Last 26th January EIOPA published a methodological paper on the liquidity stress testing for insurances, describing the principles to follow for a good appraisal of the resilience of insurances to liquidity shocks and providing a conceptual approach to measure the liquidity position under adverse scenarios. Indeed, despite the increased interest the NSAs (National Supervisor Authorities) have given to the liquidity risk, a common approach is still missing.

With this paper, EIOPA perseveres with its effort of improving the stress-testing framework, started back in July 2019 and materialized in June 2020, with a consultation paper covering three topics:

- stress test framework on climate change, to assess the vulnerabilities to climate-related risks

- potential approaches to multi-period stress testing (i.e. the scenario is not set at one point in time but rather as a path of macroeconomic and insurance-specific variables changing over time).

- approach to liquidity stress testing

Let us discuss the main contents of the 26th January paper, named “Methodological principles of Insurance Stress-testing – liquidity component”.

Objective and scope

The stress testing should have both a micro and macro view, by assessing individual undertakings and by keeping under control the resilience of the entire industry, to avoid a potential spill over to the rest of the economy. The stress test shall be run where the liquidity risk is actually managed, being this the parent company or the local entity.

Definition of Liquidity risk

The liquidity risk describe a situation where an insurance company does not have enough money to pay out the claims. Currently, under the SII framework, the liquidity position is not subject to any quantitative requirement, although even solvent companies can face this risk, being it dependent on the characteristics of assets and liabilities rather than on their size. The liquidity risk for insurance companies has been so far consider of secondary importance, because of the inverted production cycle of the business: the inflow of premiums precedes the outflows of claims, providing a stable source of funding. Nevertheless, specific events can cause unexpected cash outflows that need to be covered.

The banking system considers the liquidity of assets through a haircut on their value: the higher the haircut, the lower the possibility to sell it during a crisis with no or little loss; the time horizon is a key element in determining the haircuts. Cash is considered to be the most liquid asset, with 0% haircut, while, at the opposite side, stand the investment on real estate, even when they cover a short time period.

The liquidity of liabilities is described by the uncertainty around the timing of the payments: the more predictable the cash outflows, the more illiquid the liabilities. In the banking system, this is driven by the volatility of the withdrawals from the deposits; while in the insurance sector, it depends on many factors, including products features, surrender penalties and dynamic policyholder behaviours.

Sources of liquidity risk

On the Asset side we can list

- stressed market conditions, where monetizing the investments can become impossible or, when feasible, can cause losses

- the usage of derivatives to hedge financial risks, with unexpected big pay outs due to the margin calls

On the Liability side we can list

- pandemics and natural catastrophes, with sudden and simultaneous claims, larger than expected

- the evolution of legislation, that may change the characteristics of products (e.g. no more tunnels allowed for lapsing the contract)

- the policyholder behaviour, with a mass lapse event or no more premiums paid

- a large increase in interest rate, followed by a mass lapse event.

Measure of liquidity risk

Two perspectives are considered, complementing each other with their pros and cons: the stock-based approach is simpler (for both companies to calculate and regulators to validate), building on existing SII reporting, while the CFs approach provides a more granular view.

Stock-based approach

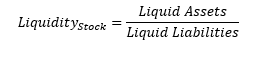

The Liquidity Stock indicator is defined as a ratio between sources (liquids assets) and needs (liquid liabilities), where original assets and liabilities are changed to consider their liquidity

The Liquid Assets are obtained through the application of the haircuts mentioned above, while Liquid Liabilities can be obtained following two alternative methods:

- Similarly to the Assets, Liabilities can be split into buckets with specifics haircuts, depending on the type of product (biometric risk policies are less liquid than saving policies), the surrender penalties structure (policies with no penalties are the most liquid) and, as an Author opinion, on the effect the policyholder behaviour may have (stability of yields provided by the segregated fund, goal of the investment – e.g. pension and class V products do not suffer this risk)

- The liquidity of the liabilities (a percentage spanning the range 0-100%) can be described by the change experienced in the BEL and CFs when moving from the baseline to a relevant SCR stress (e.g. mortality, lapse up/mass).

Cashflow-based approach

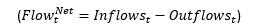

Projected liquidity sources (premiums, sales of assets, investment coupons and dividends, reinsurance inflows) and needs (claims, purchase of assets, margin calls, operational expenses, reinsurance outflows) are compared on a given time horizon to determine to what extent outflows are covered by inflows. The CFs should come from real world projections. A CFs indicator can be defined either as a net flow value

or as a ratio between the two.

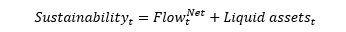

Stock and flow perspectives can be combined into an integrated indicator of “Sustainability of the flow position”:

In case of negative net flows, the indicator assesses whether Liquid assets are sufficient to cover the outflows.

In case of negative net flows, the indicator assesses whether Liquid assets are sufficient to cover the outflows.