The Solvency II Directive (Article 77a) sets out the concept of the Ultimate Forward Rate (UFR) and requires a clear specification of the methodology used for its derivation: the determination must be transparent, prudent, objective and consistent over time in order to ensure the performance of scenario calculation by insurance undertakings. Just to recall it very briefly, the Risk Free Rate YC is extrapolated smoothly towards an UFR for maturities where the markets of the relevant financial instruments are no longer deep, liquid and transparent.

To develop the UFR methodology derivation, EIOPA followed a rigorous process that started in May 2015 and went on with a workshop with stakeholders in July; later on, a public consultation on a proposal for the methodology was conducted from April to July 2016 and EIOPA reported its progresses to the European Parliament’s Committee on the 31st August 2016.

Following the consultation exercise of the last year and the recent impact assessment (which resulted in UFR changes to be manageable in all national markets), the EIOPA board of Supervisors has unanimously agreed to make some changes to the UFR methodology in order to improve its stability over time. The new methodology has been communicated last 5 April 2017:

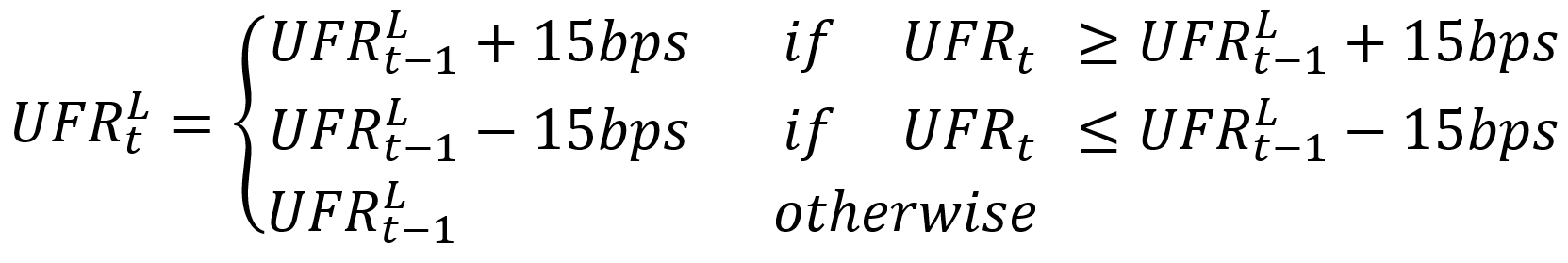

- the limit to annual changes of the UFR has been changed from 20 to 15 bps, to make the UFR changing more slowly

- the UFR will not change from one year to the other if the difference between the calculated UFR and the one currently in place is lower than 15 bps, to make the UFR change less often

- the expected real interest rate is derived as a simple average of past interest rates rather than a weighted average, to make the UFR more stable over time.

EIOPA is calculating the level of the UFR annually and the updated UFR is going to be announced every year by the end of March and used nine months later for 1 January Yield Curve

where L indicates the limitation of the annual change. The methodology ensures that the UFR moves gradually and in a predictable manner, allowing insurers to adjust to changes in the interest rate environment and ensuring policy holders’ protection.

The current value calculated for the EUR currency is UFRtL=3.65%, which means (if it stays the same in the next years)

- YE17: UFR = 4.20%

- YE18: UFR = 4.05% (=4.20% – 15bps)

- YE19: UFR = 3.90% (=4.05% – 15bps)

- YE20: UFR = 3.75% (=3.90% – 15bps)

The UFR before the limitation is the sum of an expected real rate and an expected inflation rate (for the EUR currency the values are 1.65% + 2.00%):

- the expected real rate is independent of the currency

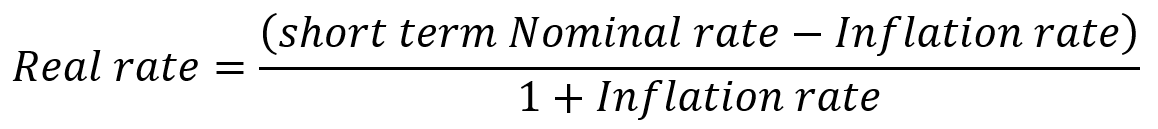

- it is calculated as the simple average of annual real rates from 1961 to the year before the calculation of the UFR

- for each of those years, the annual real rate is derived as the simple average of the annual rates of Belgium, Germany, France, Italy, the Netherlands, the UK and the USA

- each annual rate is calculated as

- the final expected real rate is rounded to full five bps

- the expected inflation rate is currency specific

- its value can be only equal to 1%, 2%, 3% or 4%

- intermediate values are rounded to the upper bound of the interval (e.g. 1.3% = 2%)

- the values are those announced by the central bank as inflation target; in case there was no target, but a wish to stay within a corridor, the midpoint of the corridors would be considered; in cases where there is not even a corridor, a value of 2% is adopted

Before changing the UFR value, EIOPA has carried out an information request to insurance and reinsurance undertakings on the impacts of the changes.

The exercise was performed at the end of 2016, with reference date 1 January 2016. Two scenarios have been analyzed with a decrease in the UFR of respectively 20 and 50 bps. On average, the SCR ratio decreases from 203% to 201% and 198%. 336 undertakings took part to the exercise, selected by the National Supervisory Authorities (NSAs) to cover the Technical Provisions (TP) of at least 75% of life insurance undertakings, 20% of non life (focusing on annuities and health insurances) and 20% of reinsurances. The German NSA has decided to include all life insurance undertakings and to exclude the others as not materially exposed. The major contributors to the exercise in terms of TP are: France (29%), Germany (18%), UK (16%), Italy (9%) and the Netherlands (6%).

A lower UFR modifies the risk free rate terms structure, producing (usually):

- an increase in the TP (increase in the Best Estimate and increase in the Risk Margin driven by a double effect: lower discounting effect and higher SCR), partly mitigated by an increase in deferred tax assets and a reduction in deferred tax liabilities

- a decrease in Eligible Own Funds (EOF)

- an increase in the SCR

- a decrease in the SCR ratio

The impacts on the TP vary a lot across the countries as they are strongly dependent on the LLP (for instance the Swedish krona insurance liabilities are all affected from maturities greater than 10y, while for the pound sterling the extrapolation starts only at year 50), for the same reason the impacts differ among lines of business, depending on their duration.

The markets more affected by a decrease in EOF are the Netherlands (-3%/-8%), Sweden (-1.5%/-3%), Austria (-1.1%/-3%) and Germany (-0.9%/-2%).

The highest average impact on the SCR has been reported by Germany, with an increase of the capital requirement of respectively 1.6% and 3.5% in the two scenarios.

The SCR ratio is quire resilient to the changes of the UFR in the first scenario (-20bps).