Il Comitato di Basilea ha emesso il documento di indirizzo “Guidance on credit risk and accounting for expected credit losses“. Il documento, composto da 11 principi, delinea l’orientamento del Comitato circa l’implementazione e l’applicazione di un quadro contabile adeguato per il calcolo della perdita attesa su crediti (ECL). Il nuovo documento sostituisce quello rilasciato nel 2006 (“Sound credit risk assessment and valuation for loans“).

L’IVASS ha posto in consultazione lo schema di Regolamento 26/2015 contenente disposizioni in materia di investimenti e attivi a copertura delle riserve tecniche. Con tale Regolamento si intende dare implementazione nazionale alle linee guida EIOPA in tema di Governance ai sensi della nuova disciplina Solvency II.

La consultazione andrà avanti fino al 15 febbraio 2016.

I requisiti tecnici pubblicati forniscono alle autorità competenti una metodologia di valutazione delle passività da derivati in caso di risoluzione. In particolare l’intervento dell’EBA è rivolto a garantire che la nuova disciplina del bail-in possa essere efficacemente estesa anche a questa tipologia di passività.

Il Comitato di Basilea ha rilasciato un documento di consultazione riguardante il cosiddetto rischio di step-in, cioè il rischio che una banca intervenga a supporto di altre entità che versano in difficoltà finanziaria senza, o al di fuori, di obblighi contrattuali precostituiti. L’approccio proposto nel documento introduce un framework per l’identificazione e la valutazione di tale rischio, potenzialmente riscontrabile soprattutto nelle relazioni tra banche e soggetti del sistema bancario ombra.

La consultazione avrà termine il 17 marzo 2016.

L’EBA ha pubblicato le Linee guida riguardanti i limiti alle esposizioni nei confronti di entità che ricadono nel perimetro del cosiddetto sistema bancario ombra.

In particolare, le Linee guida introducono un approccio per gestire in modo proporzionale i rischi che tali esposizioni possono creare per il settore bancario europeo.

Il Consiglio europeo ha emanato una Direttiva contenente nuove norme in materia di distribuzione di prodotti assicurativi tese ad aumentare la protezione dei consumatori. La nuova Direttiva mira ad incrementare il livello di integrazione del mercato assicurativo e a stabilire le condizioni per un’equa concorrenza tra gli attori coinvolti.

Gli Stati membri hanno 2 anni di tempo per tradurre la Direttiva in leggi e regolamenti interni.

L’Autorità bancaria europea, EBA, ha lanciato una consultazione sulla metodologia che le autorità competenti devono applicare per valutare la conformità di un’istituzione ai requisitiper l’utilizzo dei modelli interni per il rischio di mercato.

In particolare, il documento individua alcuni criteri oggettivi per la valutazione delle posizioni incluse nell’ambito di applicazione dei modelli interni per il rischio di mercato.

La consultazione andrà avanti fino al 13 marzo 2016.

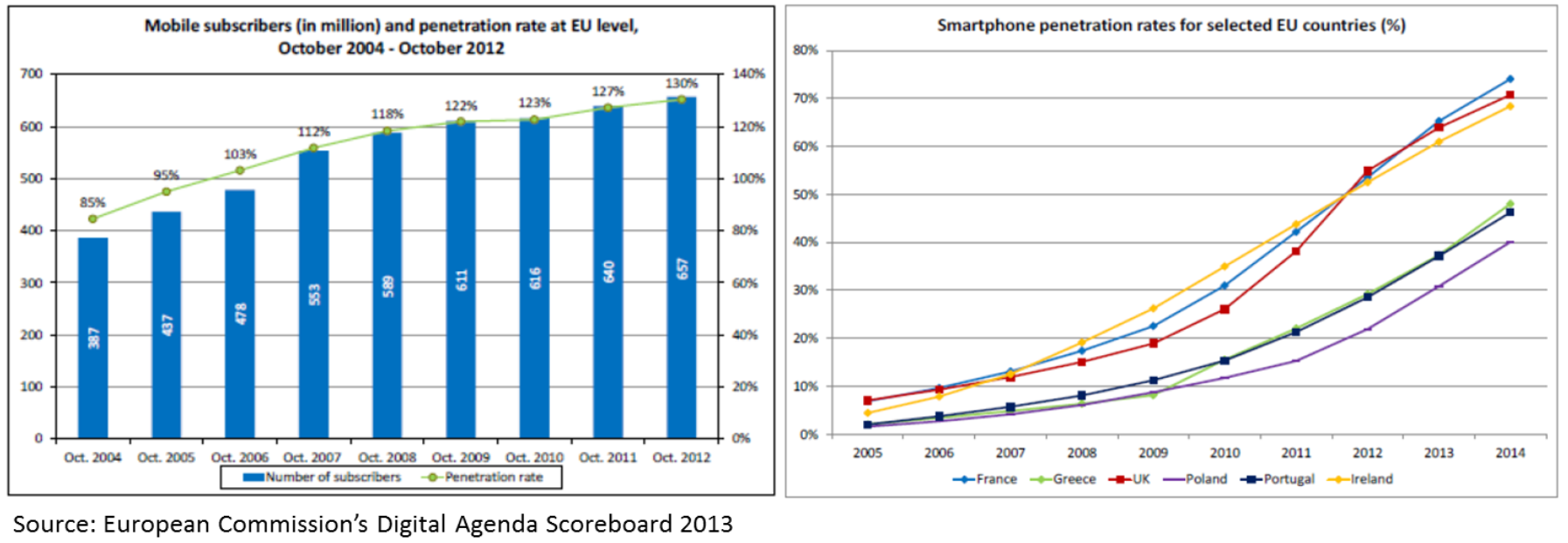

The mobile phone market has developed a lot in the last ten years across Europe: the penetration of mobile phones has increased significantly (since 2006 the subscriptions of SIM cards is higher than the number of inhabitants!) and the devices have experienced an increase in their price and values. As a result, the customers has begun to seeking for a coverage for their mobile devices and in response to that need the Mobile Phone Insurance (MPI) market has started to grow; MPI are insurance products that cover some kind of damages of mobile phones, like loss, theft or physical damages. Obviously, the MPI market goes hand in hand with the smart phone market, that is more pronounced in some EU countries.

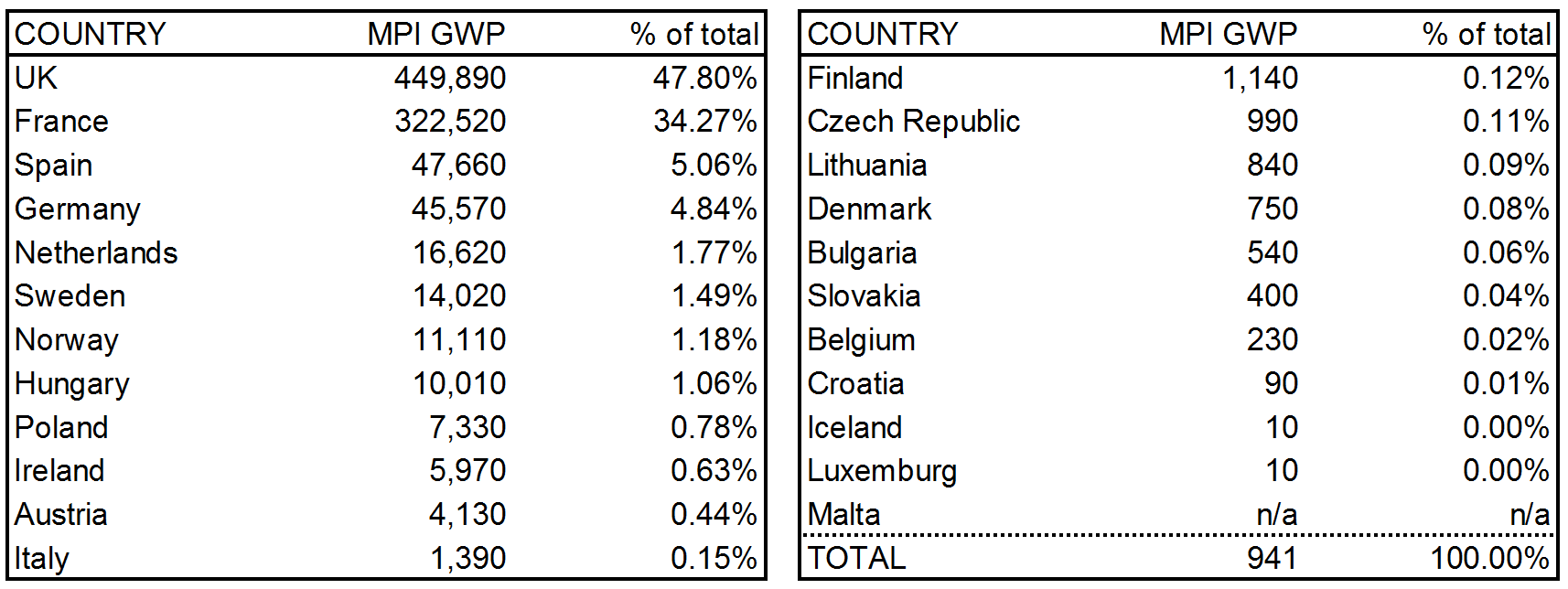

As it is reasonable to expect the MPI market to grow, EIOPA decided to conduct an EU-wide survey of this sector among its Member authorities to map the gap between what undertakings offer and what customers believe to have purchased. The summary report published on the 12th of November 2015 is based on data provided by 50 insurance undertaking and active MPI sector in 2013 of 23 countries. Covering over 80% of all sales in EU, UK and France are the largest MPI markets.

At that year, 2013, the sale of MPI insurance products through mobile operators or electronic stores was regulated at national level or in general EU legislations, but was not covered by the Directive 2002/92/EC on Insurance Mediation (IMD). As it is necessary to intervene with regulations and supervisions to prevent the customers detriment, the forthcoming IDD, expected in January 2016, will include some relevant provisions affecting the distribution of MPI products and the Member States are required to ensure their application within 2 years after the publication of the Directive. Among the most relevant provisions:

- prior the conclusion of the contract a needs and demands analysis has to be undertaken and customers have to be provided with a Product Information Document that explain in a transparent and user-friendly way not misleading information about the characteristics of the MPI product

- in case of cross-selling practice, the customer must be offered the possibility to buy both items separately; in case of package banks accounts separate information on costs and fees of each product/service must be communicated

- the remuneration policies of selling entities shall not conflict with the interest of customers and a complaints-handling procedure must be in place.

The survey suggests that MPI products are relatively standardized and very often (60%) the undertakings offer just one type of product. Among the other major evidences:

- duration: the most frequent (>55%) is 1y, in line with the usual boundaries of the mobile phone contracts. The short duration is driven by rapidity of the good to lose value (intensive daily use + constant innovation). Anyway, 34% of the cases show longer durations, up to 5 years, useless for the customer. Customers shall also be careful with the indication of the premium (a monthly one can be misleading) and if an automatic renewal is present

- type: half of the MPI policies are occurrence-based. This serves to prevent the temptation of using the insurance coverage to improve the quality of the mobile phone (usually the indemnity is a new mobile phone, maybe from the newest generation). However, 38% of the policies are claims based, so the coverage lasts until the premiums are paid

- coverage: policies commonly cover eventualities that are not already covered by the guarantee of the mobile device and are therefore known as “extended warranties”; the most common are “damage to the mobile phone”, “theft” and “loss”, but there are others like “abuse of the mobile phone after loss” and “loss of data in mobile phone”

- exclusions: differently from what customers are often incline to believe, there are a number of exclusions in the coverage: more than 50% of the products have theft-related exclusions and 32% of products have loss-related exclusions. These exclusions are sometimes misleading or not understood, e.g.

- UK: the majority of products do not cover instances where the customer accidentally leaves the mobile phone unattended in a public space

- Spain: customers are asked to provide as a proof of theft a report from the police within too short deadlines (this is not compliant with the Local legislation)

- France: the loss in case of negligence is not covered, but the word “negligence” is not defined

- sales channels: the largest one is composed of mobile phone operators and retailers, but also banking institutions play an important role. Particularly for the UK, it’s worth mentioning the package bank accounts that charge a monthly or annual fee in exchange of a series of benefits like MPI or travel insurances. The cross selling is another interesting phenomena as it can improve the quality of the products and increase the differentiation on one hand, but on the other it can lead to a lack of effective competition in the market as customers are more focused on the primary product rather than the in the add-on coverage (customers may also not be aware of buying an insurance)

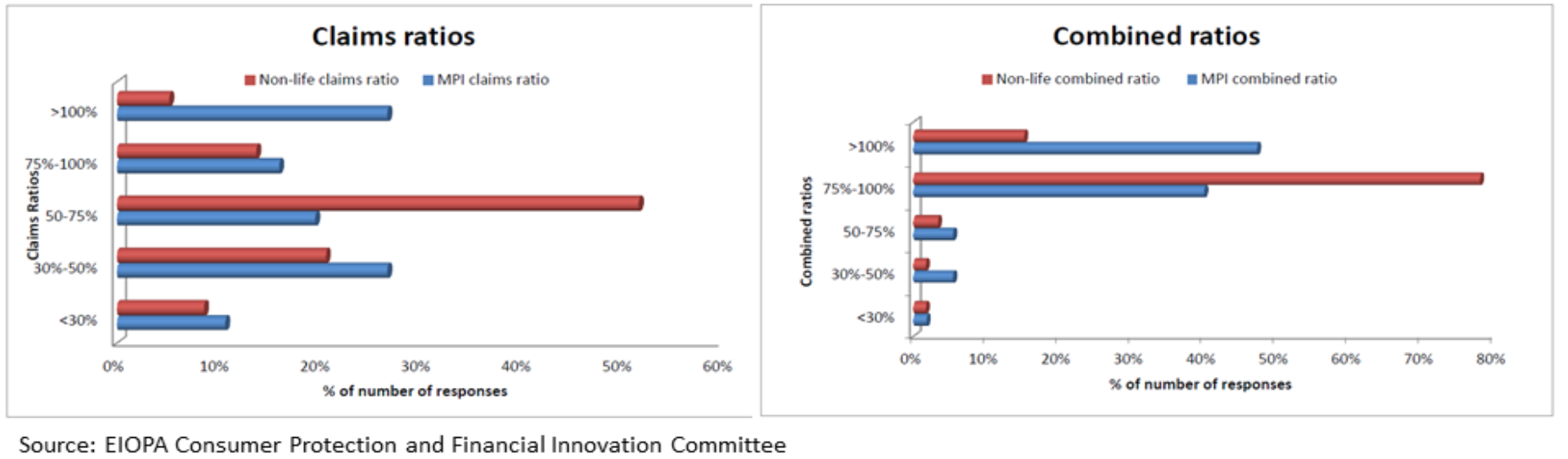

- profitability: compared to non life insurances of similar values, the claim ratios (claims payable / premium income) and combined ratios (sum of incurred losses and expenses / earned premium) of MPI products highlight that these types of insurances are often not profitable (in the 27% of cases the premia are not sufficient to cover the claims) with higher expenses. Intuitively, this is expected for a business at its early stage as the products have to bear starting costs that will be amortized in the future and on a larger scale, anyway it’s worth noticing that the average commission paid by the undertaking to the sales channels is extremely high (40% of the premium) and premia are usually small and this can turn out in aggressive selling practices. From the customer perspective, it’s important to analyze situations with very small claim ratio as this is symptomatic of misleading exclusions

- complaints: the majority (62%) are related to the administration of claims, followed by mis-selling (9%) and excessive exclusions (3%); unfortunately the complaints have not played an important role in the design of MPI products.

Executive Summary: This is the second part of the discussion of the recent BCBS paper no.325 concerning a deep review to the CVA capital charge, that was introduced with the CRR (Basel 3) regulation. This revision aims to improve the CVA calculation with respect to the forthcoming fundamental review of trading book (FRTB), and to have a more risk sensitive approach for the standard approach. Nevertheless, we believe that in this first formulation some points are not well clarified or solved. In this part we analyze some drawbacks of the suggested new set up.

1 The CVA current review. Purposes and Contents

In July 2015 the Basel Committee issued the consultative paper 325, see [1], concerning the revision of the credit value adjustment.

The main purposes can be summarized as follows:

- To capture all the risk factors in the CVA capital charge. The most relevant point here is to take in to account also the market risk factors that can affect the future value of the exposure. This is also due to the practices in the market, where also the CVA hedging deals are sensitive to these market factors

- To be compliant with the accounting principles. More specifically, the future exposure should be calculated with a market implied calibration of the parameters (i.e. underlying volatility) with a risk neutral approach. This is a strong new perspective, as currently in the CCR framework for the EAD estimation in the internal models the market calibration is not required.

- Alignment of the CVA to the new market risk framework. We refer mainly to the use of sensitivities, risk factors taxonomy and so on.

- A more risk sensitive approach for the non internal calculations.

A 3-types hierarchy of possible approaches was stated in this draft version of the paper, namely:

- FRTB-CVA framework, that splits in:

- IMA-CVA = Internal model approach

- SA-CVA = Standardized approach

- Basic CVA framework

The last approach is eligible for the banks that are not able to match the FRTB requirements or have not enough resources to implement such a project.

2 The new framework critical points. Part II

We contributed to the first consultative session, see [2]. In this section we highlight a more specific set of issues that in our opinion are not solved in a satisfactory way.

2.1 Specific calculation methodology

The paper seems to propose specific calculation methodologies for sensitivities (see par. 41 and 42 in [1]). Actually, more sophisticated methods to compute sensitivities, other than the brute force approach proposed, are available in theory and they have also been implemented in practice by some banks (e.g.: adjoints and automatic differentiation). Simple bumping the risk factors may not be the most effective way to compute sensitivities. See [4].

We suggest modifying the CVA framework to allow banks to choose the preferred numerical calculation method. In other words, we believe that the Committee should strictly prescribe only the functional mathematical definition of the indicator, allowing to the bank to select the optimal strategy to calculate it (numerical, simulation, etc.). See Bonollo et al. [3].

A similar issue arises in the EEt calculation for the EPE in CCR, where the theoretical definition (expected value in the future) is combined with the algorithm (a Montecarlo approach). We fear that this way to state the regulation could be misunderstood, since in practice the banks choose their own algorithmic strategy, combining ICT devices (GPU, grid, etc.) with mathematical tools (quasi Montecarlo, approximations, etc.).

2.2 Non-Captured Risks

The CD suggest a multiplier mCVA for the wrong way risk, if it is not properly accounted for in the bank’s methodology (see par. 32 and 33). Now, while we agree with a greater prudence in the assessment of the CVA for the un-accounted risks, we think that the CD focuses only on one of them, namely: the wrong way risk, without considering more relevant risks likely affecting the measurement in a more material way.

More explicitly the CD does not mention the errors due to the correlation matrix employed in the calculations, when it does not reflect the actual future matrix. Correlations are rarely found quoted in the market and only a few contracts can be traded to hedge the correlation risk. Since the CVA, as far as its hedging is considered, can be seen as a very complex hybrid derivative contract (especially if netting sets are cross-asset), a wrong correlation matrix implies that the second order sensitivities (Cross-Gamma and Cross-Vega) cannot be soundly hedged, and this would entail a mis-hedge also for the linear Greeks (i.e.: Delta and Vega) which may eventually result in a global increase of the P&L volatility, contrarily to the supposed minimization due to the hedging.

We suggest including in the CVA framework also an assessment of the risks related to the correlation matrix, when correlations cannot be easily traded in the market, or they cannot be traded at all. This is very likely the most common situation in the current markets.

As a general consideration, we doubt about the effectiveness of the CVA hedging (i.e.: replication) in practice. We would prefer to treat the CVA earned on the deals closed by the bank as an actuarial premium, rather than a derivative exposure to be synthetically replicated. The volatility of the CVA can surely absorb capital but the effectiveness of the hedging, set up to reduce it, should be carefully evaluated and put under stress.

2.3 FRTB CVA and Double Counting

The CVA framework relies on the changes of the Fundamental Review of the Trading Book, yet it is quite independent from the calculation of the regulatory capital for the market risk. We are aware that the Expected Shortfalls (ES) for the market risk and for the CVA volatility are computed out of two quite different approaches, and that the latter needs a simulation up to the expiry of the longest contract which is not strictly needed to determine the market ES. Nonetheless, it is obvious that the positive exposures increasing the counterparty risk could be also compensating a decreasing risk on the market risk side, due to the positive impact on the NPVs.

The CVA framework should allow banks with sophisticated skills and strong IT computational capabilities to measure jointly the ES on the market and counterparty risks, so that possible compensation of risks are properly identified and measured.

2.4 The Risk Measure and Aggregation in the FRTB SA-CVA

The computational workflow

The SA approach follows the general strategy of making the standardized model more risk sensitive, by dealing in a rigorous way the key concepts such as risk factors, sensitivities, dependency/correlation structure. Generally the parameters implied by this set-up are assigned by the Committee.

All the non-internal-models banks will be obliged to work intensively to switch from very simple standard models that do not require sophisticated mapping and calculation procedures to the new SA. We refer mainly to Market, CCR and CVA capital charge.

In this framework, we think that the SA models should be more homogenous in their “architecture”, to avoid that small-medium banks make some confusion in managing and calculating these new measures. Otherwise they are obliged to maintain at the same time two or more systems for mapping and categorizing their risk factors.

As a simple example, let us compare the new SA-EAD for the CCR (paper 279) with the current SA-CVA. For the sake of simplicity, we refer briefly to the “Equity” asset class:

- For CCR (EAD) purposes, a single risk factor model is prescribed with just one hedging set. Hence the full offset is allowed within the same reference entity, while a correlation factor is assigned with respect to the systematic factor, 50% for single names and 80% for the indices

- For the CVA, i.e.: for capturing the (equity) exposure volatility, the workflow consists of 10 buckets given by a sector/geography taxonomy. The Delta and Vega exposure CVA sensitivities are then calculated with a cross correlation rij of 15% between all couples of buckets.

Then we could easily build a counterexample, e.g.: a portfolio of 2 equity derivatives belonging to different buckets, where the price joint movements of the 2 entities are taken in to account differently for the PFE and for the CVA-Exposure effect respectively.

Correlation coefficients and Risk Weights

In the spirit of the SA calculation, we generally agree with the general workflow.

On the other hand, we suggest improving some of the current parameters value.

There are several examples, but for brevity we point out just some simple cases:

- The risk weight RW for Delta risk for FX is 15%, while the lowest RW for the Equity risk class is 30%. As well known, the RW role is to move from a what-if measure (the sensitivity of the instrument to the risk factor) to the instrument volatility. From this set-up one could argue that the highest volatility FX rate is 2 times lower than the lowest equity volatility. We claim that this is not a realistic picture of the market price volatilities

- The correlation cross buckets for the FX is 0.6, for the Equity is 0.15. Again, we find it not very accurate. It is often observed in the financial markets that the sectors move together inside a macro area, irrespectively of the size of the firms. In some cases, such as the buckets (1,2,3,4) vs bucket (9), i.e.: large cap vs. small cap in emerging markets (see Annex 1.B.2), a 0.15 coefficient is too low and not conservative. On the other hand, a 0.6 “flat” between the currencies in some cases is too high, also in a conservative perspective.

2.5 Computational Burden for the FRTB IMA-CVA

The CD proposes to compute the CVA capital charge daily, under different assumptions on the MPOR (par. 13), liquidity horizons (par. 85) and, above all, separately and jointly for all the relevant risk factors (par. 86, 87, 88, 89). On the one hand, this is a huge increase of the computational burden with respect to the current requirements to calculate the IRC; on the other hand, even more sophisticated banks calculating the CVA for the trading desks managing it, likely do not operate daily so many computations as those implied in the proposal.

IT technology is certainly available to perform the required computations on a daily frequency, but we suspect that the investments needed to upgrade existing systems would be massive even for more advanced institutions.

We are not trying to minimize the complexity and the subtleties of the risks involved with the CVA (as the point above on the correlation shows). We want simply to point out that a daily calculation represents a too high a frequency for most of practical purposes. In our view, it would be better to relax the frequency in favour of a deeper analysis of the model risks even beyond those explicitly considered in the CD.

References

[1] Basel Committee on Banking Supervision (2015), “Review of the Credit Valuation Adjustment Risk Framework “, available at http://www.bis.org/bcbs/publ/d325.htm

[2] Bonollo M. And Castagna A. (2015), “Comments to the Consultative paper Review of the Credit Valuation Adjustment Framework “, available at http://www.bis.org/bcbs/publ/comments/d325/iason.pdf

[3] M. Bonollo, L. Di Persio, I. Oliva, A. Semmoloni. “A Quantization Approach to the Counterparty Credit Exposure Estimation”. Available at www.ssrn.com, 2015

[4] L. Capriotti. Fast greeks by algorithmic differentiation. Journal of Computational Finance, 14(3): 3-35, 2011.

Il recente salvataggio di Banca Marche, Popolare dell’Etruria e del Lazio, CariFerrara e CariChieti ha sollevato un acceso dibattito tra Banca d’Italia e Commissione Europea. Quest’ultima è accusata dalla Banca Centrale di aver ostacolato soluzioni alternative che attraverso il Fondo di tutela dei depositi avrebbero permesso di non intaccare le passività bancarie. Nella stessa direzione vanno anche le rimostranze avanzate dall’Associazione Bancaria Italiana e dall’associazione che rappresenta le Fondazioni bancarie e le casse di risparmio (ACRI). In particolare le Fondazioni, principali azioniste delle banche coinvolte dal crack, confidavano nell’intervento del sistema bancario, a sua volta fortemente influenzato dalle stesse Fondazioni, che avrebbe permesso di salvaguardare anche i loro interessi. Il fatto che la Commissione si sia opposta a una simile soluzione va giudicato quindi con favore: se si vuole evitare che in futuro si ripetano crack bancari è fondamentale far pagare le crisi a chi ha avuto le maggiori responsabilità in termini di mancato controllo, come appunto gli azionisti, avendo tra l’altro, in precedenza, tratto giovamento dell’eccessiva assunzione di rischi. Sul piano di salvataggio coordinato dalla Banca d’Italia andrebbe fatta in ogni caso più luce. Quali conseguenze ci sarebbero state nel caso di un’applicazione totale del meccanismo del bail-in? Quali e quanti piccoli risparmiatori sarebbero stati coinvolti? Quali sarebbero state le perdite per il sistema bancario?

Secondo le statistiche relative a ottobre 2015 dei 620 miliardi di euro di obbligazioni bancarie in circolazione oltre 210 miliardi risultano essere state sottoscritte da altri istituti di credito nazionali. In altri termini, un terzo dei bond bancari sono stati acquistati da altre banche. Nel caso in cui il piano di salvataggio avesse colpito anche gli obbligazionisti ordinari il sistema bancario avrebbe molto probabilmente dovuto affrontare perdite non trascurabili. Altre perdite sarebbero potute derivare dalla rettifica di valore dei depositi interbancari con durata superiore alla settimana, altra tipologia di crediti potenzialmente aggredibile nel caso di applicazione del bail-in.

La questione di quali perdite il sistema bancario avrebbe dovuto subire nel caso di applicazione integrale del bail-in è importante anche per valutare l’equità del decreto di salvataggio varato dal Governo. L’intervento del Fondo di Risoluzione ha infatti determinato un esborso per le banche pari a 3,6 miliardi di euro. Di questi 1,8 miliardi sono andati a ricapitalizzare le nuove banche, somma molto probabilmente recuperabile dalla vendita sul mercato dei quattro istituti. Altri 1,7 miliardi sono serviti a coprire le perdite legate alla svalutazione dei crediti, mentre 140 milioni sono serviti alla dotazione di capitale della bad bank destinata a gestire le sofferenze. La perdita sui crediti è però puramente potenziale: i crediti in sofferenza sono stati infatti svalutati dell’83%, contro una media pari al 59% per l’intero sistema bancario (Banca d’Italia, 2015, Tavola a13.14). Non va quindi escluso che vendendo sul mercato i titoli in sofferenza, la bad bank riuscirà a trarne profitto, profitto che verrebbe poi rigirato al Fondo di risoluzione. In definitiva, dal salvataggio al di fuori della procedura del bail-in il sistema bancario ha evitato di subire perdite certe dalla svalutazione dei bond ordinari e dei finanziamenti interbancari erogati alle quattro banche fallite, sostituendole con delle perdite soltanto potenziali, a cui vanno aggiunte le perdite effettivamente sostenute sui titoli azionari e le obbligazioni subordinate detenute.

A queste considerazioni si potrebbe obiettare che nel caso di applicazione integrale del bail-in ci sarebbero stati contraccolpi sulla stabilità del sistema bancario, determinando il contagio anche a banche sane. Ma se questo è vero significa che anche dal fallimento di istituti di credito medio-piccoli possono scaturire conseguenze sistemiche. Ciò dovrebbe indurre a rivedere il primo pilastro della Banking Union, affidando interamente alla BCE il compito di vigilare sull’intero sistema bancario, e non solo sulle banche di maggiori dimensioni (Milani, 2015).

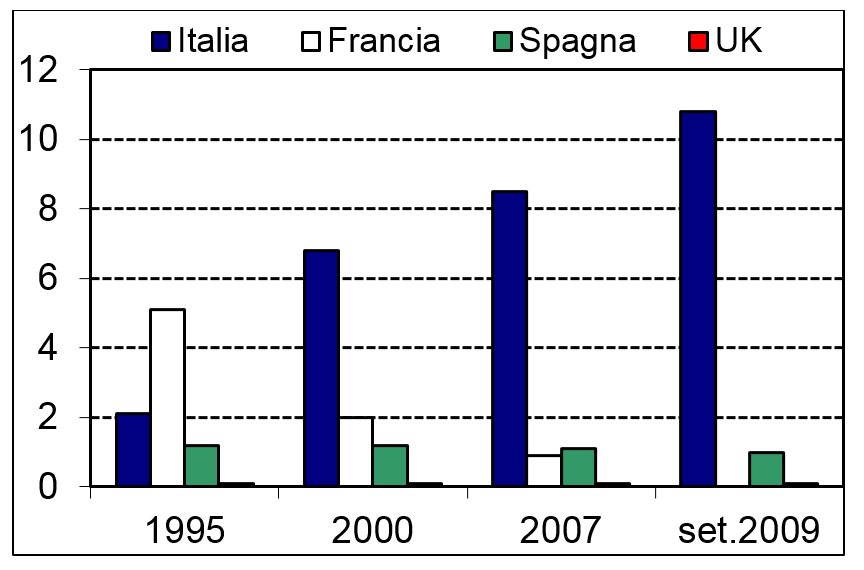

Su tutti questi aspetti servirebbe una maggiore chiarezza, e il fatto che Consob non abbia il potere di avanzare domande sul piano di salvataggio certo non aiuta (si veda l’intervista di Giuseppe Vegas su il Corriere della Sera del 14 dicembre 2015). La trasparenza nei piani di salvataggio è infatti un requisito fondamentale se si vuole evitare, da un lato, di generare il panico in alcune tipologie di investitori (quali gli obbligazionisti subordinati), e dall’altro determinare un senso di sicurezza verso altre forme di investimento. Quest’ultimo aspetto si ricollega a un’altra critica sollevata dalla Commissione, ovvero l’eccessiva diffusione di strumenti rischiosi e opachi presso i piccoli risparmiatori, che tra l’altro ha indotto la Banca d’Italia in un qualche mea culpa sul fatto di non aver limitato la diffusione delle obbligazioni subordinate presso i piccoli risparmiatori. Al riguardo bisogna ricordare come il possesso di obbligazioni bancarie da parte delle famiglie sia un fenomeno tutto italiano. Lusignani (2010) evidenzia come, subito dopo lo scoppio della crisi finanziaria, i bond bancari pesassero per oltre il 10 per centro del totale delle attività finanziarie delle famiglie italiane, contro l’1 per cento della Spagna e incidenze pressoché nulle in UK e Francia (grafico 1).

Grafico 1. Peso delle obbligazioni bancarie sulle attività finanziarie delle famiglie (in %) .Fonte: Lusignani (2010).

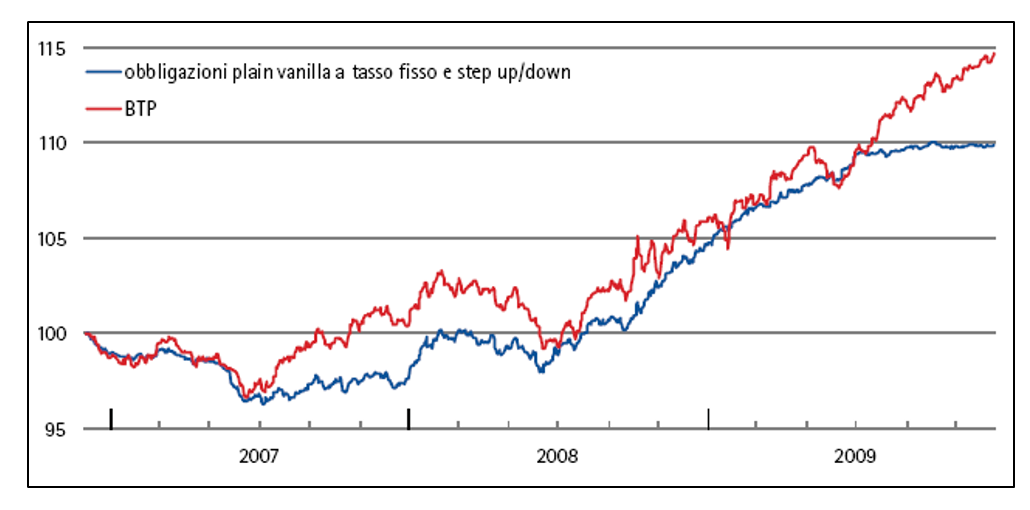

L’eccessivo investimento in obbligazioni bancarie in Italia è spiegato essenzialmente da due fattori. Il primo è la generale insufficiente cultura finanziaria degli italiani (Nicolini, 2014, Gentile, Linciano e Soccorso, 2015). La scarsa conoscenza induce i risparmiatori ad affidarsi, quasi ciecamente, a terzi soggetti per prendere le loro decisioni finanziarie. E qui sta il secondo problema: la rete distributiva di prodotti finanziari è controllata quasi completamente dal sistema bancario, da cui scaturisce un evidente conflitto di interessi. Grasso, Linciano, Pierantoni e Siciliano (2010) mostrano come il rendimento offerto dalle obbligazioni bancarie, a parità di condizioni (ad es. durata finanziaria e tipologia di tasso), sia mediamente inferiore a quello dei titoli di Stato, strumento certamente meno rischioso dei titoli bancari (grafico 2). In definitiva, una rete di vendita non indipendente sarà indotta a fare più l’interesse della banca piuttosto che quello del risparmiatore, minando però a lungo andare il rapporto di fiducia tra banca e cliente. Purtroppo né il vigilante né il legislatore hanno favorito in questi anni la nascita di una vera consulenza finanziaria indipendente. Al riguardo è interessante notare come nell’attuale dibattito parlamentare si stia proprio discutendo di riformare l’albo dei promotori finanziari, anche se la linea che sta emergendo non sembra essere favorire la trasparenza e l’indipendenza della consulenza, quanto invece cercare di mantenere lo status quo del sistema bancario nazionale. L’approccio italiano, così come quello europeo più in generale, non sembra essere simile a quello inglese dove, già a partire dal 2013 e nell’ambito della Retail Distribution Review, ogni intermediario è tenuto a dichiarare se opera in modo indipendente dalle case di gestione, per cui la sua parcella deve essere pagata dal soggetto che riceve il servizio, o, viceversa, se riceve degli incentivi per la vendita di prodotti finanziari specifici.

Grafico 2. Indici di total return delle obbligazioni bancarie a tasso fisso e dei BTP (1.12.2006=100). Fonte: Grasso, Linciano, Pierantoni e Siciliano (2010).

Inoltre, la scarsa presenza di una consulenza finanziaria ha costituito anche un ostacolo alla diffusione di canali alternativi per il finanziamento delle imprese, soprattutto di media e piccola dimensione, che quindi negli anni hanno dovuto fare quasi esclusivo affidamento al credito bancario (Milani, 2015).

Riferimenti

– Banca d’Italia (2015). Relazione annuale per il 2014.

– Gentile M., N. Linciano e P. Soccorso, 2015, “Gli investimenti poco consapevoli delle famiglie italiane”, FinRiskAlert.it

– Grasso R. , N. Linciano, L. Pierantoni e G. Siciliano (2010), “Le obbligazioni emesse da banche italiane. Le caratteristiche dei titoli e i rendimenti per gli investitori”, Quaderni di Finanza Consob.

– Lusignani G. (2010), “Il posizionamento strategico dell’industria finanziaria italiana”, mimeo.

– Milani C. (2015), “Alle radici della crisi finanziaria. Origine, effetti e risposte”, Egea Editore.

– Nicolini G. (2014), “La cultura finanziaria degli Italiani”, FinRiskAlert.it