On the 26th of March 2019 IVASS has issued a press release communicating an update on the data related to the dormant life assurance policies: 208,863 contracts, amounting to 3.9 billion euros, have been “awakened” by the Italian Regulator.

Dormant life assurance policies are those that have not been collected by the beneficiaries and lie dormant at insurance undertakings until they become time-barred. The rights arising from those policies are barred after 10 years from the event (death or maturity), when the corresponding benefits are paid to the Dormant Accounts Fund. Dormant policies can be either contingent on death, if beneficiaries do not cash in the benefits because they may not be aware of the policy itself, or saving policies not collected upon maturity for any reason.

The extensive phenomenon of potentially dormant policies arose from both the shortcomings embedded in the procedures carried out by the undertaking when checking the deaths of insureds and identifying its beneficiaries and from the widespread use of generic formulations to indicate the beneficiaries when underwriting the contract.

To contrast and reduce this phenomenon, the Regulator has:

- carried out an analysis on the dormant policies, started in 2017

- suggested the undertaking some guidelines to improve the processes for ascertaining the deaths and identifying the beneficiaries, requiring the undertakings to enhance their processes by the 30th September 2018

- required the undertaking to make available on their website a contact point in charge of responding to enquiries from possible beneficiaries on the existence of life assurance policies in their favour and to proceed with the “run-off” of the dormant policies identified

- suggested the market to check if a deceased family member had underwritten a policy by contacting the “search service for life insurance covers” of ANIA (the National Association of Insurance Undertakings) or the insurance intermediary, the bank or the insurance undertaking the family member was a customer of

- sensitized the policyholders to provide the undertaking with all the information (address, telephone number and/or e-mail address) necessary to contact the beneficiaries and make them aware of the existence of the policy and inform a third party who can inform the beneficiaries when the insured event occurs.

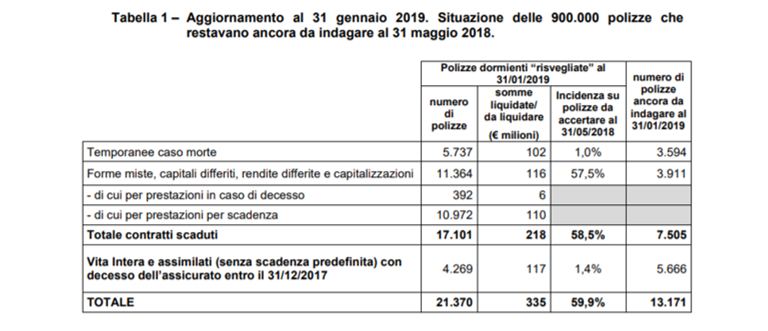

IVASS has started the investigation on dormant policies (first wave) back in 2017, publishing some important results on the 3rd September 2018. At that date, 187,493 policies amounting to 3.5 billion euros had already been “awakened” by matching the tax code of the insured people with the data stored in the tax-payers database by “Agenzia delle entrate” – Revenue Agency, the Italian IRS (Internal Revenue Service) – while other 900,000 contracts still had to be checked. The analysis, updated at the 31st of January 2019 and published on the 26th March 2019, shows that the Regulator has “awakened” other 21,370 policies, amounting to other 335 million euros. The table below, released by IVASS, reports the details of those policies and clarifies that, out of the original 900,000 contracts, 13,171 still must be verified. These ones are related to old policies, with no obligation of indicating the tax code of the insured and with no clear indication of the beneficiary. IVASS suggests in those cases to use specialized companies to retrieve the missing information. The rest of the policies (873,000 = 96%* 900,000) have correctly not been paid being the insured person alive at maturity or the policy insolvent (i.e. the policyholder has stopped the payment of the premiums, causing the resolution of the contract)

In addition to the 21,370 “awakened” policies, there are other 436 contracts, amounting to 7 million euros, that have become time-barred and should be paid to the Dormant Account Fund.

IVASS is now waiting for a feedback on other policies investigated in the last months (second wave), whose data were provided by the undertaking on the 30th October 2018. Indeed, on the 3rd September 2018, the regulator decided to extend the perimeter of the analysis to contracts expired in the period 2001-2006 and to those expired in 2017 and not yet settled. By the end of May 2019 the undertakings will have to give IVASS a feedback on the cases highlighted by the regulator, with a dead insured the undertakings were not aware of.

IVASS is now investigating the policies (third wave) whose data were provided by EEA foreign undertakings last 28th February 2019. These policies are related to contracts either expired between 2001 and 2017 or to whole life policies outstanding at 31 December 2018. The aim of this analysis is to offer the same level of protection to all the beneficiaries, independently of the nationality of the undertaking.

Following a proposal from IVASS, a new law has been issued on December 2018: every insurance company operating in Italy shall check at the end of each solar year whether its insured are still alive. If not, the undertaking shall pay the beneficiary and inform the Regulator by the next 31st March. The first check will be carried out next 31st December 2019.