This article is meant to recap the major topics highlighted in the Financial Stability Report published by EIOPA last 22nd June 2022.

Russian invasion of Ukraine and Inflation

The Russian invasion of Ukraine has increase pre-existing inflationary pressures triggered by the pandemic, planting doubts of negative economic outlooks with stagflation scenarios. Consequently, Central Banks are turning to restrictive monetary policies and a scenario with rising interest rates seem more realistic than a low yield one. Insurers benefit or suffer from an increase in interest rates based on duration mismatch of assets and liabilities: when assets are shorter than liabilities (negative duration gap) their value decreases less than the liabilities’ one. This often happens for life insurers and pension schemes, while the opposite is observed for non-life insurers, that also massively suffer raising claims driven by the inflation increase. Obviously, also life insurers suffer an increase in inflation (expense risk), as well as policyholders, who face lower real word returns and a reduced purchasing power. This may lead to an increase in lapse rates (indeed many companies turned from lapse down to lapse mass risk) and lower pension contributions, or even accesses to pension pots to afford a higher cost of living.

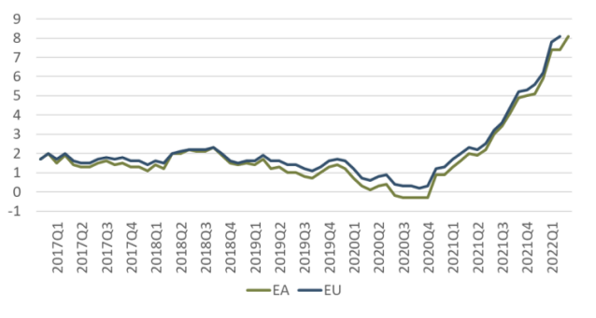

During 2021, the inflation has increased in the euro area by 2.6%, well above the 2.0% target; the growth has continued in 2022, reaching an annual estimate of 8.1% in May 2022. The chart shows the HICP annual % change, sourced by ECB.

The EU Commission forecasts inflation levels of 6.8% in 2022 and 3.2% in 2023, while the IMF World Economic Outlook forecasts euro area inflation rates of 5.3% in 2022 and 2.3% in 2024.

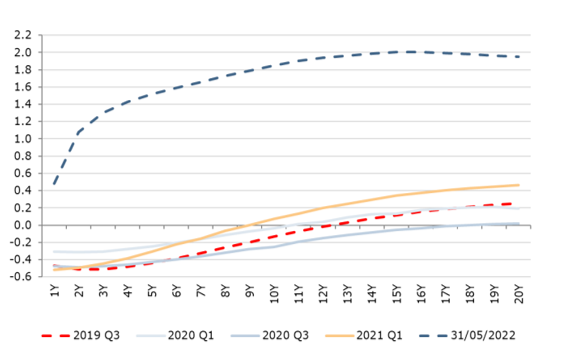

Following high inflation rates and a tighter monetary policy, Sovereign yields have increased in Europe during the second half of 2021 and in the beginning of 2022, being significantly higher than in the last years. The government bond yields are back to be positive, and the Euro swap curve is even above the 2019 level, as showed by the following chart, sourced by Refinitiv.

Luckily, so far, a direct impact of the invasion on assets and liabilities is quite limited: the assets directly exposed to Russia, Ukraine and Belarus are lower than 0.1% of the total investments and the volume of technical provisions in these regions is negligible; only few small European insurance groups are active there and are not exposed to energy-commodity or sovereign default risk derivatives.

Cyber Risk

Following the Russian invasion of Ukraine and the wider and wider development of digital solutions and reliance on remote work, the European supervisors expect a rise in the materiality of cyber risk, that is now ranked as third place in terms of materiality, after market and macro risks. On one hand, this challenge may turn into an opportunity for the insurance sector, which can take the chance to provide cyber underwriting policies; on the other, it can further increase coverage gaps raising issue of insurability and reputational risk (for instance, the so-called “war exclusion”, losses caused by armed conflicts not paid, is now at dispute): with this respect, a clear disclosure and communication of the scope of the coverages is extremely important. It’s also important to remind that, back in 2020, during the SII review, EIOPA proposed the European Commission a new reporting template of data for cyber insurance policies and, starting from January 2022, the Authority has included a new risk category (Digitalization and cyber risks) in its Risk Dashboard. EIOPA will work on improving its methodological framework for bottom-up insurance stress test, including cyber risk, during 2022 and 2023. Luckily, so far, only a limited number of European insurers are active in crypto asset investments, with negligible materiality, almost all concentrated in unit linked life products.

Climate Change and Sustainable Finance

Climate change is producing extreme weather and driving several natural disasters, in 2021 much higher than in previous years: the World Meteorological Organization has reported an increasing factor of five over the 50-year period. If they become more frequent or severe, non-life insurers will face a high pressure. EIOPA has published a paper to set out methodological principles to incorporate climate change risks in a stress testing framework. Furthermore, many risks are still not covered, and this protection gap may limit productive investments, putting in trouble the overall economic growth. Indeed, in 2021, there were covered only 43% of USD losses, only 55% of CAD losses and only 24% of German losses.

The Russian invasion has ultimately underlined the demand for renewable energy, to replace Russian fossil fuels and the European Commission has also emphasized the need to accelerate the launch of clean energy technologies. Insurers can invest in green bonds to support this initiative: the European insurance industry has planned to allocate over 140bln euro to sustainable investments by 2022 and keeps on calling for increasing the availability of sustainable long-term assets.

European insurance sector in 2021 and 2022

After a 2020 characterized by the pandemic, the European insurance sector remained resilient in 2021, entering the 2022 calendar year with a solid median SCR ratio of 216% (improved for life and composite insurers, slightly declined for non-life insurers). During 2021 the financial markets performed well, providing both a slightly improved profitability for the insurers (median return on assets of 0.57% compared to 0.38% of 2020) and high returns for the policyholders, with consequent stable lapse rates (median value of 2.8% in 2021, compared to 2.7% in 2020); the gross written premiums grew compared to 2020 (also because of the earlier pandemic) and the share of unit linked business in life segment increased up to 39%, the highest level since 2016, when SII was introduced, emerged as a credible investment helping consumers to address the inflation risk.

The outlook for 2022 is not as good: the growth has started slowing down in the fourth quarter of 2021 and has significantly slowed down in first quarter of 2022, this combined with a weaker consumer and industry confidence driven by the fear of a longer conflict in Ukraine and a total ban of oil and gas from Russia. Industrial producer prices have increased year-over-year by over 30%, with different supply shock across member states, consequent to cross-country differences related to the effect of sanctions. The forecast of gross domestic product growth for 2022 and 2023 has been already decreased to respectively 2.7% and 2.3% in the Commission Spring 2022 Economic Forecast. This goes in hand with a declining path for the Equity market.

Reference:

- EIOPA Financial Stability Report, 22nd June 2022