«È ancora troppo presto per dichiarare la vittoria sull’inflazione». Lo ha affermato la presidente della Bce Christine Lagarde in un’intervista al gruppo editoriale spagnolo Vocento, secondo cui «stiamo facendo dei progressi», ma «c’è ancora molto da fare». «So che le persone stanno soffrendo per l’inflazione – aggiunge – specie quelle più vulnerabili e esposte come i pensionati a basso reddito.

The European Securities and Markets Authority (ESMA), the EU’s financial markets regulator and supervisor, has today published the results of the annual transparency calculations for equity and equity-like instruments, which will apply from 1 April 2023.

The calculations made available include:

- the liquidity assessment as per Articles 1 to 5 of CDR 2017/567;

- the determination of the most relevant market in terms of liquidity as per Article 4 of CDR 2017/587 (RTS 1);

- the determination of the average daily turnover relevant for the determination of the pre-trade and post-trade large in scale thresholds;

- the determination of the average value of the transactions and the related the standard market size; and

- the determination of the average daily number of transactions on the most relevant market in terms of liquidity relevant for the determination of the tick-size regime.

Coinbase Global, la più grande borsa di criptovalute negli Stati Uniti, non accetterà o trasferirà più pagamenti in dollari da o verso Silvergate Capital per i titolari di conti Coinbase Prime, che fornisce servizi a investitori istituzionali e società. La decisione è legata alla delicata situazione finanziaria che sta attraversando Silvergate, la cripto-banca che dopo aver chiuso il quarto trimestre con una perdita da 1 miliardo di dollari ha messo in dubbio la sua capacità di rimanere in attività.

India’s economy grew by 4.4% in last fiscal quarter, down from 6.3% the previous quarter. Economists had expected closer to 4.6%. But this still puts India’s average annual GDP growth for last year at about 7%, making it one of the world’s best-performing economies. By comparison, the World Bank projects the global economy will grow just 1.7% this year—the third-weakest pace of global growth in almost three decades.

https://www.weforum.org/agenda/2023/03/indias-gdp-growth-outpaced-china-economy/

The EFI 8 – Energy Finance and Climate Change Conference brought together experts and professionals from the energy and finance sectors to discuss the latest trends and challenges in the industry. The conference, held at Politecnico di Milano from the 8th to the 10th of February, featured a program that has explored the energy financial sector through mathematical finance models. The conference also commemorated Professor Peter Laurence for his work in quantitative finance, specifically in the energy field.

Just a few numbers: more than 100 participants during the three days of conference, coming from 34 universities and research centres, 14 countries represented, 14 leading companies in the sector involved. The event featured 46 presenters and 3 superlative keynote speeches from Clémence Alasseur, Fred Espen Benth, and Florian Ziel.

Clémence Alasseur has presented “A Rank-Based Reward between a Principal and a Field of Agents: Application to Energy Savings”, a work which tackles the problem of designing a reward function to a field of heterogeneous agents in order to stimulate their energy savings. In the proposed setting, the agents compete with each other through their rank within the population to obtain the best reward. She first obtains explicitly the equilibrium for the mean-field game played by the agents, and then characterizes the optimal reward in the homogeneous setting. For the general case of a heterogeneous population, she develops a numerical approach, which is then applied to the specific case study of the market of Energy Saving Certificates.

Fred Espen Benth has given a talk on “Recent advances on forward curve modeling and applications”. He presents infinite-dimensional stochastic volatility models, including leverage, and discusses the question of option pricing in this context. Neural networks in Hilbert spaces provide an attractive numerical method to price options on forward curves, where stylized structures of the curves are used as additional information in the training. Finally, he presents new limit theorems on the realized variation of forward curves, which can be used for estimation.

Florian Ziel has presented “Electricity price forecasting: Data science meets fundamental models” There are two structurally different model approaches in the literature: i) data science models, which evaluate historical price and external data, and ii) fundamental models, which model the electricity price economically using supply and demand approaches. First, he discusses advantages and disadvantages of both modeling approaches. Then, he considers several options on how to combine and intertwine the two modeling approaches to improve model performance and forecast accuracy. This talk has shown how data scientists should learn from fundamental modelers and vice versa.

The conference also featured a Best Paper Award, which was won by Alexander Blasberg for his paper, “Carbon Default Swap – Disentangling the Exposure to Carbon Risk Through CDS.” The paper explored the exposure to carbon risk through CDS, offering valuable insights for investors and finance professionals. The paper is coauthored by Luca Taschini and Kiesel Rudiger.

The conference has also dedicated some sessions to ESG and climate change research. This research highlighted the importance of sustainable finance and innovative models to support the growth of renewable energy.

The EFI 8 Conference has provided a platform for experts and professionals to exchange ideas and insights on the latest trends and challenges facing the industry. As the world continues to face the challenges of climate change and the energy transition, conferences like this are crucial in shaping the future of energy finance.

Website: https://www.energyfinanceitalia.it/

LinkedIn: https://t.ly/uJG_

Slide of the presentations: https://www.energyfinanceitalia.it/speakers/

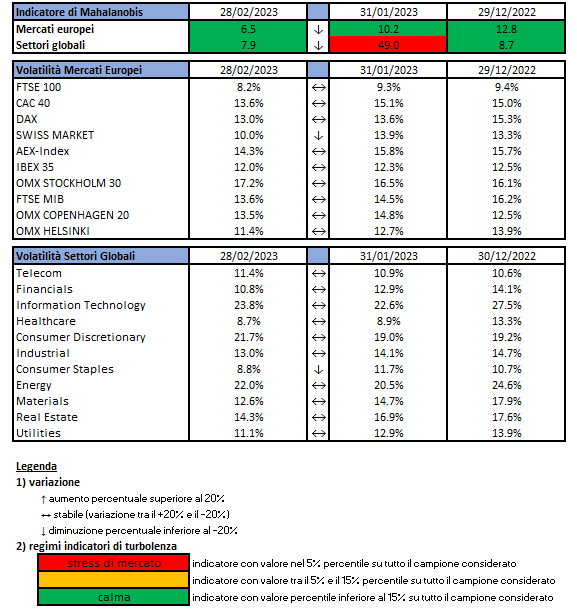

a cura di Gianni Pola e Antonello Avino

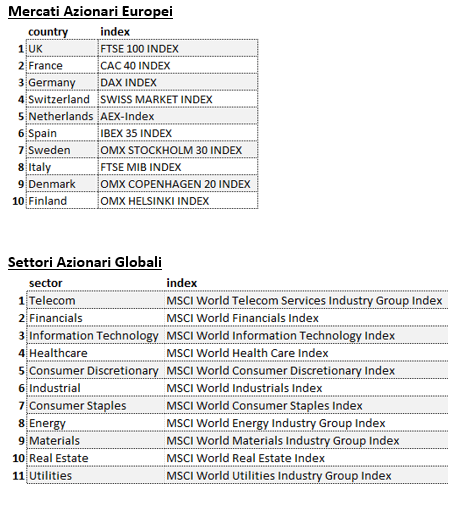

Gli indici utilizzati sono:

Le volatilità riportate sono storiche e calcolate sugli ultimi 30 trading days disponibili. Per ogni asset-class dunque sono prima calcolati i rendimenti logaritmici dei prezzi degli indici di riferimento, successivamente si procede col calcolo della deviazione standard dei rendimenti, ed infine si procede a moltiplicare la deviazione standard per il fattore di annualizzazione.

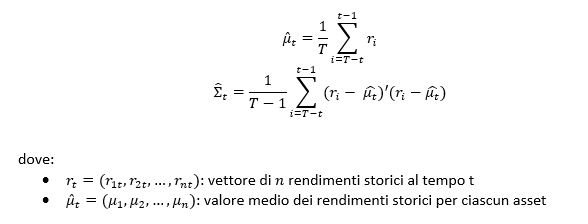

Per il calcolo della distanza di Mahalnobis si procede dapprima con la stima della matrice di covarianza tra le asset-class. Si considera l’approccio delle finestre mobili. Come con la volatilità, si procede prima con il calcolo dei rendimenti logaritmici e poi con la stima storica della matrice di covarianza, come riportato di seguito.

Supponendo una finestra mobile di T periodi, viene calcolato il valore medio e la matrice varianza covarianza al tempo t come segue:

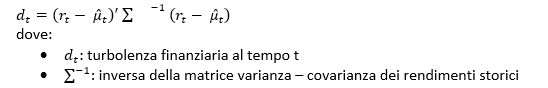

La distanza di Mahalanobis è definita formalmente come:

Le parametrizzazioni che sono state scelte sono:

- Rilevazioni mensili

- Tempo T della finestra mobile pari a 5 anni (60 osservazioni mensili)

Le statistiche percentili sono state calcolate a partire dalla distribuzione dell’indicatore di Mahalanobis dal Dicembre 1997 al Dicembre 2019 su rilevazioni mensili.

Ulteriori dettagli sono riportati in questo articolo.

Disclaimer: Le informazioni contenute in questa pagina sono esclusivamente a scopo informativo e per uso personale. Le informazioni possono essere modificate da finriskalert.it in qualsiasi momento e senza preavviso. Finriskalert.it non può fornire alcuna garanzia in merito all’affidabilità, completezza, esattezza ed attualità dei dati riportati e, pertanto, non assume alcuna responsabilità per qualsiasi danno legato all’uso, proprio o improprio delle informazioni contenute in questa pagina. I contenuti presenti in questa pagina non devono in alcun modo essere intesi come consigli finanziari, economici, giuridici, fiscali o di altra natura e nessuna decisione d’investimento o qualsiasi altra decisione deve essere presa unicamente sulla base di questi dati.

Gas -57%, petrolio cede il 18%. Euro in flessione del 5,8%. Dopo un anno dall’invasione russa in Ucraina, le Borse europee sono in rialzo rispetto al giorno in cui i carri armati di Mosca sono entrati nel territorio di Kiev, Wall Street mostra un bilancio in rosso, petrolio e gas sono tornati a scendere e la Borsa di Mosca appare “vincente”. E’ disomogeneo per i mercati internazionali il bilancio del primo anno di guerra…

The European Central Bank’s (ECB’s) audited financial statements for 2022 show that the ECB’s profit was zero (2021: €192 million) and thus there will be no profit distribution to the euro area national central banks (NCBs). This result takes into account a release of €1,627 million from the provision for financial risks to cover losses incurred during the year. These losses…

https://www.ecb.europa.eu//press/pr/date/2023/html/ecb.pr230223~398b74f1dc.en.html

The price of permits on the European Union’s carbon market hit 100 euros ($106.57) per tonne for the first time on Tuesday, a milestone that reflects the increased costs that factories and power plants must pay when they pollute. The benchmark EU Allowance (EUA) contract rose to a high of 101.25 euros per tonne and was trading at 100.49 euros per tonne by 15.49 GMT. EUAs are the main currency…

https://www.reuters.com/markets/carbon/europes-carbon-price-hits-record-high-100-euros-2023-02-21/

Since G20 Leaders endorsed the Roadmap for Enhancing Cross-border Payments in 2020, much has been accomplished through the necessary stocktakes and analyses. Quantitative targets were established to meet the roadmap’s ambition for achieving cheaper, faster, more transparent, and more accessible cross-border payments. During these first two years of the Roadmap…