It is a fact that the insurance companies are not ready to fulfil the burdensome new requirements for the PRIIPs (Packaged Retail and Insurance-based Investment Products), but it is now doubtful the regulation will be effective starting from the 1st of January 2017, as it should have been. Some months ago, the insurance industry tried to delay the deadline, but the request was declined by the European Commission on the 18th of May 2016. Later on, the 30th of August, the Members of the European Parliament (MEP) proposed to reject the detailed specifications (Regulatory Technical Standards – RTS) and the motion was largely approved by the European Parliament on the 14th of September 2016. All of this just few months before the directive’s original planned implementation date, that is now likely to be postponed waiting for the European Commission to define new detailed rules.

Even if the RTS are under review, the idea of the regulation stays the same: the product manufacturers (anyone who has substantively changed the risk or cost structure of an existing product, e.g. by combining products) and the distributors are required to create, maintain and publish a large volume of Key Information Documents (KIDs) for retail customers living in the European Economic Area. These KIDs, written in plain language, should make it easy for retail investors to understand and compare products before making a choice. The PRIIPs usually offer a medium/long term capital accumulation that beats the risk free rate by combining exposures to multiple underlying assets. In the Packaged Retail products the investors are typically exposed to fluctuations in the market, without holding the assets directly: a sort of “wrapping” mechanism is placed between them and the market (e.g. pooling of capital or use of derivatives). Additional features like guarantees on the capital or insurances may be part of the deal.

Under the Regulation, Member States have the power to require product manufacturers to provide competent authorities with copies of every KID before commencing any marketing activities; the national regulators, then, can intervene to ban or restrict the marketing, distribution or sale of a PRIIP.

A first proposal for the regulation was published by the European Commission on the 3rd July 2012, but, at that time, it only covered the Packaged Retail Investment Products (PRIPs). After two years of negotiation the European Parliament succeeded to massively extend the scope to include all retail investments of any kind, particularly the Insurance-based ones (from PRIPs to PRIIPs). Including those amendments, the regulation now covers a huge category of products, among which: UCITs and other funds, policies ‘with profits’ and other life insurance products with a maturity or surrender value that are at least partially exposed to market fluctuations, structured or derivatives based investments and some other investments issued by Special Purpose Vehicles. The regulation does not cover products with no investment risk, general insurance and life insurance paying only benefits on death or incapacity, occupational pension schemes and direct holdings of shares and bonds.

The compromise text was agreed on the 1st April 2014 and the final Regulation was adopted on 15th April 2014 with the goal of improving the safety of retail investors through new rules on advice standards and information disclosure. Then, the Commission initiated the Level 2 process in July 2014 with a request to EIOPA for technical advice on possible delegated acts. Late on, in November 2014, EIOPA, EBA and ESMA issued a discussion paper on draft RTS via the European Supervisory Authorities (ESA) Joint Committee. The final draft for the RTS has been published by EIOPA on the 31st March 2016 and finally, on the 30th June 2016, the European Commission released the Commission Delegated Regulation (EU) along with 7 annexes with further details on the KIDs.

Yet, many doubts remained on how the RTS were to be implemented and the European Commission and European Supervisors Authorities (ESAs) were planning to publish sets of level 3 measures at the end of September to address these concerns. Now that the European Parliament has rejected the Regulatory Technical Standards, everything is going to change.

Here after a description of the regulation is summarized: the ideas will stay the same, but some technicalities are going to be modified. The KID should be a stand-alone document, separate from marketing material and published on the manufacturer’s website. It should be short and not technical, presented in a common format to allow investors to compare the details of different products. The regulation also specifies the titles and contents of the KID and the order in which it should be arranged. Here is the outline:

– it must begin with basic, key information:

- the identity of the product

- the identity and contract details of the products manufacturer

- the national regulator responsible for the product manufacturer

- the date of the document

– then it goes on with a ‘comprehension alert’, where applicable, to warn if a product is particularly complex “This product is considered to be very complex, and may not be appropriate for all retail investors”

– ‘What is this product?’

- type of PRIIP, its objectives, and how it achieves them (e.g. the underlying instruments)

- the consumer type to which the PRIIP is intended to be marketed

- details of any insurance benefits, where applicable

- the term of the product, if known

– ‘What are the risks and what could I get in return?’

- a simple summary risk indicator (SRI)

- a narrative explanation of the risks

- the possible maximum capital loss, and any other financial risks

- whether or not there is a capital guarantee. If so, the conditions

- indicative future performance scenarios

- any other conditions on returns to investors, or performance caps

- a statement of the tax regime which applies to the product

- the precise details of any compensation or guarantee scheme, where applicable

– ‘What are the costs?’

- all costs, both one-off and recurring, indirect or direct, with total aggregate cost figures expressed both in cash terms and as percentage of investment

- a note that the distributor can provide details of his own additional commission and costs

– ‘How long should I hold it and can I take money out early?’

- details of any cooling-off or cancellation period

- the recommended and, where applicable, required minimum holding period

- any conditions on disinvestment

- any penalties, fees, or other negative consequences arising from early disinvestment

– ‘How can I complain?’, with details on complaining

– ‘Other relevant information’, including any additional documents to be provided to the investor.

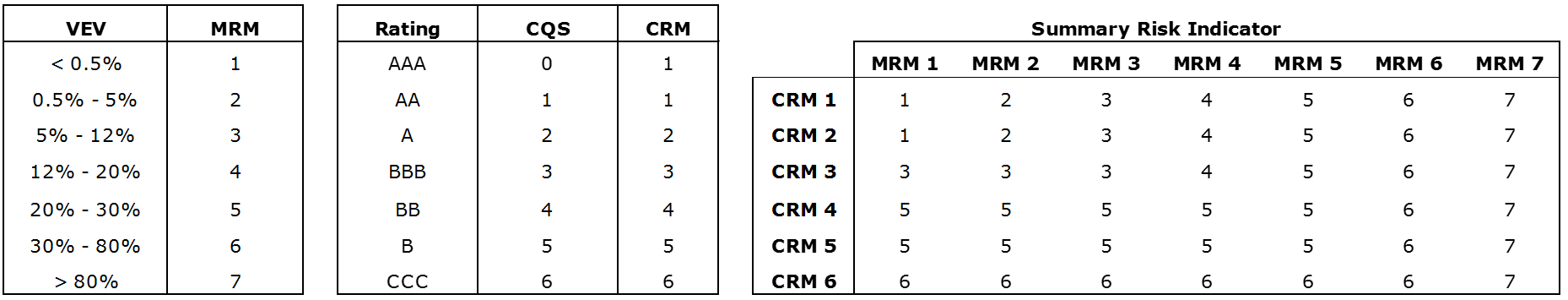

The SRI summarizes in a single figure the riskiness of the PRIIP. It is made up of Market Risk Measure (MRM) and a Credit Risk Measure (CRM):

– the MRM is calculated using a V@R approach @97.5% level over the recommended holding period. The regulation sets out two approaches to be used according to the PRIIP category

- in case of linear dependency of the PRIIP value on the fund NAV, the VEV (VaR Equivalent Volatility) is calculated via a close formula

- otherwise a bootstrap approach is used

– the CRM is instead quantified via the External Credit Assessment Institutions (ECAI) – e.g. Moody’s, Fitch, S&P. The rating is converted into a Credit Quality Step (CQS) that may be adjusted under some circumstances (e.g. long recommended holding period).

Another very important element of the KID is the section on the performance scenarios. The expected future performance of the PRIIP is shown at the maturities (1, half-holding period and holding period) at three different quantiles of its distribution: 25%, 50% and 75%. The quantiles correspond to an unfavorable, moderate and favorable state of the world. In case the PRIIP offers an additional coverage insurance, the level of the death benefit guarantee is shown supposing the death of the insured at the very same maturities, under a moderate economic scenario.

This way of expressing the performances has been questioned last June by eight asset management groups (Allianz Global Investors, AXA Investment Managers, BlackRock, Fidelity International, JPMorgan Asset Management, Nordea Asset Management, Robeco and Schroders). They claimed this way of expressing data is misleading, not warning the investors on the possibility of losing money, even for products that have regularly led to losses over the recommended minimum holding period. They said the regulation examines future scenarios, but removes past performance data. Consequently, the (MEP) presented a motion to the European Parliament’s Committee on Economic and Monetary Affairs, which has supported the complaint. The European Parliament then decided the need for the European Commission and Council to redraft the current PRIIPs RTS.

As a personal opinion, I just partially agree with those comments as the history of the product is embedded in the future performance: the return is projected according to its average measured on a 5y maximum time series (to be clearer the last 2 years counts for 40% of the average value). Yes, even in case of occurred losses, the moderate scenario could potentially show a growth, but the unfavorable one would make clear the possibly of facing a loss. On the other hand, it is true that people may not be familiar to the concept of probability.

Although the regulation strives to describe any step with a crystal clear layout, in order to make the products comparable in an easy way, the content of some sections are not that clear and may be subjective. One main issue concerns the Multi-option product (e.g. segregated fund + unit linked). The regulation prescribes either to produce one single KID for the whole product with an annex for each option or one KID for each option. The latter choice is generally too burdensome, while the risk of adopting the former is to become too generic in defining the risk, cost and performance: too different options are collapsed together (the resulting SRI may be “from 2 to 6”, spanning a range of 1 to 7 – this would not be a useful indication).