Last 16th August 2022 IVASS published its bulletin concerning the Italian separately managed accounts over the period 2017-2021. Those will be referred to in the following as Segregated Funds (SF), being like the Canadian ones.

Beyond pursuing the stability of the financial system and markets, IVASS, the Italian Institute for the Supervision of Insurance, aims at ensuring adequate protection of the policyholders, fostering a prudent management of the undertakings and their transparency and fairness towards customers. The Italian supervisor publishes on a regular basis statistical data on the Italian insurance market: the main figures are gathered in its annual report printed in June, and many others are collected in the statistical bulletins, issued more than once a month. Those include information on quarterly written premiums, trends in motor insurance and in other lines of business, with-profit life policies and crime in the insurance industry.

It is useful to recall that SF are pools of investments where the premiums of with-profit insurance contracts are invested to offer capital appreciation and death (and maturity and lapse) benefits to the policyholders. SF are managed in separate accounts by the insurance company and regulated by the Regulation n.38 issued in 2011 by ISVAP (as IVASS was named at that time). The returns of the SF are usually smooth and suffer from the market volatility in a limited manner, thanks to the way in which they are derived: a ratio between the financial result of the fund and the average assets under management, measured at their book values, independently of their current market value. Regarding the numerator, the fixed coupon bonds provide the minimum financial guarantees offered, coherent with the bonds returns bought at the time of issue, the floating coupons vary with the market, and the undertakings can choose from time-to-time how much gains or losses to realize by selling or purchasing assets, according to the benefits they must pay. The SF return is credited to the policyholders according to the rules defined in the policy term sheets, usually providing a minimum guaranteed revaluation, with a defined profit share defined (either a simple profit share or a minimum rate retained by the undertaking or a combo of the two). Starting from February 2018 and following the Order n.68 issued by IVASS concerning the amendments to Regulation n.38, the undertakings can define the SF returns for the new contracts taking into consideration the surplus funds (Fondo Utili), to defer within a certain limit the net financial gains and cover any future losses that may occur.

The highlights reported in the August 2022 statistical bulletin on SF are

- a constant (7) number of segregated funds with surplus funds and a decrease in the total number of segregated funds without surplus funds (from 288 in 2020 to 284 in 2021; there were 303 in 2017), of which 14 (stable) in foreign currency (8 USD, 5 CHF, 1 JPY)

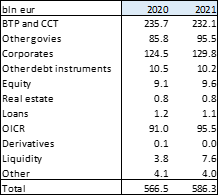

- a small increase of 2.6% in the overall technical reserves (from 560 bln in 2020 to 575 bln eur in 2021), including a boost of 36.3% in the SF with surplus funds (from 3 to 4 bln), those remaining a small share (0.7%) of the total

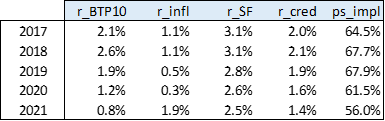

- a decrease in the implicit profit share and SF returns, albeit these are higher (and less volatile) than the 10y BTP and the FOI inflation rate (consumer price index for Families of labourers -Operai- and employees -Impiegati) in the 5y observation period during the last ten years (2011-2021) the 4 major assets categories held in the SF have changed their mix as follows: BTP decreased from 50% to 11%, other EU govies increased from 9% to 16%, corporate remained stable at 25%, OICR increased from 5% to 17%

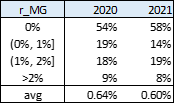

- the share of SF with 0% financial minimum guarantee increased from 54% to 58%

- the share of govies with credit rating better than BBB increased from 17.7% in 2020 to 19.4% in 2021, while that with rating equal or lower than BB remained stable (from 0.3% to 0.5%); the corporate bonds with ratings BBB and A or higher remained stable as well, with a share of respectively 52% and 37%. Here is the composition of SF without surplus funds

Reference:

- IVASS, Bollettino Statistico Gestioni Separate Vita (2017 – 2021), Anno IX – n. 9, agosto 2022