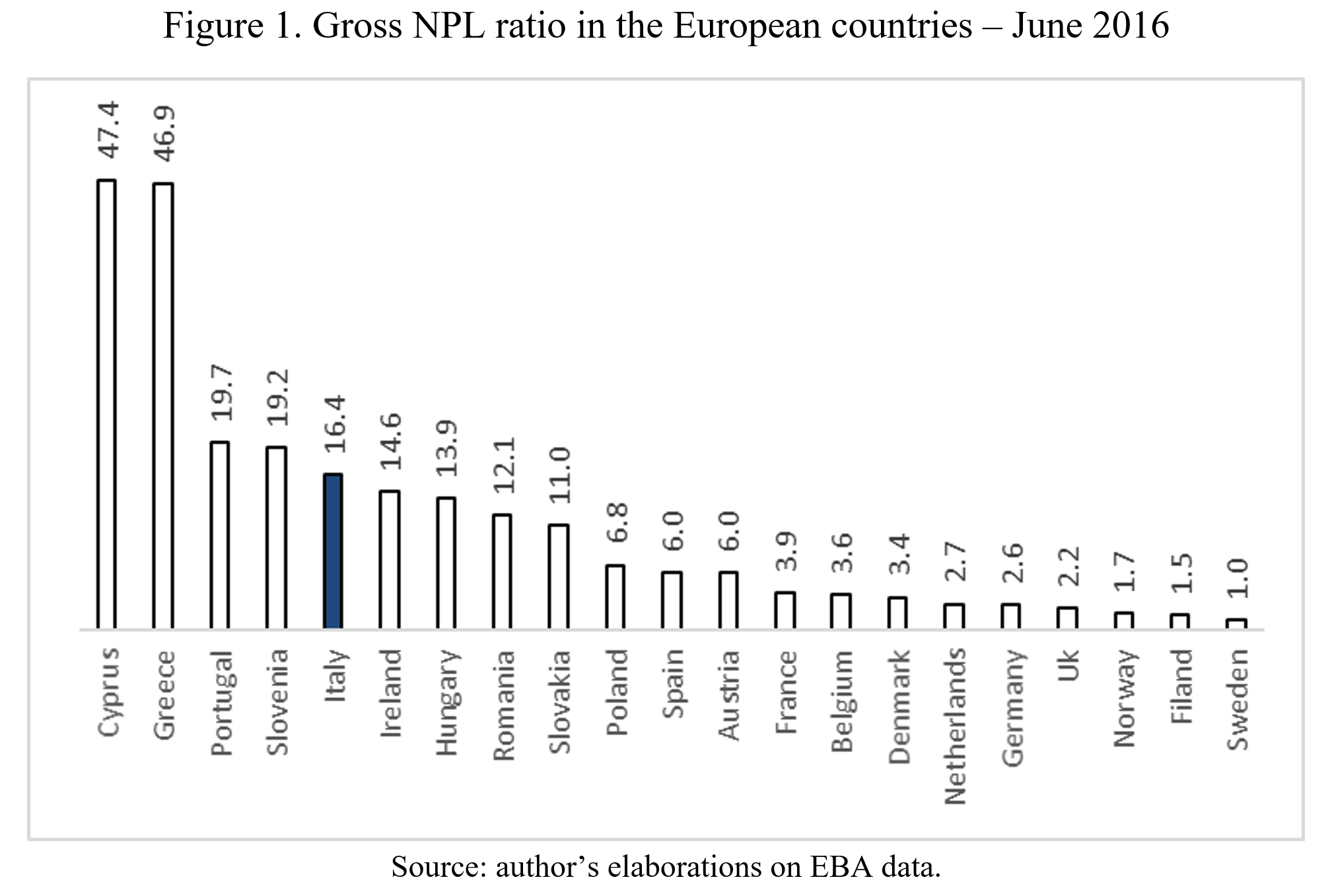

After the international financial crisis of 2007–08, the consequent economic collapse in the advanced economies and the financial turbulence in the Euro area, non-performing loans (NPLs) reached high levels in Europe. The gross amount of NPLs in the European Union was around €1.0 trillion at the end of 2016. Based on European Banking Authority’s (EBA) data, the gross NPL ratio – that is the ratio between NPLs and total loans (performing and non-performing), where both numerator and denominator are not adjusted for provisions – is close to 50% in Cyprus and Greece in June 2016 (Figure 1). In Portugal and Slovenia, it is close to 20%, while in Italy it is 16.4%. High NPL levels are present also in Ireland, Hungary, Romania and Slovakia. However, due to the larger size of the Italian banking system compared to the other distressed market, 25% of the Euro area NPLs are concentrated in Italy (Italy represented 16% of the Eurozone GDP in 2016). At the end of 2016, the Italian gross NPLs were equal to around €325 billion, of which €200 billion were bad debts (firms represented 77% of bad debts).

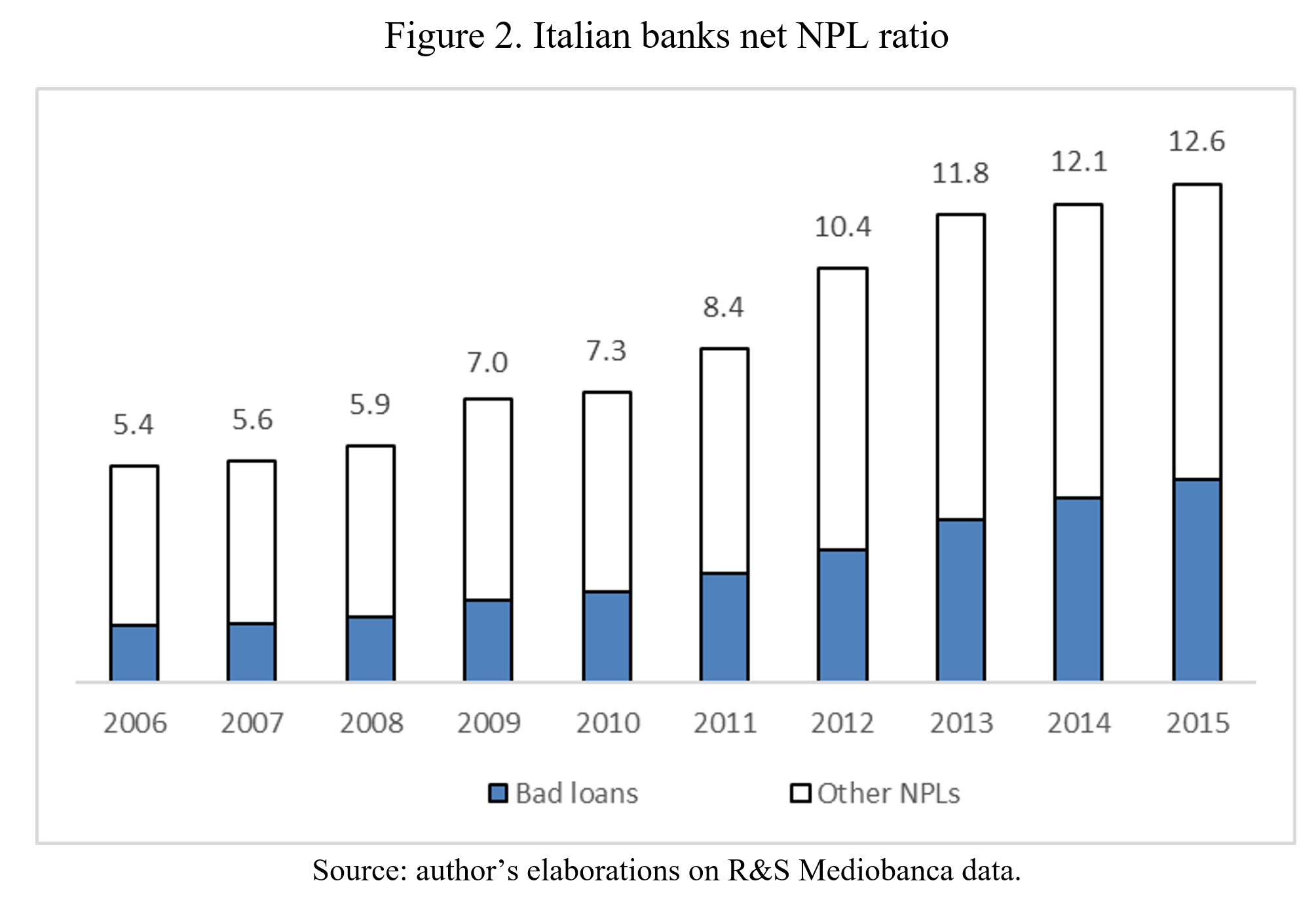

The Italian net NPL ratio – defined as the ratio between NPLs plus provisions and total loans plus provisions – showed an increase in the period between 2006 and 2015. It moved from 5.4% to 12.6% based on R&S Mediobanca data (Figure 2). The growth involved bad loans and the other form of NPLs (substandard, past due and restructured loans).

NPLs have relevant implications on the macroeconomic and financial side. A high level of NPLs is a signal of an excessive leveraged non-financial sector, thus also economic growth could be negatively affected. Moreover, banks are less inclined to grant more loans when they have to deal with a high level of NPLs, with a consequence of further damage on the real economy through credit crunch (Bernanke and Gertler 1989, Bernanke et al. 1999). On the financial side, NPLs affect the resilience of the banking sector, increasing the risk of financial instability.

In a recent working paper (Milani, 2017), I evaluate the effect of macroeconomic and bank-specific determinants of NPLs during a very turbulent period for Italy.

I use data from R&S Mediabanca, which includes all banks operating in Italy over the period 2006-2015 with at least €50 million of total assets. My annual based data set includes 482 juridical different commercial banks. Taking into account 2015, these banks represent 85.4% of the Italian credit market and they have more than 28,000 branches (94.8% of the total). This high-quality and high-representative data set allows me to test several factors that theoretical and empirical literature indicate as having a potential impact on NPLs (see Louzis et al., 2012).

I find evidence in favor of the too-big-too-fail (TBTF) hypothesis. In other words, very big banks, those with a market share in term of total assets at least equal to 0.96%, show that leveraging tends to significantly increase net NPLs. Moreover, I find robust evidence in favor of the ‘moral hazard’ and the ‘bad management’ hypotheses, both for TBTF and small-enough-to-fail (SETF) banks. This result signals that bank managers have a relevant role in the increase in net NPLs after the international financial crisis due to their risk-loving approach and their unsatisfactory management quality.

On the other hand, bank size has a relevant effect on the ‘diversification’ and ‘procyclical credit policy’ hypotheses. I find that diversification helps in the management of credit portfolio only when large banks are considered. For the sample of banks small-enough-to-fail it seems that the higher complexity overrides diversification benefits. Furthermore, to avoid losing private information on their customers, small banks seem to renovate and/or renegotiate existing loans to low quality borrowers. However, such a strategy compromises loan quality in the long-run.

Furthermore, I find robust evidence in favor of the ‘relationship lending’ hypothesis, both for the overall sample and for SETF banks. In the middle of financial turmoil, banks that apply a higher level of automatization in the underwriting procedures show worse performance in terms of NPLs.

I also find robust evidence in favor of the ‘cooperative banks’ hypothesis. Banks that are organized as cooperative seem to take fewer risks. Independent cooperative/mutual banks, which based their loan strategy on soft information, anticipating their difficulty to raise funds during a financial crisis, seem to adopt a more risk-averse approach.

Finally, macroeconomic explanatory variables do not seem to have a significant impact on net NPLs in Italy. More specifically, I do not find robust evidence in favor of the ‘sovereign debt’ hypothesis. A high level of public debt does not seem to impact net NPLs when a measure of leveraging is included in the estimations. I interpret this result as evidence that the sovereign risk affects only leveraged banks.

My results have important policy implications. First of all, since the macroeconomic variables for a big economy like Italy have no relevant effect on net NPLs, expected benefits from macro prudential policy are low. ‘Lean against the wind’ (Borio and Lowe 2002) is not enough to prevent financial imbalance. Only bank-based supervision can limit risk-lover behavior and bad management choices (Arpa et al. 2001). Moreover, after the financial crisis, bank supervision has mainly focused on large banks, as also remarked by the European Single Supervisory Mechanism which involves only the 120 biggest banks operating in Europe. If the too-big-to-fail problem is an issue for financial stability, small banks could also bring instability in the long-run, mainly through their procyclical credit policy.

References

- Arpa, M., Giulini, I., Ittner, A., and Pauer, F. The influence of macroeconomic developments on Austrian banks: implications for banking supervision. BIS Papers, 2001, 1, 91–116.

- Bernanke, B., Gertler, M. Agency costs, net worth, and business fluctuations. American Economic Review, 1989, 79, 14–31.

- Bernanke, B., Gertler, M., and Gilchrist, S. The financial accelerator in a quantitative business cycle framework. Handbook of Macroeconomics, 1999, 1, 1341–1393.

- Borio, C. and Lowe, P. Asset prices, financial and monetary stability: exploring the nexus. BIS Working Papers 114, 2002.

- Louzis, D. P., Vouldis, A. T. and Metaxas, V. L. Macroeconomic and bank-specific determinants of non-performing loans in Greece: A comparative study of mortgage, business and consumer loan portfolios. Journal of Banking and Finance, 2012, 36, 1012-1027.

- Milani, Carlo, What Factors Affect Non-Performing Loans During Macroeconomic and Financial Turbulence? Evidence from Italy, 2017. Available at SSRN: https://ssrn.com/abstract=3056189