1. Introduction

This paper discusses the economic and financial impact of the COVID-19 crisis across some representative countries, including some of the most significant economies worldwide: Italy, Spain; France, Germany and UK.

Our work is organized in two parts:

- A benchmark analysis regarding the most important capital markets indicators for the cited countries prior and post the spreading of the COVID-19 pandemic

- A quantitative analysis aimed at measuring the impact of COVID-19 on sovereign Credit Default Swap spreads of the upward countries.

2. The economic impact of COVID-19

2.1. Highlight of the COVID-19 spreading

COVID-19 outbreak started in December 2019 in Wuhan, located in the Chinese region of Hubei. Nowadays the pandemics is continuing to spread across the world with more than 9 million confirmed cases and about 500,000 victims.[1] Given the public health risk, the WHO[2] in March 11th has declared the status of global pandemic because of the COVID-19.

COVID-19 is a very infectious disease that is heterogeneously distributed among individuals. Indeed, high contagiousness and lack of scientific knowledge has put a strain on national hospitals, particularly as regards Intensive Care Unit.

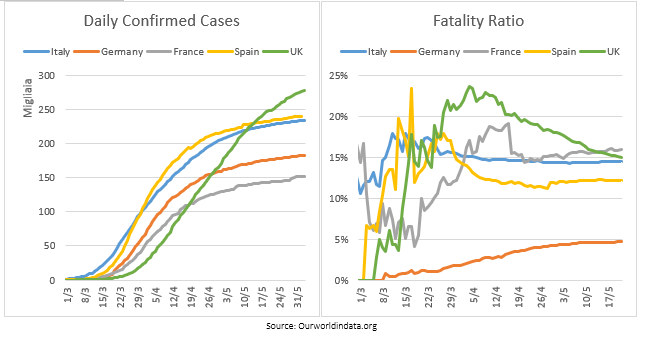

While the left chart gives an overview of the disease trend, the right one gives a clearer picture of how the pandemic has impacted the countries included in our dataset. According to most of the literature on the topic, the fatality ratio is defined as:

assuming that on average people severely infected pass away after 5 days.[3]

Between the end of March and the beginning of April, the virus reached a peak in its fatality ratio in all the analyzed countries. In the aforementioned period, Italy, Spain, France and the UK have been close to 20%, while the UK steadily exceeded such value.

The reasons for a higher mortality rate in some regions compared to others may reside several reasons, such as the country level demography, late or poorly organized response to the virus, and low medical capacity rate, particularly related to intensive care units.

2.2. COVID-19 Economic consequences on equity and bond market

The high contagiousness of the disease combined with the lack of herd immunity due to its novelty, has forced all countries in our analysis to take severe lockdown measures starting from the beginning of March.

The ability of a country to put in place measures to contain the virus allows to reduce the intensity of the lockdown and to mitigate the shock due to the production breakdowns. Because of that, in a strongly connected economy, the consequences of the pandemic go far beyond the mortality. Indeed, lockdowns has caused countries suffering an unprecedented joint supply and demand shock:

- On the supply side, the shock was due to the production interruption which led to the drop of capacity usage, implying a serious warnings for a value chain breaking down, especially in some sectors like automotive, airlines or tourism;

- On the demand side, income losses together with the fear to be infected and future uncertainty are inducing people spend less. Workers may be laid off, as firms are unable to pay their salaries.

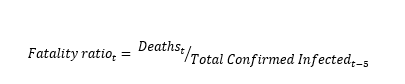

The reaction of the financial markets has been immediate as can be seen in the following chart where the trend of main national stock market indices are rescaled in terms of the quotation of January 1st .

Since it became clear that the virus was beginning to spread in Europe at the end of February, markets have fallen dramatically, faster than what observed during the 2008 global financial crisis and stocks indexes’ reaction vary among countries (on one side Germany and UK are recovering quiet quickly, on the other hand, Spain and Italy are still experiencing a slow recovery although the first wave of the contagion seems to be coming to an end).

Albeit a complex debate is taking place, regulators (both governments and central banks) seems to agree to do whatever it takes to deal with the critical economic and health care conditions, leaving aside for a while moral hazard risk and austerity arguments:

- Households and businesses, hit by supply disruptions and a drop in demand, are receiving cash transfers, wage subsidies, and tax relief, all measures aimed at helping people to meet their needs and businesses to be resilient;

- Companies are having easier access to credit through direct or indirect state guarantees.

European Union has been allowing access to the ESM relaxing the original contractual terms and conditions, imposing as the only covenant the use of funds for direct or indirect health care investments in order to drawdown the facility, in addition to the availability of structural funds already existent.

Central Banks put in place dovish measures to support credit market and minimize spreads volatility.

The European Central Bank (ECB) is expanding its asset purchasing programs on the secondary market and announced a massive shared debt issuing program aimed at containing the negative effects of the pandemic. The Bank of England is cutting tax rate in order to provide liquidity to banks and firms and maintain tax rate as low as possible.

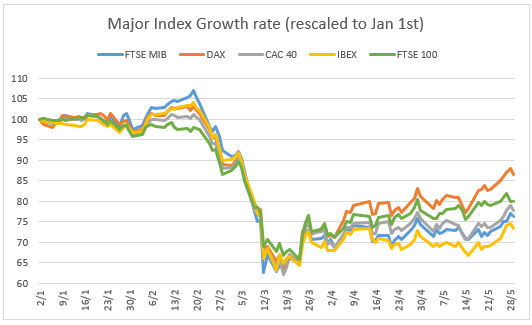

Most of the declarations and actions by policy makers took place in the first half of March. In the following chart is clear how, after a sharp increase during first days of March due to the overall panic caused by the pandemic, the fiscal and monetary actions had a positive impact in the government bond market by reducing returns and volatility.

Thanks to these measures, bond yields, suddenly hit harder by the virus such as Italy and Spain, are not experiencing an out of control increase in their financing cost.

It can been argued that the subsequent announcements of expansion of the purchase programs described above have calmed down the rising trend of the yield market. As showed in the chart, government bond yields in the analyzed countries do not seem to have exploded so far, although they have significantly increased. Despite some positive signals, the joint supply and demand crisis generated by the virus and the aforementioned measures aimed at tackling it will have the inevitable consequence of an unprecedented fall (at least for 2020/2021) in GDP and a sharp increase in debt. Countries with already long-standing structural growth problems and high public debt, could be exposed to a serious increase of their default risk.

3. Evidences on the Covid-19 and CDS market relationship

The pandemic impact is not only in the countries financing costs (government bond market) but also in the risk perceived related to those countries. In the present section we will assess how the CDS market has reacted to the evolution of the Covid-19 contagion with respect to some reference countries.

CDS configures as credit derivatives traded in over the counter (OTC) markets, both through bilateral agreements or under the jurisdiction of a clearing house, which guarantee to the buyer be insured against the default of a reference entity. Therefore a sovereign CDS can be taken as a measure of a country’s risk.

As expected, a sharp reaction of the sovereign CDS market to the spreading of the Covid-19 pandemic seems to be confirmed by available market data[4].

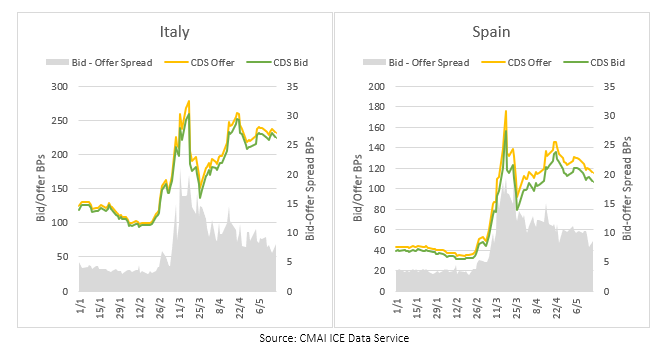

As concerns the Covid-19 storyline outlined in section 2, the majority of countries started their lockdown and social distancing period at about the beginning of March 2020. Starting from countries dramatically affected by the pandemic, such as Italy and Spain, it is observable an extraordinary rise of the 5Y[5] CDS conventional spread around the end of February 2020. At the same time, bid-offer spreads began to widen as a proof of market participants struggling in a reduced liquidity in the derivative market environment.

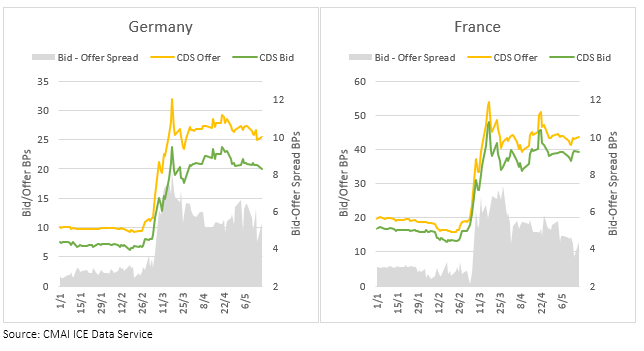

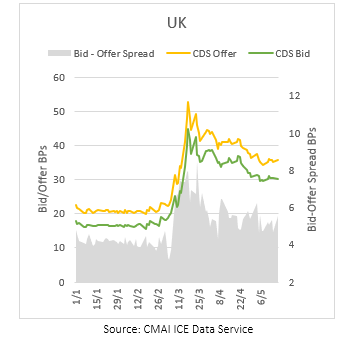

As regards the leading European economies, such as Germany, France and the UK, they have behaved quiet similarly, showing a peak in their respective 5Y CDS spread around the mid of March 2020.

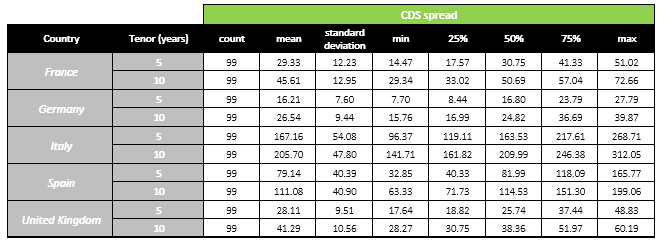

In order to provide an overall picture of about CDS Market during the last months, some baseline descriptive statistics related to both the market and the pandemic trends are showed in the following table:

Italy has been perceived as the mostly risky country[6]. Together with Spain, these two counties have also been affected by the highest levels of volatilities in their respective sovereign CDS spread. On the other side, the German CDS showed be the cheapest protection one can buy among those in our dataset.

To conclude, it seems that all countries displayed a similar 5Y CDS pattern, clearly differentiated by some scale factors (for instance the average German 5Y CDS spread has been ten times lower than the Italian one). According to our dataset, the only exception seems to be represented by the UK which displayed a clearer inverse u-shaped pattern in the 5Y CDS spread.

As can be noticed, CDS spreads of all investigated countries are quiet coherent with the 10Y bond yields patterns described in section 2. After that maximum, a downward trend can be observed even though no pre crisis CDS spread levels have been reached so far. Such evidence might be related to the massive economic program announced by ECB aimed at containing the negative effects of the pandemic. Despite the quick positive reaction in the government bond market (see session 2), the CDS market still present a liquidity gap between bid and ask quote as demonstrated by the wider bid-offer spread after middle of March with respect to the bid-offer spread before.

3.1. Correlation analysis

In order to assess the dependence degree of 5Y CDS dynamics from the spreading to the Covid-19 disease, we have analyzed two orders of correlation:

- The country level correlation between CDS spreads and new Covid-19 daily cases by splitting our time window in Pre and Post the structural break represented by the ECB shared debt program announcement;

- The country level piecewise weekly correlation between CDS spreads and new Covid-19 daily cases.

3.1.A Country level overall correlations

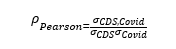

To quantify the impact of the relationship between new daily Covid-19 cases and the CDS patter, we measured the Person correlation index between the two variables:

Where:

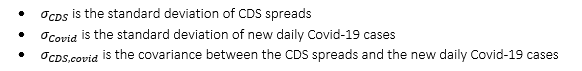

The Person correlation index has been calculated before and after the structural break that took place from beginning of March where policy makers provided clear messages and intention to deal with the Covid-19 with all the measures required:

It is quite clear that prior to the ECB announcements the two country level time series appeared to be highly correlated: the peak has been reached by France which showed 95% correlation between CDS spreads and new Covid-19 daily cases. After the cited structural break, the two time series switched to the regime of anti-correlation, especially in Italy which registered -77% correlation. These evidences sharply testify the good response of the sovereign CDS market to how governments and international institutions are handling the Covid-19 crisis, probably as a result of what it has been learned by the global financial crisis in 2008 and the sovereign debt crisis in 2012. The negative relation between the CDS spread and the number of new daily Covid-19 cases demonstrate the reduction of the panic-effect in the derivative markets generated by the news.

Despite the UK, US are outside the ECB jurisdiction, they behaved similarly probably in the light of the specular policy enhanced by their respective governments and central banks.

3.1.B Weekly country level correlations

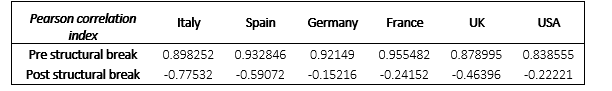

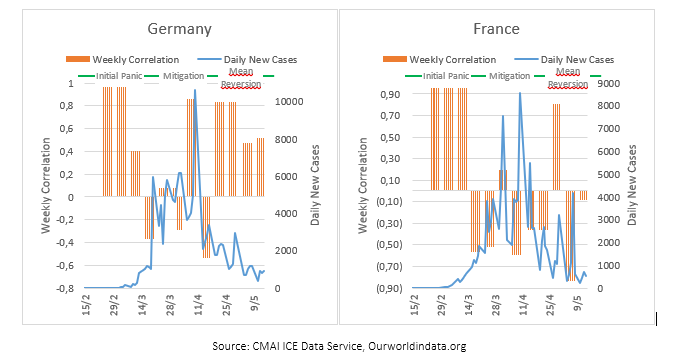

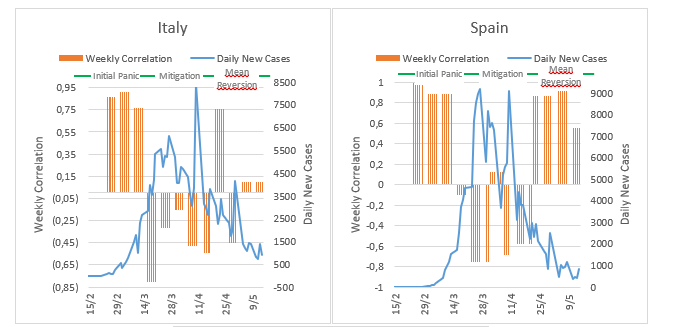

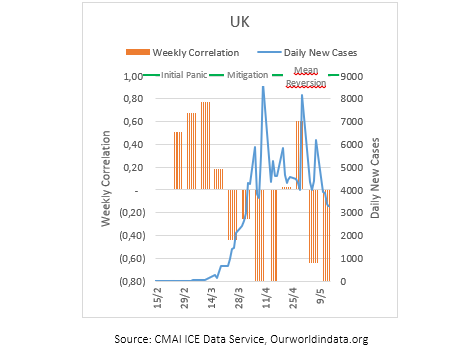

As regards the country level weekly Pearson piecewise correlations between CDS spreads and new Covid-19 daily cases, they seem to confirm what highlighted by Pre and Post structural break correlations.

The overall period can be divided in three phases:

- Initial panic effect: starting from mid of February, the initial increasing number of new daily Covid-19 cases generated a panic effect due to the uniqueness of the situation; moreover no fiscal and monetary policies were put in place to face future economic shocks;

- Mitigation effect: after the initial phase, national governments and supranational institutions started concrete actions both at sanitary level and at fiscal and monetary level; in this situation, in spite of the continue increase in the new daily Covid-19 cases, the correlation started to turn to negative showing how markets positively responded to the concrete action took by policy makers;

- Mean reversion effect: starting from May, the overall sanitary situation started to improve and the new daily cases started to decrease. During this positive context, CDS prices continued to decrease thank to all the action taken by policy makers. All these factors combined let to positive weekly correlations that now can be seen as an overall positive situation (in opposite with respect to the first period, the panic effect)[7].

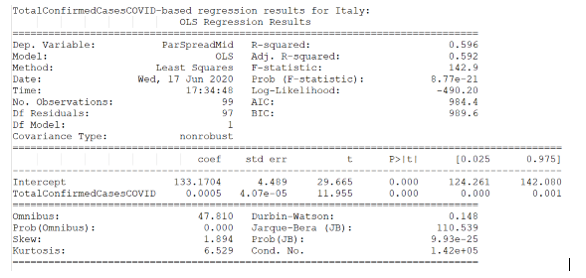

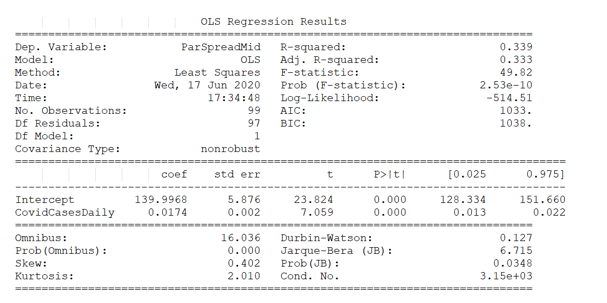

In addition, by the application of two simple Ordinary Least Squares (OLS) regression models, we have figured out that both the overall stock of Covid-19 patients and daily new cases are statistically significant in determining the level of 5Y Italian sovereign CDS spread during the first two 2020 quarters. Moreover, we have found similar results for other European countries and the US.

Nevertheless due to complexity of our panel data, univariate OLS specifications display some shortcomings which suggest the use of more refined techniques, see the Appendix for details. The use of such more advanced regression techniques might be the goal of future developments.

4. Conclusion

The spreading of COVID-19 has been devastating both in terms of life losses and economic consequences. The long term impacts of the contagion are far to be clarified.

Apart from the positive German exception, the fatality rate our set of investigated countries has been above 10% for almost the whole period, reaching around 25% for the UK. Equity, bond and credit derivatives markets, have been deeply impacted, showing unprecedented negative peaks, especially for stock markets.

In the present work we have pointed out the evidence of close connection of the trend of COVID-19 infections and deaths with available data of financial markets.

However, no lack of mitigating measures has been observed by policy markets, who have certainly contributed to the resilience of financial markets, in particular that of CDS.

In particular the impact of all the policy maker actions – both at national and supranational level – have been more direct in the bond markets than in the CDS market. The impact in the bond market shows that the countries’ cost of financing have been clearly facilitated by the monetary policies more than what observed in the derivative market.

Appendix

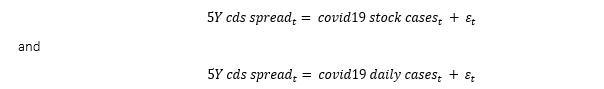

On the quantitative side, in the present work we have performed some basic Ordinary Least Squares (OLS) regressions in the attempt to describe the evolution of CDS spreads by taking as explanatory variables, separately:

- The overall country level stock of Covid-19 patients;

- The daily confirmed new Covid-19 cases.

In formulas we have, respectively:

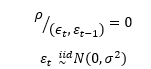

Where, according to usual OLS model assumptions, residuals are not autocorrelated and normal distributed:

With square of sigma the constant variance (homoscedasticity). We now discuss our regression results in the case of Italy, similar conclusions might be drawn for other countries.

As Italy is concerned, both our two simple regression models display some explanatory power, even though the R-squared is higher in the stock based regression settings. In such case, our model is able to explain 59.6% of the overall deviance. The F-statistic probability, otherwise known as its p-value, is very low allowing us to reject the null hypothesis of no explanatory power.

In both the two regressions, the p-value for the T-statistic is zero for both the intercept and of the explanatory variable, allowing us the reject us the null hypothesis of zero coefficients. On the other hand, it seems that usual OLS assumptions on the residuals form are not met. In particular, the Durbin-Watson test return a value significantly lower than 2, denoting relevant residuals autocorrelation. Moreover regards the Jarque-Bera probability, it is significantly lower than 5% in the first model and however lower than 5% in the second model. Jarque-Bera statistic is based on higher than second order moments (i.e. skewness and kurtosis) so that in our case residuals do not confirm to be normally distributed. These evidences, together with some multicollinearity warnings, suggest that in the light of the complexity of our dataset some more refined multivariate regression models should rather be used. These might be part of future developments.

Nonetheless we can conclude that our simple regression models demonstrate that both the overall stock of Covid-19 patients and daily new cases are statistically significant in determining the level of 5Y Italian sovereign CDS spread during the first two 2020 quarters. As previously said, we have found similar results for other European countries and the US.

Authors:

– Annalisa Izzo, Partner at Deloitte Consulting – Finance Transformation

– Vien Hoc Thong Loi, Partner at Deloitte Consulting – Digital Banking Leader

– Nicola Boscolo Berto, Manager at Deloitte Consulting

– Fabio Antonino De Maria, Manager at Deloitte Consulting

– Vincenzo Eugenio Corallo, Senior Consultant at Deloitte Consulting

– Niccolò Grossi, Analyst at Deloitte Consulting

– Irmici Pierpaolo, Analyst at Deloitte Consulting

– Davide Chiefa, Analyst at Deloitte Consulting

Bibliography

Schnabel. 2020. The ECB’s response to the COVID-19 pandemic. Frankfurt.

Furno, 2020. Emergenza COVID – Situazione Italia

Alesina, Giavazzi, 2020. The EU must support the member at the centre of the COVID-19 crisis

Baldwin, di Mauro, 2020. Mitigating the COVID Economic Crisis: Act Fast and Do Whatever It Take

[1] Source: John Hopkins University & Medicine: Coronavirus Resource Center (data as end of June)

[2] Source: World Health Organization

[3] Source: Francesco Furno, Emergenza COVID – Situazione Italia

[4] CDS conventional spreads have been retrieved from CMAI ICE Data Service. In addition, some Deloitte proprietary data processing has been performed.

Our motivation for focusing on sovereigns instead of corporates, lays on the country-level availability of contagion data. Nevertheless, a corporate based analysis might be the objective of future developments.

[5] The 5Y tenor is usually the mostly liquid pillar in credit curves.

[6] This holds true even if we precise that just risk neutral default probabilities can be bootstrapped from CDS spreads. These do not exactly match to those one might try to estimate from economic fundamentals. Risk neutral PDs are rather driven by no arbitrage market dynamics.

[7] In the period in analysis, the mean reversion phase for UK started later because daily new cases significantly increased later than the other countries.