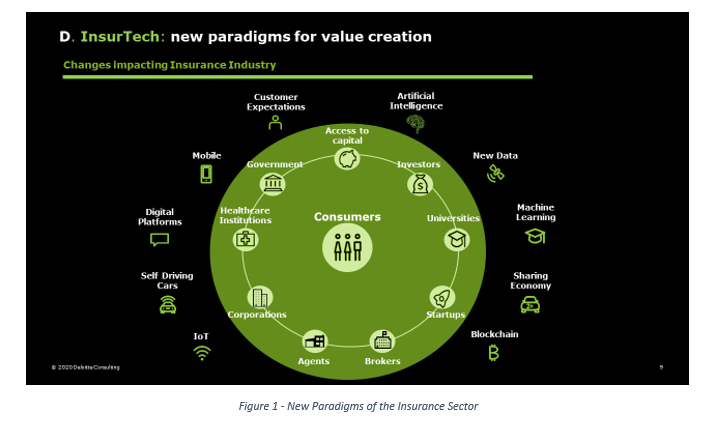

Artificial Intelligence, Machine Learning, IoT and Digital Platforms are some of the new technological paradigms that are significantly changing insurance market dynamics, in terms of customers’ needs, expectations and ways of connecting with Insurance Companies.

More than ever before, insurance Companies have to manage an increasing demand of innovation by:

- taking advantage from the opportunities offered by new digital technologies;

- updating their own operating and service model to better address clients, distribution channels and repair network needs.

The current pandemic scenario and the need of “social distancing” is going to dramatically change both customer behaviors and the way to approach him. Customers are increasingly looking for digital ways of interaction (e.g. on-line policy renewal, digital payments, etc.) and, in the meantime, get the “human touch” by relying on the distribution network as a distinctive element of quality of service.

Rethinking the Customer Journey along the overall claim lifecycle in a digital perspective has a crucial role since the customer satisfaction is one of the most relevant factor of the renewal process (e.g. settlement speed and amount of reimbursementsupporting customer retention).

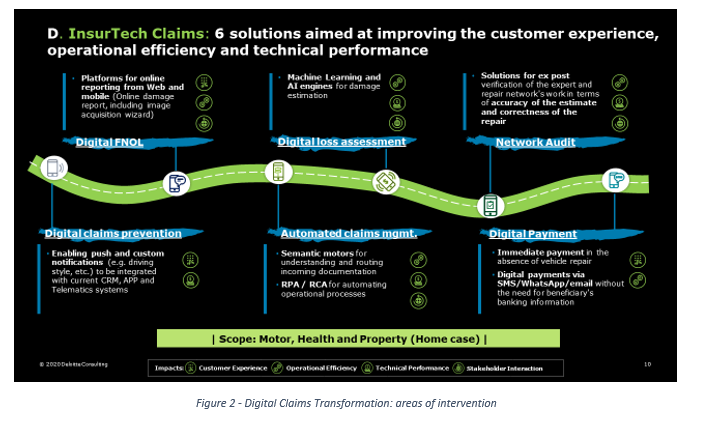

An E2E Digital Claims Journey can be made up of:

- Digital Claims Prevention: acting on prevention to minimize the probability of claims occurrence by push and custom notifications to be integrated with CRM, APP, Telematics, IoT solutions, wearables

- Digital FNOL: introducing platforms for Web / mobile claims reporting (e.g. Motor: online accident report; Property: video-appraisal)

- Digital Loss Assessment: leveraging on AI engine and Machine Learning algorithms to assess damages with the aim of reducing the claim settlement time and improving reimbursement accuracy

- Automated claims management: automating administrative task within claim management processes with RPA / RCA solutions (e.g. semantic engines for understanding and routing incoming documentation, etc.)

- Network Audit: evaluating expert and repair networks results in terms of estimates accuracy aimed to improve technical performance through network monitoring

- Digital Payments: boosting up digital payment solutions based on SMS / WhatsApp / e-mail without the need of banking information to speed up the payments

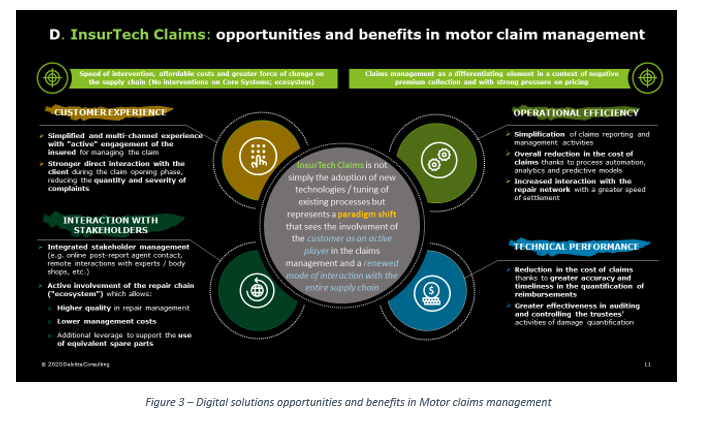

The benefits of digital solutions adoption in claim management can be summarized as follows:

- Customer experience improvement byoptimizing E2E claims lifecycle (from FNOL to payment) and by supporting a more effective and up-to-dated communication to the client (e.g. claim status)

- Reduction of the average claims cost by decreasing administrative and repair network costs. Digital solution will also lower average claim cost by improving direct contact with the clients as well as settlement time (e.g. less layers intervention, automated settlement)

- Availability of a timely and accurate damage assessment powered by AI engine (fed by Automotive database) according to the Company settlement policies (e.g. repair vs. replacement; equivalent spare parts, etc.)

- Effectiveness in monitoring the repair network through ex-post audit in terms of correctness of expertise, repair / replacement decisions, spare parts compatibility, etc.

The above mentioned benefits become more and more relevant also in terms of technical performances consolidation, especially in a market context characterized by negative Motor premium collection and strong pressures on pricing.

Companies’ capability to innovate claims management processes will be crucial to address customer needs and choices and it will become the real competitive advantage in a context already characterized by customer loyalty decreasing trend.

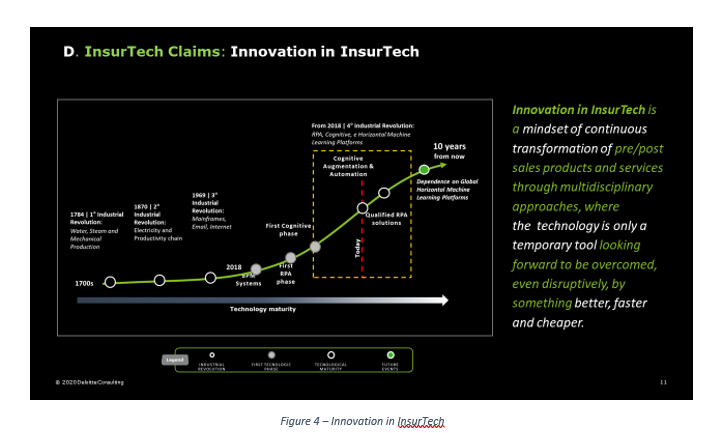

An innovative approach in claims management is not only referred to the identification and introduction of new technologies that could become quickly obsolescent, neither to the adoption of traditional process leveraging digital technologies but it is a matter of continuous and constant aspiration to reach the maximum efficiency.

The adoption of a claims management solution based on new digital paradigms must provide an organic and structured path that gives access to available technologies, changing them over time, safeguarding the specificities and distinctiveness of the Insurance Companies. It is highly recommended to adopt an operational approach that includes:

- Scope & GAP Analysis: identification of the types of claims impacted by the automation and analysis of customer specificities to define the expected impacts of the implementation

- Digital Claims Journey Map: definition of the high-level Digital Claims Journey and identification of the specific target areas for the new Digital Claims process in terms of resources, processes and systems, taking into account both technical targets and Customer Journey improvements

- Identification of technological partners: selection of the best technological partners that fit Company digital claim operating model

- Solution customization: improve the alignment between AI market engine results with Company settlement policies and operative processes by increasing AI engine effectiveness through Machine Learning algorithms based on a historic claims database (at least 12/18 months)

- Change Management: initiatives to spread a digital culture within the Company to support the adoption of new digital solutions

- Marketing campaigns: distribution network involvement to promote and support Digital claims Journey adoption by the customers

Insurance Companies that will be able to combine new technologies with their own peculiarities in terms of product and service model will achieve an important competitive advantage to increase customer retention, attract new customers and, at the same time, optimize their operations and technical performance.

Romano Sacchi – Partner Deloitte Consulting

Maria Cristina De Anna – Director Deloitte Consulting

Alessandro Greco – Senior Manager Deloitte Consulting

Davide Adduci – Manager Deloitte Consulting