At the beginning of 2017 EIOPA launched a project dedicated to the review of the Solvency Capital Requirement (SCR) calculation under the Standard Formula (SF). The project was aimed at ensuring a proportionate and technically consistent supervisory regime and at looking for possible simplifications of the SCR calculation.

Two sets of technical advices have been respectively published last 30 October and 6 November 2017; the consultation period ends on the 5.1.2018, resulting in a final set of advices to be submitted to the European Commission by end-February 2018.

Among the items quoted in the consultation papers, three of particular relevance are:

- the reduction in the resilience to external credit ratings

EIOPA advises to introduce two new simplified calculations and not to further extend the internal credit rating approach at this stage;

- the mortality and longevity risk calibration

EIOPA confirms the longevity risk parameter stress (20%), but advises to increase the mortality one (from 15% to 25%) and does not advise to increase the risk granularity;

- the interest rate risk sub-module

EIOPA advises to adjust the current formula either inserting a minimum shock with a static floor or making use of a combined approach (minimum shock + affine model).

The use of credit quality steps and rating ensures sufficient risk sensitivity in the calculation of both Technical Provisions (TP) and SCR; the undertakings have to allocate their exposures to one of the seven steps in a credit quality assessment scale. To do so, they usually rely on the judgement of certified credit agencies or central banks that issue ratings, the ECAIs (External Credit Assessment Institutions). In most cases the undertakings need to nominate several ECAIs to cover their whole portfolios (the first ECAI covers on average 73% of the exposures), with an average of 2.5 ECAIs per undertaking, and this additional cost may not be even proportionate to the risk the undertaking is actually facing. EIOPA advises to introduce two new simplified calculations, applicable only under these conditions:

- the first ECAI covers the 80% of the debt portfolio

- the remaining asset classes are of simple form (no loans, structured notes, collateralised securities or derivatives) and do not cover liabilities that provide mechanism of profit sharing participations or unit/index linked liabilities or liabilities where the matching adjustment is applied

- the proportionality requirement is met and the average risk profile of the assets not covered is not below the credit quality step 3.

To mitigate the risk of over reliance on external providers, the undertakings are currently required to produce their own internal credit assessment, but, in view of the proportionality principle, only for their largest or most complex exposures, without the possibility of reducing the capital requirements. Some stakeholders asked for the possibility to “overrule” the ECAI’s assessment and reduce the SCR, but the request was declined as it would have meant the need of a supervisory approval and of a change in the SII directive, potentially increasing the administrative burden for both undertaking and NSAs.

EIOPA was asked to develop guidance for a standardized approach that could target also the minor exposures, but the Authority advised not to further extend the internal credit rating approach at this stage, proposing a new assessment in few years. Finally, the possibility of using Market implied ratings and accountancy-based measures was explored as an alternative to ECAIs and discarded not being appropriate for all the asset classes.

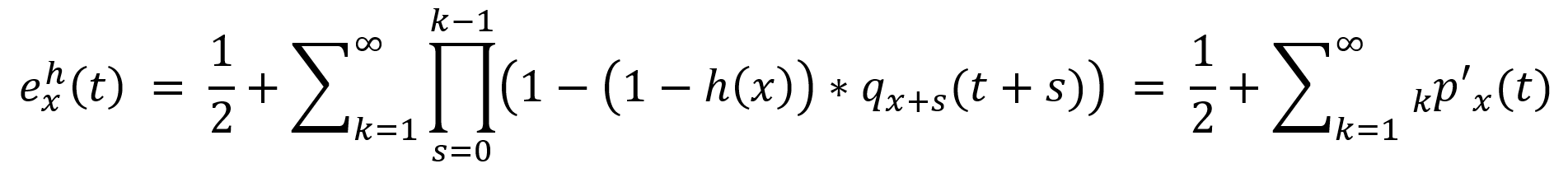

The life underwriting risk module should reflect, at least, the risk of increased insurance liabilities values resulting from changes in level, trend or volatilities of mortality rates, where an increase/decrease (mortality/longevity risk) in these rates leads to an increase in value of the insurance liabilities; the standard parameters for mortality and longevity risk have been assessed to verify their appropriateness. The losses resulting from changes in the level of mortality rates can be captured by the use of the best estimate mortality tables, while those resulting from changes in the trend can be considered via using the estimated trend for the forecast and development of future cohort mortality tables. Mortality sensitivities can be measured by changes in life expectancies, which can be captured using a stochastic mortality model. EIOPA agreed with the opinion provided by the stakeholders to project the mortality rates by making use of the Lee-Carter (LC) and Cairns-Blake-Dowd (CBD) models, calibrated to data sourced from the Human Mortality Database (HMD) – no other specific national database were used. As EIOPA does not have access to insured population data, the Authority made the hypothesis that the mortality rates are the same as the one of the general population; there is no general consensus on whether these should be higher or lower: in general insured people are wealthier and should leave longer, but on the other hand some claim that the recent improvements in mortality benefit mainly the general population.

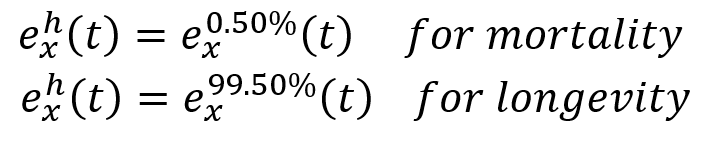

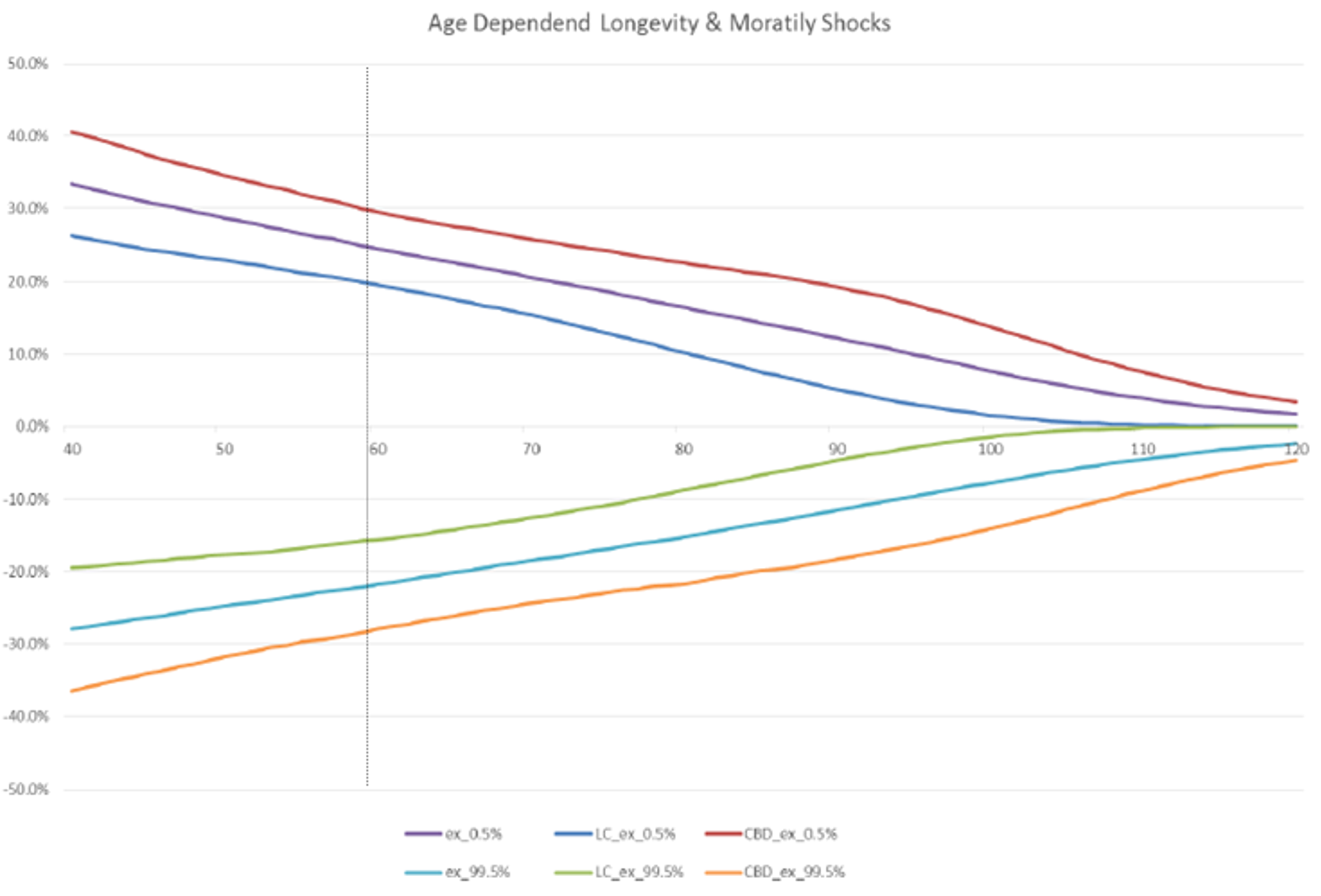

Based on the parameters estimates for each model and country, EIOPA simulated 5000 cohort mortality tables, deriving the life expectancy ex(t) for each age x and time t (average value and 0.50% – 99.50% quantiles) and calculating the appropriate shocks h(x) to apply to the mortality rates to match

where the expected shocked life expectancy is defined as

EIOPA then combined the different shocks h(x) into a weighted average over all the countries and later between the two models (LC and CBD)

The stresses defined in this way are “equivalent stresses”, applied to all mortality rates of an insured person over the projection. For age close to 60 years, the longevity stress of 20% is confirmed, while for mortality a stress of 25% would be more appropriate than the current 15%. Finally, EIOPA did not advise to improve the granularity of the stresses because of the added complexity due to the interaction with the BE model points, the implementation costs and the misalignment to the SF methodology.

The review of the interest tare risk module is an EIOPA own initiative, driven by the questionable appropriateness of the current approach that is not suitable anymore to represent the real 1 in 200 years shock event: due to the relative calculation of the shocks, the absolute one becomes smaller with decreasing rates and negative rates are not even stressed. Although some stakeholders pointed out that the review of the interest risk module should go in hand with the review of the Ultimate Forward Rate (UFR) and the correlation of the entire market risk module, EIOPA preferred to focus on resolving the issues identified, recognizing the importance to define adequate shocks also in a high interest rate environment. EIOPA confirmed that no extrapolation toward the UFR has to be done on the stressed yield curves (it would increase the complexity, putting the stakeholders in charge of the calculation, without producing appropriate stresses beyond the LLP). A direct calibration on market data would have been more market consistent, nonetheless EIOPA preferred to use the smoothed risk free curves to avoid the drawback of illiquid points; the relative stress factors were calibrated through the principal component analysis and used as inputs to the three approaches tested:

1. shifted approach

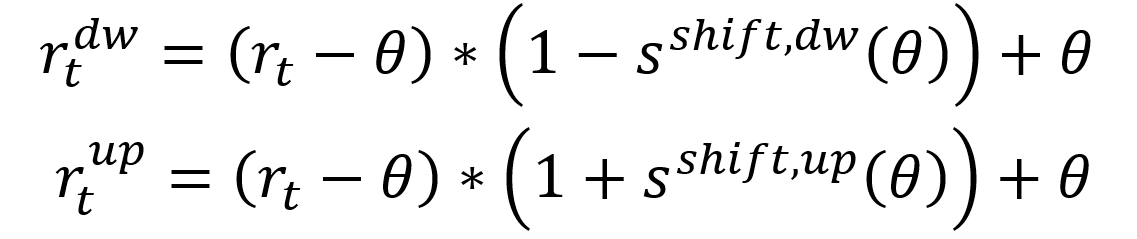

The shifted approach works similarly to the current relative one, where the x-axis is shifted of a certain quantity θ, potentially maturity dependent, and the relative stress factors depend on the shift itself

EIOPA considered a constant shift vector, calibrated to minimize the difference with the interest rate up yield curve under the constrain -1 ≤ θ ≤ m < 0, being the smallest negative rate in the calibration data set of the correspondent currency. EIOPA performed a sensitivity analysis with θ=-3%,-5%,-10%. This approach is fairly simple and data driven and works well in moderate and high interest rate environment, but unfortunately underestimates the risk in a low yield environment. An in depth analysis of historical data showed the same results to hold also when the lognormal shifted approach is used.

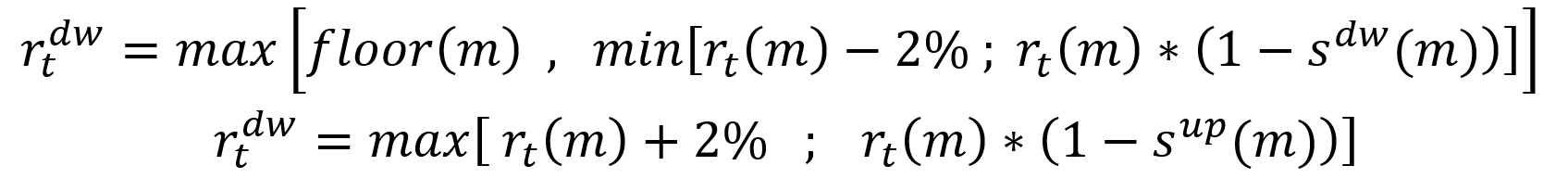

2. symmetric 200 bps minimum shock with a static interest rate floor

A minimum decrease can be introduced to ensure the risk not to be underestimated, mitigated by a static floor when the rates are negative

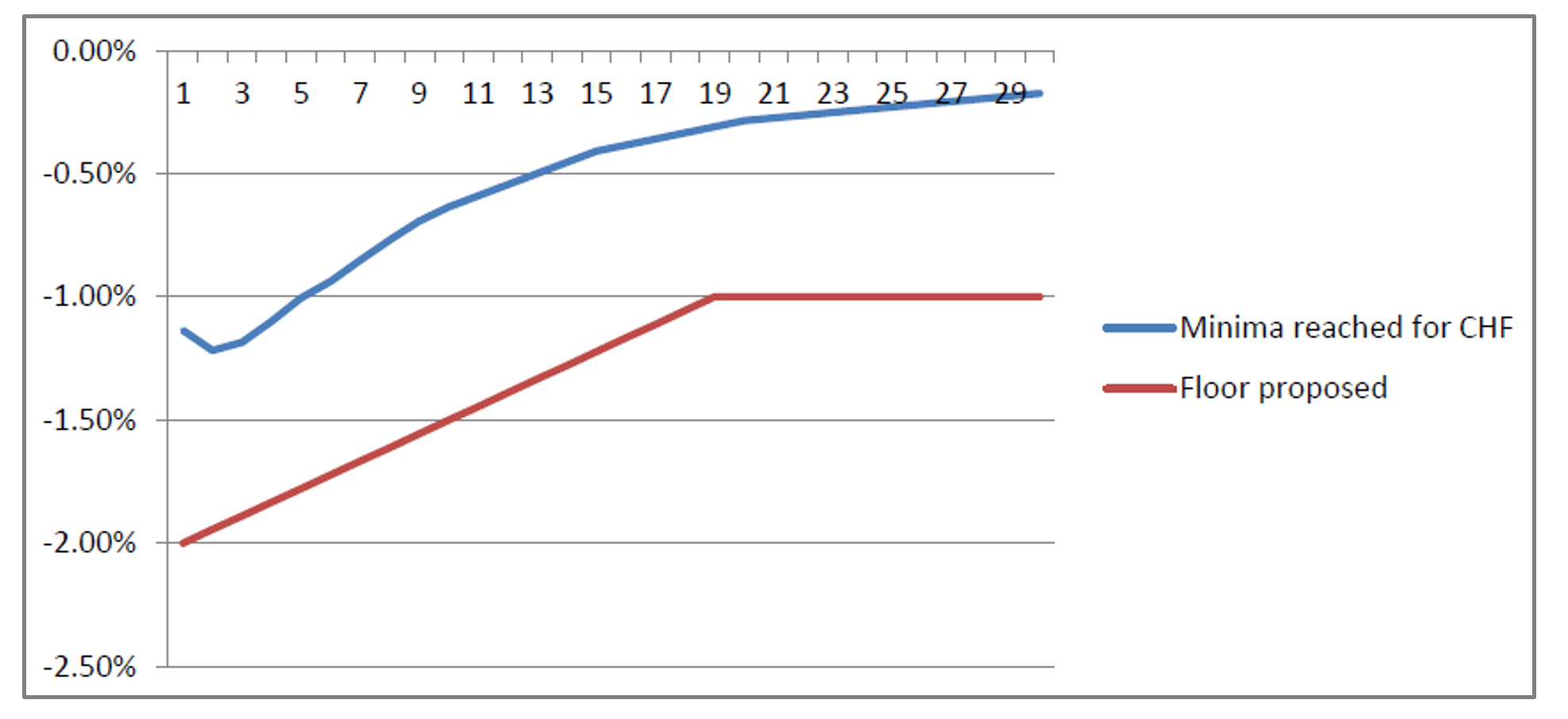

The calibration of the floor, maturity dependent, was based on the lowest rates observed (CHF) across maturities

This simple approach works in both medium high and low yields environments, without requiring a frequent calibration. However, the 2% minimum shock can be considered too prudent: no negative rates has been observed significantly below -1%, -200bps changes have occurred only with rates greater than 2.75% and no extreme annual movements greater than -100bps happened in low yields environments.

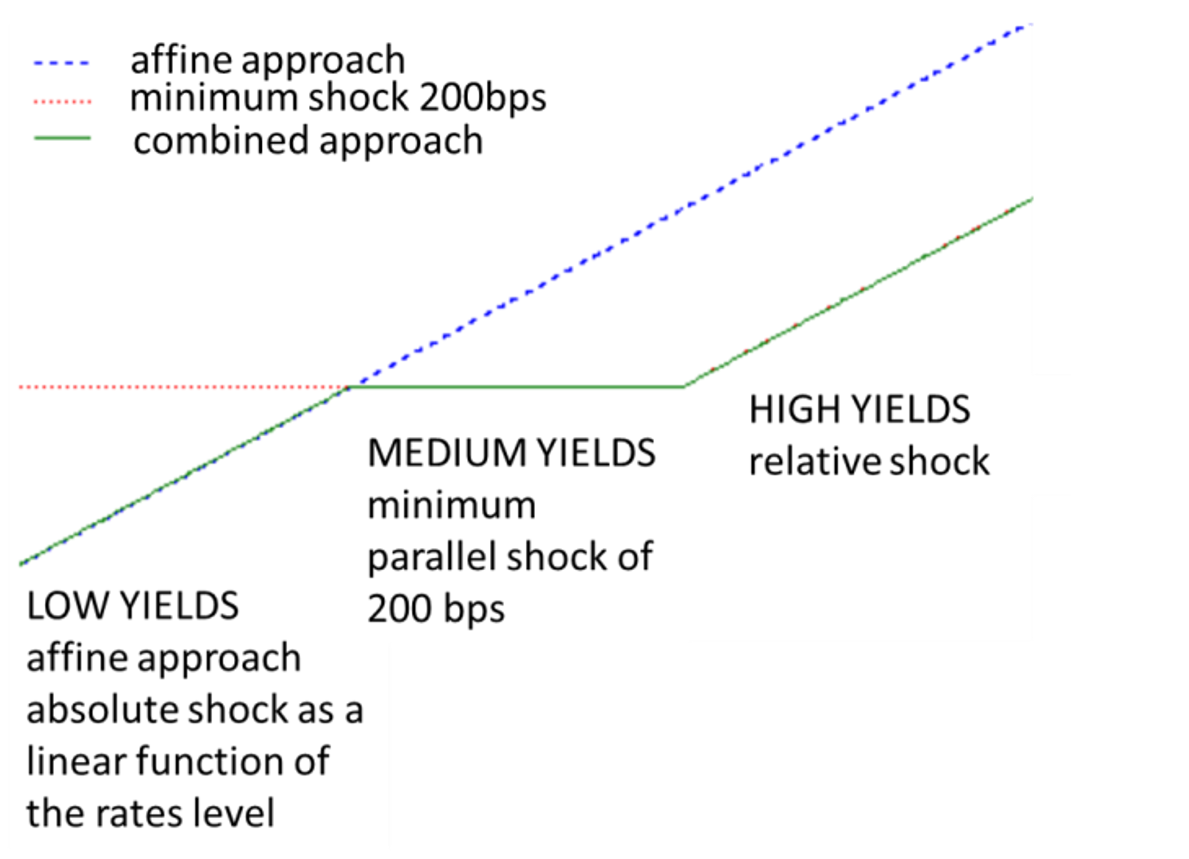

3. combined approach

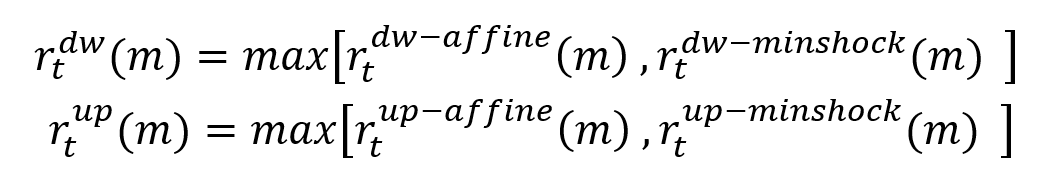

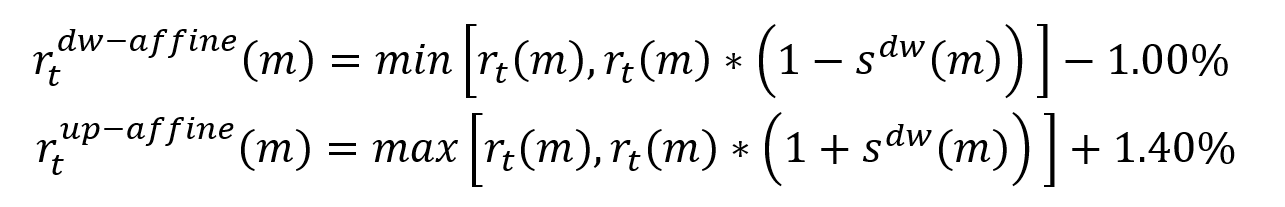

The idea of a combined approach is to apply a pure relative stress in high yields environments, a minimum shock in moderate environments and an affine model in low yields environments, with no need of introducing a lower bound to the interest rates

In formulas:

where

and the min/max operators are applied for negative rates only. The affine stresses contain an asymmetric additive component, estimated for different EEA currencies, higher in upward scenarios, as, when the rates are low, a large increase is more likely than a large decrease. For most tenor points the affine shock turns into the minimum shock at latest when the rates level is around 3.5% in the down scenario. This model appears to be fairly simple, does not require a setting of a lower bound and is capable of capturing the risk in all the rates environments.