Last 21.05.2019 EIOPA (European Insurance and Occupational Pensions Authority) published the calculation of the Ultimate Forward Rate (UFR) applicable as of 2020.

The value to apply for the EUR currency is 3.75%.

Actually, the EUR calculated value would be 3.55%, but because of both the current value (3.90%) and the limit on the maximum annual change (15 bps), the applicable UFR for the EUR currency is floored to 3.75%. The EUR UFR has been previously equal to 4.20% (2017), 4.05% (2018) and 3.90% (2019).

The methodology to derive the UFR was decided by EIOPA at the end of March 2017. EIOPA calculates the UFRs on an annual basis, by the end of March, and, if they are sufficiently different from those in place, requires an update 9 months after the announcement, at the beginning of the following year.

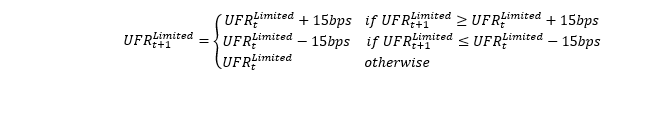

The change in the UFR is limited in such a way that either it can increase/decrease by 15bps, or it remains unchanged:

As the UFR is a target for the long-term Nominal rates, it is defined as the sum of two components:

- Expected Real rate

This is the same for all currencies.

It is updated yearly, being the simple average of the past real rates since 1961 to the year before the calculation of the UFR.

Each annual real rate is derived as the simple arithmetic mean of the annual real rates of Belgium, Germany, France, Italy, the Netherlands, the United Kingdom and the United States. For each of those years and each country the annual real rate is calculated as follows:

Real rate = (short-term Nominal rate – Inflation rate) / (1+Inflation rate).

- The short-term Nominal rates are taken from the annual macro-economic database

of the European Commission (AMECO database)

- The inflation rates are taken from the Main Economic Indicators database of the OECD

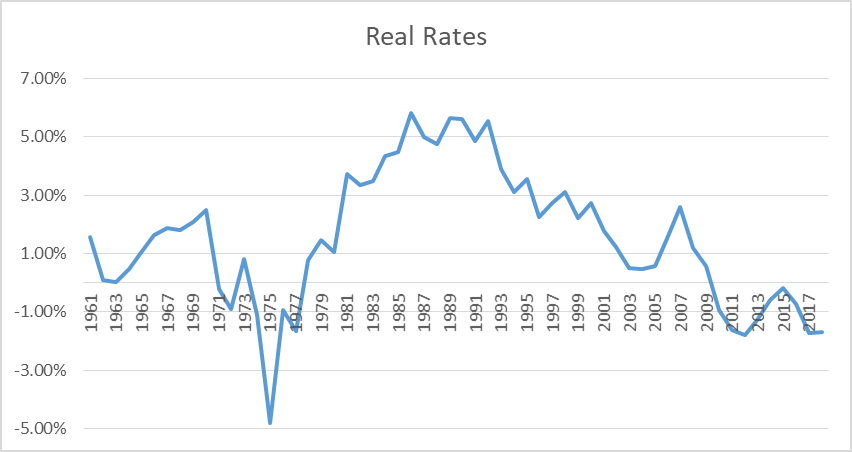

The following chart shows the Real rates time series updated at 2019 (till 2018)

The time series is currently composed by 58 items, with the last observation, related to 2018, that enters the vector with a value of -1.68%.

The simple average gives a value of 1.51312%, rounded up to 1.55%.

Indeed, the expected real rate is rounded to full five basis points as follows:

- when the unrounded rate is lower than the rounded rate of the previous year, the rate is rounded upwards

- when the unrounded rate is higher than the rounded rate of the previous year, the rate is rounded downwards.

- Expected Inflation rate

This is currency specific.

It remains unchanged over time and it is based on the inflation targets of the central banks, assuming the values of 1%, 2%, 3% or 4% (e.g. 2% when the target is higher than 1%, but lower than 3%).

Where a central bank is not targeting a specific inflation figure but tries to keep the inflation in a specified corridor, the midpoint of that corridor is relevant for the allocation to the four inflation rate buckets.

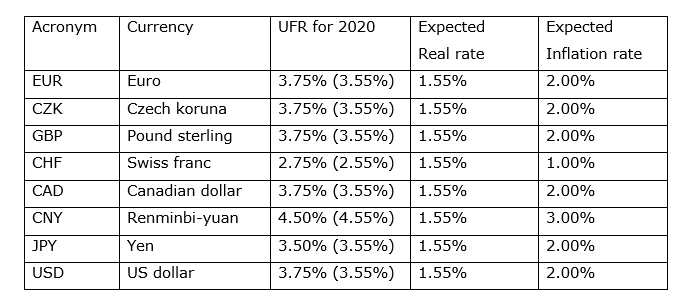

For currencies where the central bank has not announced an inflation target, the expected inflation rate is 2% by default. However, where past inflation experience and projection of inflations both clearly indicate that the inflation of a currency is expected in the long-term to be at least 1 percentage point higher or lower than 2%, the expected inflation rate will be chosen in accordance with those indications. The expected inflation rate will be rounded downwards to full percentage points. The past experience is assessed against the average of a 10 years time series and the projection is derived by the means of an ARMA model. The table below summarized the UFRs values for the major currencies.