The crypto advocacy group is going on a charm offensive and meeting with top representatives of the Biden administration…

https://cointelegraph.com/news/blockchain-association-meeting-with-key-biden-staff-about-regulations

The crypto advocacy group is going on a charm offensive and meeting with top representatives of the Biden administration…

https://cointelegraph.com/news/blockchain-association-meeting-with-key-biden-staff-about-regulations

Con il Comunicato Stampa N. 35 del 25/02/2021 ([1]) il Ministero dell’Economia e delle Finanze (MEF) ha annunciato la pubblicazione del “Green Bond Framework” ([2]), quadro di riferimento dei primi BTP “Green” italiani. Con questa novità l’Italia entra nel mercato del debito sovrano collegato alla finanza sostenibile dando un nuovo impulso alla strategia di sostenibilità ambientale del paese. Ad ora è stato comunicato un tetto massimo teorico di emissioni per i soli investitori istituzionali di 35 miliardi di euro che potranno variare dipendentemente dalle condizioni di mercato e dalla domanda. I fondi raccolti verranno utilizzati per rifinanziare retroattivamente spese già effettuate nel periodo 2018-2020 e per coprire quelle previsionali del 2021.

Prima di entrare nei dettagli più tecnici dei “Green bond” italiani, facciamo il punto sul contesto internazionale e storico in cui questi si inseriscono.

Le “obbligazioni verdi”, o “Green Bond”, sono strumenti finanziari che fanno parte dell’insieme dei “Thematic bond”, ossia titoli di debito che condizionano i fondi ottenuti per finanziare progetti di impatto sociale ed ambientale. In questa famiglia troviamo i “Green bond”, di matrice ambientale, i “Social bond”, di impatto sociale, ed infine i “Sustainability Bonds”, che coniugano i due precedenti. Questo tipo di obbligazione è relativamente nuova e ha trovato una crescita notevole dal 2007, anno in cui la European Investment Bank (EIB) ha emesso il primo “Green Bond” denominato “Climate Awareness Bond” (CAB).

Nonostante la EIB abbia raccolto a fine 2020 EUR 33.7 miliardi in CAB e la Banca Mondiale abbia emesso in 20 monete diverse un totale di USD 13 miliardi di “Green Bond” dal 2008 ad oggi, gli esempi di obbligazioni statali sono pochi e assai più recenti. L’apripista è stata la Polonia a dicembre 2016 a cui sono seguite Francia (gennaio 2017), Belgio (febbraio 2018) e Lituania e Irlanda, entrambe nella primavera 2018. Nel 2019 si sono uniti anche i Paesi Bassi e lo scorso anno Germania, Svezia e Ungheria hanno sperimentato questo nuovo strumento. I fondi raccolti da questi stati finanziano progetti nazionali volti a diminuire il loro “carbon footprint”, come ad esempio investendo in impianti di energie rinnovabili, trasporto a basse emissioni, lotta all’inquinamento idrico e tutela della biodiversità.

Per i prossimi anni si prevede un crescente interesse in questi strumenti finanziari. La Banca Svedese SEB prevede una emissione globale di “Thematic Bond” per il 2021 che va da 708 a 786 miliardi di dollari (dai 510 ai 550 miliardi di dollari per i soli “Green Bond”) per scenari più o meno favorevoli a una transizione sostenibile. Questo rappresenterebbe un aumento dal 30 al 45%, rispettivamente, sul volume degli stessi strumenti finanziari del 2020.

2. Quando un Bond può definirsi Green?

Al momento non esiste uno standard globale per certificare se un determinato bond possa essere definito “Green”. I principi su cui il BTP “Green” italiano si basa derivano dalle linee guida elaborate dall’International Capital Market Association (ICMA) [4]. Le direttive ICMA sono riassumibili nei seguenti punti: per prima cosa, chi emette un titolo deve identificare con chiarezza la destinazione dei proventi. In secondo luogo, si devono seguire procedimenti particolari per la valutazione e selezione dei progetti. Quindi, chi emette l’obbligazione deve garantire la massima trasparenza nel comunicare la gestione dei fondi raccolti. Infine, report dettagliati devono essere prodotti e resi disponibili per mantenere aggiornati gli investitori sull’avanzamento dei progetti finanziati.

3. Il BTP Green Italiano più da vicino

Durante il processo di strutturazione del quadro di riferimento dei BTP “Green”, il MEF è stato supportato da due banche selezionate tra gli Specialisti in titoli di Stato in veste di “structuring advisors”: Crédit Agricole Corp. Inv. Bank e Intesa Sanpaolo S.p.A. Inoltre, la documentazione è stata sottoposta a una secondo parere indipendente da parte di Vigeo Eiris [5] che ha assegnato un giudizio “Advanced”.

Oltre alle direttive ICMA, il prodotto finanziario proposto cerca di allinearsi il più possibile alla bozza “EU Green Bond Standards”, attualmente sui tavoli di discussione dell’Unione Europea. I fondi raccolti verranno utilizzati dallo stato italiano per contribuire alla realizzazione di vari obiettivi ambientali in linea con la tassonomia europea delle attività sostenibili (processo di “positive screening”) come mitigazione dei cambiamenti climatici, uso sostenibile e protezione delle risorse idriche, transizione verso un’economia circolare, protezione e ripristino della biodiversità. Tutte queste attività saranno in linea con molteplici obiettivi dell’Agenda 2030 dell’Onu (SDGS – Sustainable Development Goals) [6], sottoscritta anche dall’Italia il 25 settembre 2015.

Nel Documento redatto dal MEF sono esplicitate inoltre tutte quelle spese che non potranno in alcun modo essere finanziate con i soldi raccolti dai “Green Bond” (processo di “negative screening”) come estrazione e lavorazione di combustibili fossili, fissione nucleare, lavorazione e produzione di bevande alcoliche, contratti militari o di produzione di armi e altre attività tipicamente escluse da investimenti ESG.

Infine, per garantire gli standard ICMA per i “Green Bond”, verranno rese pubbliche con frequenza annuale le rendicontazioni denominate “Italian Sovereign Green Bond Allocation and Impact Report” che serviranno agli investitori per conoscere nel dettaglio come verranno spesi i propri soldi investiti. Tale rapporto includerà lo stato di avanzamento di emissione dei titoli green e conterrà una scheda sulla realizzazione dei progetti finanziati. Prima della pubblicazione, tale rapporto verrà inoltre verificato e vagliato da un organismo indipendente.

4. La prima tranche di emissioni: 3 Marzo 2021

A distanza di una settimana dal Comunicato Stampa N. 35, il MEF ha annunciato nelle giornate del 3 e 4 Marzo (rispettivamente [7] e [8]) i primi risultati dell’emissione e del collocamento del BTP “Green”. Nei comunicati stampa si legge che il primo titolo statale “Green” italiano avrà scadenza 30 aprile 2045 e cedola annua dell’1.50% pagato in due cedole semestrali (Codice ISIN IT0005438004). Il titolo è stato collocato al prezzo di 99.168 corrispondente ad un rendimento lordo annuo all’emissione dello 1.547%.

All’operazione hanno partecipato 530 investitori per una domanda totale di oltre 80 miliardi di euro, stabilendo il record di richieste nelle emissioni inaugurali di “Green Bond” sovrani nel vecchio continente. Complessivamente ai “fund manager” (investitori ESG) è stata allocata oltre la metà del collocamento (53.1%) mentre le banche ne hanno sottoscritto il 18.5%. Il 24.3% è stato acquistato da investitori di lungo periodo (fondi pensione, assicurazioni, banche centrali ed istituzioni governative) e agli “hedge fund” è stato allocato circa il 3.6%. Il restante 0.5% è stato acquistato dalle imprese non finanziarie.

Guardando alla distribuzione geografica del titolo si nota come la partecipazione sia stata per gran parte di investitori esteri (circa il 73.7%) coinvolgendo oltre 40 paesi. I maggiori sottoscrittori sono stati Regno Unito (circa il 22.1%), e Germania, Austria e Svizzera (19.9%).

Il collocamento è stato effettuato tramite la costituzione di un sindacato composto da BNP Paribas, Crédit Agricole Corp. Inv. Bank, Intesa Sanpaolo S.p.A., J.P. Morgan AG e NatWest Markets N.V., che hanno vestito il ruolo di “lead manager”.

La transizione sostenibile è un processo politico, sociale nonché economico e per attuarla sono necessari ingenti finanziamenti. Il “Green bond” è una delle risorse che lo stato possiede per finanziare questo cambiamento e per dare la possibilità di “fare bene mentre si fa del bene” (“doing well while doing good”). Quanto durerà questa risposta positiva ai prodotti finanziari green e riusciranno questi ultimi a dare l’impulso necessario alla transizione sostenibile?

[1] Comunicato Stampa MEF N. 35:

https://www.mef.gov.it/ufficio-stampa/comunicati/2021/documenti/comunicato_0035.pdf

[2] Green Bond Framework:

[3] SEB, “The Green Bond: Your insight into sustainable finance”:

[4] ICMA Green Bond Principles

[5] Second Party opinion di Vigeo Eiris

https://www.mef.gov.it/focus/documenti/btp_green/20210224_V.E_SPO_Italia_VF.PDF

[6] ONU, Agenda 2030:

https://unric.org/it/wp-content/uploads/sites/3/2019/11/Agenda-2030-Onu-italia.pdf

[7] Comunicato Stampa MEF N. 39

https://www.mef.gov.it/ufficio-stampa/comunicati/2021/Risultati-dellemissione-del-primo-BTP-Green/

[8] Comunicato Stampa MEF N. 40

https://www.mef.gov.it/ufficio-stampa/comunicati/2021/Dettagli-del-collocamento-del-primo-BTP-Green/

Banca d’Italia ha pubblicato il nuovo codice deontologico per i componenti degli organi delle procedure di gestione delle crisi (gestione provvisoria, amministrazione straordinaria, liquidazione coatta amministrativa) delle banche e degli altri intermediari sottoposti a vigilanza…

Nvidia is also launching Cryptocurrency Mining Processors (CMP) specifically for Ethereum miners…

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has written to the European Commission (EC) with its proposals to improve the Transparency Directive (TD) following the Wirecard case…

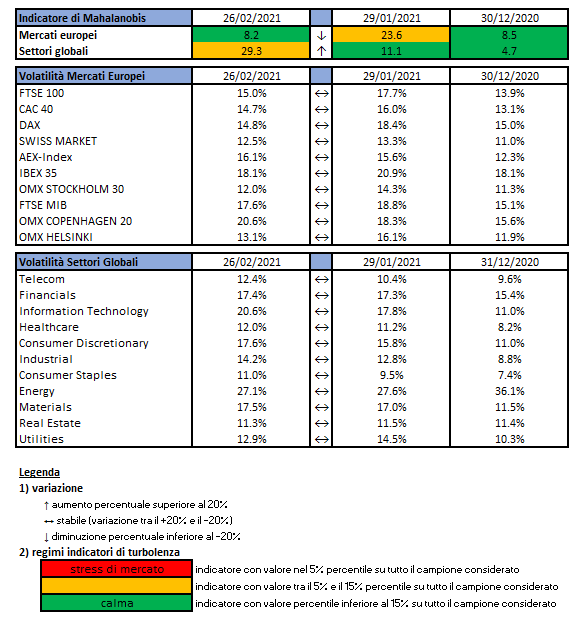

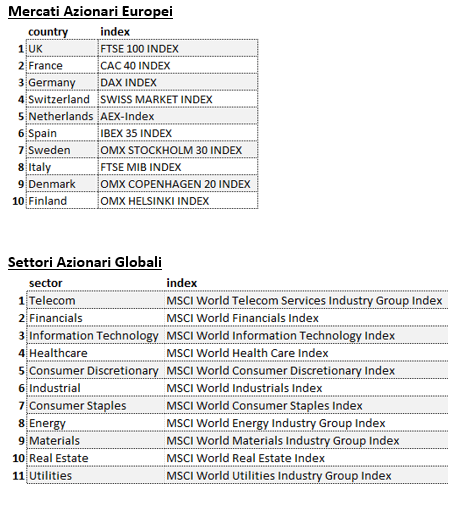

L’indicatore di Mahalanobis permette di evidenziare periodi di stress nei mercati finanziari. Si tratta di un indicatore che dipende dalle volatilità e dalle correlazioni di un particolare universo investimenti preso ad esame. Nello specifico ci siamo occupati dei mercati azionari europei e dei settori azionari globali.

Gli indici utilizzati sono:

Le volatilità riportate sono storiche e calcolate sugli ultimi 30 trading days disponibili. Per ogni asset-class dunque sono prima calcolati i rendimenti logaritmici dei prezzi degli indici di riferimento, successivamente si procede col calcolo della deviazione standard dei rendimenti, ed infine si procede a moltiplicare la deviazione standard per il fattore di annualizzazione.

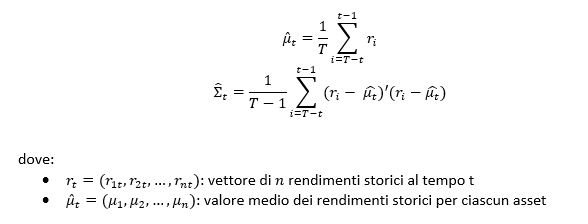

Per il calcolo della distanza di Mahalnobis si procede dapprima con la stima della matrice di covarianza tra le asset-class. Si considera l’approccio delle finestre mobili. Come con la volatilità, si procede prima con il calcolo dei rendimenti logaritmici e poi con la stima storica della matrice di covarianza, come riportato di seguito.

Supponendo una finestra mobile di T periodi, viene calcolato il valore medio e la matrice varianza covarianza al tempo t come segue:

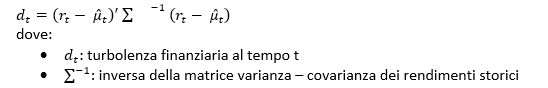

La distanza di Mahalanobis è definita formalmente come:

Le parametrizzazioni che sono state scelte sono:

Le statistiche percentili sono state calcolate a partire dalla distribuzione dell’indicatore di Mahalanobis dal Dicembre 1997 al Dicembre 2019 su rilevazioni mensili.

Ulteriori dettagli sono riportati in questo articolo.

Disclaimer: Le informazioni contenute in questa pagina sono esclusivamente a scopo informativo e per uso personale. Le informazioni possono essere modificate da finriskalert.it in qualsiasi momento e senza preavviso. Finriskalert.it non può fornire alcuna garanzia in merito all’affidabilità, completezza, esattezza ed attualità dei dati riportati e, pertanto, non assume alcuna responsabilità per qualsiasi danno legato all’uso, proprio o improprio delle informazioni contenute in questa pagina. I contenuti presenti in questa pagina non devono in alcun modo essere intesi come consigli finanziari, economici, giuridici, fiscali o di altra natura e nessuna decisione d’investimento o qualsiasi altra decisione deve essere presa unicamente sulla base di questi dati.

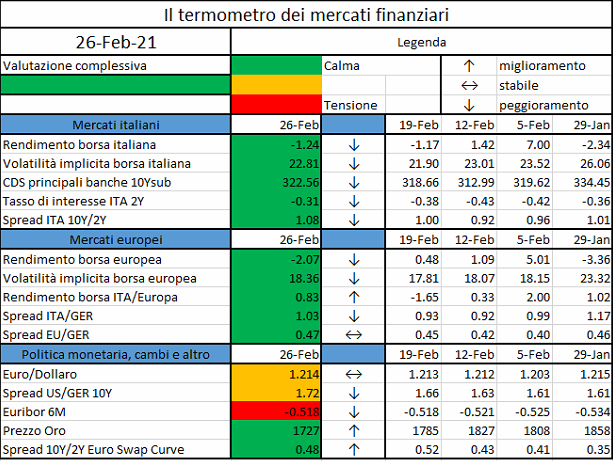

L’iniziativa di Finriskalert.it “Il termometro dei mercati finanziari” vuole presentare un indicatore settimanale sul grado di turbolenza/tensione dei mercati finanziari, con particolare attenzione all’Italia.

Significato degli indicatori

I colori sono assegnati in un’ottica VaR: se il valore riportato è superiore (inferiore) al quantile al 15%, il colore utilizzato è l’arancione. Se il valore riportato è superiore (inferiore) al quantile al 5% il colore utilizzato è il rosso. La banda (verso l’alto o verso il basso) viene selezionata, a seconda dell’indicatore, nella direzione dell’instabilità del mercato. I quantili vengono ricostruiti prendendo la serie storica di un anno di osservazioni: ad esempio, un valore in una casella rossa significa che appartiene al 5% dei valori meno positivi riscontrati nell’ultimo anno. Per le prime tre voci della sezione “Politica Monetaria”, le bande per definire il colore sono simmetriche (valori in positivo e in negativo). I dati riportati provengono dal database Thomson Reuters. Infine, la tendenza mostra la dinamica in atto e viene rappresentata dalle frecce: ↑,↓, ↔ indicano rispettivamente miglioramento, peggioramento, stabilità rispetto alla rilevazione precedente.

Disclaimer: Le informazioni contenute in questa pagina sono esclusivamente a scopo informativo e per uso personale. Le informazioni possono essere modificate da finriskalert.it in qualsiasi momento e senza preavviso. Finriskalert.it non può fornire alcuna garanzia in merito all’affidabilità, completezza, esattezza ed attualità dei dati riportati e, pertanto, non assume alcuna responsabilità per qualsiasi danno legato all’uso, proprio o improprio delle informazioni contenute in questa pagina. I contenuti presenti in questa pagina non devono in alcun modo essere intesi come consigli finanziari, economici, giuridici, fiscali o di altra natura e nessuna decisione d’investimento o qualsiasi altra decisione deve essere presa unicamente sulla base di questi dati.

Se diamo un’occhiata a diverse metriche, il fintech sta continuando a crescere: numeri e volumi di investimenti, clienti, ricavi, fusioni e acquisizioni aziendali. Anche l’ultimo report dell’Osservatorio Crowdinvesting del Politecnico di Milano ha registrato una crescita dei verticali che seguono (equity crowdfunding, lending crowdfunding e crowdfunding nel real estate): gli ultimi 12 mesi hanno confermato e rafforzato la forte crescita dell’industria. Al 30 giugno 2020, l’equity crowdfunding è arrivato a € 159 milioni raccolti (il dato del 2019 si è fermato a circa la metà, € 82 milioni), mentre il lending è arrivato a ben € 749 milioni (nel 2019 era € 435 milioni).

Anche il numero di persone che lavorano nel fintech è cresciuto in modo importante negli ultimi anni. Quando le persone iniziano a guardare al fintech come settore dove poter sviluppare la propria carriera o reindirizzare la propria carriera, spesso ci contattano e ci chiedono: dove posso trovare maggiori informazioni per orientarmi?

A questa domanda, possono esserci molte risposte. Anche sul mercato italiano sono disponibili diverse newsletter che trattano il fintech. Alcuni substacks, molti gruppi di Clubhouse e podcast cercano di coprire i diversi argomenti e approfondimenti sui prodotti e le notizie settimanali per contestualizzare il fintech in modo più ampio.

“Con la crescita delle realtà fintech, per banche e assicurazioni diventa necessario formare o assumere figure professionali capaci di dialogare e collaborare in un mercato sempre più digitale, dove consumatori e imprese si aspettano di vivere un’esperienza utente che eguagli o ecceda l’esperienza che già vivono attraverso altri servizi online”, affermano Fabrizio Villani e Giancarlo Giudici, autori di “Fintech Expert. Contro il logorio della banca moderna”, pubblicato dalla FrancoAngeli all’interno della collana “Professioni Digitali”.

Nella guida anche una selezione delle professioni più interessanti in ambito fintech, quelle che hanno il più alto disallineamento tra domanda delle imprese e offerta lavorativa: sviluppatore blockchain, sviluppatore di app, analista finanziario, UX designer, compliance manager, esperto di sicurezza informatica, analista quantitativo, data analyst e data scientist.

“Oltre alle soft skill (risolvere problemi, gestire lo stress, saper lavorare in gruppo, essere flessibili e dotati di spirito di adattamento…), anche le conoscenze delle lingue e le competenze digitali sono importanti” aggiungono gli autori.

Per ogni professione vengono definite attitudini, descritto il mercato del lavoro e forniti link utili per la formazione in modo da acquisire le competenze (soft e hard skills) necessarie per poter sviluppare o riorientare la propria carriera verso quella determinata professione. Il libro vede i contributi della Vice Direttrice Generale di Banca d’Italia Dott.ssa Alessandra Perrazzelli, Demetrio Migliorati, Innovation Manager & Head of Blockchain Program di Banca Mediolanum, Francesca Bartolino, Senior Marketing e Communication Specialist di N26, Dario Lo Buglio, Security Researcher di OpenZeppelin, Mattia Ciprian, Cofondatore e Presidente di modefinance, Claudio Bedino, Cofounder di Starteed e Oval, Tommaso Baldissera Pacchetti, CEO e cofounder di CrowdFundMe S.p.A. e Emanuela Campari Bernacchi e Valentina Lattanzi Partner dello Studio legale Gattai, Minoli, Agostinelli & Partners.

Per stimolare e ispirare chi non trova lavoro o desidera cambiarlo, nel volume è presente anche una serie di interviste a professionisti di successo: imprenditori, esperti di blockchain, analisti quantitativi, etc.

“In uno scenario in cui l’Italia ha bisogno di accelerare nel mercato internazionale e sta puntando sulle nuove tecnologie digitali, basti pensare alle discussioni che si sono avute negli scorsi mesi sul cashback e la lotta al contante, una guida come questa era necessaria – concludono gli autori – il fintech è in crescita e le imprese hanno certamente colto questo nuovo impulso, arrivato dai consumatori e da una domanda collettiva, investendo in competenze digitali e finanza digitale, un settore in cui è necessario indirizzare e coltivare le competenze”.

The European Insurance and Occupational Pensions Authority (EIOPA) identified business model sustainability and adequate product design as two Union-wide strategic supervisory priorities relevant for national competent authorities (NCAs)…

L’ESMA ha pubblicato delle Linee guida funzionali a garantire uniformità nel processo di riesame e valutazione da parte delle autorità di vigilanza competenti previsto dall’art. 21 comma 1 del Regolamento (UE) 648/2012 (EMIR)…