An introduction of actual crisis

A pandemic disease, which represents an outbreak of a disease spreading across wide geographic areas of the whole world and affecting an exceptionally high proportion of the entire population, spreading all over the world is an exceptional event not occurred in Europe since 1918-19 when the “Spanish Flu” found Europe as the ground-zero of a similar disease (and since 1968-69 in the World with the “Hong-Kong Flu”).

In these weeks, we have just moved from the “Phase 1”, a nearly complete economy and social lockdown due to over 3 billion people constrained in their houses, to the “Phase 2” also called “Exit strategy” which will consider a step-by-step re-opening. Prevention and social distancing are still the key words for this transition.

While virologists and experts are focusing on pandemic curves trend, economists try to understand what is going to happen on financial markets and real economy and specifically to predict the recovery shape (V, W, U, L in terms of GDP).

Considering each country peculiarities and reaction to the virus, as reported by Antonio Fatás (Noyes, 2020), this recession is unique and can show a completely new different shape from the past, probably with a jeopardized behaviors rather than a common path as it has been observed in 2008 crisis (except for Greece and Portugal).

May Bank of America’s monthly global fund manager survey (Winck, 2020) shows a limited pessimistic 10% who expect a V-shape recovery and a more optimistic 75% who predict prolonged U- or W-shaped recoveries.

Within this context, a crucial role must be played by banks. They hold a primary role and must act as facilitator and enhancer of the recovery.

In this article we want to provide some insights about what it is happening on the Advisory sector, what banks will have to do in order to support their clients and what are the main challenges that they will face soon.

Advisory services: new shape of a role

Advisory segment has become more and more relevant over the years representing steadily a 25% (Damyanova, 2020) of total revenues even in crisis period, but it represents even more. Advisory Service, including not only investment counselling but also IPO, ECM and DCM, are the first contact between bank and client and plays a relevant role to strengthen relationship and cross-selling. Coronavirus will strongly re-shape how this business segment is undertaken, creating new roles and ending some others, and banks need to encompass this process because, as Einstein spoke, “In the middle of difficulty lies opportunity”.

Contrary to 2008 crisis, were banks were badly perceived as the principal creator of the economy drawdown forced by their focus on revenues heedless of the control measures, nowadays they are engulfed in the situation as all stakeholders but can proactively help economy to recover.

Capital Markets are under widely pressure. Due to high market volatility (e.g. roller-coaster on TVIX), companies are in trouble obtaining funding both on equity and debt solutions. Actual crisis exacerbates companies with previous already critical situations while poses threats to healthy ones which can access market only with high costs.

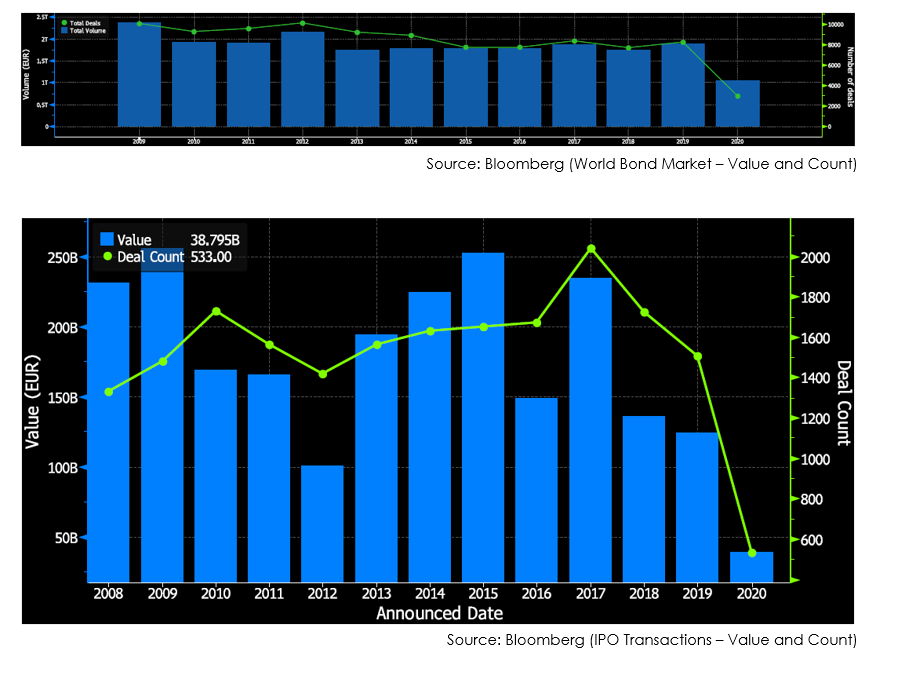

As reported below, European IPO and bond markets have shrunk in 2020 as companies are suspicious over them.

On the other side, private equity can be a relevant factor within this situation due to high liquid investment funds and/or High Net Worth Individuals (HNWI) who can provide liquidity and sustainment to companies but not for free. In a context where prices are falling and immediate need can tarnish judgement, risk of cannibalization are significant as well as potential one-life deals.

Banks role, in order to preserve financial fabric, is double as they must:

- on one side act as real advisor rediscovering their role as guide and counselor addressing clients to the best funding solution (through bank loan or not)

- on the other side foster new way to connect to client more rapidly and provide always interconnected systems with updated data.

Being an advisory means above all to shift priorities from short-term marginality to long term relationship. Nowadays both retail and corporate institutions need a guide to understand how to operate in order to preserve revenues and have easily access to liquidity at a cost which not burden them in the future.

Moreover, another relevant point is the imposed introduction, due to Coronavirus, of a switch from face-to-face advisory to digital one, of course without losing trust and/or knowledge within the process.

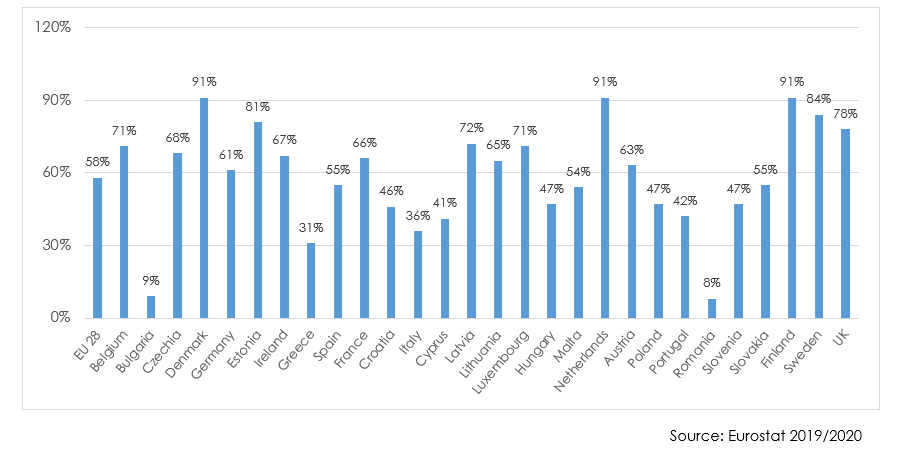

EU countries are still on the run with the digital journey for bank services as reported by the graph above. Except for some outliers, the average number of people accessing banks’ services through digital systems (PC/Smartphone) is at 58% and mainly constituted by young people (below 35/40 years). Italy (36%), specifically, is well below the average.

This process urges to speed-up not only to face actual situation but also to keep the pace with other competitors, engage new young and digital clients and enhance efficiency within processes. As of now “digital” has been perceived as a project and a complement to actual offering but never, except for small and innovative banks, as a core value to be centralized. Financial system requires to shift vision from a channel oriented where clients are divided according to the way they address to financial instruments with a clear distinction of products offering to a client based one where banks must guide and be accessible through different ways but always according to client need. Main concerns should be to simplify procedure, reduce the time-to-market and enhance to its best the cross-selling.

Conclusions

Aftermath of 2008 downturn is still something banks and entire financial systems are coping with and some countries, like Italy, are still in the middle of a long process of bad loans cutting. Recovery nowadays appears difficult and requires not only short-term financial measures but possibly a structural change to advisory services.

Uncertainty over financial markets makes it difficult for companies and investors to fund their needs, try to maintain their revenues at least at minimum level to cover costs which cannot be postponed and decide where to invest in order to catch correct market opportunities due to lowering prices.

However, this is an unprecedented opportunity for banks to, on one side reassess their advisory role and leverage on their experience and knowledge of the market while on the other side become real leader in the digital innovation.

In a wider consideration, this attitude can grant significant benefits for the future as backing-up clients today can increase potential clients tomorrow and becoming first-mover for digital transformation can lay foundation for relevant competitive advantage. Due to forced speed-up of digitalization, many organizations are beginning to introduce digital learning programs for employees and are investing over new digital innovation for clients’ engagement and management. This kind of processes will surely speed-up more and more in the future as, besides of attracting new clients, it can also reduce fixed costs and allow a more efficient internal procedures granting a better time-to-market.

Bibliography

“Dizionario di Medicina” – Treccani, su treccani.it.

Rachel Noyes, “The Shape of the COVID-19 Economic Recovery”, Economics & Finance – Blog, 2020

Ben Winck, “Only 10% of 223 fund managers surveyed by Bank of America expect a V-shaped economic recovery”, Markets Insider, 2020

Vanya Damyanova, “Global investment banks’ 2019 revenues slip to 2008 levels amid equities slump”, S&P Global, 2020

Eurostat, European Statistics, 2019-2020

“Coronavirus: Considerations for Capital Markets”, Baker Mckenzie, 2020

Peter Lee, “Private equity can be the big winner from Covid-19 sell-off?”, Euromoney, 2020

Dominic O’Neill, “Coronavirus: Italian banks try to make up for lost time”, Euromoney, 2020