L’EBA ha pubblicato un promemoria riguardante le principali scadenze per la presentazione dei dati per l’esercizio di benchmarking degli approcci interni che si svolgerà il prossimo anno. In particolare, l’esercizio di benchmarking 2017 avrà ad oggetto il rischio di mercato e di credito per i cosiddetti low default portfolios (costituiti da esposizioni nei confronti di società di grandi dimensioni, Stati sovrani e istituzioni finanziarie). Le banche europee che utilizzano gli approcci interni per il calcolo dei requisiti patrimoniali, infatti, saranno oggetto di valutazione e dovranno comunicare alle Autorità competenti le informazioni necessarie rispettando la tempistica individuata dall’EBA.

L’Autorità Bancaria Europea (EBA) ha pubblicato il programma di lavoro relativo all’anno 2017, in cui descrive sia le attività che i compiti delineati per il prossimo anno. Tra le tematiche principali che saranno affrontate dall’Autorità nel 2017, vi sono:

– liquidità e leverage ratio;

– rischio di credito;

– pianificazione delle attività di recovery e di intervento preventivo;

– promozione della convergenza regolamentare e miglioramento del quadro normative per la protezione dei consumatori e il monitoraggio dell’innovazione finanziaria.

Contestualmente, l’EBA ha rilasciato un programma di lavoro pluriennale che evidenza le aree strategiche di lavoro e i risultati attesi nel periodo 2017-2020. In particolare, l’Autorità individua i seguenti campi di azione per i prossimi anni:

– mantenere un ruolo centrale nello sviluppo e mantenimento del Single Rulebook bancario europeo;

– promuovere la gestione efficace e coordinate delle crisi delle istituzioni finanziarie all’interno dell’UE;

– promuovere la convergenza e il perfezionamento delle politiche di vigilanza;

– tutelare i consumatori e monitorare le innovazioni in campo finanziario e contribuire alla semplificazione del Sistema dei pagamenti retail in Europa.

Il Rapporto Consob sulle scelte di investimento delle famiglie italiane, pubblicato lo scorso settembre, come di consueto rileva molteplici aspetti che concorrono a definire la qualità delle scelte finanziarie: il livello di conoscenze, le attitudini comportamentali, gli stili decisionali e il ricorso alla domanda di consulenza. Il Rapporto dedica un approfondimento anche a fenomeni emergenti quali il crowdfunding e il robo advice, che nel contesto domestico trovano una domanda potenziale ancora contenuta anche a causa di una ridotta propensione a investire via Internet.

La scarsa alfabetizzazione finanziaria …

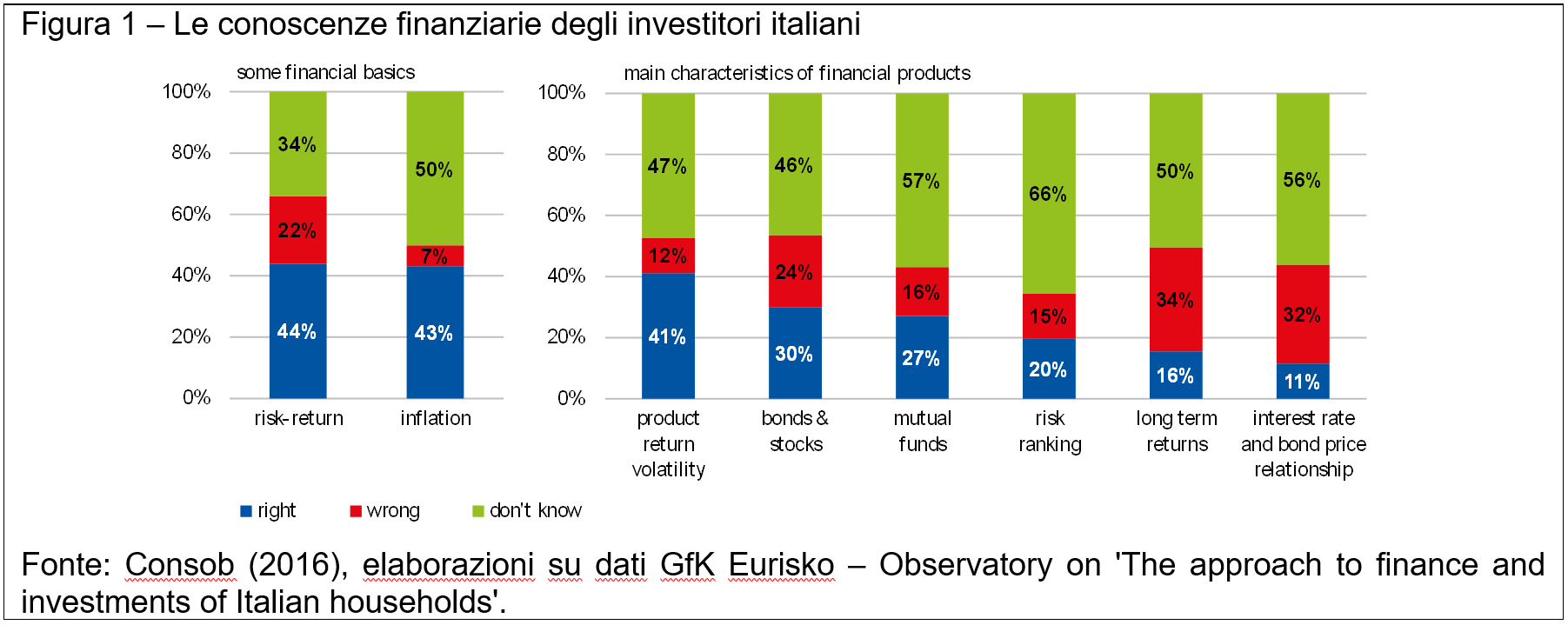

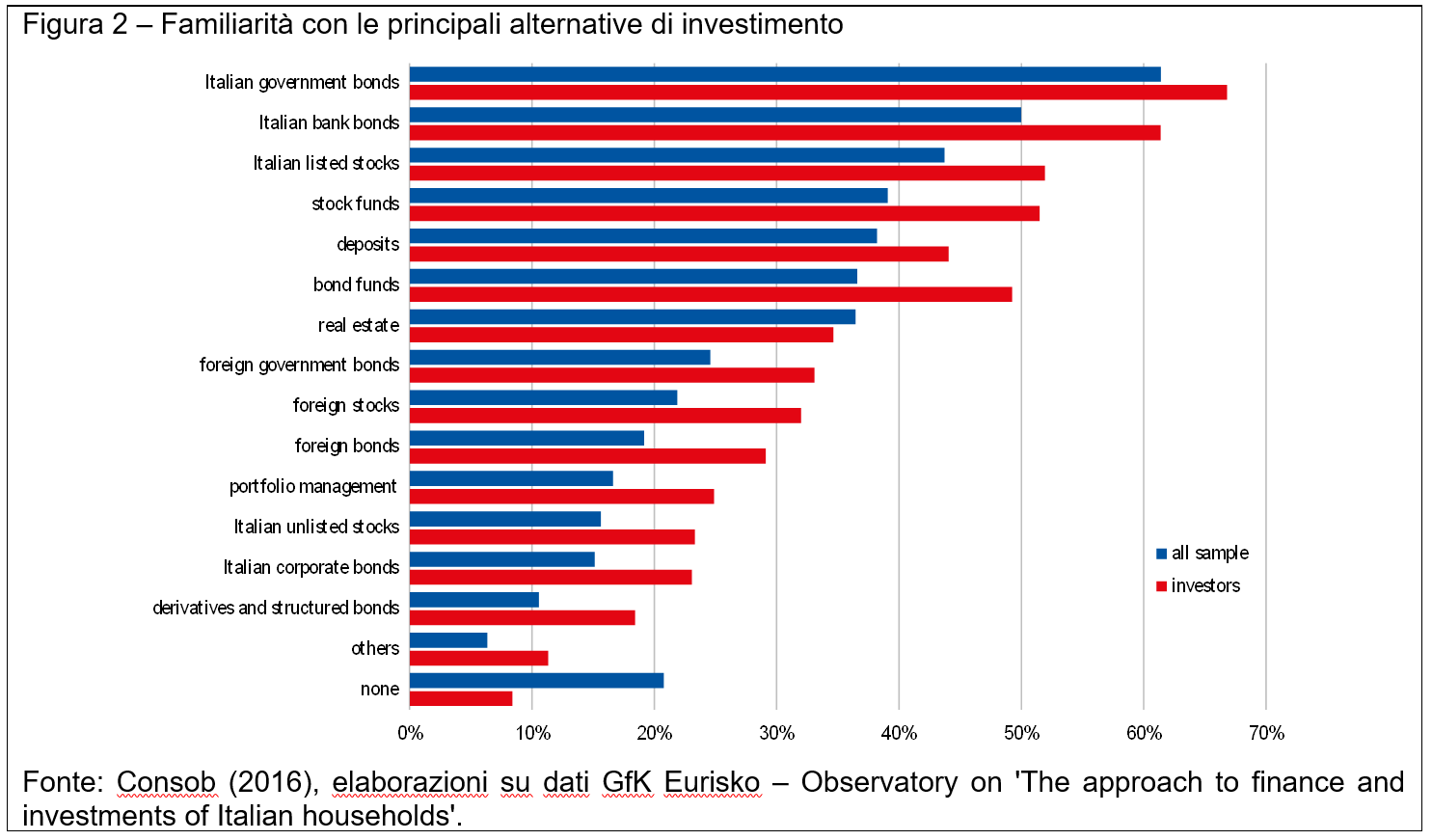

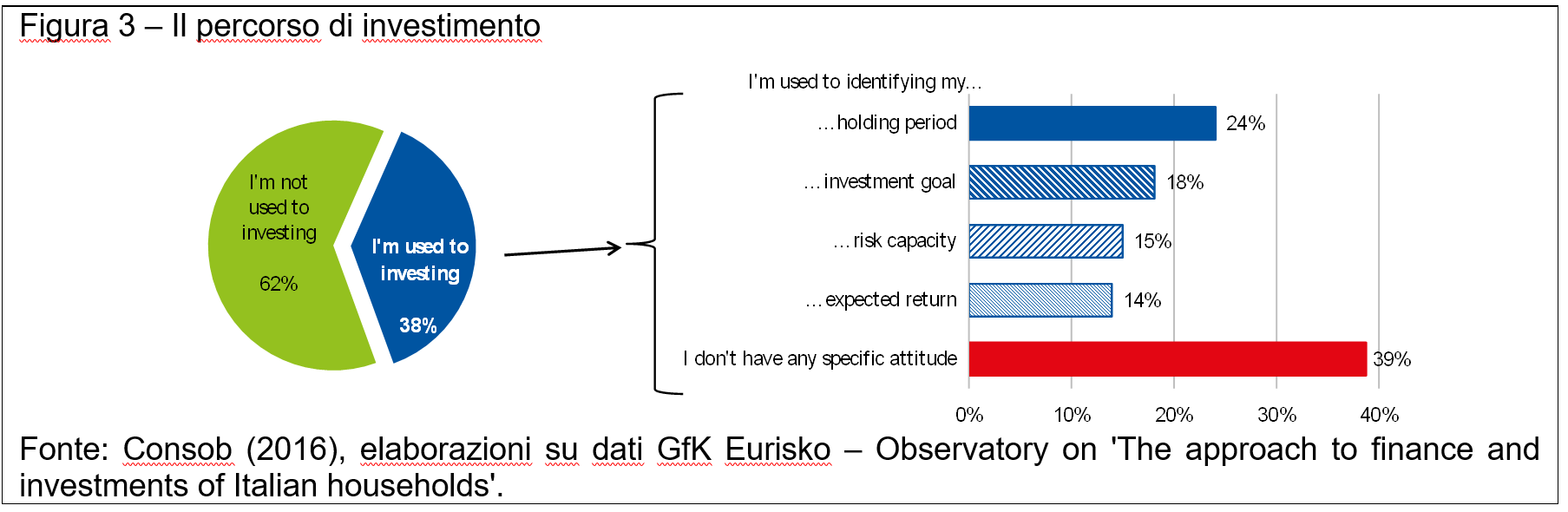

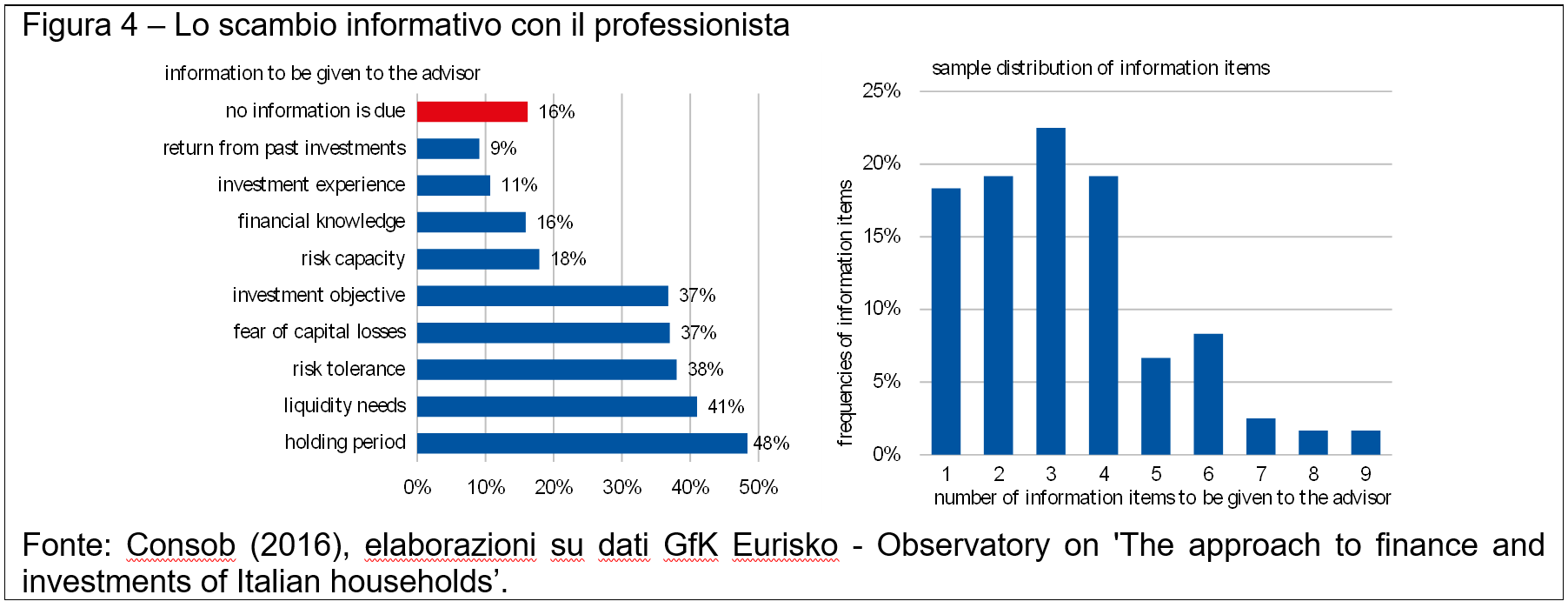

Le conoscenze finanziarie delle famiglie italiane, in linea con altre rilevazioni domestiche e internazionali, rimangono insufficienti. Solo poco più del 40% degli intervistati è in grado di definire correttamente alcune nozioni di base, quali inflazione e rapporto fra rischio e rendimento; concetti più sofisticati riguardanti le caratteristiche dei prodotti più diffusi registrano percentuali anche inferiori (fino all’11%; Figura 1). Più del 20% degli intervistati dichiara di non avere familiarità con alcuno strumento finanziario (il dato scende all’8% per il sotto-campione degli investitori), mentre il restante 80% indica più frequentemente i titoli del debito pubblico e le obbligazioni bancarie, seguiti da azioni quotate e fondi azionari (Figura 2). A queste carenze si associano lacune che attengono al processo decisionale in sé. Gran parte degli investitori, infatti, non ha piena consapevolezza dei fattori da ponderare prima di investire (orizzonte temporale, obiettivi, aspettative di guadagno e capacità economica di assumere rischi; Figura 3), né dell’importanza dello scambio informativo con il professionista ai fini della profilatura del cliente e della valutazione dell’adeguatezza degli strumenti finanziari raccomandati (Figura 4).

… e le competenze digitali ancora contenute …

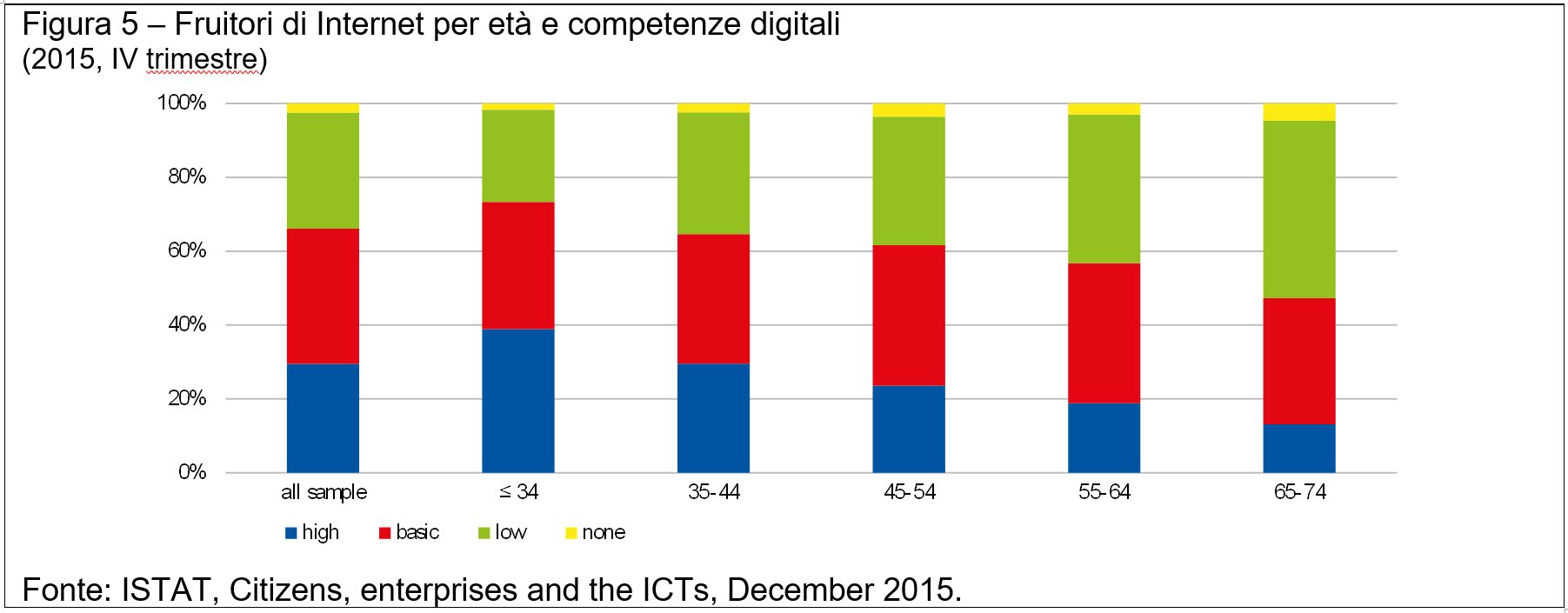

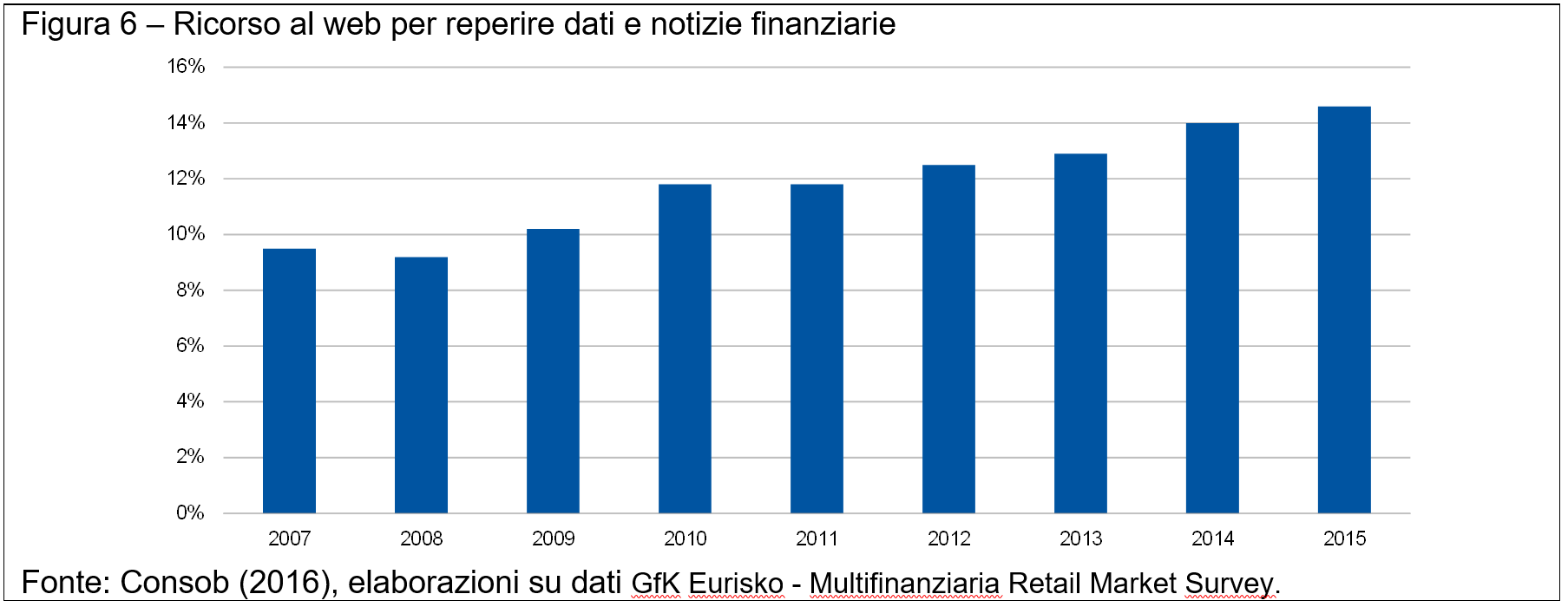

Secondo i dati ISTAT (2015), alla fine dello scorso anno solo il 30% degli utenti di Internet (corrispondenti al 65% circa della popolazione italiana) mostra di avere una cultura digitale elevata; di questi la maggior parte si concentra nella fascia d’età al di sotto dei 35 anni (Figura 5). Con particolare riferimento all’uso di Internet nell’ambito delle decisioni di investimento, la quota di famiglie che fa ricorso al web per reperire dati e notizie utili a compiere e a monitorare le scelte finanziarie, sebbene in crescita, supera di poco il 12% (Figura 6).

… condizionano l’attitudine delle famiglie italiane verso il contesto di riferimento e le dinamiche strutturali in atto

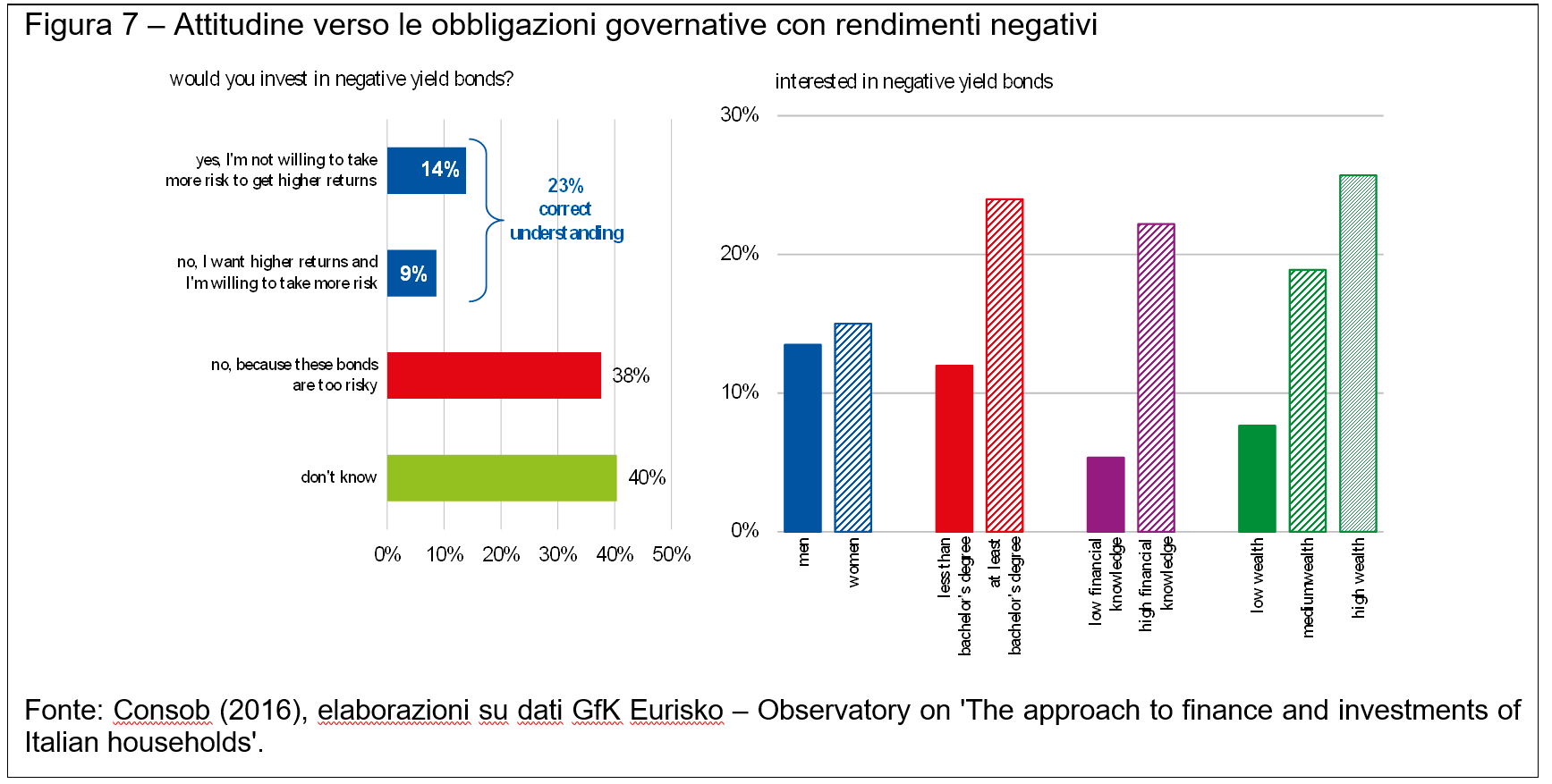

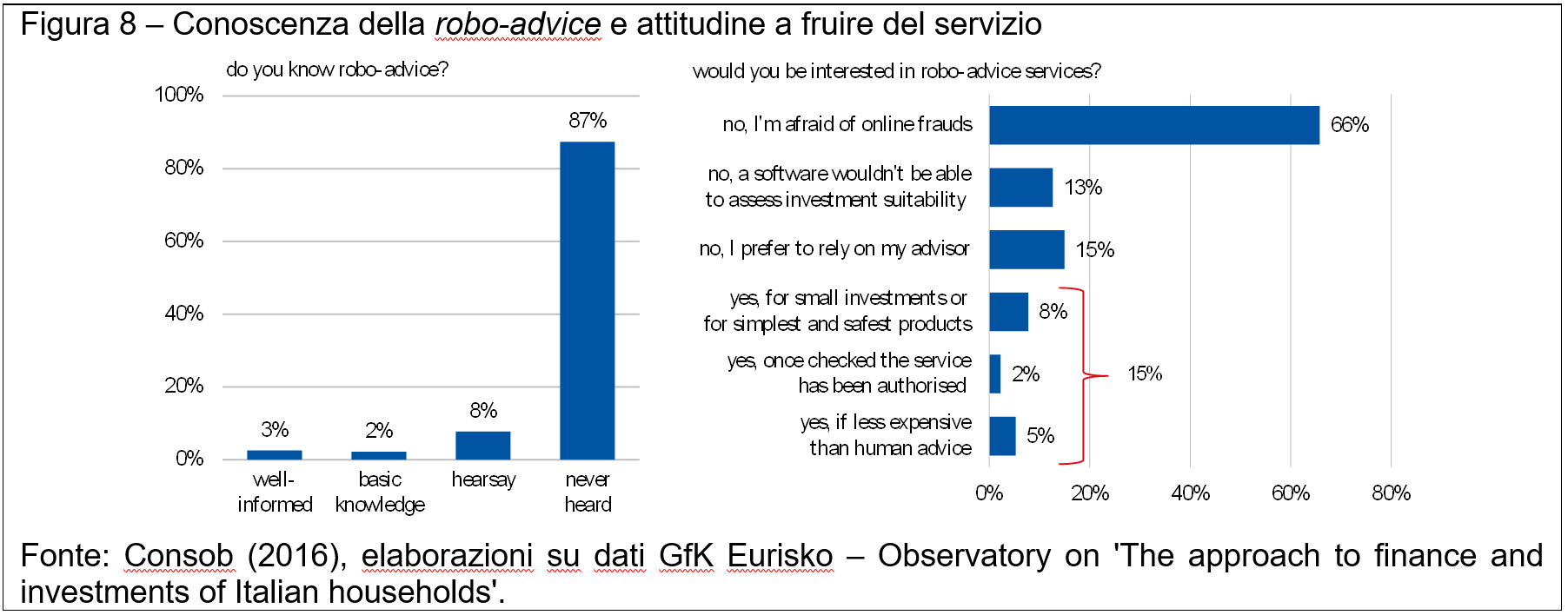

La scarsa alfabetizzazione finanziaria e digitale dell’italiano medio condizionano sensibilmente la comprensione dell’evoluzione del contesto di riferimento. Il Report Consob 2016, in particolare, ha indagato l’attitudine degli italiani verso le obbligazioni governative con rendimenti negativi e verso modalità innovative di investimento, quali la consulenza finanziaria automatizzata (cosiddetto robo-advice) e il crowdfunding.

Il 40% degli intervistati non è in grado di esprimere un’opinione sui titoli di Stato dell’Eurozona connotati da rendimenti negativi ovvero (nel 38% dei casi) li considera troppo rischiosi; soltanto il 23% del campione è in grado di comprendere il fenomeno ponendolo in relazione con il trade-off rischio-rendimento (Figura 7). Ancora una volta, il dato conferma la difficoltà che accomuna la maggior parte dei risparmiatori a valutare correttamente la relazione tra rendimento atteso e rischio di uno strumento finanziario. Difficoltà che nell’attuale contesto di tassi negativi può stimolare un’inconsapevole quanto pericolosa attitudine al search for yield.

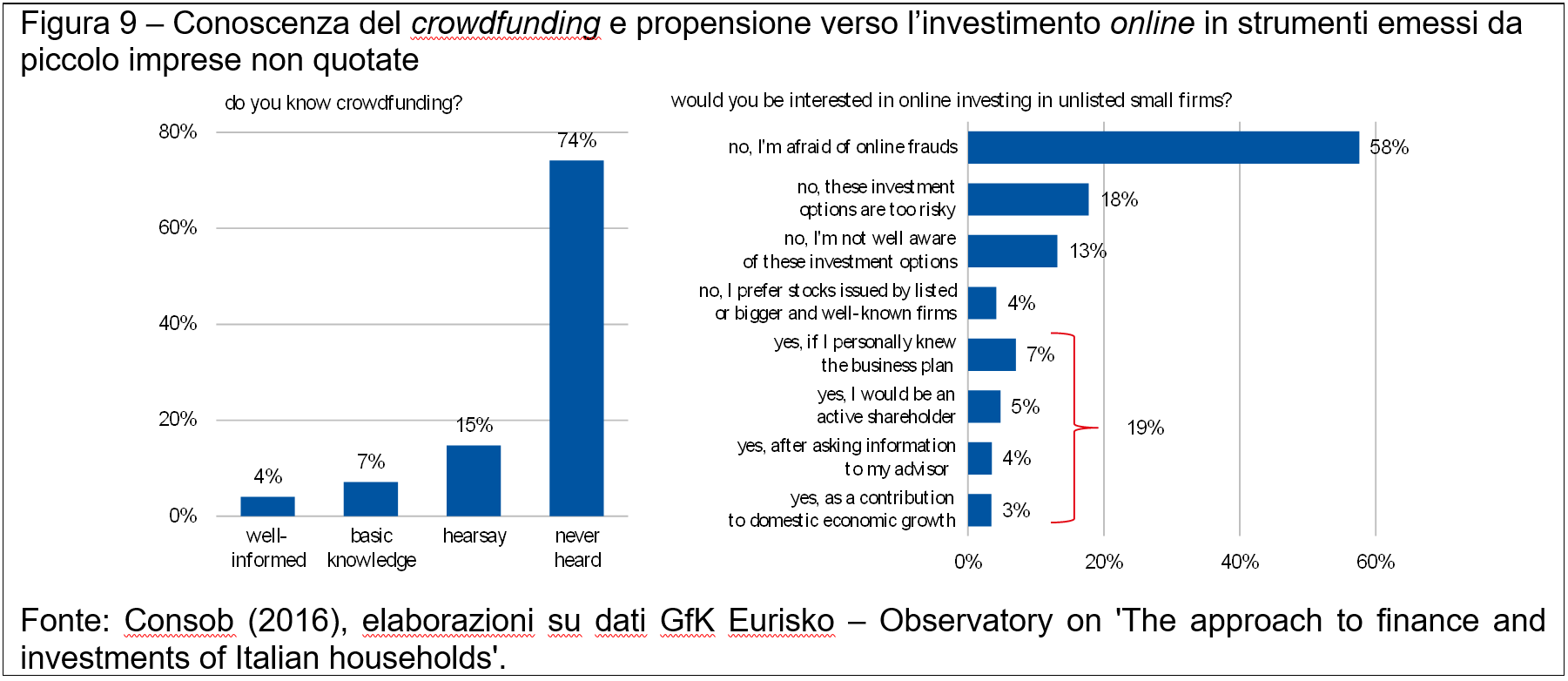

Sono altresì poco noti fenomeni come la consulenza automatizzata o il crowdfunding, visto che, rispettivamente, solo l’87% e il 74% dichiarano di averne almeno sentito parlare. La propensione verso queste modalità di investimento è comunque bassa, poiché la maggioranza degli intervistati non è bendisposta a causa del timore di truffe online (rispettivamente 66% e 58%; Figure 8 e 9).

La consulenza resa nel miglior interesse del cliente potrebbe migliorare la qualità delle scelte degli investitori, che tuttavia faticano a distinguerla da altri servizi di investimento e ad apprezzarne il valore aggiunto rispetto al fai-da-te o all’informal advice.

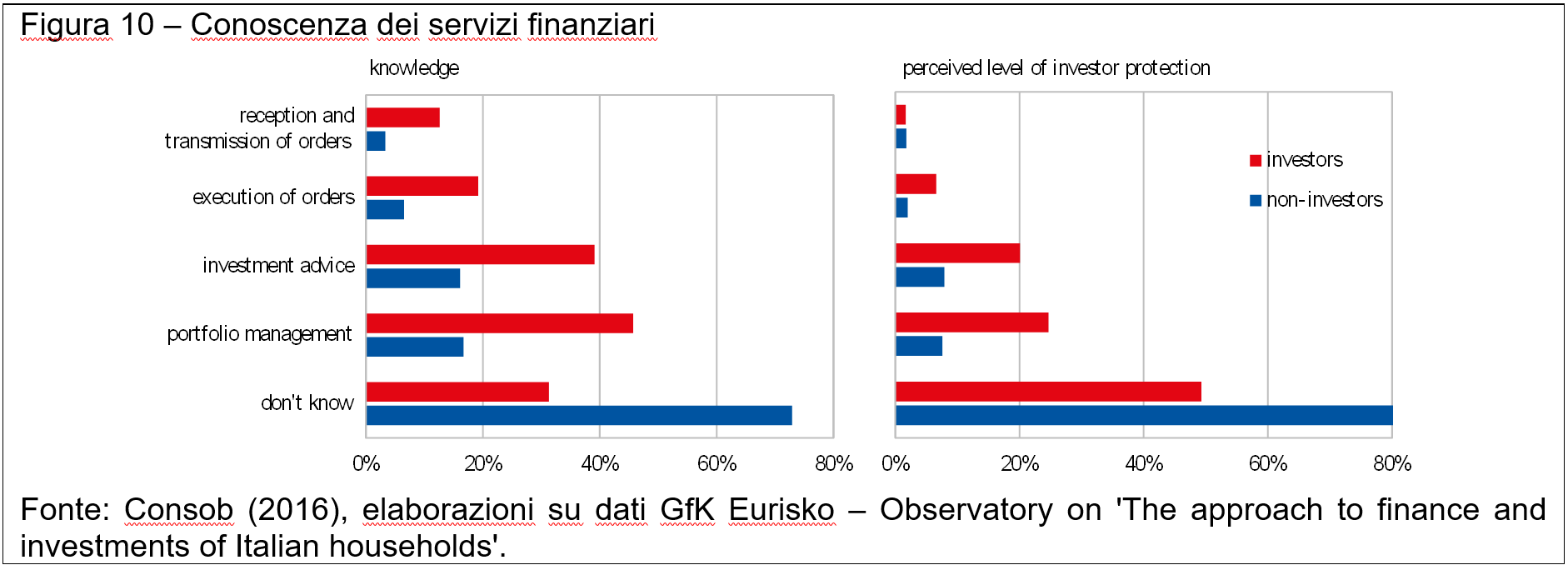

Circa il 60% circa degli intervistati non conosce nessuno dei servizi di investimento previsti dalla normativa vigente, mentre la percentuale di coloro che dichiarano di avere familiarità con i servizi di investimento oscilla tra il 7% (per il servizio di ricevimento e trasmissione di ordini) e il 30% (servizio di gestione di portafoglio; Figura 10). In linea con questa evidenza, la maggior parte degli intervistati (più dell’80% dei non investitori e il 50% degli investitori) non è in grado di identificare nella consulenza e nella gestione di portafoglio i servizi che garantiscono il più alto livello di tutela per effetto dell’obbligo della valutazione di adeguatezza.

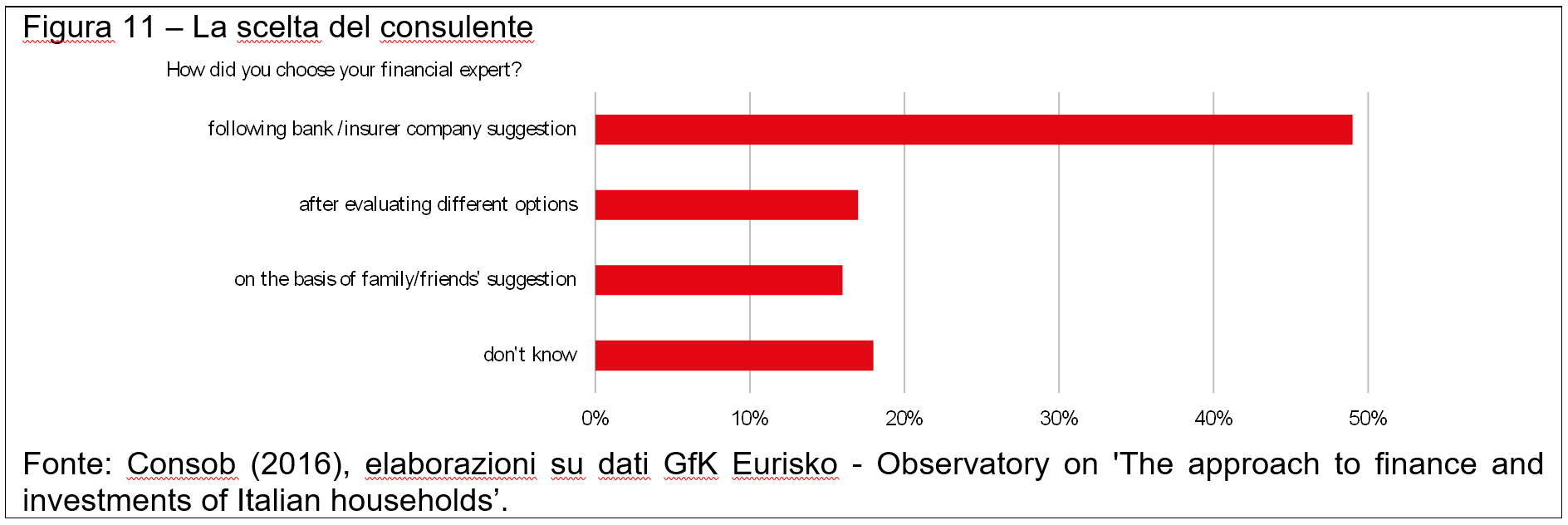

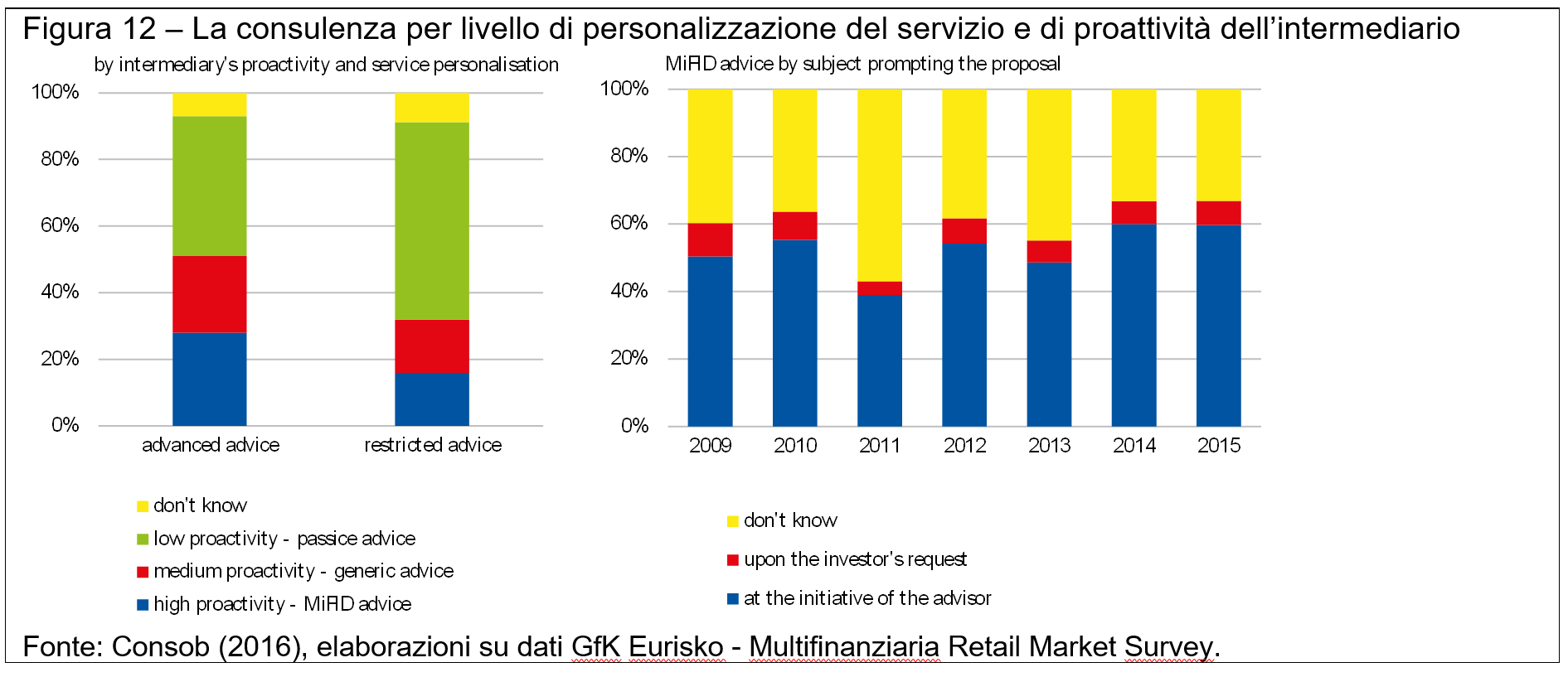

Tra gli investitori, solo il 28% riferisce di avvalersi di consulenza MiFID (ossia di raccomandazioni personalizzate e riferite a uno specifico strumento finanziario). Il servizio è erogato da un professionista che nella metà dei casi è stato scelto seguendo le indicazioni dell’istituto di credito di riferimento e in un quinto dei casi dopo aver valutato più di un’alternativa tra quelle disponibili sul mercato (Figura 11). La consulenza MiFID viene fornita prevalentemente su iniziativa dell’esperto e solo nel 7% dei casi su impulso dell’investitore; un terzo degli intervistati inoltre non sa individuare chi sia il soggetto ‘proponente’ (Figura 12). Alla luce di queste evidenze, non stupisce che gli investitori fatichino a riconoscere il valore aggiunto della consulenza rispetto al fai-da-te e al cosiddetto informal advice (il consiglio di famigliari e conoscenti) e che, di conseguenza, solo il 25% degli intervistati dichiari una disponibilità (contenuta) a pagare per il servizio. La domanda di consulenza, peraltro, si associa negativamente al livello di conoscenze finanziarie, così che a restare esclusi dal servizio sono proprio gli individui che potenzialmente beneficerebbero più degli altri dei consigli di un esperto.

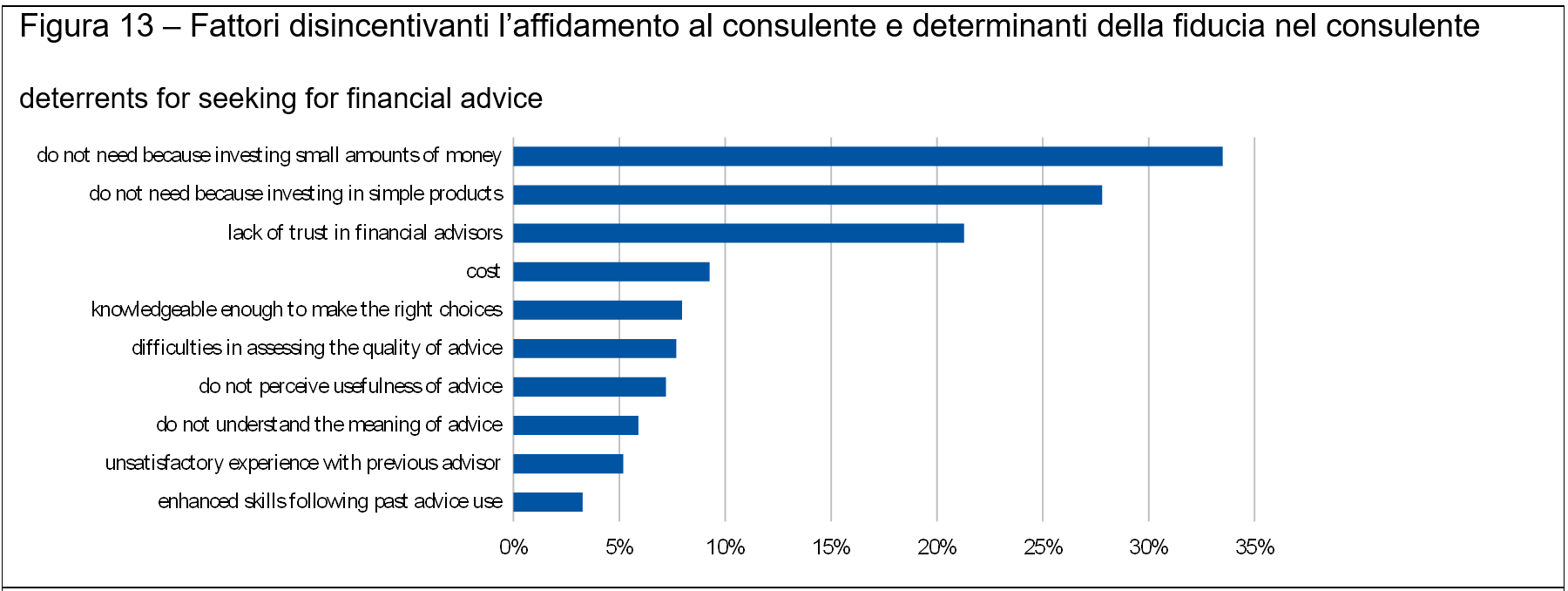

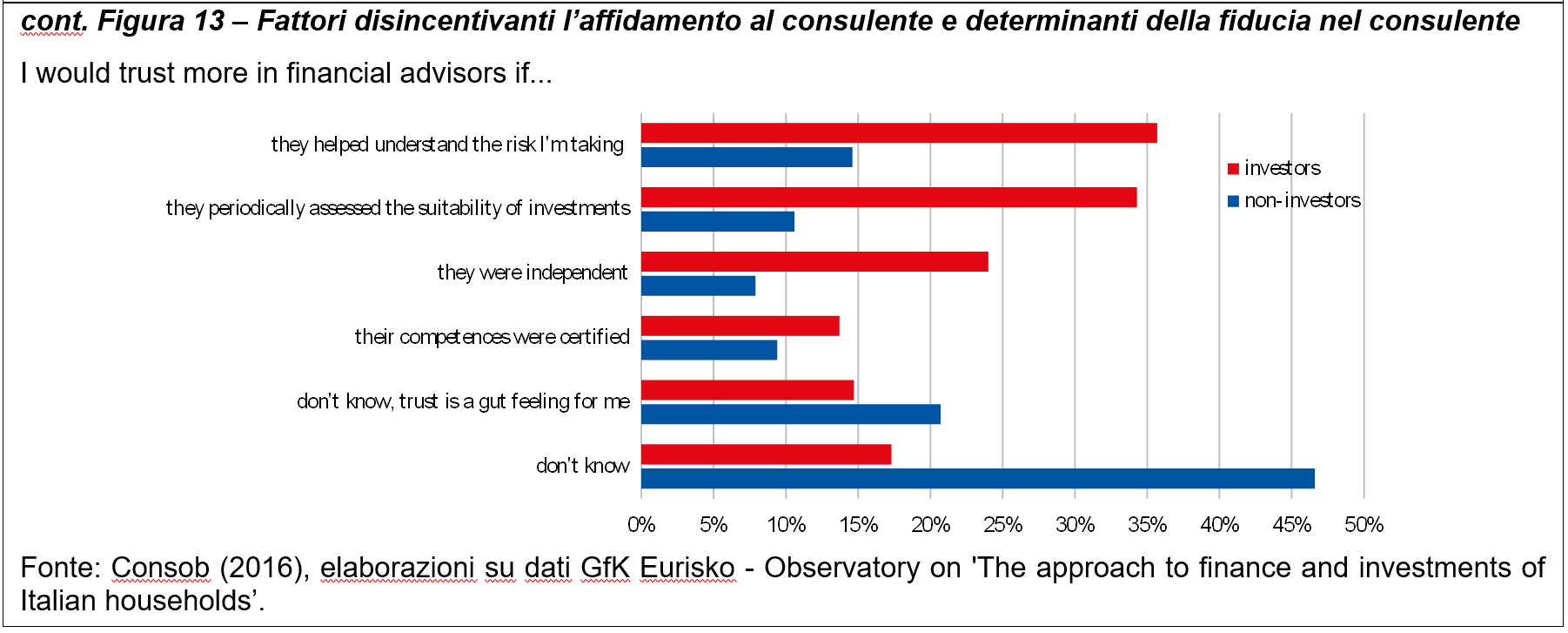

Il ricorso alla consulenza viene scoraggiato, inoltre, dalla dimensione ridotta degli investimenti (34%), dalla consuetudine a investire in prodotti considerati molto semplici (28%) e dalla mancanza di fiducia negli intermediari (22%; Figura 13). Tra i fattori che, in particolare, potrebbero elevare la fiducia riposta nel professionista, gli investitori indicano il suo impegno a guidare i clienti nella comprensione dei rischi e nel monitoraggio degli investimenti (35% circa) nonché l’indipendenza (quasi il 25%) e la certificazione delle competenze (15%). Infine, circa il 15% degli investitori definisce la fiducia come una percezione soggettiva, alimentata dall’istinto piuttosto che da specifiche caratteristiche o abilità del consulente; tale percezione è più diffusa tra i non investitori (21%), che nella metà dei casi non sono comunque in grado di indicare alcun elemento che possa accrescere la propensione ad affidarsi a un esperto.

Note:

– Il presente intervento riprende i temi sviluppati nel Report 2016 sulle scelte di investimento delle famiglie italiane della Consob. Le opinioni espresse sono personali e non impegnano in alcun modo l’Istituzione di appartenenza.

– Il Report fa riferimento ai dati derivanti dall’Indagine Multifinanziaria Retail Market e dall’Osservatorio su ‘L’approccio alla finanza e agli investimenti delle famiglie italiane‘ (GfK Eurisko). Multifinanziaria Retail Market: campione di circa 2.500 famiglie. Osservatorio su ‘L’approccio alla finanza e agli investimenti delle famiglie italiane‘: 1.000 famiglie. In entrambi i casi il decisore finanziario (di età compresa fra 18 e 74 anni) è il percettore di reddito più elevato in famiglia.

L’ESMA ha pubblicato il Work Programme 2017 che delinea le priorità e le aree di intervento identificate per il prossimo anno per il rafforzamento della tutela degli investitori e la promozione di della stabilità dei mercati finanziari. Le principali aree di interesse saranno:

– convergenza delle prassi di vigilanza sull’attuazione della MiFIDII / MiFIR;

– istituzione e gestione dei database previsti dalle diverse normative, con particolare attenzione alla qualità dai dati raccolti;

– implementazione della regolamentazione in materia di benchmark finanziari e altre iniziative rientranti nel perimetro dell’Unione Capital Markets;

– supervisione diretta delle agenzie di rating creditizio (CRA) e delle trade repositories.

L’Autorità europea degli strumenti finanziari e dei mercati (ESMA) ha annunciato nuovi aggiornamenti alle Q&A (Questions and Answers) pubblicate sul proprio sito istituzionale. In particolare, gli aggiornamenti riguardano:

– Applicazione della direttiva AIFMD (Alternative Investment Fund Directive);

– Applicazione della direttiva UCITS (Undertakings for the Collective Investment in Transferable Securities Directive).

L’Autorità bancaria europea (EBA) ha pubblicato il nuovo report sul monitoraggio degli strumenti di capitale appartenenti alla categoria Additional Tier 1 (AT1). L’attività di monitoraggio delle emissioni di strumenti di capitale delle istituzioni finanziarie rientra, infatti, nei compiti attribuiti all’Autorità dalla normativa CRR (Capital Requirements Regulation).

La nuova versione del report si basa sulla revisione di 33 emissioni di strumenti AT1 compiute da istituzioni europee, nel periodo agosto 2013 – dicembre 2015, per un importo complessivo di 35,5 miliardi di euro.

Comunicato stampa

Aggiornamento Report EBA su emissioni strumenti AT1

La Banca d’Italia ha emanato l’aggiornamento n. 18 della circolare n. 285 del 17 dicembre 2013 recante disposizioni di vigilanza per le banche. Quest’ultimo aggiornamento, che entrerà in vigore dal 1 gennaio 2017, introduce i seguenti coefficienti minimi per la riserva di conservazione del capitale:

– 1,25% dal 1 gennaio 2017 al 31 dicembre 2017;

– 1,875% dal 1 gennaio 2018 al 31 dicembre 2018;

– 2,5% a partire dal 1 gennaio 2019.

La riserva di conservazione del capitale deve, inoltre, essere costituita da capitale primario di classe 1. In questo modo, la disciplina transitoria della riserva di conservazione del capitale si allinea a quanto previsto, in via ordinaria, dalla direttiva CRD IV.

L’EBA ha avviato una consultazione sulla proposta di Linee guida per la valutazione del rischio informatico o ICT (Information and Communication Technology) all’interno del processo di valutazione SREP. Tali linee guida sono rivolte alle autorità di vigilanza competenti e mirano a promuovere procedure e metodologie comuni per la valutazione del rischio ICT.

La consultazione avrà termine il 6 gennaio 2017.

La Banca centrale europea (BCE) ha comunicato la decisione di apportare delle modifiche alle disposizioni in materia di strumenti di debito non garantiti emessi da istituzioni creditizie, imprese di investimento o da enti strettamente legati (strumenti noti come unsecured bank bonds o UBBs).

La BCE ha deciso di mantenere, per il momento, l’ammissibilità degli UBBs come forma di collateral, comprendendo anche gli UBBs statutariamente subordinati che, in base alle norme vigenti, sarebbero diventati inammissibili al 1 ° gennaio 2017. L’ammissibilità sarà però oggetto di misure addizionali di controllo dei rischi.

La BCE ha, inoltre, deciso di ridurre, dal 1 ° gennaio 2017, il limite di utilizzo per le obbligazioni bancarie non garantite dal 5% al 2,5%. Questo limite non si applica però in presenza dei seguenti requisiti:

(a) il valore di tali attività non supera i 50 milioni di euro dopo ogni haircut applicabile, o

(b) tali attività sono garantite, ai sensi dell’articolo 114 della BCE sull’attuazione del quadro di politica monetaria dell’Eurosistema, da un ente pubblico che ha il diritto di imporre tasse.

L’adeguamento dei criteri di eleggibilità degli UBBs rientra nel piano di applicazione della normativa BRRD ed è conforme al sistema di requisiti minimi MREL di prossima adozione. Tale modifica, inoltre, permette alle banche di rilevanza sistemica globale (G-SIB) di aderire al nuovo quadro di assorbimento delle perdite TLAC.

La BCE riesaminerà il tema nel corso del 2017, in modo da tener conto anche dei progressi compiuti verso la definizione di un approccio comune europeo in tema di gerarchia creditizia in caso di insolvenza di istituti finanziari.

L’Autorità europea degli strumenti finanziari e dei mercati (ESMA) ha pubblicato 2 documenti di consultazione su materie rientranti nel perimetro della Direttiva MiFID II. In particolare, le consultazioni riguardano:

– Linee guida per la governance in materia di strumenti finanziari (product governance) in relazione alla valutazione del segmento di mercato per la distribuzione di nuovi prodotti. La consultazione avrà termine il 5 gennaio 2017;

– Linee guida per la calibrazione del meccanismo di sospensione delle negoziazioni (trading halts) deli strumenti finanziari negoziati su mercati regolamentati europei. La consultazione avrà termine il 6 dicembre 2016.

Documento di consultazione su product governance

Documento di consultazione su trading halts