Abstract

In this short note we briefly review the state of the art of the ongoing transition from interbank rates (IBORs) to alternative risk free rates, with a focus on LIBOR and EUR benchmark rates. This note is a reduced version of a position paper published by AIFIRM in December 2019 [1], reporting more details regarding the impacts of the transition on Bank’s internal processes, updated to December 2020.

1. IBORs Transition Overview

The Inter-Bank Offered Rates (IBORs) have been widely used by the market players as benchmarks for an enormous number of market transactions and a broad range of financial products since their invention by M. Zombanakis in 1969 [2] and their successive standardization by the British Bankers’ Association in 1986 [3].

Currently, IBORs are the predominant interest rate benchmark for USD, GBP, CHF, EUR and JPY derivatives contracts [4]. EURIBOR is the most widely used interest rate benchmark for EUR contracts [5]. They are calculated through contributions from panel banks, and they reflect the offered rates for interbank unsecured wholesale deposits. IBORs indexed OTC derivatives and ETDs represent approximately 80% of IBOR-linked contracts by outstanding notional value, and thus derivatives represent the focus for global transition and reform initiatives. Going forward, this focus will include other products, such as securities, loans and mortgages.

After the LIBOR manipulation scandals [6][15], in 2013 IOSCO issued a set of principles that administrators of financial benchmarks should comply with, stating that interest rates must be reliable, robust and reflect real transactions [7].

By that time, the G20 had also mandated the Financial Stability Board (FSB) with conducting a global review of the main benchmarks and plans for their reform, in order to ensure that these were coherent and coordinated to the extent possible. In its 2014 report “Reforming major interest rate benchmarks” [8] the FSB recommended:

- strengthening existing reference rates by underpinning them, to the greatest extent possible, with transaction data;

- developing alternative, nearly risk-free reference rates.

In the euro area, the reform efforts were accelerated by the adoption of the EU Benchmarks Regulation (BMR) on 8 June 2016 [9], which codifies the IOSCO Principles into EU law and defines critical benchmarks that need a robust framework: EONIA, EURIBOR, LIBOR, STIBOR, WIBOR. Among other requirements, since 1January 2018 BMR requires to include fallback clauses in specific type of contracts and permit the usage of critical benchmarks not compliant to the BMR until 31 December 2021.

Following these new requirements, in particular, EONIA, EURIBOR and LIBOR, were the subject of a deep reform, accelerated in the case of LIBOR from the statement of the Financial Conduct Authority (FCA) that confirmed it will no longer compel banks to submit LIBOR post December 2021.

In order to lead the market through the reform and with the will to be the link between market participants and regulators, each jurisdiction established a Working Group (WG) to define the Alternative Risk Free Rate (Alt-RFR) for the different currencies with which IBORs are contributed.

2. Features of the Alternative Risk Free Rates

Starting from the IOSCO principles and the following Authorities’ guidelines, the Alt-RFRs are:

- transaction based, including non-bank counterparties deals;

- secured or unsecured

- reflecting the borrowing costs from wholesale market including non-bank counterparties.

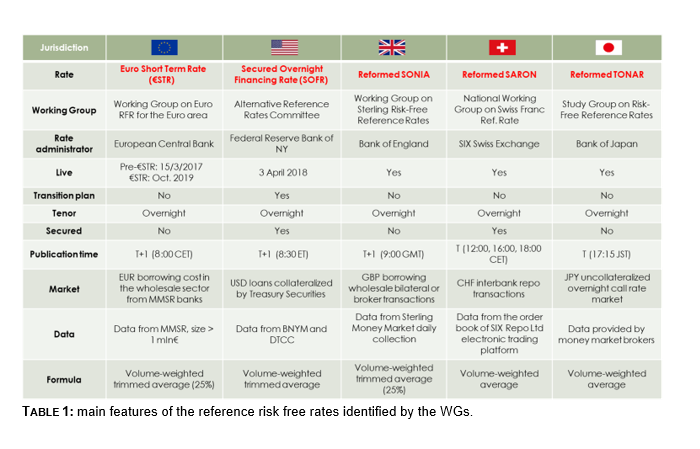

Table 1 below reports the main features of the reference risk free rates identified by the WGs: they will side next to the IBORs and eventually substitute them.

3. Focus on the EURO area

3.1. From EONIA to €STR

In February 2018, the European Central Bank (ECB), the Financial Services and Markets Authority

(FSMA), the European Securities and Markets Authority (ESMA) and the European Commission

established the working group on euro risk-free rates (the ECB WG, [10]). The working group was tasked with (i) identifying risk-free rates which could serve as the basis for an alternative to the current benchmarks used in a variety of financial instruments and contracts in the euro area, (ii) identifying best practices for contractual robustness, and (ii) developing adoption plans – and, if necessary – a transition plan for legacy contracts which reference existing benchmarks.

The ECB WG works to provide guidelines and recommendations to market participants, in order to facilitate a smooth transition: its recommendations apply to different areas of impact (legal, accounting, risk management, etc.). In particular, the Working Group recommended €STR as euro risk-free rate on 13th September 2018 [11] [12]. Some of the key properties of €STR are:

- significant and steady volumes, markedly above EONIA volumes. On average, around 30 banks report data each day out of a pool of 52 MMSR reporting banks, which ensures that there is sufficient underlying data to calculate a reliable rate;

- very stable with an average daily volatility of just 0.4 basis point. Comparing the performance of the so called pre-€STR with that of EONIA over the period from March 2017 to July 2018, pre-€STR was very stable and was trading at a spread of around 9 basis points below EONIA.

Since 1 October 2019 €STR is published and EONIA is computed as EONIA = €STR + 8.5 bps, a one-off spread provided by the ECB, calculated as the arithmetic average of the daily spread between EONIA and pre-€STR (data from 17/04/2018 until 16/04/2019), after removing the 15% of observations from the top and the bottom of the sorted series.

Also the timing changed: while EONIA was published at 19.00 CET on each business day (T), €STR is published at 8:00 CET on the next business day (T+1). In case of errors in the €STR calculation that affect the rate value by more than 2 bps, €STR is revised and re-published on the same day at 09:00 CET. As a consequence of the recalibrated methodology, also EONIA is published on the next business day (T+1) at 9:15 CET.

EONIA will be published until 3 January 2022, when it is discontinued. Before its discontinuation, market participants have to perform a series of activities to be ready. The ECB WG issued a lot of recommendations to address a smooth transition and the milestones are:

- creation of a new market based on €STR-linked derivatives: at the beginning, the €STR OIS curve was EONIA OIS curve – 8,5bps but, with the passage of time, the €STR OIS curve is being built;

- PAI and discounting regime switch performed by CCPs on 27 July 2020: LCH, EUREX and CME switched from EONIA to €STR all their EUR OTC derivatives in clearing;

- PAI and discounting regime switch to be performed by counterparties with respect to their derivatives positions under bilateral CSAs: several banks are dealing each other to agree how and when perform the switch;

- Decision by market makers and brokers on how to quote non-linear/volatility/correlation derivatives. Currently Cap/Floor are still quoted versus EONIA, while Swaption are quoted versus €STR: the way is still long but it is traced;

- Decision by market participants to revise risk-free net present values and xVAs pricing models or to perform new valuation adjustments.

The transition from EONIA to €STR has a number of consequences on the valuation of derivatives, as outlined e.g. in [13].

3.2. From EURIBOR to Hybrid EURIBOR

EURIBOR is the commonly used term rate for euro denominated financial contracts. EURIBOR reflects the rate at which wholesale funds in euro can be obtained by credit institutions in EU and EFTA countries in the unsecured money market, and seeks to measure banks’ costs of borrowing in unsecured money markets [5].

In 2016, EURIBOR was declared a critical benchmark by the European Commission, so its administrator, the Euro Money Markets Institute (EMMI), has conducted in-depth reforms in recent years in order to meet the BMR requirements, by strengthening its governance framework and developing a hybrid methodology in order to ground the calculation of EURIBOR, to the extent possible, in euro money market transactions.

In July 2019, the supervisor of EURIBOR, the FSMA, granted authorisation to EMMI for hybrid-EURIBOR under the BMR. This authorisation provides confirmation that EMMI and the EURIBOR hybrid methodology meet the requirements laid down in the BMR and that EURIBOR may continue to be used in new and legacy contracts.

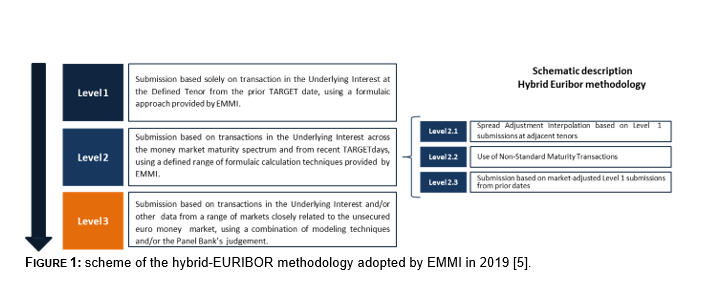

Starting from the end of 2019 all panel banks contribute their data following the “hybrid” determination methodology developed by EMMI, based on a 3 levels hierarchy, as illustrated in Figure 1 below.

The ECB WG recommended to use the €STR term structure as a fallback to EURIBOR [14]. On 23 November 2020 the ECB WG issued two consultantions on fallback trigger event and €STR-based fallback whose results will be shared during the ECB WG meeting in February 2021 [15]. Starting from the industry’s feedbacks, the ECB WG will issue recommendations on fallback rates to be applied to different products. It is worth to be highlighted that €STR will be the EURIBOR fallback rate, but the calculation methodology will depend on the products to be applied.

4. Focus on LIBOR

The Financial Stability Board and Financial Stability Oversight Council have both publicly recognized that the decline in wholesale unsecured term money market funding by banks poses structural risks for unsecured benchmarks, including LIBOR. Although significant progress has been made by the LIBOR Administrator (ICE Benchmark Administration – IBA) in strengthening the governance and processes underlying LIBOR, the scarcity of underlying transactions poses a continuing risk of a permanent cessation of its production after the end of 2021.

Andrew Bailey, then the Chief Executive of the United Kingdom’s Financial Conduct Authority (FCA)

highlighted this end-2021 timeline in a speech in 2017 [16] and the FCA recently reemphasized [17] that the central assumption that firms cannot rely on LIBOR being published after the end of 2021 has not changed and that this should remain the target date for all firms.

On December 4, 2020, IBA published its consultation, with deadline January 25, 2021, on its intention to cease the publication of the LIBORs (CHF, GBP, JPY and EUR) on December 31, 2021, considering some postponements only for USD LIBOR until June 30, 2023 [4].

Different WGs are providing recommendations to lead a smooth transition from USD, GBP, CHF, JPY and EUR LIBOR to, respectivey, SOFR, SONIA, SARON, TONA and €STR: with 13 months left until LIBOR could become unusable, it is important that market participants accelerate their transition efforts, having in mind that:

- new LIBOR cash products should include fallback language as soon as possible;

- third-party technology and operations vendors relevant to the transition should complete all necessary enhancements to support Alt-RFR by the end of this year;

- New use of LIBOR should stop, with timing depending on specific circumstances in each cash product market.

- For contracts specifying that a party will select a replacement rate at their discretion following a LIBOR transition event, the determining party should disclose their planned selection to relevant parties some months prior to the date that a replacement rate would become effective.

Considering the cleared USD OTC derivatives, the CCPs switched the PAI and discounting regime in October 2020 from Fed Fund Rate to SOFR through a complex mechanism. Since there is no fix spread between EFFR and SOFR, the switch resulted in cash compensation, to manage the valuation change, and swap compensation, to manage risk profile change.

The first next milestone that USD market participants have to reach before the USD Libor discontinuation is the PAI and discounting regime switch for derivatives under bilateral CSAs.

The second next milestone for the LIBOR WGs is to lead the market participants in the construction of a term rate structure or address the impacts that the only use of overnight rate compounding could cause (e.g. some derivatives cannot be priced with compounded rates).

5. Focus on ISDA work on Derivatives

In 2016, the Official Sector Steering Group (OSSG) formally launched a major initiative to improve contract robustness and address the risks of widely-used interest rate benchmarks being discontinued. The OSSG invited ISDA to lead this work as it pertained to derivative contracts – the largest source of activity for the IBORs.

ISDA [18] conducts its work through different WGs: ISDA Americas and Europe Benchmark WG, ISDA APAC Benchmark WG, ISDA JPY Benchmark WG, ISDA EU Benchmark Regulation Advocacy Group and the ISDA IBOR Fallback Implementation Subgroup.

To address the risk that one or more IBORs are discontinued while market participants continue to have exposure to that rate, counterparties are encouraged to agree to contractual fallback provisions that would provide for adjusted versions of the RFRs as replacement rates.

ISDA developed fallbacks that would apply upon the permanent discontinuation of certain IBORs and upon a ‘non-representative’ determination for LIBOR. ISDA will amend the 2006 ISDA Definitions by publishing a ‘Supplement’ to the 2006 ISDA Definitions on January 25, 2021: transactions incorporating it, that are entered into on or after the date of the Supplementwill include the amended floating rate option (i.e., the floating rate option with the fallback). Transactions entered into prior to the date of the Supplement (so called “legacy derivative contracts”) will continue to be based on the 2006 ISDA Definitions as they existed before they were amended pursuant to the Supplement, and therefore will not include the amended floating rate option with the fallback.

ISDA has published a protocol [19] to facilitate multilateral amendments to include the amended floating rate options, and therefore the fallbacks, in legacy derivative contracts. By adhering to the protocol, market participants would agree that their legacy derivative contracts with other adherents will include the amended floating rate option for the relevant IBOR and will therefore include the fallback. The protocol is completely voluntary and will amend contracts only between two adhering parties (i.e., it will not amend contracts between an adhering party and a non-adhering party or between two non-adhering parties). The fallbacks included in legacy derivative contracts by adherence to the protocol will be exactly the same as the fallbacks included in new transactions that incorporate the 2006 ISDA Definitions and that are entered into on or after January 25, 2021.

6. References

- AIFIRM Position Paper n. 16, “From IBORs to RFRs: Impacts on Banks’ Processes and Procedures”, December 2019, http://www.aifirm.it/wp-content/uploads/2020/01/2019-Position-Paper-16-From-IBORs-TO-RFRs.pdf

- https://www.bloomberg.com/news/features/2016-11-29/the-man-who-invented-libor-iw3fpmed

- https://www.bis.org/publ/qtrpdf/r_qt0803f.htm.

- https://www.theice.com/iba/libor

- https://www.emmi-benchmarks.eu/euribor-org/about-euribor.html.

- https://en.wikipedia.org/wiki/Libor_scandal

- Principles for Financial Benchmarks” Final Report, July 2013, https://www.iosco.org/library/pubdocs/pdf/IOSCOPD415.pdf.

- https://www.fsb.org/2014/07/r_140722/.

- https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32016R1011.

- https://www.ecb.europa.eu/paym/interest_rate_benchmarks/WG_euro_risk-free_rates

- https://www.ecb.europa.eu/stats/financial_markets_and_interest_rates/euro_short-term_rate/html/eurostr_overview.en.html.

- https://www.ecb.europa.eu/paym/initiatives/interest_rate_benchmarks/shared/pdf/ecb.ESTER_methodology_and_policies.en.pdf.

- https://ssrn.com/abstract=3674249.

- https://www.ecb.europa.eu/press/pr/date/2018/html/ecb.pr180913.en.html; https://www.ecb.europa.eu/paym/interest_rate_benchmarks/WG_euro_risk-free_rates/shared/pdf/20180913/Item_3_High_level_implementation_plan.pdf

- https://www.ecb.europa.eu/pub/pdf/other/ecb.pubcon_EURIBORfallbacktriggerevents.202011~e3e84e2b02.en.pdf; https://www.ecb.europa.eu/pub/pdf/other/ecb.pubcon_ESTRbasedEURIBORfallbackrates.202011~d7b62f129e.en.pdf

- https://www.fca.org.uk/news/speeches/the-future-of-libor

- Transition from LIBOR | FCA

- https://www.isda.org/2020/05/11/benchmark-reform-and-transition-from-libor/

- ISDA Launches IBOR Fallbacks Supplement and Protocol ISDA-Launches-IBOR-Fallbacks-Supplement-and-Protocol.pdf