Fulfilling the duties required by article 9 of its founding regulation, last 18 January 2023 EIOPA published its annual (2022) Consumer Trends Report. The document aims at identifying the risks arising from trends in the insurance / pension market, that may require supervisory actions from the NCAs and EIOPA itself. This kind of monitoring is nowadays even more important, given the hope placed on the financial sector to improve the consumers’ financial health, currently damaged by disruptive events such as the pandemic, the Russian-Ukraine war, the increasing cost of energy and frequency in natural catastrophes. The report summarizes the results collected in a survey (“Eurobarometer”) carried out by EIOPA during 2022 on a representative sample of European consumers. The major outcomes are quoted in the following.

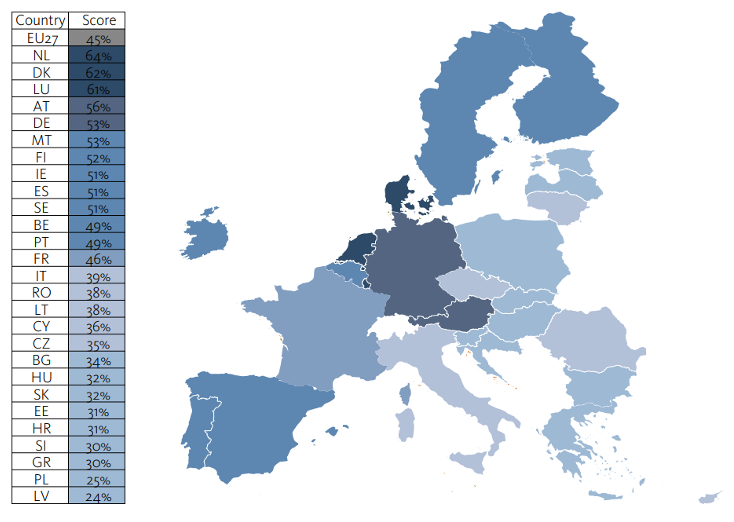

As a start, it’s worth recalling the meaning of “financial health”. According to the definition reported in the “Principles of Responsible Banking” developed by the United Nations Environment Programme (UNEP) and to the one given by the United Nations Secretary-General’s Special Advocate (UNSGSA), being “financially health” means being capable of smoothly meeting short terms needs, of absorbing financial shocks, of reaching future goals and feeling secure and in control of finances. When it comes to insurance and pensions, this imply having access to products that provide a sufficient coverage for financial and non-financial shocks (e.g. job loss or accidents), gain adequate returns and a secure income for retirement. The picture, sourced from the EIOPA Flash Consumers’ Eurobarometer 2022, provides the scattered European sentiment on how many people feel comfortable about their financial ability to live throughout retirement.

In addition to that, a considerable number of consumers consider themselves not to be able to face shocks either because they do not own an insurance product, or because those have limited or unclear coverages. To quote some figures:

- [job loss] only 6% of consumers own a private insurance with no specific limits; 41% rely on government support and 10% are not sure about the coverage;

- [accident] only 16% of consumers own a private health insurance with full coverage and an additional 10% are covered with high deductible, 17% are covered for just certain medical procedures and 11% are nor sure about the coverage.

Both high interest rates and high inflation have impacted the insurance business: the root of lapse rates increase can be found in the willing of seeking for more profitable instruments or in the immediate need of money to face the increased cost of living. The inflation has also damaged vulnerable groups in the sense that they are no longer able to keep up with the payment of regular premiums or contributions to voluntary pension schemes or cannot afford the needed insurance coverages. Furthermore, the inflation lowers the value of insurance coverages, especially when it comes to pension schemes (benefits do not really increase in a proportionate way) and home insurances (higher costs of construction materials in case of damage compared to a fixed insurance capital). Lastly, a gender gap emerged as a key trend, with female having lower access to insurance and pensions products: 56% of women (vs 46% men) are not confident to have enough money after the retirement.

A positive note comes from the financial innovation, that appears to facilitate the delivery of products and services, lower the distribution costs, improve the pricing practices and fasten the claims settlements. The increased trend observed in the usage of data-driven business models raises though some challenges, like the unfair discrimination of certain categories, charged with higher premiums (10% of the people interviewed said they have terminated their insurance contracts because of an unjustified increase in the premium) or data privacy concerns and cyber risk. Digitalisation and technology are also helping the pension system, with a witnessed increased engagement of members with their pensions and greater interest shown by younger generations, which ensures they will save more for retirement. The other side of the coin poses a risk in the potential exclusion of less tech members. Another positive note comes from the increased number of financial education programs that have been put in place in several Member States and that many NCAs and providers continue to invest in with the aim of improving consumers’ financial literacy and, in turn, their financial health.

Together with the disruptive events already recalled at the top of the article, in recent years, the transition towards a more sustainable economy has been under the light and the consumers’ appetite for sustainability-related investments has grown. To meet the increased demand, the insurance companies have adapted their products by promoting environmental or social characteristics or by offering sustainable investments. But as often happens, together with the good it comes the bad: misleading and unsubstantiated claims have led to evidence of greenwashing, that are being tackled by the supervisor activity since August 2020 thanks to the new sustainability-related requirements under the Insurance Distribution Directive (IDD34).

As said, a hope is placed on the financial sector to improve the consumers’ financial health: indeed, when designed to offer value and sold to meet the consumers’ needs, insurance products can provide important benefits. On this note, it’s worth recalling that in 2021 the total life insurance GWP increased by 14% across the EEA, albeit mostly driven by index and unit-link products (+35%), that shift the financial risk from the industry to the policyholders. To ensure a consumer-centric product design, the POG (Product Oversight and Governance) requirements were put in place back in 2018, with considerable improvements observed by the NCAs; however, concerns around the value for money and mis-selling of unit-linked products persist in terms of costs, complexity, target market, poor advice and conflict of interests. To address this, last 31st October 2022, EIOPA published a methodology to assess the value for money of unit linked and hybrid (multi-class) products, followed by many NCAs initiatives.

Lastly, it is important to comment on the insurance protection gap, observed across various lines of business and describable as the total uninsured losses. It is indeed usually expressed as the ratio between the uninsured losses and total losses, to provide an idea of the share of coverage. To quote some figures:

- [natural catastrophe] on average, half of consumers are not covered (with important differences across the Member States, partially explained by the compulsoriness of the insurance in some of them) and 22% of them are unsure about the coverage in their policies;

- [loss of income and urgent medical expenses] most of consumers (41%, 37%) rely on the state, as highlighted by the pandemic, during which the EU governments had to take unprecedented measures to cover the loss of income for workers and expenses for people hospitalisations.

The reason behind the formation and widening of the insurance protection gap is twofold: on the demand side, it stems from the non-affordability caused by the general increase in prices, together with the consumers’ awareness (unclear conditions, complex documentation, numerous exclusions); on the supply side, the insurers consider some risks too difficult to be insured and with low commercial appetite.

References:

[1] EIOPA, Consumers trends report 2022, 18 January 2023

[2] Silvia D.A., EIOPA and UL value for money, 20 November 2022