Last 17th December 2020 EIOPA published its opinion regarding the review of the SII directive. It will now be reviewed by the European Commission, who is finalizing its proposal by 21Q3. The proposal will be then then discussed and drafted into a low by the European Parliament.

The review process started last February 2019, with the European Commission calling EIOPA for an advice and the latter publishing a number of public consultations, including a complementary information request to consider the effects of the COVID-19 pandemic (see https://www.finriskalert.it/2020-review-of-sii-a-cura-di-silvia-dellacqua/ and https://www.finriskalert.it/european-commission-and-sii-review-a-cura-di-silvia-dellacqia/).

The SII review is focused on adapting the current regulation to the new economic context (especially the persistence of low interest rates), with the ultimate goal of ensuring a better protection to the policyholders, without penalizing too much the insurance industry. The main areas EIOPA puts under the spotlight are:

- LTG measures and equity risk (RF extrapolation, VA, RM and LTE)

- SCR (Interest Rate Risk)

- Reporting and disclosure

- Proportionality

- Macroprudential policy

- Recovery and resolution

- Insurance guarantee schemes

- Long-Term Guarantee (LTG) measures and equity risk

The SII directive should consider that liquid interest rates exceed the Last Liquid Point (LLP), currently set to 20 years for the EUR currency. From this point, the Smith-Wilson (SW) extrapolation starts, driving the forward rates towards a defined target value (UFR – Ultimate Forward Rate, set to 3.75% for EUR in 2020) within a certain convergence period (40 years for EUR).

In the previous consultation, EIOPA suggested to take the market information into account by choosing a later LLP (e.g. 30 or 50y for EUR) or by considering a different extrapolation method, with an expected severe increase in both TP and SCR, particularly for firms characterized by long duration businesses.

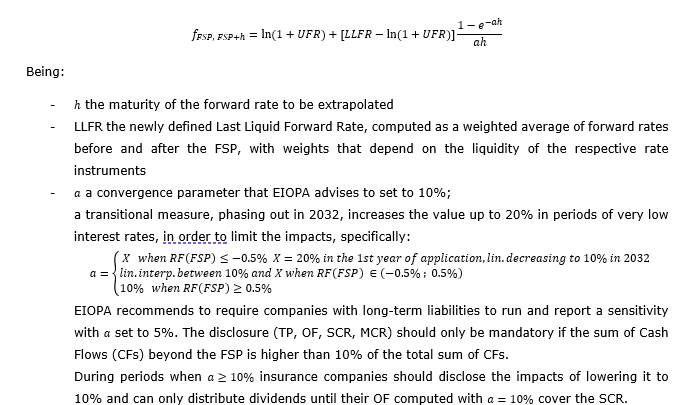

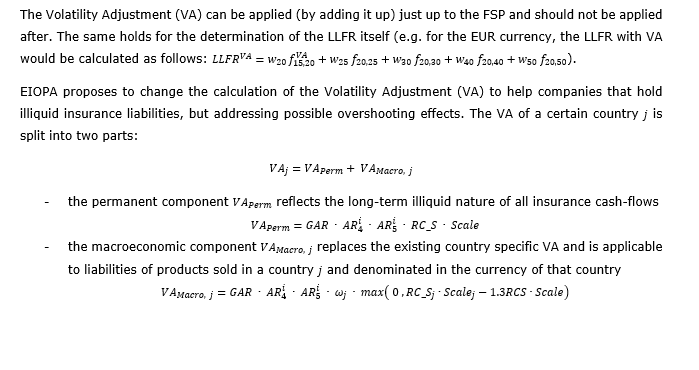

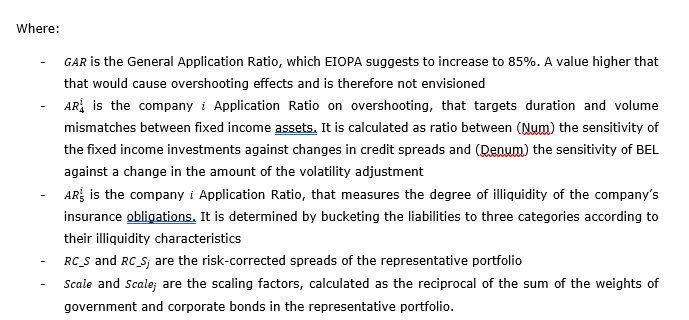

This time, EIOPA suggests to abandon both the LLP and SW technique in favour of an extrapolation to the UFR that starts from the First Smoothing Point (FSP). Between these two values, forward rates are defined as follows:

EIOPA suggests to forbid the use of dynamic volatility adjustment in the SCR standard formula and also suggests to increase the prudency principle for internal models applying it.

Unexpectedly, EIOPA proposes changes to the Risk Margin (RM) too. The industry has criticized this metric because it is too sensitive to changes in the interest rates (and, therefore, to changes in their extrapolation) and it appears in general to be too large. The proposed new design reduces both the size and volatility of the RM, by multiplying future SCRs by a floored exponentially decreasing factor.

Finally, EIOPA advises that insurance companies with illiquid obligation should be able to classify more equity as LTE (Long Term Equity), benefiting of the low capital charge (22%, almost half of the normal equity holdings) associated to this asset class, introduced back in 2019 with the purpose of helping the sector, but with too stringent criteria to satisfy.

- Solvency capital requirements (SCR)

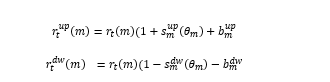

EIOPA confirms its previous advice dated 2018 (relative shift approach), highlighting the need of modifying the IR risk calibration into a relative shift approach; EIOPA believes that the current design does not properly reflect the steep fall of interest rates into negative values. The proposed calibration works as follows:

The shocked interest rates in the downward scenario are floored to a minimum of -1.25%. This new calibration is expected to take a significant toll on the SII position of the companies, therefore EIOPA proposes to phase it in over a 5 years period. The proposals is a view of EIOPA and may not be adopted, as the European Commission will balance technical considerations to political ones. EIOPA has reiterated the advice of introducing negative interest rates in the SF SCR calculation in a number of Consultation Papers (first one dated 2018), at that time rejected by the EC.

- Reporting and disclosure

EIOPA stresses the need of changing the Solvency and Financial Condition Report (SFCR) to improve its outreach. The report will be split into two parts: the first addressed to policyholders with a high-level content, while the latter addressed to a professional audience. Furthermore, the SFCR will be subject to a mandatory audit review.

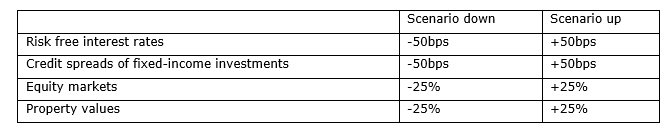

Another proposal concerns the standardisation of the sensitivities on OF, SCR and SR:

In addition to that, companies may include other sensitivities when considered suitable to assess their own risk profile.

- Proportionality

EIOPA wants to increase and standardize the level of proportionality across the three pillars of Solvency II. Companies that are eligible for proportionality measures, by passing objective criteria, have access to simplified methodologies for calculating their capital requirements.

- Macroprudential policy

EIOPA advises to expand the Solvency II perimeter to include a macroprudential perspective: EIOPA and the NSA (National Supervisor Authorities) should be provided with the power to impose capital charges for systemic risk, to suspend shareholder dividend payments, to include macroprudential concerns in the ORSA, to impose concentration limits. In exceptional circumstances the supervisory authorities would even have the power to impose a temporary freeze on the policyholders’ redemption rights.

- Recovery and resolution

EIOPA advises to integrate Solvency II with an EU-wide recovery and resolution framework for insurers and reinsurers. A relevant share of undertakings (chosen by size, cross-border activity, business model and risk profile) should be required to develop and maintain recovery plans as preventive measure. The occurrence of specific judgment-based conditions would trigger preventive measures such as more intensive dialogue and reporting and limits on variable remuneration and bonuses; further conditions (such as non-compliance with the SCR) would trigger the entry into the recovery and resolution phase, where more measures would be available to the supervisors, up to taking control of the undertaking.

- Insurance guarantee schemes

EIOPA proposes to introduce a European network of insurance guarantee schemes, with a common minimum set of coverages, funded by all insurance undertaking. The insurance guarantee schemes are meant to protect policyholders either with a monetary compensation or by ensuring the continuation of their policy in case the insurance company becomes insolvent.