An introduction of actual crisis

Current situation is something extraordinarily dramatic. On March 11 the World Health Organization declared COVID 19 a pandemic, it means an outbreak of a disease spreading across wide geographic areas of the whole world and affecting an exceptionally high proportion of the entire population. It was since 1968-69 that a similar event, at the time the “Hong-Kong Flu”, gripped a significant region; that time Asia and America, while we have to throwback to 1918-19 with the “Spanish Flu” to find the Europe as the ground-zero of the disease.

On the verge of completion from Phase 1 to Phase 2 transition which means a step-by-step re-opening, uncertainty is still raging. Economists are trying to understand what is going to happen on financial markets and real economy. Their effort is devoted to predicting, as far as possible, the recovery shape (V, W, U, L in terms of GDP) but difficulty is mainly dependent on how long coronavirus will affect business and every economic activity.

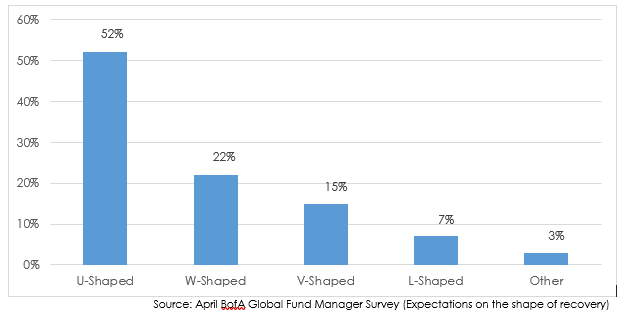

Bank of America’s April monthly global fund manager survey (Nagarajan, 2020) shows that 52% of fund managers believe the economic recovery from COVID-19 will be U-shaped (gradual recovery), 22% say W-shaped (double-dip recession), and only 15% say V-shaped (strong re-growth).

Even if we still have a long way to go through, following the optimism spreading in the system, the updated survey (Winck, 2020) as of May shows a reduced 10% who expect a V-shape recovery and a 75% who predict prolonged U- or W-shaped recoveries.

Within this context, a relevant role must be pursued by banks which are first in line in order to speed-up recovery.

In this article we want to provide some insights about what it is happening on the Corporate & Investment Banking sector, what banks will have to do in order to support their clients and what are the main challenges that they will face soon.

Corporate & Investment banking: impact and recovery

Economic uncertainty has risen significantly; market conditions are challenging for all stakeholders but, in recent weeks, a widespread optimism is observed over investors with global indices climbing at a fast pace after an initial collapse. Above all banks, which after 2008 downturn faced a strengthen of solidity measures imposed by Regulators (e.g. different liquidity and anticyclical buffer and continuously solvency tests through stress test exercises) appear to be quite correctly funded to provide liquidity to the system. Nevertheless, the dramatic speed of the COVID outbreak; estimated global GDP reduction, at its worst, were 5% – 7% while now, optimistically, is 25% (Lee, 2020) worldwide, has led to reassess every corporate, government and financial sponsor’s plan with a contingency perspective.

What is the current focus of all? The near term. The critical turning point to not fall into a stagnation is right now. Companies need capital, fresh liquidity to preserve financial stability in the short term until their income will cover, at least, 80% of pre coronavirus scenario.

Within this context, banks’ main concerns are related to:

- Liquidity

- Risk management

- Clients and portfolio management.

Demand for liquidity will be high and continuous considering that all companies are struggling to defend their positions. Even the bigger and wealthier ones will have to cope with unpaid debts by their clients or critical situation of their suppliers (e.g. Hertz bankruptcy declared on the 22th of May 2020) and banks, even if correctly funded, can’t survive long without other financial stakeholders. Moreover, some countries like Italy, are still in the middle of a recovery from previous 2008 downturn and non-performing loan cutting process which will unavoidably be slowed down.

Banks need to carefully manage their liquidity positions being able to offer maturity shifting (longer to shorter), bridge financing strictly related to current situation (e.g. long period reimbursement plan) and/or ad hoc financing plan related to business activities recovery. In addition, some non-repayable money is highly demanded and really make a difference for small/medium companies and retail clients. This kind of behavior are more and more highlighted also by Regulators with also official introduction of first Papers and Regulations on ESG (Environmental, Social and Governance) which tries to lay the foundation for more responsible conduct. The whole world has seen the environmental impact of the shut-down and pro bono donations made by financial institution have not gone silent. These kinds of behavior are becoming more and more relevant from now on.

Flip side, it has also to be noted that banks are not no-profit institution. Within this context and with a potentially relevant shifting from longer to shorter maturities, banks will also have to protect its own marginality so to sustain its role and correctly assess risks. A bank failure or a credit crunch from one of them now more than ever can have critical impact on the whole system. In a normal situation, banks should have no problem in granting a mortgage payment holiday but within this situation a complete reassessment of risk profiles must be carried out. A prolonged suspension/reduction of interests’ income can shrink banks’ liquidity at a moment where a lack of it is also increasing the cost of loans on interbank market.

Finally, it must to be noted that crisis is widespread, but it has not to be mistakenly conceived that banks can bear all liquidity effort or can act on the same level as Governments. Following the third point mentioned, own clients and portfolio management must be the priorities. Sustain client’s relationship by granting special conditions or postponements to them and transmit a positive and reliable image are today a key factor which can enable credit institutions to set-up basis for future growth. To manage clients and portfolio means to carefully advise over the best choice in terms of liquidity funding both through banks both through capital markets. Basically, it means to be a very accurate valuator on liquidity management and potentially sacrifice revenues in the short term for a greater income in the long one.

Conclusions

Just came out from a big dare as the 2008 downturn, banks are undergoing another and more sever challenge. Recovery nowadays requires not only time and bad loans management but a structural change to corporate and investment business approach.

Uncertainty over markets is gripping investors while companies are struggling to at least breakeven in a thinned market. It is time for banks to once again show their relevance and importance in the financial sector as a guide to focus on correct investments and to sustain difficult enterprises but with good fundamentals. To do so, financial institutions need to sacrifice in the short term their marginality and fees incoming in order to privilege reconstruction.

Banks have started waiving fees, increasing credit card limits and granting mortgage payment holidays as well as access to special accounts for ad hoc categories but, in a moment like this, the best action is to make clients feel that someone has their back.

In a wider consideration, this attitude is a sort of investments for the future as sustain recovery can strengthen relationship over territory and increase positive image consolidating and/or increasing potential clients

Finally, even considering the postponement of different regulatory activities (e.g. 2020 Stress Test), this momentum can be the occasion to put special focus on structural changes for too long relegated to the background such as digital innovation for clients’ engagement and management.

Bibliography

“Dizionario di Medicina” – Treccani, su treccani.it.

Shalini Nagarajan, “A Bank of America survey found 93% of global fund managers expect a 2020 recession”, Markets Insider, 2020

Ben Winck, “Only 10% of 223 fund managers surveyed by Bank of America expect a V-shaped economic recovery”, Markets Insider, 2020

Peter Lee, “Can banks withstand the impact of Covid-19?”, Euromoney, 2020

Walter David, Gourlay Alastair, McGrath Duncan and O’Brien Maria, “COVID-19: Finance and New Money Considerations for Australian Borrowers”, Baker Mckenzie, 2020

“Coronavirus: Considerations for Capital Markets”, Baker Mckenzie, 2020

Andreas Becker, “COVID-19 and Corporate Banking: Cash is King – but there is more…”, Strategy&, 2020