The European Banking Authority (EBA) published today two reports, which measure the impact of implementing Basel III reforms and monitor the current implementation of liquidity measures in the EU. The EBA Basel III capital monitoring report includes a preliminary assessment of the impact of the Basel reform package – as endorsed by the Group of Central Bank Governors and Heads of Supervision (GHoS) – on EU banks assuming its full implementation.

The report on liquidity measures monitors and evaluates the liquidity coverage requirements currently in place in the EU. The EBA estimates that the Basel III reforms would determine an average increase by 16.7% of EU banks’ Tier 1 minimum required capital. The liquidity coverage ratio (LCR) of EU banks stood at around 145% in December 2017, materially above the minimum threshold of 100%.

Basel III monitoring report

The Basel III monitoring report assesses the impact on EU banks of the final revisions of credit risk, operational risk, and leverage ratio frameworks, as well as of the introduction of the aggregate output floor. It also quantifies the impact of the new standards for market risk (FRTB), as set out in January 2016, and credit valuation adjustments (CVA).

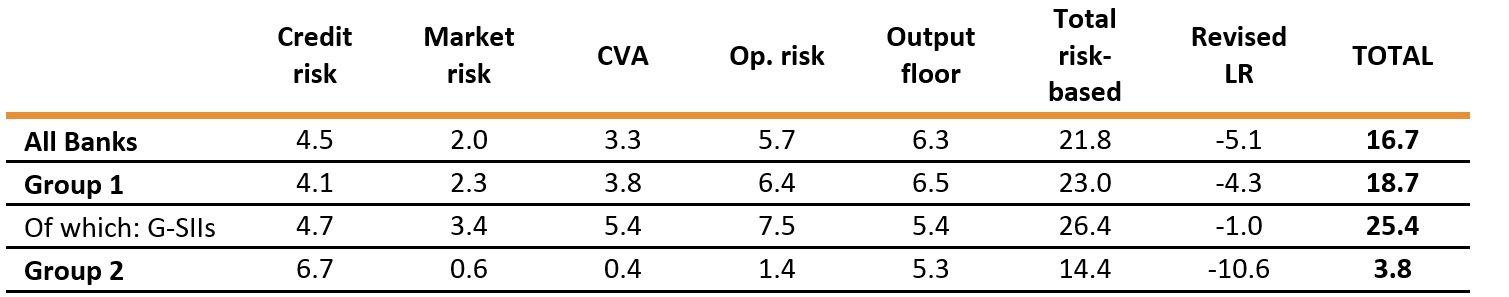

Overall, the results of the Basel III capital monitoring, based on data as of 31 December 2017, show that European banks’ minimum Tier 1 capital requirement would increase by 16.7% at the full implementation date. The impact of the risk-based reforms is 21.8%, of which the leading factors are the output floor (6.3%) and operational risk (5.7%). The leverage ratio is the constraining (i.e. the highest) Tier 1 requirement for some banks in the sample, explaining why part of the increase in the risk-based capital metric (-5.1%) is not to be accounted as an actual increase of the overall Tier 1 requirement.

Change in total Tier 1 minimum required capital, as percentage of the overall CRR/CRD IV minimum required capital, due to the full implementation of Basel III (2027), in %

Source: EBA QIS data (December 2017)

To comply with the new framework, EU banks would need EUR 24.5 billion of total capital, of which EUR 6.0 billion of additional CET1 capital.

EBA report on liquidity measures

The EBA report on liquidity measures under article 509(1) of the Capital Requirements Regulation (CRR) shows that EU banks have continued to improve their LCR. At the reporting date of 31 December 2017, EU banks’ average LCR was 145% and the aggregate gross shortfall amounted to EUR 20.8 billion corresponding to four banks that monetised their liquidity buffers during times of stress. A more in-depth analysis of potential currency mismatches in LCR levels, suggests that banks tend to hold lower liquidity buffers in some foreign currencies, in particular US dollar.

I commenti per questo post sono chiusi