L’innovazione mette alla prova i Wealth Manager

Le Fintech stanno diventando realtà anche nel Wealth Management, il mercato più “human intensive” per definizione. Intelligenza artificiale, chatbot e robot sono le tecnologie Fintech che stanno cambiando il mercato finanziario e che saranno sempre più sulla bocca di tutti, clienti e consulenti finanziari compresi. In tale contesto le tecnologiche emergenti impatteranno sia le dinamiche di relazione consulente-cliente sia la macchina operativa.

È arrivato il Robo Advisory

Il mercato della Consulenza Finanziaria sta affrontando la sfida del Robo Advisory, il servizio di gestione degli investimenti supportato da algoritmi ed erogato attraverso piattaforme digitali. Il Robo Advisory, utilizzando le informazioni dei clienti e combinandole alle strategie desiderate di asset allocation, permette di fornire raccomandazioni d’investimento/ portafogli personalizzati. In poche parole un servizio di consulenza personalizzato, supportato da una gestione e da un’ottimizzazione automatizzata del portafoglio, fruibile mediante dashboard interattive. Questo fenomeno, che interessa sia operatori storici che start-up Fintech, ad oggi sta vivendo in Italia una forte fase espansiva.

Robo Advisory: un trend in crescita

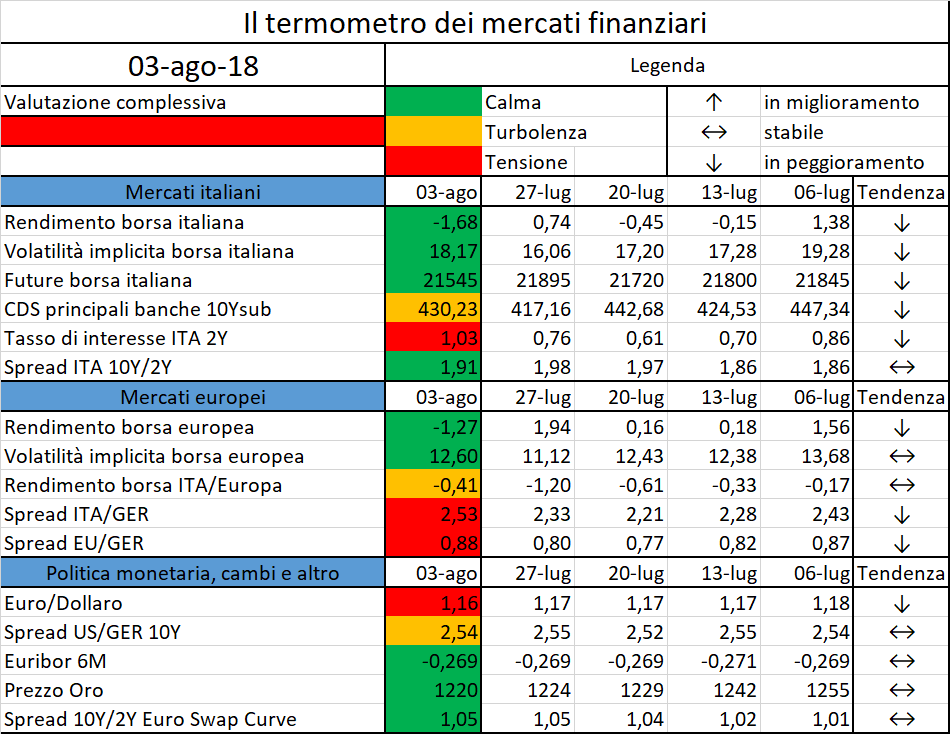

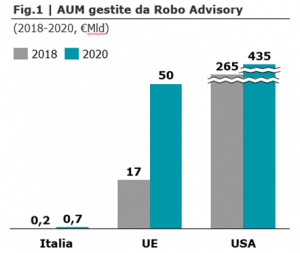

A livello globale le masse gestite direttamente attraverso tecnologie Robo Advisory sono destinate a crescere considerevolmente nei prossimi 2 anni. Questo trend sarà principalmente guidato dal mercato americano: nei soli Stati Uniti, infatti, il mercato passerà dagli attuali ~265 €Mld a ~435 €Mld nel 2020. In Europa, invece, si passerà da ~17 €Mld (di cui ~170 €Mln in Italia) a ~50 €Mld nel 2020 (di cui ~670 €Mln in Italia) [Fig. 1]. L’impennata globale degli AUM gestiti da “Robo Advisor” non è tuttavia destinata a rallentare: le attese sono quelle di raggiungere ~1.300 €Mld nel 2025. Spinti da questo trend di crescita, anche i grandi player leader dell’Asset Management stanno orientando alcuni dei loro investimenti sulla costruzione di nuove piattaforme per la gestione completamente automatizzata di grandi portafogli. BlackRock, per esempio, ha recentemente annunciato l’introduzione di un fondo ETF seguito interamente da robot, che utilizzerà l’intelligenza artificiale per la selezione dei titoli replicando “meccanicamente” le analisi normalmente effettuate da intelligenza umana. L’investimento di BlackRock ha fin da subito portato a risultati soddisfacenti: i fondi gestiti dai robot hanno mostrato una performance significativamente superiore rispetto ai classici “stock pickers” discrezionali. Sulla scia di questa iniziativa anche altri grandi gestori di asset management come Bridgewater Associates, Point72 Asset Management e JPMorgan stanno andando nella stessa direzione sperimentando attivamente l’uso dell’automazione.

A livello globale le masse gestite direttamente attraverso tecnologie Robo Advisory sono destinate a crescere considerevolmente nei prossimi 2 anni. Questo trend sarà principalmente guidato dal mercato americano: nei soli Stati Uniti, infatti, il mercato passerà dagli attuali ~265 €Mld a ~435 €Mld nel 2020. In Europa, invece, si passerà da ~17 €Mld (di cui ~170 €Mln in Italia) a ~50 €Mld nel 2020 (di cui ~670 €Mln in Italia) [Fig. 1]. L’impennata globale degli AUM gestiti da “Robo Advisor” non è tuttavia destinata a rallentare: le attese sono quelle di raggiungere ~1.300 €Mld nel 2025. Spinti da questo trend di crescita, anche i grandi player leader dell’Asset Management stanno orientando alcuni dei loro investimenti sulla costruzione di nuove piattaforme per la gestione completamente automatizzata di grandi portafogli. BlackRock, per esempio, ha recentemente annunciato l’introduzione di un fondo ETF seguito interamente da robot, che utilizzerà l’intelligenza artificiale per la selezione dei titoli replicando “meccanicamente” le analisi normalmente effettuate da intelligenza umana. L’investimento di BlackRock ha fin da subito portato a risultati soddisfacenti: i fondi gestiti dai robot hanno mostrato una performance significativamente superiore rispetto ai classici “stock pickers” discrezionali. Sulla scia di questa iniziativa anche altri grandi gestori di asset management come Bridgewater Associates, Point72 Asset Management e JPMorgan stanno andando nella stessa direzione sperimentando attivamente l’uso dell’automazione.

In Italia, Money Farm è stato un pioniere nell’offerta di servizi di consulenza automatizzata. Società fondata nel 2011, oggi conta 20k clienti attivi al mondo, 150k iscritti profilati dalla piattaforma al mondo e masse gestite a livello mondiale (tra Italia e UK) per oltre 400 €Mln. Lo sviluppo di piattaforme digitali di advisory per i segmenti “affluent” e “mass” con un patrimonio inferiore a 500 €k si sta diffondendo anche tra le banche commerciali italiane.

Quali sono i vantaggi del Robo Advisory?

L’introduzione del Robo Advisory permette di avere costi commissionali e di gestione significativamente più bassi rispetto ai modelli tradizionali, così da costituire un’opportunità per i segmenti di clientela a basso valore attualmente non pienamente serviti. L’utilizzo di algoritmi per la creazione e la gestione di portafogli, infatti, rappresenta una soluzione in grado di ridurre i costi di servizio per la Banca. Questa graduale riduzione dell’effort “discrezionale” dell’uomo si ribalterà sul cliente finale, generando una significativa riduzione dei costi dei servizi finanziari. Secondo le analisi Monitor Deloitte, solo l’utilizzo delle chatbot porterà, entro il 2020, a significativi risparmi di costo quantificabili tra 0,50 e 0,70 dollari per ogni interazione banca-cliente.

La tecnologia viene quindi vista più come a supporto che come in sostituzione del lavoro umano in un’ottica “Robo 4 Advisor”. Riteniamo che questo potrebbe aprire il mercato della consulenza finanziaria su segmenti di clientela meno abbienti consentendo costi del servizio più accessibili e offrendo la possibilità al gestore di servire meglio e in modo più efficiente i clienti in portafoglio. Da un lato, se oggi per coprire costi diretti e indiretti del servizio, un Wealth Manager può arrivare a dover gestire 100 milioni di euro di masse, attraverso un modello combinato questa soglia potrebbe essere dimezzata.

Come “contropartita”, dal consulente ci si attende che riesca a seguire da vicino portafogli dai 100 ai 200 clienti. Senza il supporto della tecnologia, difficilmente si riuscirebbe ad essere proattivi su un portafoglio di tale entità e focalizzare, allo stesso tempo, l’effort commerciale sui clienti a maggior valore e/o intensità relazionale.

La consulenza Robo può quindi essere “vincente” su profili di clientela che tradizionalmente non potevano permettersi un consiglio finanziario personalizzato, strategia particolarmente attrattiva in questo periodo di tassi di interesse prossimi allo zero.

L’automatizzazione nella gestione dei portafogli, come detto, supporterà senza sostituire la componente umana. A seconda della diversa composizione del portafoglio, infatti, l’intervento umano rappresenta ancora un asset prezioso per la Banca. Nei portafogli molto concentrati (o caratterizzati da titoli con scarsa liquidità) la scarsa disponibilità di informazioni societarie e di settore genera la necessità di un tipo di consulenza più “insightful” ed elaborata, più adatta quindi a una valutazione discrezionale e personale. Saranno invece i settori caratterizzati da asset class consolidate e molto liquide, con la disponibilità di una grande quantità di informazioni, i più adatti a tale innovazione.

Cosa ne pensano i clienti?

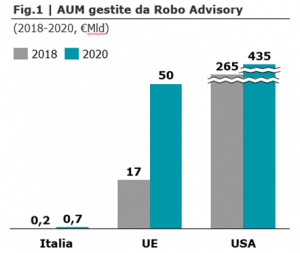

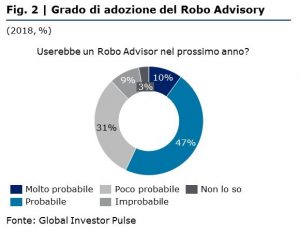

Secondo il “Global Investor Pulse”, ricerca annuale di BlackRock sul mercato Italiano, il 46% degli investitori dichiara di sapere conoscere questa tecnologia, con punte che raggiungono il 62% tra i Millenial. Fra coloro che conoscono il Robo Advisory, il 57% dichiara che potrebbe ricorrere a un servizio di consulenza automatizzata già nel corso del prossimo anno (con picchi oltre il 70% per i Millenial) [Fig. 2]. In generale, comunque, tale apertura non è incondizionata, ma è subordinata per la maggior parte degli investitori alla presenza di un supporto terzo: quasi la metà condiziona la sua adozione alla possibilità di interagire con un consulente o con un’istituzione finanziaria avente un forte brand. Poco più del 10% si dice pronto a percorrere questa strada in modalità pienamente autonoma, livello di adozione in linea con i trend caratteristici dei canali digitali in Banca. Per fare un parallelismo con il mondo delle banche tradizionali, il canale fisico rimane (e rimarrà) centrale per la relazione con il cliente evolvendo, tuttavia, il proprio ruolo. Allo stesso modo, anche per il consulente finanziario, le nuove tecnologie prima ancora di cannibalizzare parte del mercato, potranno abilitare una relazione con il cliente più diretta, profonda ed economica.

Le nuove generazioni? Si aspettano sempre di più

Le piattaforme automatizzate possono risultare potenzialmente molto interessanti per una “nuova” fascia di clientela bancaria, giovane, con ampi margini di crescita, molto evoluta digitalmente che allo stesso tempo richiede alla propria banca un controllo e una conoscenza dei propri investimenti sempre maggiore. Infatti, anche i clienti high-net-worth (HNW) diventano più esperti di tecnologia digitale e si aspettano gli stessi livelli di trasparenza e connettività offerti dalle banche retail. Si prevede che le generazioni più giovani erediteranno 1 trilione di dollari nei prossimi 20 anni, aspettandosi un funzionamento dei servizi per la gestione dei propri patrimoni simile a quella di altre applicazioni, come Amazon e Google: servizi semplici e perfettamente integrati nella vita di tutti i giorni.

Tradizionalmente, i Private Banker, grazie alle relazioni personali, hanno gestito le esigenze dei clienti e garantito un livello di servizio elevato. La digitalizzazione non sostituisce quella relazione personale, ma la migliora accelerando i processi e utilizzando i dati dei clienti per prevedere con precisione ciò che sarà più vicino ai loro bisogni. In questo senso, i Private Banker dovranno essere in grado di fornire ai propri clienti un servizio ancora più personalizzato. Offrire un servizio di consulenza eccellente a 360° su tutto il patrimonio non è facile così come non è semplice amministrare capitale, partecipazioni, immobili, con un unico strumento. In questo senso, l’Intelligenza artificiale e tutte le nuove tecnologie disponibili possono venire in aiuto al consulente, permettendogli di offrire un servizio sempre più specifico e personalizzato nel prossimo futuro.

Carlo Murolo, Senior Partner, Head of FS Industry, Deloitte Consulting

Manuel Pincetti, Senior Executive, Monitor Deloitte Strategy Consulting

Luigi Capitanio, Senior Executive, Monitor Deloitte Strategy Consulting

Daniele Ingannamorte, Senior Associate, Monitor Deloitte Strategy Consulting