No free lunch. A catchphrase to express that it is impossible to get something for nothing, or, in other words, that the investors are not able to make large profits without bearing the risk of a potential loss.

Partial information surrounded by loose comments may be deceiving and together with trust and lack of time, can influence people in taking decisions without really knowing all the implications. This article provides a practical example of how this can happen.

I was holding my smartphone and when opening the browser some news popped up (politics, science, music, …): one captured my attention – the launch of a very promising financial product. The article (http://www.websimaction.it/?p=19416) reports:

- for the investor looking for home court advantages, with a low risk product

- if none of the three underlying will lose more than 50% in the next five years, the investment will end with a yearly return of 8.4%

- the three underlying are Italian firms: two protagonists of the Italian history with great possibilities of performing well, and the other with earnings doubled in the last five years.

These biased news are accompanied by optimistic comments on the Italian politics (no longer under the microscope of the markets), on the BTP spreads (lower than in the past) and on the good economic conditions and GDP estimate. Few other information regarding the real structure of the payments (coupons and notional) are reported only at the end of a quite long text, lacking important details.

A distracted reader would conclude that this is an opportunity not to lose. But how does this instrument work in truth?

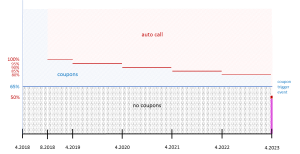

The investment was issued last March 2018 at 1000€ (notional), with maturity set at April 2023; the contract can end before (auto-call event), subject to a certain rule that varies over time; the coupons payments are conditioned to another rule (coupon trigger event). The following chart shows the possible outcomes as different portions of the space. The x-axis reports the time passing and the y-axis indicates different level of the worst underlying compared to its initial value (please note that as the rules are defined on conditions concerning all the three underlying simultaneously, the trigger conditions are activated by the worse one, that can change over time)

- coupons: every month the prices of the underlying are compared to their threshold (65% of the prices at the issue date): if all the prices are higher than their thresholds, a coupon of 7,25€ (i.e. 8.7% annual yield) is paid; otherwise the contract goes on till the next “monitoring date” (once a month). The unpaid coupons can still be cashed in the first monitoring data when all the prices are higher than their thresholds, till the contract is in place (i.e. not auto-called)

- notional:

- [April 2018; August 2018] in the first semester, the auto call option is not in place;

- [September 2018; March 2019] if all the prices are higher than the prices at the issue date (auto-call level of 100%), the notional is paid back and the contract ends;

- [April 2019; April 2022] the auto-call level is regularly updated every 12 months, defined as a decreasing percentage of the price at the issue date (95%, 90%, 85%, 80% till March 2023);

- at maturity (April 2023, last monitoring date), the notional is either totally reimbursed (when all the prices of all the three underlying are higher than 50% of their values at the issue date) or partially reimbursed, with a quota corresponding to that of the worst performing underlying (i.e. <50%).

This is not exactly what one would expect given the very promising description reported above. This structure indeed implies two outcomes that may not have been that clear:

- [auto-call event] if the three assets do not lose value in the first semester, the extraordinary yield of 8.7% is paid for 6 months only then and the contract ends (maybe the investor wanted to invest its money for a 5-years horizon). In general, the probability of auto-call (red area) increases over time, reducing the probability of the coupons to be paid (blue area);

- [reduced notional / lost coupons] if at least one of the three assets performs bad at all the monitoring dates, showing a price lower than 65% of its initial value, no coupons are paid in the next five years and, at maturity, there are three possible scenarios:

- price >65%: missed coupons refunded, notional entirely paid;

- 50% < price <=65%: missed coupons lost, notional entirely paid;

- price <= 50%: missed coupons lost, notional reduced.

Differently from what commented by the author of the article I happened to read, this does not seem a riskless product (although the definition of “risk” is subjective): the historical prices and correlations of the three underlying imply a probability of receiving a notional more than halved of around 27%; it is also worth recalling that the probability of an event (>50%) to happen simultaneously to all the three underlying is significantly lower than the probability of the same event to happen to any of the underlying: it’s the intersection of the Euler-Venn diagram. The next chart shows how the values of the three underlying have been changing over 26 months preceding the issue date and an illustration of the Eulero-Venn diagram, where the areas do not correspond to the real probabilities (i.e. given an area of the rectangle, Universe set, equal 100%, the area of the intersection of the three sets does not indicate the true probability of the event)

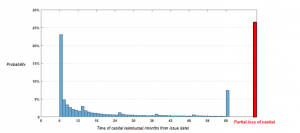

Based on the historical volatilities of the log-returns of the prices of the three underlying and their historical correlation, I’ve run a simulation to quantify the probability of the notional to be paid back at different monitoring dates (auto call events) and at maturity:

- during the first 6 months, the probability is 0, as there is no auto-call event in place

- at T=6, the probability rockets to 23%

- the probability then decreases over time, showing local peaks in correspondence of the auto-call level resetting (the cumulated probability of the contract to end within a year is around 39%)

- the probability of the contract to last till the original maturity (T=60) is 34%, of which 7% corresponds to the case where the notional is entirely paid back and 27% corresponds to the event that the notional is just partially reimbursed (red bar).

This analysis also provides an estimate of the expected coupon the investors are going to receiving on average: the expected yearly rate is high (6.97% out of the maximum advertised of 8.70%), but is expected to be paid for a limited period (until the auto-call event). It is important to bear in mind that all the “missed” coupons are refunded the first time that the coupon trigger event is actioned.

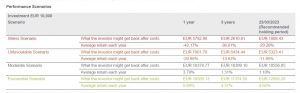

As commented above, the definition of risk is subjective and not straightforward. To help investors is assessing the risk, the costs and the expected performance of different investment products (PRIIPs[1]), a new Key Information Document was introduced since January 2018. The KID of this product shows the following:

- the Risk Indicator is 5 out of 7, i.e. “medium-high risk”

- the average annual return at the Recommend Holding Period (5 years) is 4.92% in the favorable scenario, 1.10% in the moderate scenario and -11.95% in the unfavorable scenario (these values have been probably calculated as an average return on a five years horizon, when the contract is likely to auto-call much before)

References

[1] Dall’Acqua Silvia, KIDs for PRIIPs ESAs, https://www.finriskalert.it/?p=4275