FinTech as an Essential Service

In these times of unprecedented pandemic led economic uncertainty, there is a sector almost as vital as the healthcare system, which is “silently” sustaining the global quarantined economy, FinTech.

As people and companies progressively shut their doors, governments around the globe assured that the financial services will be guaranteed. This means that financial services are accounted as “essential” services to maintain the global societal order, along with the energy, pharmaceutical and agro-industrial sectors. This should not come as a surprise, as banks around the globe will play a critical role as systemic stabilizers for their customers, their employees, and for their economies at large in the imminent economic fallout. Cash and deposit services, credit extension, payment facilitation, and market making are all essential services for the society to function, as we know it.

So in fact, the financial system has always sustained the global order during crises, but the nature of this sanitary crisis would have collapsed traditional banking and related services, heavily reliant on physical interaction.

On the other hand, FinTech companies are particularly well-suited to deal with the logistical challenges and health risks posed by the spread of the coronavirus because of the relatively large number of remote workers in the sector. After all, developers, consultants, project managers, and other employees of FinTech companies are very often located across different cities, or even different countries, occasionally meeting in person, but keeping most of their operations online. Therefore, depending on how a FinTech company is structured, this presents nowadays a tremendous advantage, both in the sense that services can be delivered as normal, and that employees face lower risks of infecting one another.

Notwithstanding the nature of the economic fallout, comparing the financial sector response in 2020 COVID-19 crisis with the CDOs and following sovereign debt crisis of 2008/2009, three major contextual differences can be identified when looking at financial institutions:

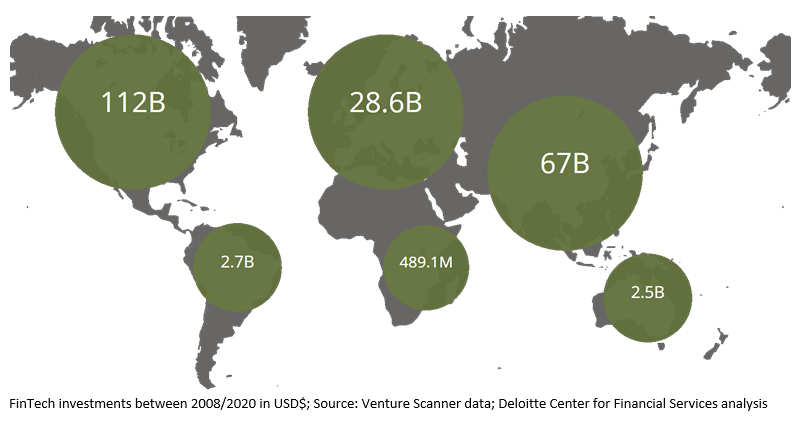

- More efficient banking infrastructure & technology: as per our report “The Next Phase of FinTech Revolution”, between 2008 and 2020 it has been invested a global aggregate of $ 213.3B in FinTech technologies, with an avg. annual investment of $ 17.8B, marked by an exponential growth specifically in the second half of the last decade. Another Deloitte report shows how this investment translated in an addition for the same period of 645 Fin-tech companies in Payment Services, 410 in Asset Management and 332 Insurance

Companies globally by the end of 2018.

- Capital solidity: stricter capital requirements for financial institutions following the 2008 crisis, along with intensified regulatory activity (e.g PSD II, MIFID II) left banks and the credit system less vulnerable to financial shockwaves. Consequently, also companies that experienced the credit crunch are now better capitalized and dispose of more credit services (e.g. crowdfunding, P2P, etc…).

- Geographic diversification: both users and companies have truly gone global in their reach and access to services in the past decade. The reduced exposure to national markets, as countries gradually resume normal activities, will redistribute demand and supply more quickly and effectively on the already existing international “essential” supply chains and related financial services, sustaining revenue. As reported by Bloomberg, the Chinese first two months of 2020 show exactly such phenomena. PRC’s exports contracted of -17.2% in dollar terms, and imports only by -4%, in January and February, with a trend inversion in recent weeks as the virus epicenter moved in Europe and North America. Now, as the latter economies shut down, China is re-increasing exports and further lowering imports, sustaining the affected countries supply chains.

FinTech is interconnected to all these three factors improvements and, whether by easing access to credit for SMEs or by digitalizing traditional bank service, it built an essential infrastructure that the whole economy is now relying on for daily operations, from online grocery shopping to large corporate invoice factoring services.

FSI with and without FinTech during crises: the Italian Case

The Italian economy offers the perfect ground to emphasize the role of FinTech in sustaining the country in COVID-19 times.

If we go back to 2008, it is easy to remember how the opening of a simple bank account in Italy (and most of Southern Europe) was a bureaucratic and time-consuming process that required a never-ending amount of documents and the deposit of a considerable sum. At the time, the most innovative FinTech company was PayPal with traditional banks providing few hard-to-access digital services. Huge entry barriers and the inability to access services or opportunities, due to the obsolescence of the financial services ecosystem, plagued the national economy recovery.

The credit crunch that afflicted SMEs in 2012 was particularly amplified by the impaired equity positions of lenders and the technological gap in the national financial services infrastructure. Due to this need, new FinTech corporate services started to appear not only in Italy (e.g. Credimi.it) but also at a European level. The European start-ups had to face a corporate market based on traditional banking, where trust for newcomers is not given easily.

Things have changed, seven years later at least 5% of Italian SMEs uses FinTech credit services regularly as the 2019 EU commission inquiry on SME’s access to credit reports, and this number is destined to rise in these upcoming months.

The incredible agility of FinTechs allowed for immediate crisis responses, which even if very modest in volumes compared to traditional banks, have a great significance and potential for future enhancements. Italian FinTech companies took concrete actions in support of their clients and communities; here are two examples:

- The corporate lender October.eu suspended capital repayments for a period of three months for more than 500 SMEs with active repayment schedules. This measure was initiated automatically and without any bureaucratic procedures by entrepreneurs. October will renounce the fees charged to SMEs throughout the period as a further sign of its efforts.

- The digital bank Hype offered its customers the possibility to make a donation directly from its app, using the “send money” function, to help the ASST Fatebenefratelli Sacco hospital, in Milan.

Of course, FinTech cannot sustain the economic downturns alone but it is the synergy of its new technologies with the traditional banking industry that is holding the economy nowadays, and will likely boost economic growth once the FinTech companies approach a stage of maturity and full scalability.

Future Outlook: the Black Swan as a blessing of progress

Hard times create strong men. Strong men create progress. It is notable to remember that the digital side of FinTech as we know it, raised from the ashes of the 2008 crisis. The systemic crisis highlighted the weak spots and quickly economic Darwinism took place. The systemic gaps quickly got filled with the FinTech start-ups that are now getting more and more integrated in the traditional system.

These hard times we are living in, will definitely create social distress and economic disruptions, but history teaches us that after every crisis, we have been able, as economies and people, to identify the weaknesses that brought us down to our knees and rise stronger than before by innovating and by stimulating change adoption. This time it will be no different, and it is already happening.

In the shops where cash was king, now digital payments and contactless cards are becoming the norm. “The less contact, the better” is what we hear everywhere, and that is also what governments and central banks are starting to think.

In a version of the US Congressional bill, containing $ 2T of exceptional stimuli to the economy, proposed last week by the House Financial Services Committee, there was evidence of a proposal for the creation of a system of digital dollar wallets maintained and operated by Federal Reserve System banks. The suggested purpose was to serve as the infrastructure for delivering stimulus payments to American consumers as they weather the economic storm triggered by the spread of COVID-19. Unfortunately, the proposal has been stripped away in the latest version from the House of Democrats, but the message is strong.

As Mario Draghi recalled before leaving his tenure at the helm of the ECB last October, the need to inject liquidity in times of low inflation or even worse during recession is vital for the survival of capitalism, as we know it. He recalled multiple times the “helicopter money” theory during the massive QE he initiated for a reason: the injected liquidity was not getting rapidly enough where it was most needed. The creation of digital currencies maintained by central banks is now looking more realistic than ever, and that is just a way of how FinTech is and will silently sustain our economic rebirth. As we explored along the article, FinTech is not only AI, RPA, digital payments or Blockchain, but also the technology that enables us nowadays to exchange value in circumstances never explored in human or modern history. COVID-19 crisis could also be defined as the biggest social experiment ever undertaken, it is a stress-test for the fabric of our societies and economies, and if we endure, it will not be only thanks to medical devices.

Authors:

Paolo Gianturco – Senior Partner at Deloitte Consulting S.r.l.

Marco Mione – Manager at Deloitte Consulting S.r.l.

Luca Cerruti – FinTech Team Analyst at Deloitte Consulting S.r.l.

Matteo Prencipe – Analyst at Deloitte Consulting S.r.l.