The European Banking Authority (EBA) published the complete report for the Credit Value Adjustment (CVA) risk monitoring exercise. The exercise asseses the impact on own funds requirements of the reintegration of the transactions currently exempted from the scope of the CVA risk charge. The results, in line with those of the previous monitoring exercise, continue to show the materiality of CVA risks that are currently not capitalised due to the CRR exemptions.

The Monetary and Economic Department of the Bank of International Settlement (BIS) published a working paper assessing the issue of conducting a wise monetary policy in emerging countries. In particular, the focus is whether central banks in emerging markets should take systemic risk into account when making monetary policy decisions.

Since the Great Financial Crisis of 2007-09, policymakers needed to address financial risk concerns. Some commentators suggest that central banks should take account of financial risk in setting the policy rate. In particular, they propose “leaning against the wind”, by which central banks should raise interest rates when financial imbalances accumulate.

Research on “leaning against the wind” has concentrated on the experience of advanced economies. Little is known about the advisability of such policies in emerging markets, where capital flows are important contributors to financial imbalances. Results show that, in emerging markets, “leaning against the wind” considerations for conducting monetary policy are weakened. Higher interest rates attract additional capital flows, which in turn fuel domestic credit growth and the accumulation of financial imbalances.

Financial and price stability in emerging markets: the role of the interest rate (PDF)

No free lunch. A catchphrase to express that it is impossible to get something for nothing, or, in other words, that the investors are not able to make large profits without bearing the risk of a potential loss.

Partial information surrounded by loose comments may be deceiving and together with trust and lack of time, can influence people in taking decisions without really knowing all the implications. This article provides a practical example of how this can happen.

I was holding my smartphone and when opening the browser some news popped up (politics, science, music, …): one captured my attention – the launch of a very promising financial product. The article (http://www.websimaction.it/?p=19416) reports:

- for the investor looking for home court advantages, with a low risk product

- if none of the three underlying will lose more than 50% in the next five years, the investment will end with a yearly return of 8.4%

- the three underlying are Italian firms: two protagonists of the Italian history with great possibilities of performing well, and the other with earnings doubled in the last five years.

These biased news are accompanied by optimistic comments on the Italian politics (no longer under the microscope of the markets), on the BTP spreads (lower than in the past) and on the good economic conditions and GDP estimate. Few other information regarding the real structure of the payments (coupons and notional) are reported only at the end of a quite long text, lacking important details.

A distracted reader would conclude that this is an opportunity not to lose. But how does this instrument work in truth?

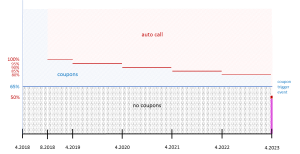

The investment was issued last March 2018 at 1000€ (notional), with maturity set at April 2023; the contract can end before (auto-call event), subject to a certain rule that varies over time; the coupons payments are conditioned to another rule (coupon trigger event). The following chart shows the possible outcomes as different portions of the space. The x-axis reports the time passing and the y-axis indicates different level of the worst underlying compared to its initial value (please note that as the rules are defined on conditions concerning all the three underlying simultaneously, the trigger conditions are activated by the worse one, that can change over time)

- coupons: every month the prices of the underlying are compared to their threshold (65% of the prices at the issue date): if all the prices are higher than their thresholds, a coupon of 7,25€ (i.e. 8.7% annual yield) is paid; otherwise the contract goes on till the next “monitoring date” (once a month). The unpaid coupons can still be cashed in the first monitoring data when all the prices are higher than their thresholds, till the contract is in place (i.e. not auto-called)

- notional:

- [April 2018; August 2018] in the first semester, the auto call option is not in place;

- [September 2018; March 2019] if all the prices are higher than the prices at the issue date (auto-call level of 100%), the notional is paid back and the contract ends;

- [April 2019; April 2022] the auto-call level is regularly updated every 12 months, defined as a decreasing percentage of the price at the issue date (95%, 90%, 85%, 80% till March 2023);

- at maturity (April 2023, last monitoring date), the notional is either totally reimbursed (when all the prices of all the three underlying are higher than 50% of their values at the issue date) or partially reimbursed, with a quota corresponding to that of the worst performing underlying (i.e. <50%).

This is not exactly what one would expect given the very promising description reported above. This structure indeed implies two outcomes that may not have been that clear:

- [auto-call event] if the three assets do not lose value in the first semester, the extraordinary yield of 8.7% is paid for 6 months only then and the contract ends (maybe the investor wanted to invest its money for a 5-years horizon). In general, the probability of auto-call (red area) increases over time, reducing the probability of the coupons to be paid (blue area);

- [reduced notional / lost coupons] if at least one of the three assets performs bad at all the monitoring dates, showing a price lower than 65% of its initial value, no coupons are paid in the next five years and, at maturity, there are three possible scenarios:

- price >65%: missed coupons refunded, notional entirely paid;

- 50% < price <=65%: missed coupons lost, notional entirely paid;

- price <= 50%: missed coupons lost, notional reduced.

Differently from what commented by the author of the article I happened to read, this does not seem a riskless product (although the definition of “risk” is subjective): the historical prices and correlations of the three underlying imply a probability of receiving a notional more than halved of around 27%; it is also worth recalling that the probability of an event (>50%) to happen simultaneously to all the three underlying is significantly lower than the probability of the same event to happen to any of the underlying: it’s the intersection of the Euler-Venn diagram. The next chart shows how the values of the three underlying have been changing over 26 months preceding the issue date and an illustration of the Eulero-Venn diagram, where the areas do not correspond to the real probabilities (i.e. given an area of the rectangle, Universe set, equal 100%, the area of the intersection of the three sets does not indicate the true probability of the event)

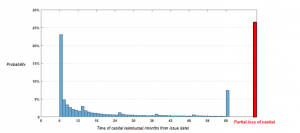

Based on the historical volatilities of the log-returns of the prices of the three underlying and their historical correlation, I’ve run a simulation to quantify the probability of the notional to be paid back at different monitoring dates (auto call events) and at maturity:

- during the first 6 months, the probability is 0, as there is no auto-call event in place

- at T=6, the probability rockets to 23%

- the probability then decreases over time, showing local peaks in correspondence of the auto-call level resetting (the cumulated probability of the contract to end within a year is around 39%)

- the probability of the contract to last till the original maturity (T=60) is 34%, of which 7% corresponds to the case where the notional is entirely paid back and 27% corresponds to the event that the notional is just partially reimbursed (red bar).

This analysis also provides an estimate of the expected coupon the investors are going to receiving on average: the expected yearly rate is high (6.97% out of the maximum advertised of 8.70%), but is expected to be paid for a limited period (until the auto-call event). It is important to bear in mind that all the “missed” coupons are refunded the first time that the coupon trigger event is actioned.

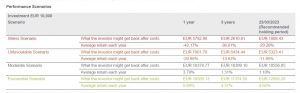

As commented above, the definition of risk is subjective and not straightforward. To help investors is assessing the risk, the costs and the expected performance of different investment products (PRIIPs[1]), a new Key Information Document was introduced since January 2018. The KID of this product shows the following:

- the Risk Indicator is 5 out of 7, i.e. “medium-high risk”

- the average annual return at the Recommend Holding Period (5 years) is 4.92% in the favorable scenario, 1.10% in the moderate scenario and -11.95% in the unfavorable scenario (these values have been probably calculated as an average return on a five years horizon, when the contract is likely to auto-call much before)

References

[1] Dall’Acqua Silvia, KIDs for PRIIPs ESAs, https://www.finriskalert.it/?p=4275

Particularly, a growing number of issues related to cross-border business activities was detected, as a consequence of the ‘freedom to provide services’. Under the Solvency II Directive, once authorised by the home national supervisory authority, insurance and reinsurance undertakings have the right to establish a branch within the territory of another Member State (known as freedom of establishment) or may pursue their business in another Member State (known as the freedom to provide services) without any further authorisation.

To enhance cooperation and communication between supervisory authorities in such situations, EIOPA rolled out cooperation platforms, a new and important tool that facilitates stronger and timely cooperation between national supervisors in the assessment of the impact of cross-border activities and identification of preventive measures. By the close of 2017, nine cooperation platforms were operational, and the benefits of these platforms have been identified for both home and host supervisors.

Furthermore, a wide range of tools such as balance sheet reviews, peer reviews, consistency projects on internal models, participation in meetings of colleges and bilateral engagements with national supervisory authorities continued to be used to enhance the supervisory capacity of national supervisors. F

This year, in the field of oversight, EIOPA will pay specific attention to further implementation of prudential regulation, Solvency II, and conduct of business supervision. In particular, EIOPA will continue to focus on the close interaction with national supervisory authorities, improvements in supervisory practices in the authorisation process and supporting reviews of business models to detect those models posing material prudential or conduct risk.

The Financial Stability Board (FSB) released a toolkit that firms and supervisors can use to mitigate misconduct risk. The FSB’s work in this area follows widespread misconduct in the financial sector including the manipulation of wholesale markets and retail misselling. Such misconduct in the financial sector on a broad scale creates mistrust, weakening the ability of the markets to allocate capital to the real economy, which in turn may give rise to systemic risks.

Mitigating misconduct risk requires a multifaceted approach. The report identifies 19 tools that firms and supervisors could use to address the three main issues identified by the FSB as part of its earlier work on misconduct, namely:

- Mitigating cultural drivers of misconduct – including tools to effectively develop and communicate strategies for reducing misconduct in firms and for authorities to effectively supervise such approaches.

- Strengthening individual responsibility and accountability – including tools that seek to identify key responsibilities and functions in a firm, and assign them to individuals to promote accountability and increase transparency.

- Addressing the “rolling bad apples” phenomenon – including tools to improve interview processes and onboarding of new employees and for regular updates to background checks to avoid hiring individuals with a history of misconduct.

The toolkit provides a set of options based on the shared experience and diversity of perspective of FSB members in dealing with misconduct issues.

Banca d’Italia ha pubblicato il primo rapporto sulla stabilità finanziaria 2018, che include anche l’andamento del mercato assicurativo. In sintesi, i rischi per la stabilità finanziaria appaiono mitigati dalla crescita robusta dell’economia globale e dal rafforzamento del settore bancario nell’area Euro.

I rischi connessi con l’uscita del Regno Unito dalla Unione Europea si sono attenuati a seguito dell’intesa su un periodo

di transizione, anche se rimangono incertezze sulla ratifica dell’accordo e sul futuro assetto per l’accesso a infrastrutture e mercati finanziari.

In Italia l’impatto sul costo medio dei titoli di Stato di un eventuale rialzo dei tassi di interesse sarebbe attenuato dalla loro lunga vita residua. L’alto livello del debito pubblico rende tuttavia l’economia italiana vulnerabile a forti tensioni

sui mercati finanziari e a revisioni al ribasso delle prospettive di crescita.

La situazione finanziaria delle famiglie italiane è solida. L’indebitamento è contenuto; la crescita del reddito disponibile e i bassi tassi di interesse ne favoriscono la sostenibilità. La ripresa economica sostiene la redditività delle imprese e ne attenua la vulnerabilità. Permangono però aree di fragilità tra le piccole e medie imprese e nel settore delle costruzioni, caratterizzato da un indebitamento elevato e da livelli di attività ancora contenuti.

La qualità del credito bancario continua invece a migliorare. I flussi di nuovi prestiti deteriorati sono sui livelli precedenti la crisi finanziaria. Il peso dei crediti deteriorati nei bilanci degli intermediari è in forte riduzione, soprattutto per le banche che

hanno effettuato ingenti operazioni di cessione.

Il completamento di alcuni aumenti di capitale ha ridotto il divario in termini di patrimonializzazione rispetto alla media degli altri paesi europei. La redditività delle banche sta aumentando, ma rimane molto bassa per numerosi intermediari di piccola e media dimensione. La necessità di ampliare i ricavi e di ridurre i costi operativi è accentuata dall’imminente introduzione del

requisito MREL, che potrebbe determinare incrementi rilevanti del costo della raccolta.

Gli indici di solvibilità delle assicurazioni italiane sono aumentati. L’impatto del periodo di bassi tassi di interesse sulle compagnie italiane è stato meno pronunciato che in altri paesi. Prosegue la diversificazione degli investimenti

finanziari, ma le compagnie restano esposte ai rischi connessi con l’eventuale acuirsi di tensioni sui mercati del debito sovrano.

La crescita sostenuta del risparmio gestito contiene invece i rischi per la stabilità finanziaria, a causa del buon allineamento tra la liquidità dell’attivo e del passivo dei fondi comuni e della ridotta dimensione di quelli caratterizzati da un’elevata leva finanziaria

The Bank of International Settlement (BIS) published today a report on FinTech credit, that is, credit activity facilitated by electronic platforms such as peer-to-peer lenders. The report aims at shed light on the significant uncertainty as to how FinTech credit markets will develop and how they will affect the nature of credit provision and the traditional banking

sector.

The study draws on public sources and ongoing work in member institutions to analyse the functioning of FinTech credit markets, including the size, growth and nature of activities. It also assesses the potential microfinancial benefits and risks of these activities, andconsiders the possible implications for financial stability in the event that FinTech credit should

grow to account for a significant share of overall credit.

Conduct and prudential regulatory policies in selected countries are also outlined. The report provides several key messages. The nature of FinTech credit activity varies significantly across and within countries, due to heterogeneity in the business models of FinTech credit platforms. Although FinTech credit markets have expanded at a fast pace over recent years, they currently remain small in size relative to credit extended by traditional intermediaries.

A bigger share of FinTech-facilitated credit in the financial system could have both financial stability benefits and risks in the future, including access to alternative funding sources in the economy and efficiency pressures on incumbent banks, but also the potential for weaker lending standards and more procyclical credit provision in the economy.

The emergence of FinTech credit markets poses challenges for policymakers in monitoring and regulating such activity. Having good-quality data will be key as these markets develop.

Fintech Credit: Market structure, business models and financial stability implications (PDF)

A new context brings new challenges

.The increasing levels of regulation and more challenging regulatory expectations are having significant operational impacts on firms requiring people, process and technology based solutions.

In respect of new legislation and regulation this can create challenges around understanding, implementing and embedding the new requirements whereas for existing legislation there can be challenges around understanding and managing the risks.

In addition, as EBA suggests in its recent paper on FinTech topic, the evolving nature of technological innovation will require a new regulatory and supervisory approach that should have such characteristics as:

- Risk Based, expanding the regulatory perimeter to include activities and risks regardless the new FinTech business

- Flexible and principles-based, maintaining a forward-looking approach as new technologies change quickly and continuously

- Holistic in Nature, increasing the focus to policy issues that are not traditionally associated with financial sector supervision, such as cybersecurity, data use and privacy (stronger coordination with non-financial regulators)

- Cross-Border, ensuring international cooperation

This, however, needs to be part of an overall, cross-sectoral approach, drawing from the other EU financial authorities from the securities, insurance, and other financial areas (including ESMA and EIOPA), with the strongly international coordination led by the Financial Stability Board (FSB).

Organizations need to solve complex compliance challenges in light of this changing landscape, such as linking compliance to strategy, managing regulators and compliance operations, and navigating the compliance technology ecosystem. In particular, a snapshot of the main challenges in these different areas is listed below:

Regulators

- Responding to new regulations

- Higher regulatory scrutiny

- Influencing regulators to enable innovation

- Brand and reputation risks of non-compliance

Strategy

- Creating a compelling business case for change

- Driving strategic decision making from compliance data

- Need for an enterprise governance program

Operations

- Reducing compliance costs

- Transparency and compliance reporting

- Managing inefficiencies in paper-driven processes

Technology

- Applying new technologies to existing platforms

- Managing disparate tech solutions and vendors

- Understanding the new technology ecosystem

- Lack of technology awareness

- Managing and analyzing compliance data

New opportunities to leverage RegTech

RegTech solutions, powered by emerging technologies, help deliver richer and faster insights, drive efficiencies in compliance processes through automation, reduce costs, and offer foresight into emerging risk issues. These emerging technologies, such as advanced analytics, RPA, cognitive computing, and cloud, is enabling the creation of RegTech solutions to help address some of the compliance, regulatory, and risk management needs. At the same time, new opportunities are growing for financial services institutions (FSIs) to leverage RegTech for compliance:

Technology-enabled process efficiencies

- Robotic process automation (RPA) | Leveraging rules-based systems to automate repeatable, logic-based business processes, such as checking internal compliance controls for organizations

- Intelligent automation | Using cognitive technologies to build self-learning systems for automating intuitive tasks, such as compliance investigations processing, data extraction, and quality control

Data sharing and aggregation

- Regulatory data sharing | Managing compliance requirements by allowing organizations to share proprietary data with business partners and alliances over a secure network

- Regulatory data aggregation | Accessing alternate datasets, comprised of structured and unstructured information, aggregated from multiple sources, to make identity verification and compliance more accurate and efficient

Data-driven insights generation

- Real-time data monitoring and anomaly detection | Monitoring structured and unstructured compliance data in real-time for various purposes, such as identifying possibilities of non-compliance and detecting threat of money laundering

- AI/advanced analytics-enabled prediction of risks | Analyzing entity data and behavior for predicting regulatory and compliance risks. Allows organizations to mitigate risks proactively and address their compliance requirements

Platform development

- Compliance over cloud | Offering easy-to-adopt, flexible compliance solutions on cloud-hosted platforms to enable businesses to address compliance issues at lower costs

- Blockchain-based platforms for compliance | Creating immutable, agreed-upon, aggregated, and efficient compliance records for processes, such as AML/KYC and transaction reporting

- On-demand compliance expertise | Providing easy access to specialized skills for assisting FSIs with their regulatory and compliance requirements

Where does RegTech lead?

RegTech has a very bright future, with a huge amount to opportunity for those developing this type of technology to automate and enable new way of business.

As you stand at the crossroads of this new paradigm in the RegTech age, have a look at the following real cases of RegTech implementations:

Data insights for customer protection | software that analyzes “big data” on customers (huge volumes of data) and allows company to perform smart analysis and clustering (e.g. identify the Positive and Negative Target Markets, understand the real customer needs, analyze the usual customer behaviors, monitor the correct selling process reducing the miss-selling cases, produce consumable reports for board of directors, etc.)

Digital Identity for customer on-boarding| software that allows both the automatic, quick, secure registration of the customers’ identity information, during the complex on-boarding process (also enabling the digitalization of the entire operation – no face to face required). Moreover, this software creates a digital identity of the customer and enables the automatically sharing of a full range of information across the entire market (in a secure, encrypted, tracked way)

Deep dive transaction monitoring | software that, using complex cognitive algorithms, allows several different scenario analysis on customer data in order to help the identification of trends and from a regulatory perspective help to recognize outliers, right down to the individual customer transaction level

Intelligent help desk | software that allows the automatic management, through Artificial Intelligence engines, of trouble ticketing in some category of services (e.g. electronic banking, loans, investment, payments, …)

Contracts analysis automation | software that analyzes the completeness and accuracy of contract filling, ensuring their compliance with regulations in a fast and effective way. This software, with a minimum set of standard rules, is able to check and identify automatically the missing / incorrect parts of the contract

Predictive process transformation & regulatory reporting | software that organizes huge volume of data / information and allows deep processes check-up in order to identify process inefficiencies and operating risks. Moreover, the software allows bespoke reporting to be created in a way that is flexible enough to meet regulatory requirements of today and configurable to meet the regulatory requirements of tomorrow.

Final conclusions

In the short term, RegTech solutions will help FSI firms to automate the more mundane compliance tasks and reduce operational risks associated with meeting compliance and reporting obligations. In the longer term, they will likely empower compliance functions to make informed risk choices based on data provided insight about the compliance risks it faces and how it mitigates and manages those risks. Moreover, in any case, RegTech solutions will bring huge benefits in terms of processes efficiency and business improvement.

RegTech firms approach the solution from a technology solution-oriented point of view rather than a strategic one centered around key regulatory needs leading to suboptimal business outcomes.

For FSI organizations, the road to implement RegTech solutions starts understanding their business challenges, identifying the RegTech opportunities with the highest business value and designing a compelling future-state vision to develop the optimal implementation plan.

Alessandro Vidussi

Partner Strategy & Operation Deloitte Consulting – Innovation Representative FSI

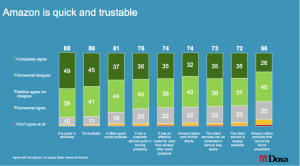

Some facts are objective: consumers need immediate and customized attention, as people have less and less disposable time, and Amazon is the point of reference when talking about customer experience: transparency and clear communication. Furthermore, Amazon is a “place” where a customer can rapidly find any product and any service. Nevertheless, people need banking services and life and P&C insurances.

Does this mean that Amazon can be a threat for the insurance and financial industry? Or is it an opportunity to form a strategic alliance? This article tries to give these questions an answer, both looking at what happened in the past and gathering some insights from the web: the latter analysis has been conducted by Barbara Galli, Director at Doxa and author of the book “Web Listening. Conoscere per agire”[1].

For what concerns the bank industry, Amazon already offers a credit card (co-branded with Jp Morgan) and a service, called “AmazonPay”, to pay on third party websites though the Amazon Account; in the US, a service called “Amazon monthly payment” is available to split the outgo into installments. In addition to that, Amazon is currently designing with Jp Morgan and Capital One Financial a financial product, similar to a cash account, in order to both reduce the transaction fees paid to credit card companies (e.g. Visa/MasterCard) and to collect information about the financial position and purchasing behaviors of its customers. Is Amazon trying to replace the banks?

First of all, we must recall that it would not be the first time for a corporation to try to acquire banking licenses: in the past, Walmart was stopped more than once by lawmakers and banking groups (1999 in Oklahoma and 2006 in Utah). Looking at the Amazon case, it seems that their strategy has more to do with enabling people to get theirs goods faster, smoothing the selling process, rather than to be a business to make money out of. Nevertheless, banks should worry as they are losing their cross selling opportunities. Amazon is not the only example where customers can skip the bank in the selling process: for instance, also IKEA is offering lending services, like many other retailers.

For what concerns the insurance industry, Amazon has already made some moves too. In 2016, the US-based retail giant has cooperated with Liberty Mutual, one of the largest diversified auto and home insurer in the US, enabling their consumers to navigate the insurance process by using their voice. This was possible thanks to Alexa, the voice service that allows customers to interact with devices in a more intuitive way: customers can access via vocal commands an insurance glossary, or can find a nearby agent to get a quote.

In 2017, Amazon has partnered with The Warranty Group to launch in the UK a P&C insurance policy, called Amazon Protect, to cover against accidental damages, malfunctions or thefts of goods bought on its ecommerce platform. Finally, in 2018, Amazon has entered the US employee healthcare market, collaborating with JP Morgan and Berkshire Hathaway to create a healthcare company with the aim of cutting costs and improving services for their US employees. It seems that Amazon wants to look overseas too, having already recruited insurance professionals in London to join a new team focused on the insurance market of the UK, Germany, France, Italy and Spain.

According to some rumors, dated beginning of 2018, Amazon was considering to use India as a test lab for expanding its insurance operations, investing in the insurtech Acko (provider of online insurance products). Such an operation would give Amazon the possibility of a huge expansion opportunity: nowadays only 3% of insurances are bought online, but this percentage is expected to skyrocket as India’s young population attains financial maturity – like it happened in China.

The important question is: can Amazon really supersede the insurance companies? Advisory practices need to serve both preferences: those who like traditional face to face and those who like the digital market. Currently, most life insurance sales occur when an agent engages in discussion about very personal issues, making people think about their deaths, sometimes without promising any immediate reward – probably the empathy of a human being can be crucial in this type of transactions.

On the other hand, it is indubitably that the current customer experience in purchasing an insurance policy can be improved: sometimes customers suffer a lack of understanding of the policies (pricing, exclusions, guarantees) together with an inefficient processing and products that are mostly commoditized (for both life and P&C insurances). Insurers should personalize products and provide transparency, demonstrating excellence in on-demand distribution. Amazon can be the opportunity to form a strategic alliance, acting as an aggregator and generating synergies for cross selling, though the functions “customers who bought this also bought…” or “customers who viewed this also viewed…” (e.g. goods for babies and life insurance for the parents or furniture for a new house and a fire P&C policy); user reviews could instill a sense of trust among the customers.

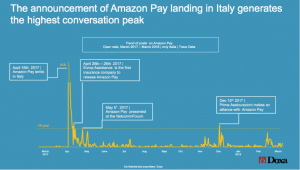

One question remains open: would customers buy insurance policies from Amazon? Some insights to answer this question can be found in the web. A quick web listening exploration has been run on what has been discussed, setting queries on the topics mentioned above

- Amazon pay

- Amazon and the insurance market

- Amazon, JP Morgan and bank accounts

- Amazon and Liberty mutuals

- Amazon and Acko

- Amazon and the warranty Group

Furthermore, the general feeling of the Italian customers about this major player entering a new marker has been analysed. The topics treated are not “trending” yet: there are about 1620 posts published during the last year on the open web [2], almost all related to “Amazon pay” (1451); the number dramatically decreases when it comes to more specific issues as “Amazon, JP Morgan and bank accounts” (114) or “Amazon and the insurance market” (51), nearly no conversations on the other topics. As shown by the peaks of conversations registered, the curiosity and attention level is high when linked to major news and events (e.g. Amazon Pay introduced in Italy, Europe Assistance releases Amazon Pay and Prima Assicurazioni forms an alliance with Amazon Pay).

Among the top engaging posts, those of Quixa and Wired dominate the web: the former refers to the promo of receiving a 50 Euro coupon when purchasing/renewing a Quixa insurance policy paying by Amazon Pay (770 interactions, 15 shares); the latter, dated April 2017, announces that digital payments attract the multinational corporation Wired (140 interactions, 34 shares).

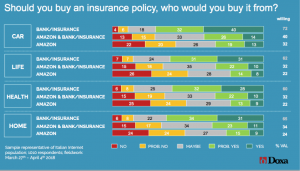

The level and topics of conversations gathered above do not allow yet for a proper sentiment analysis, but a survey run on the Italian online population gives a clear indication on their feeling about Amazon becoming an insurance player. Though the level of credibility of banks and insurance companies is still higher, the Italian surfers are open to consider Amazon as a valuable player: 32% are willing (surely + probably) to subscribe a car insurance with Amazon and the percentage increases to 40% when Amazon partners with a “traditional” player (insurance company / bank). Figures are not that distant (roughly 10 p.p. less) when the underlying considered is a Life/Health insurance. In both cases, the latter counts for roughly half of the total population willing to buy an insurance policy. [3]

To catch opportunities and anticipate trends, the insurance companies should keep one ear open by the mean of prompted surveys and web listening, identifying the most proper way to offer their proposition by a distinctive communication, in each territory, be it social or not. As to Amazon, looking at its brand image, one thing is sure: it meets trust, quality and service expectations, a good starting point to be leveraged [4]

Bibliography

[1] https://www.linkedin.com/feed/update/urn:li:activity:6376753915790192640

[2] data retrieved from the crawling platform Tracx ; dedicated queries; Doxa courtesy. Web listening from March 2017 to March 2018, open web (social properties excluded); Focus: Italy, conversations in Italian

[3] Sample representative of Italian Internet population; 1010 respondents; fieldwork: march 27th – April 4th 2018

[4] Sample representative of Italian Internet population; 1010 respondents; fieldwork: march 27th – April 4th 2018

This sector benefits from an increased, comfortable level of liquidity and enjoys continuous profitability, with some financial institutions being also able to increase the amount of debt securities issued. Core and non-core capital instruments contributed to keep capital buffers at a safe level, and helped in reducing the aggregate amount of NPL in banks’ balance sheets.Namely, the NPL ratio for Spanish banks (including cross-borders activity) moved down to the EU average. Financial institutions further improved their business models, and increased their capability of supplying new loans to the economy.

Threats are represented by the high level of private and public debt, as well as by the high unemployment rate. Since the country is currently enjoying an expansion pahse, European authorities suggests the Spanish government to profit from this favourable situation to pursue fiscal consolidation and also to reduce the level of debt among all sectors.

It will be important that Spain puts in place policy efforts to ensure a durable growth path and achieve higher productivity growth. This includes steps to continue reducing unemployment, make the labour market more inclusive, improve the business environment and enhance the innovation capacity of the economy.