 1 trillion over the next 10 years).

Finally, investors show appreciation for sustainability and, as a recent Deloitte survey has shown, they are inclined to invest in these products and they expect adequate support from intermediaries.

Intermediaries will have to adopt a strategic approach to the new incoming regulatory package, in order to respond in a structured way to a growing customer demand, defining a value proposition dedicated to impact investing that goes beyond the topics, although essential, of the product and the Branding.

To seize this opportunity, intermediaries will need to work on several areas:

Products

- Update the product range, in line with market demands and in a way that is of real support to the real economy;;

- Review the Target Market framework;

- Review/update the product information;

- Consider introducing a specific labelling;

Governance

- Redefining governance and internal organisation, also in order to manage/reduce new emerging risks;

- Define how to integrate and exchange data with manufacturers;

- Review the processes and introduce new tools, including IT tools, adequate to gain and process all relevant information to be integrated into processes and communicate clearly and completely to customers;

- Promote the development of skills/expertise in ESG, also through the updating of training paths.

Proposition

- Detect and understand in depth the sustainability needs of the customers;

- Review the main components of the Advisory model (e.g. profiling, suitability, financial planning, etc.);

- Communicate and educate investors about the benefits of ESG investments by providing a comprehensive view of how their investments have contributed to environmental and social goals;

- Support customers in developing their ESG performance through active management and Advisory, consolidating the relationship and improving the quality of the customer portfolio;

- Develop new features in IT tools to support Advisors’ operations;

- Increase the reputation as a leader in ESG, improving competitive positioning and increasing market share;

- Define the communication strategy;

Several intermediaries are anticipating the trend and have initiated a review of the value proposition incorporating sustainability. In this new context, success will not only depend on offering customers the right product, but above all from communicating appropriately by providing information describing the positive impacts on environmental and social factors and the contribution of investment choices to the performance.

Authors:

– Alessandra Ceriani, Partner and DCM FSI Consulting Leader at Deloitte Consulting

– Alessandro Mastrantuono, Partner at Deloitte Consulting

– Emanuele Meo, Senior Manager at Deloitte Consulting